Glacier Media Inc. (TSX: GVC) ("Glacier" or the "Company") reported

cash flow, earnings and revenue for the period ending December 31,

2010.

Summary Results

---------------------------------------------------------------------------

(thousands of dollars except share and Year Ended Year Ended Year Ended

per share amounts) 31-Dec-10 31-Dec-09 31-Dec-08

---------------------------------------------------------------------------

Revenue $242,605 $229,128 $249,093

Gross profit $89,344 $82,179 $97,252

Gross margin 36.8% 35.9% 39.0%

EBITA(1) $44,083 $35,792 $51,822

EBITA margin(1) 18.2% 15.6% 20.8%

EBITA per share(1) $0.48 $0.38 $0.56

Interest expense, net $6,223 $6,450 $9,100

Net income before non-recurring

items(1)(2)(3)(4) $25,569 $22,163 $34,963

Net income before non-recurring items per

share(1)(2)(3)(4) $0.28 $0.24 $0.38

Net income $20,560 $13,926 $28,269

Net income per share $0.22 $0.15 $0.30

Cash flow from operations(1)(2)(3)(4) $39,074 $30,456 $44,782

Cash flow from operations per

share(1)(2)(3)(4) $0.42 $0.33 $0.48

Capital expenditures $8,207 $9,345 $9,483

Total assets $507,847 $503,747 $518,950

Debt net of cash outstanding before

deferred financing charges and other

expenses $94,732 $99,939 $112,577

Shareholders' equity $326,514 $311,043 $297,517

Weighted average shares outstanding, net 92,023,370 92,721,210 93,131,183

---------------------------------------------------------------------------

(1) Refer to "Financial Measures" following for disclosure regarding non-

GAAP measures used in this table.

(2) Fiscal 2010 excludes $4.0 million goodwill and intangible assets

impairment charge and $1.0 million restructuring expense.

(3) Fiscal 2009 excludes $5.8 million goodwill and intangible assets

impairment charge, $2.0 million restructuring expense, and $0.4

million non-recurring item.

(4) Fiscal 2008 excludes $6.3 million non-recurring item and $0.4 million

restructuring expense.

Highlights

Glacier's results for the year ended 2010 reflect the resumption

of growth in its operations:

-- Consolidated revenue increased 5.9% to $242.6 million from $229.1

million for the year prior;

-- Glacier's consolidated cash flow from operations (before changes in non-

cash operating accounts and excluding restructuring expenses) increased

28.3% to $39.1 million from $30.5 million for the year prior;

-- Glacier's consolidated cash flow from operations (before changes in non-

cash operating accounts and excluding restructuring expenses) per share

increased 29.3% to $0.42 per share from $0.33 per share for the prior

year;

-- EBITA increased 23.2% to $44.1 million from $35.8 million for the prior

year. The Company's EBITA margin increased to 18.2% for 2010 from 15.6%

the year prior; and

-- Net income increased 47.6% to $20.6 million from $13.9 million for the

prior year.

2010 Annual and Fourth Quarter Operating Performance

The 5.9% growth in revenue for 2010 came from organic growth,

several small acquisitions and the purchase of the joint venture

partners' interests of one of the Company's operations.

Same-store revenue growth increased during the course of the

year. In the fourth quarter of 2010, same-store revenue growth was

2.4%. This was accomplished despite $1.3 million of non-recurring

revenue generated in the fourth quarter of 2009 from the Olympics.

Adjusted for the non-recurring revenue, same-store revenue growth

was 4.6% in the fourth quarter of 2010 compared to the year

prior.

EBITA in the fourth quarter was $11.7 million, or $0.6 million

higher than 2009, despite $0.6 million of non-recurring EBITA being

earned in the fourth quarter of 2009 from the Olympics.

The recovery in revenue occurred across the majority of

Glacier's businesses in 2010. Growth came from both traditional

print sources and digital media sources, and is directly

attributable to Glacier's operational, business segment and media

platform strategies.

New revenues were generated in a wide variety of areas including

online, mobile, tablet, electronic product and lead generation

developments, special publishing initiatives, special features,

supplements, new community magazines, production and promotion of

community events, custom publishing, sponsored industry specific

research studies, educational offerings, conferences and

tradeshows, new directories, and a number of other initiatives.

Glacier was selected as the exclusive publisher of the Olympic

Official Vancouver 2010 Souvenir Program and Hockey Guide. Efforts

continue to be made to leverage and monetize content across print,

online, wireless and other channels and platforms.

