Glacier Media Inc. (TSX:GVC) ("Glacier") reported revenue, cash flow and

earnings for the period ending September 30, 2008.

Highlights

- Revenue for the third quarter grew 21.0% and cash flow from operations grew

12.4% compared to the same period last year. Cash flow from operations per share

for the quarter grew 13.2% compared to the same period last year.

- Glacier's strategic diversification in Western Canadian local newspapers and

trade, business and professional information combined with the primacy and

essential nature of product content, strong product quality, dominant market

positions and focus on operational improvement has resulted in continued revenue

and profit growth despite challenging economic conditions.

- For the nine months ended September 30, 2008, cash flow from operations per

share increased 29.9% from the same period last year, EBITA per share increased

18.9% and net income per share increased 34.0%.

- Glacier acquired several community newspapers in Western Canada during the

quarter. In total, Glacier has completed acquisitions and investments totalling

$43.5 million in aggregate purchase price for the nine months ending September

30, 2008.

- Glacier has a strong, secure and flexible financial position with 2.2x debt to

EBITA as at quarter end and the majority of its debt comprised of a revolving

facility with no scheduled mandatory principal repayments that does not renew

until December 31, 2010.

Operating Results

--------------------------------------------------------------------------

$000's except 3 Months 3 Months 9 Months 9 Months

share and per September 30, September 30, September 30, September 30,

share amounts 2008 2007 2008 2007

--------------------------------------------------------------------------

Revenue $ 59,932 $ 49,551 $ 187,647 $ 159,303

--------------------------------------------------------------------------

EBITA $ 10,059 $ 9,516 $ 41,657 $ 34,962

--------------------------------------------------------------------------

EBITA margin 16.8% 19.2% 22.2% 21.9%

--------------------------------------------------------------------------

EBITA per share $ 0.108 $ 0.102 $ 0.447 $ 0.376

--------------------------------------------------------------------------

Cash flow from

operations $ 7,986 $ 7,102 $ 35,612 $ 27,399

--------------------------------------------------------------------------

Cash flow from

operations per

share $ 0.086 $ 0.076 $ 0.382 $ 0.294

--------------------------------------------------------------------------

Interest expense,

net $ 2,460 $ 2,515 $ 7,038 $ 8,214

--------------------------------------------------------------------------

Net income $ 3,968 $ 3,819 $ 24,998 $ 18,624

--------------------------------------------------------------------------

Net income per share $ 0.043 $ 0.041 $ 0.268 $ 0.200

--------------------------------------------------------------------------

Debt outstanding, net

of cash reserves and

before deferred

financing charges

and other $ 121,259 $ 109,426 $ 121,259 $ 109,426

--------------------------------------------------------------------------

Shareholders' equity $ 294,801 $257,397 $ 294,801 $ 257,397

--------------------------------------------------------------------------

Average shares

outstanding, net 93,150,994 93,197,032 93,181,111 93,077,450

--------------------------------------------------------------------------

For the three months ending September 30, 2008, Glacier earned $8.0 million of

consolidated cash flow from operations on revenue of $59.9 million, as compared

to $7.1 million on revenue of $49.6 million for the three months ended September

30, 2007. Glacier's EBITA was $10.1 million and net income was $4.0 million for

the quarter, as compared to EBITA of $9.5 million and net income of $3.8 million

for the same period last year.

For the three months ended September 30, 2008, cash flow from operations per

share increased 13.2% to $0.086 from $0.076 for the same period last year, EBITA

per share increased 5.9% to $0.108 from $0.102 for the same period last year and

net income per share increased 4.9% to $0.043 from $0.041 for the same period

last year.

Consolidated cash flow from operations was $35.6 million for the nine months

ended September 30, 2008, as compared to $27.4 million for the same period last

year. Revenue for the period was $187.6 million compared to $159.3 million for

the same period last year, EBITA was $41.7 million compared to $35.0 million

last year, and net income was $25.0 million compared to $18.6 million last year.

For the nine months ended September 30, 2008, cash flow from operations per

share increased 29.9% to $0.382 from $0.294 for the same period last year, EBITA

per share increased 18.9% to $0.447 from $0.376 for the same period last year

and net income per share increased 34.0% to $0.268 from $0.200 for the same

period last year.

