BONDUELLE

March 27, 2015

The Bonduelle

Group repurchased a block of 2009 redeemable equity warrants

(BSAARs) and then initiated a buyout procedure (procédure de désintéressement).

On March 27, 2015, Bonduelle SCA

made a block purchase of redeemable equity warrants from its main

shareholder, Pierre et Benoit Bonduelle SAS and initiated a buyout

offer to the other warrant holders. The objective of this

transaction, made possible by the vast improvement of the Group's

financial profile and justified by the increase in its stock price,

was to limit the creation of equity and the dilution that could be

caused if the redeemable equity warrants issued in 2009 were

exercised.

Reasons for the

transaction

In July 2007, Bonduelle issued

150,000 bonds with redeemable warrants (OBSAARs) for an amount of

€150 million, with five warrants attached to each bond, i.e. a

total of 750,000 redeemable equity warrants. This issue allowed

Bonduelle to improve its financial structure by optimizing the cost

of its debt, with the option to increase its equity if new shares

are issued when the bonds are exercised.

In April 2009, Bonduelle issued

233,333 additional bonds with redeemable warrants for an amount of

€140 million, with three warrants attached to each bond, i.e. a

total of 699,999 redeemable equity warrants issued. The financial

benefits of the transaction were the same for Bonduelle as those

during the 2007 issue, i.e. the cost of debt was optimized with the

option to increase its equity.

At the time of this new issue,

Bonduelle had also offered to exchange the 750,000 redeemable

equity warrants from 2007 against the same number of warrants with

the same features as the warrants attached to the 2009 OBSAARs,

i.e. maturing on April 8, 2016 and with a strike price of €80.

Following this operation, there was a total of 1,449,999[1] redeemable

equity warrants in circulation.

A detailed description of the

redeemable equity warrants (ISIN code: FR0010734509) can be found

in the prospectus, which the French financial markets authority

certified under No. 09-052 on March 6, 2009 and in the information

note with certification number 09-075 of April 2, 2009. This

prospectus and the information note are available free of charge on

the websites of the French financial markets authority

(www.amf-france.org). On March 28, 2013, the Bonduelle share was

split into four, leading to a parity adjustment of the redeemable

equity warrants, which now carry entitlement to four shares per

warrant, at a strike price of €80.

On the date of the block purchase,

all of the 2007 warrants had matured and 1,426,739 of the 2009

warrants remained in circulation, which could lead to the creation

of 5,706,956 new shares with a unit strike price of €20 each, i.e.

a potential dilution of 15.14% and an equity increase of

€114,139,120.

In view of the continued

improvement in its financial profile, making a capital increase

irrelevant, the Bonduelle Group decided to limit the dilution which

would be brought about by the exercising of the redeemable equity

warrants and the associated equity creation.

To do this, the company purchased,

on that day, a block of 1,016,350 redeemable equity warrants over

the counter from Pierre et Benoit Bonduelle SAS at the unit price

of €18, for a total of €18,294,300. This block represented 71.24%

of the warrants in circulation which could lead to the creation of

4,065,400 new shares. The warrants purchased will be canceled in

accordance with the terms of the issue agreement and the

law.

Following this purchase, 410,389 redeemable equity warrants

remained in circulation, i.e. 28.76% of the warrants that had been

in circulation prior to the purchase. To ensure the equal treatment

of all holders, Bonduelle SCA initiated a buyback procedure for the

outstanding redeemable equity warrants on the NYSE-Euronext

regulated market in Paris. This procedure will take place as

outlined below.

After the sale of its block, Pierre et Benoit Bonduelle SAS held

170,962 redeemable equity warrants. In support of the aim of this

transaction and wanting to support the growth of the Bonduelle

Group and its value creation, Pierre et Benoit Bonduelle SAS will

exercise, subsequently and subject to market conditions, the

balance of the redeemable equity warrants remaining in its

possession after sale of the block, by reinvesting the net proceeds

of the sale of the warrants.