As previously indicated, management pursued a cost reduction

strategy prior to and during the recession that was focused on

realizing significant reductions in operating costs and

efficiencies while protecting the strength of Glacier's human

resources, content quality, sales force and market and competitive

positions. Additional cost savings are being realized in 2011 as a

result of production and printing related technology and equipment

investments, amongst other things.

Placed in context, same-store 2010 revenue and EBITA returned to

93% and 85% of 2008 levels respectively. 2008 was a record year for

Glacier during which organic revenue grew 8% over the year prior

and total revenue grew 15%. In addition to the improvement in

economic conditions, Glacier was able to realize the $44.1 million

of EBITA earned in 2010 as a result of the strong sales efforts

made, discipline exercised in minimizing discounting to maintain

sales price levels, and the cost reductions realized during 2009

and 2010. The results were achieved while increased operating

investment was made in digital media resources and other content

and quality related areas, which investment also contributed to the

increased revenues.

The revenue growth that was realized prior to the recession and

that resumed in 2010 continues to underscore the value of Glacier's

community newspapers, which offer a unique selling proposition and

competitive advantage through the local information that they

provide, of which they are a primary source. This is very different

to the challenges that exist for large metropolitan daily

newspapers. The value of Glacier's local community content can and

is now being provided to Glacier's readers in print and online, by

tablet and smartphone platforms. Glacier is in the beginning stages

of the development of this local market digital media strategy.

This timing has been geared to be proactive while aligning

operating cost investment with market needs. The timing also means

that significant digital revenue opportunities still exist to be

realized.

Given that the demand for local community information is

expected to exist for the long term, Glacier expects to be able to

monetize the information and marketing value through advertising

and other revenue sources for the long term. As 85% of Glacier's

local newspaper distribution is free, this also provides for a more

durable reach of readership for advertisers over time wherein total

market coverage can always be provided.

Glacier's trade and business information operations also

experienced strong revenue recovery in 2010. Agriculture, energy,

mining, medical, manufacturing and many of Glacier's other business

and trade verticals generated significant rebounds in revenue

growth and profitability. The growth primarily began in June and

occurred throughout the last six months of the year, although the

agricultural information group and several other verticals

generated strong performance throughout the entire year. A wide

array of digital media initiatives resulted in strong growth in

online and electronic revenues. These initiatives continue to offer

Glacier's customers an increasingly richer value proposition

through both the enhancement of information value that digital

media provides, the enhancement of customer targeting and marketing

effectiveness provided to advertisers, and the breadth of new

product opportunities and related monetization available.

Significant increases in print advertising were also realized.

Performance during both the recession and 2010 also highlighted the

strength of Glacier's electronic business and trade information

subscription and directory offerings.

Significant focus and related investment will continue to be

made to enhance Glacier's digital trade and business information

verticals, through both organic development and the acquisition of

new businesses. These acquisitions will be targeted to expand the

markets that Glacier covers, expand the breadth of information

products and marketing solutions provided, and to expand Glacier's

digital media staff, technology and other relevant resources.

Financial Position

Glacier's consolidated debt net of cash outstanding before

deferred financing charges and other expenses was 2.1x EBITA as at

year end. Subsequent to year end, the Company amended its revolving

loan facility on substantially the same terms and conditions. The

amended facility includes greater potential borrowing capacity and

matures on March 30, 2015.

The Company used its cash flow from operations to repay $14.0

million of revolving debt and repurchase $5.0 million of preferred

shares and $4.9 million of its common shares during the year.

Glacier's consolidated debt net of cash outstanding before deferred

financing charges and other expenses was $94.7 million as at

December 31, 2010 compared to $99.9 million as at December 31,

2009.

Glacier invested $8.2 million of capital expenditures during

2010, $4.5 million of which were investment capital expenditures

made primarily to complete the consolidation and expansion of

several printing facilities and upgrade production technology.

These investments have resulted in attractive direct revenue and

cash flow improvements and payback consistent with Glacier's

targeted return on investment, as well as improved quality and

colour capacity.

Glacier also invested $6.9 million of cash inclusive of bank

indebtedness in acquisitions during the year, including the

purchase of the joint venture partners' interests of one of the

Company's operations. This level of investment was intentionally

modest due to the preference to maintain a strong financial

position while economic risk was being monitored.

The Company recorded a $4.0 million impairment of goodwill and

intangible assets as at December 31, 2010. The write-down primarily

related to Glacier's continuing medical information business.