Review of Operations

Glacier continued to generate strong financial performance during the quarter

despite challenging economic conditions in Canada and the United States. For the

three months ending September 30, 2008, revenue increased 21.0% and EBITA

increased 5.7% compared to the same period last year.

On a normalized basis, EBITA from operations increased 12.4% for the quarter

compared to the same period last year after adjusting for $0.6 million of

quarter over quarter adjustment to pension accruals and foreign exchange

classification (the 12.4% adjusted EBITA from operations growth is consistent

with Glacier's 12.4% growth in cash flow from operations for the quarter).

The 21.0% increase in revenue and normalized 12.4% increase in EBITA were a

result of both growth from operations and acquisitions.

As previously disclosed, Glacier's first and third quarters are typically weaker

than its second and fourth quarters given the seasonality of some of its

businesses. In particular, the EBITA growth was proportionately less than would

be normal relative to the revenue growth because the JuneWarren energy

publications acquired in January 2008 have lower profitability in the third

quarter. The PrintWest Communications Ltd. ("PrintWest Communications")

operations acquired in May 2008 also have a lower EBITA margin than Glacier's

other publications. These acquisitions resulted in a reduction in Glacier's

EBITA margin for the third quarter compared to last year.

Glacier's operations performed well in terms of "same-store" revenue and EBITA

growth. Same-store EBITA contributed approximately two-thirds of the 12.4%

normalized EBITA growth for the quarter, which was a result of both strong

organic revenue growth as well as cost management. The acquisitions completed in

the third quarter of 2008 and subsequent to the third quarter of 2007 also

contributed to the growth.

Glacier's same-store revenue growth from existing operations reflects the

primacy and essential nature of the information offered by its local newspapers,

trade and business information publications and electronic product offerings,

their effectiveness for advertisers, the industry sectors Glacier targets,

product quality, strength of market positions, improved sales effectiveness, new

product offerings and regional advertising efforts that allow advertisers to

benefit from Glacier's larger group of publications and expertise. This growth

is being achieved despite softening in some areas of the economy such as the

commodities, energy, manufacturing and other sectors.

Management believes that the strength of Glacier's publication and information

offerings and mix of geographic market, information niche and product and

channel balance combined with low debt levels (see following) have positioned

Glacier to endure the challenging economic environment and perform well over

both the near and longer term.

Management is monitoring economic conditions and business events in the United

States and Canada closely to ensure that operational performance is maximized

and that acquisition opportunities are identified that can benefit Glacier.

Glacier has strong operating platforms with which to integrate these

acquisitions and realize immediate improvements in profitability through cost

efficiencies, and expected increases in sales. While these opportunities will be

pursued, management intends to maintain prudent debt levels given the greater

level of uncertainty in the economy.

Unlike some of the factors affecting publishers of large metropolitan daily

newspapers, Glacier's local daily and weekly community newspapers continue to be

the primary source of local information for readers, and continue to enjoy high

readership levels because of the demand for this information. The local

newspapers are also a primary marketing channel for local and regional

advertisers. Paid subscription revenue and national advertising represent a

small percentage of Glacier's overall revenue. Approximately 85% of Glacier's

newspaper distribution is free. Although also a small portion of Glacier's

overall revenue, classified sales in our local markets continue to perform well.

Glacier is also investing in a substantially expanded Internet presence for its

local newspaper markets, which offers attractive new revenue growth

opportunities.

Glacier's trade and business information operations are demonstrating their

resilience derived from the essential nature of their content. In difficult

economic times, their content is of significant value to business and industry

readers who need information with which to be well informed and make prudent

decisions in challenging market conditions.

Glacier's trade and business information operations benefit from a depth and

breadth of content. Glacier publishes over 200 titles in more than 20 business

and industry niches including medical, dental, environmental, occupational

health & safety, insurance, construction, communications, real estate,

manufacturing, transportation, agriculture, energy, mining, financial, legal,

compliance, and securities law, amongst others. The group has a strong mix of

channel and format balance, with particular focus being placed on electronic and

online information revenue growth.