As of February 28, 2015, Pierre et

Benoit Bonduelle SAS has held, directly and indirectly, 27.66% of

the share capital and 37.89% of the voting rights which may be

exercised in a Bonduelle SCA Shareholders' Meeting. In the event

that the redeemable equity warrants, are exercised, these

percentage holdings would become 29.80% and 38.79%

respectively.

Should the exercise of the

redeemable equity warrants lead to a situation in which the

combined holding of Pierre et Benoit Bonduelle SAS and the Concert

results in a mandatory public takeover bid, a request for a waiver

to the obligation to file a mandatory public takeover bid will be

made to the AMF.

Details of the buyback

procedure

Bonduelle irrevocably commits to buy back the redeemable equity

warrants during a period of 10 trading days at a price identical to

the price paid for the block purchase, i.e. €18 per warrant. During

this period, listing of the redeemable equity warrants will be

suspended.

The procedure applies to all redeemable equity warrants remaining

in circulation not held by Pierre et Benoit Bonduelle SAS following

the block purchase, i.e. 239,427 warrants.

Any holder wanting to sell all or

some of their redeemable equity warrants under the procedure must

send their sale instruction to their broker at the unit price of

€18.

The buyback offer will be open to

warrant holders from March 30, 2015 to April 14, 2015

inclusive.

The buyout transactions will be

managed by Société Générale Securities Services.

At the end of the buyback period,

the warrants will be purchased at the unit price of €18 per

warrant.

Settlement and delivery of the

repurchased warrants will take place on April 21, 2015.

At the end of the buyback period, Bonduelle SCA will issue a

financial press release to announce the overall amount of warrants

purchased.

The warrants purchased will be canceled in accordance with the

terms of the issue agreement and the law.

Furthermore, the company holds

1,590,564 treasury shares allocated to external growth operations.

After the outstanding redeemable equity warrants on the market have

been repurchased, Bonduelle SCA will reallocate part of its

treasury shares to hedge the redeemable equity warrants to deliver

the existing shares in the event that the warrants are exercised.

By reallocating its treasury shares, the company will limit the

issue of new shares when the warrants remaining in circulation are

exercised, and will have thus limited any dilution caused by the

exercising of the warrants.

Impact of the operation on Bonduelle's financial

statements

According to IFRS, derivatives of

treasury shares are analyzed as equity instruments when their

exercise involves exchanging a fixed amount of cash against a fixed

number of shares. This is the case with the redeemable equity

warrants, as each warrant carries entitlement to four Bonduelle

shares in exchange for payment of €80.

So, as they are equity

instruments, the buyout of the redeemable equity warrants in the

consolidated financial statements will not have an impact on the

company's income statement and will materialize by the following

entries:

-

The buyback of the block of warrants from Pierre

et Benoit Bonduelle SAS is reflected in a cash outlay and an equity

reduction of the same amount;

-

At the start of the buyback procedure, a debt

equal to the number of redeemable equity warrants remaining in

circulation multiplied by the buyback price of the block will be

recorded offset by an equivalent equity reduction. This debt has a

fixed value (the price and the quantities are fixed) and as such

will not be revalued over the 10 days of the transaction. Finally,

this debt will be cleared by the offsetting cash outflow;

-

After the buyback procedure, the debt initially

recorded will be reclassified under equity at the value of the

warrants which have not been contributed.

In the corporate financial

statements, the redeemable equity warrants repurchased in this way

with a view to their cancellation will also be recorded as a

deduction from the company's equity, without any impact on the

income statement.

Therefore, in the consolidated

financial statements of the Bonduelle Group, as an equity

instrument, the impact of this transaction on the redeemable equity

warrants will be recorded against equity.

In the individual financial

statements of Bonduelle SCA, this transaction will also impact on

equity, with the exception of warrants exercised delivered in

treasury shares, which would impact on the income statement.

The planned accounting systems

were submitted to the Group's statutory auditors, who did not make

any observations on it.