Outlook and Opportunities for Value Creation

Management expects that growth will continue in 2011 in

Glacier's various business segments. While risks remain in some

areas of the economy that affect Glacier's operations and not all

markets have recovered from the recession to the same extent as

others, advertiser confidence and spending have shown marked

improvement across the majority of Glacier's business verticals and

are resulting in overall revenue growth. Customer demand for

Glacier's electronic information products remained strong during

the recession and increased in many areas in 2010.

The combination of revenue growth and a lower cost base resulted

in significantly increased profitability during 2010 and both

revenue and profitability are expected to continue to grow

organically in 2011. The growth in profitability resulted in a

13.3% return on average adjusted equity earned for the year ending

December 31, 2010, calculated as cash flow from operations (before

changes in non-cash operating accounts and non-recurring items)

divided by consolidated average shareholders' equity for 2010 and

2009 adjusted to exclude $25.8 million of minority equity

investments, for which no amount is included in cash flow from

operations.

Given that cash flow is growing and debt is at 2.1x EBITA,

Glacier is reviewing acquisition opportunities that fit with the

Company's business strategy. Given the current juncture of the

business cycle, many attractive opportunities are expected to

arise.

Management will continue to seek a balance of maintaining debt

at manageable levels, continuing to strengthen operations, and

delivering growth through acquisition.

Shares in Glacier can be traded on the Toronto Stock Exchange

under the symbol GVC.

About the Company: Glacier Media Inc. is an information

communications company focused on the provision of primary and

essential information and related services through print,

electronic and online media. Glacier is pursuing this strategy

through its core businesses: the local newspaper, trade information

and business and professional information markets.

Financial Measures

To supplement the consolidated financial statements presented in

accordance with Canadian generally accepted accounting principles

(GAAP), Glacier uses certain non-GAAP measures that may be

different from the performance measures used by other companies.

These non-GAAP measures include cash flow from operations (before

changes in non-cash operating accounts and non-recurring items),

net income before non-recurring items and earnings before interest,

taxes and amortization (EBITA), which are not alternatives to GAAP

financial measures. Management focuses on operating cash flow per

share as the primary measure of operating profitability, free cash

flow and value. EBITA per share is also an important measure as the

Company has low ongoing capital expenditures and amortization

largely relates to acquisition goodwill and copyrights and does not

represent a corresponding sustaining capital expense. These

non-GAAP measures do not have any standardized meanings prescribed

by GAAP and accordingly they are unlikely to be comparable to

similar measures presented by other issuers.

Forward Looking Statements

This news release contains forward-looking statements that

relate to, among other things, the Company's objectives, goals,

strategies, intentions, plans, beliefs, expectations and estimates.

These forward-looking statements include, among other things,

statements under the heading "Outlook and Opportunities for Value

Creation" and statements relating to the Company's expectations

regarding revenues, expenses, cash flows and future profitability,

including our expectations that growth will continue in Glacier's

business segments, our expectations as to organic revenue and

profitability growth, that profitability will continue to improve

as the economy recovers, and that cost savings will be realized.

These forward looking statements are based on certain assumptions,

including continued economic growth and recovery and the

realization of cost savings, and are subject to risks,

uncertainties and other factors which may cause results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements, and undue

reliance should not be placed on such statements.

Important factors that could cause actual results to differ

materially from these expectations are listed in the Company's

Annual Information Form under the heading "Risk Factors" and in the

Company's MD&A under the heading "Business Environment and

Risks", many of which are out of the Company's control. These

factors include, but are not limited to, the ability of the Company

to sell advertising and subscriptions related to its publications,

foreign exchange rate fluctuations, the seasonal and cyclical

nature of the agricultural industry, discontinuation of Department

of Canadian Heritage, Canada Periodical Fund, general market

conditions in both Canada and the United States, changes in the

prices of purchased supplies including newsprint, the effects of

competition in the Company's markets, dependence on key personnel,

integration of newly acquired businesses, technological changes,

and financing and debt service risk.

The forward-looking statements made in this news release relate

only to events or information as of the date on which the

statements are made. Except as required by law, the Company

undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date on which the statements

are made or to reflect the occurrence of unanticipated events.

Contacts: Glacier Media Inc. Mr. Orest Smysnuik Chief Financial

Officer 604-708-3264 www.glaciermedia.ca

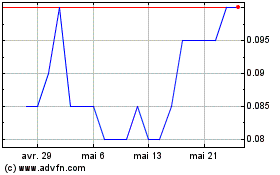

Glacier Media (TSX:GVC)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Glacier Media (TSX:GVC)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024