Management continues to believe there are meaningful opportunities to realize

value from Glacier's expanded operations through increased cost efficiencies,

improved sales effectiveness and focus on publication quality, amongst other

things. While some of these improvements have been realized and contributed to

Glacier's strong operating results, many of the opportunities are still to be

achieved.

New Acquisitions

During the third quarter of 2008, Glacier acquired several Western Canadian

community newspapers for $2.5 million located in Alberta, Saskatchewan and

Manitoba. These acquisitions fit with Glacier's strategy of growing through the

local newspaper, trade and business and professional information sectors. During

the nine months ended September 30, 2008, Glacier has completed acquisitions and

investments totalling $43.5 million in aggregate purchase price.

Glacier's local newspaper group offers distribution of approximately 1.5 million

copies across B.C., Alberta, Saskatchewan and Manitoba. Glacier's trade

publication group consists of the largest agricultural publication group in

Western Canada, the Business In Vancouver Media Group, and the Business

Information Group - one of Canada's largest trade information operations.

Glacier's business & professional information group includes Specialty Technical

Publishers which publishes regulatory & compliance information, Eco Log which is

an electronic environmental information and report service, CD Pharma

Interactive Medical Productions which develops electronic interactive continuing

medical education programs for doctors, Fundata which provides investment fund

related electronic and print information and analytics to the Canadian and

global investment community and a wide variety of Canadian newspapers and media,

and a variety of directories, specialty websites and electronic information

published by the Business Information Group.

Improved Financial Position

During the quarter Glacier repaid $0.9 million of debt and funded $6.3 million

of acquisitions and sustaining capital investments with cash flow from

operations. Glacier's net consolidated debt (net of cash on hand) to EBITA ratio

was approximately 2.2x as at September 30, 2008, based on the trailing 12 months

EBITA for all of Glacier's operations, regardless of the date acquired. This

lower level of leverage has reduced Glacier's interest rate paid on borrowings

and overall interest expense.

As previously disclosed, in December 2007 Glacier converted its senior debt

facility into a revolving facility with the ability to re-borrow up to a certain

level with no scheduled mandatory principal repayments. Glacier has an operating

loan facility in addition to the revolving facility.

Subsequent to quarter end, Glacier repaid its $12.0 million of subordinated

bonds with cash on hand and an increase in the Company's revolving senior debt

facility. This is expected to reduce annual interest expense by approximately

$0.9 million.

Overall, Glacier has a strong, secure and flexible financial position with the

majority of its debt comprised of the revolving facility that does not renew

until December 31, 2010.

Glacier's profitability and moderate leverage levels are such that sufficient

free cash flow is being generated to internally fund additional accretive

acquisitions while maintaining prudent debt levels, and pursue other initiatives

where appropriate that will enhance shareholder value. While realizing

improvements from operations is a top priority, Glacier is continuing to pursue

acquisition opportunities in the information communications sectors.

Market conditions are such that attractive buying opportunities are expected to

arise, and Glacier is well positioned operationally and financially to benefit.

Shares in Glacier can be traded on the Toronto Stock Exchange under the symbol GVC.

About the Company: Glacier Media Inc. is an information communications company

focused on expanding across North America through both internal growth and the

strategic acquisition of information communications companies that provide

essential information and related services through print, electronic and online

media. Glacier is pursuing this strategy through two core business segments: 1)

the business and professional information markets and 2) the newspaper and trade

information markets.

Forward Looking Statements

Certain statements in this press release are not historical and may constitute

forward-looking statements reflecting financial performance. Investors are

cautioned that all forward-looking statements involve risks and uncertainties.

Forward-looking statements are based on management's estimates, beliefs and

opinions on the date the statements are made. Glacier assumes no obligation to

update forward-looking statements if circumstances should change. Additional

information on these and other potential factors that could affect Glacier's

financial results are detailed in documents filed from time to time with the

applicable Canadian securities regulatory authorities.

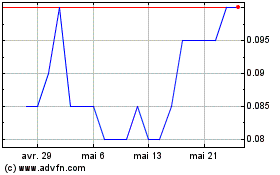

Glacier Media (TSX:GVC)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Glacier Media (TSX:GVC)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024