UPS Rides E-commerce Surge to 21% Jump in Package Volumes

30 Juillet 2020 - 1:13PM

Dow Jones News

By Paul Ziobro

United Parcel Service Inc. rode a pandemic fueled surge in

e-commerce to higher profits and a 13% jump in revenue during the

June quarter, underscoring how the illness upended daily life.

The delivery giant said its average daily shipping volume rose

21% in the quarter, faster than the company has ever recorded, with

a 65% increase in shipments to homes.

"Our results were better than expected, driven in part by the

changes in demand that emerged from the pandemic," said UPS's new

chief executive, Carol Tome.

Shares rose more than 9% in premarket trading.

UPS and rival FedEx Corp. are being inundated with millions of

extra daily packages after many retail stores were temporarily

closed, pushing people to shop online for everything from toilet

paper to pet food. Even as most stores have reopened, some shoppers

remain reluctant to head to stores as coronavirus cases rise in

parts of the U.S.

UPS has benefited from handling packages for Amazon.com Inc.

after FedEx cut ties with the e-commerce giant last year.

UPS said it also had an increase in Covid-19 related health-care

shipments and an increase in outbound packages from Asia.

The sudden growth comes at a cost, though, as the carriers incur

greater expenses from more miles driven and fewer packages

delivered per stop as they deliver more to homes instead of

businesses.

Despite the surge of packages in the U.S., UPS's operating

profit fell slightly in its main domestic segment. UPS's average

revenue per package in the U.S. dropped 5% from a year ago.

Both UPS and FedEx are trying to offset some of the costs with

new surcharges on large packages and on some of their lower-priced

shipping services. The two companies have also started to impose

higher rates on some of their shippers whose volumes have changed

significantly in recent months.

Investors have been looking for signs that the carriers would

start to wield their greater pricing power and extract to see

higher returns from billions of dollars of investment in recent

years on upgrading their networks with added capacity and more

automation. The pandemic has sped up the timeline under which that

was expected to occur amid the significant shift to online shopping

in just a matter of weeks.

For the period, UPS reported a profit of $1.8 billion, or $2.03

a share, up from $1.7 billion, or $1.94 a share, a year earlier.

Excluding some restructuring charges, UPS said adjusted earnings

were $2.13. Revenue hit $20.3 billion. Analysts polled by FactSet

expected UPS to post earnings of $1.07 a share, on revenue of $17.5

billion.

(END) Dow Jones Newswires

July 30, 2020 06:58 ET (10:58 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

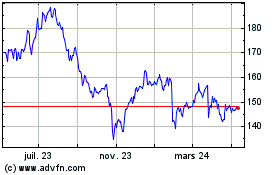

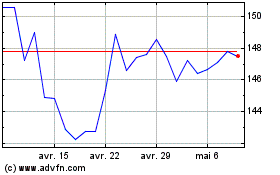

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024