Independent expert report on the corporate interest and

fairness of the transaction

An independent expert, Associés en

Finance, prepared a report on the transaction, to confirm that it

is in the company's corporate interest, and that it is fair, as

concerns both the shareholders and the warrant holders. The report

also certified that the buyback price proposed is consistent with

the valuations obtained using the commonly-used tools to determine

the price of optional instruments.

The conclusions were as

follows:

"The main aim of the transaction

for Bonduelle is to limit the potential creation of equity

resulting from the exercising of redeemable equity warrants, which

is no longer necessary in the Group's current structure. [.]

The equity raised from the main

shareholder exercising the remaining redeemable equity warrants

would offset the equity impact caused by the buyback of the

redeemable equity warrants. In addition, this transaction would not

entail, according to the calculations resulting from the Trival

model used by Associés en Finance, any major change in Bonduelle's

level of financial risk.

The transaction is consistent with

the company's corporate interest.

The buyback procedure gives

managers and the public a liquidity opportunity on a security on

which market trading is very low.

The redeemable equity warrants

were valued based on the average weighted prices of the share

volumes over 20 trading days ending on March 25, 2015, i.e. €24.47.

It was also based on the low point of €23.10 and the high point of

€24.91 of the weighted prices over the period.

On March 25, 2015, the value of

the Bonduelle redeemable equity warrants was between €13.58 and

€19.64, depending on the volatility and the reference price

used.

Based on the buyback price of €18

proposed by the company, slightly higher than our central valuation

scenario at €17.88, the advantage granted to warrant holders by the

shareholders is between €121,962 i.e. the insignificant amount of

€0.00 per share or 0.02% of the closing share price on March 25,

2015 and €150,693, i.e. €0.00 per share or 0.02% of the share

closing price on March 25, 2015,.

The main shareholder is negatively

affected by the transaction to the same extent as all shareholders

and positively to the same extent as all warrant holders. Its

financial benefit is measured by offsetting the advantage from its

redeemable equity warrants and the disadvantage from its shares.

This is between €77,972, i.e. €0.00 per share or 0.01% of the

closing share price on March 25, 2015 and €86,359, i.e. €0.00, per

share or 0.01% of the closing share price on March 25 2015.

The block buyback and buyout at

the same price as offered to other warrant holders offsets for the

shareholders most of the dilution which would be caused by the

warrants being exercised. This would lead to a capital increase of

€20 per share for a listed price of €24.47 on average over 20

trading days.

The block buyback transaction

followed by the buyout of the other holders limits the creation of

potential equity, which is no longer necessary in Bonduelle's

current situation, and fits in with the company's corporate

interest.

In light of the above information,

the offered purchase price of €18, which is within the range of our

valuations, is therefore fair under current market conditions for

holders of redeemable equity warrants and for all the company's

shareholders."

The independent expert's report is

available at www.bonduelle.com

Opinion and Authorization of the Supervisory

Board

The transaction described above

was submitted to the Bonduelle SCA Supervisory Board for approval

on March 27, 2015. The latter issued a favorable opinion.

The block buyback of redeemable

equity warrants from Pierre et Benoit Bonduelle SAS falls under the

agreements referred to in Article L. 226-10 and L. 225-38 of the

Code de Commerce, referred to as regulated agreements. This

agreement was submitted to the Supervisory Board for prior

authorization the same day. After discussion, the Supervisory Board

authorized this agreement.

About Bonduelle

Bonduelle is a

family company established in 1853 with the mission to become a

worldwide champion of well-being by eating vegetables. Favoring

innovation and a long-term outlook, the group has diversified its

business lines and its geographic locations. Its vegetables, which

are grown over 128,000 hectares, are sold in 100 countries under

different brands, via different distribution channels and in all

technologies. It has unique food industry expertise and 58

manufacturing and agricultural production sites. Bonduelle uses the

best cultivation areas closest to its clients.

Bonduelle is

listed on the NYSE - Euronext compartment B - Indexes: CAC MID

& SMALL - CAC ALL-TRADABLE - CAC ALL SHARES

ISIN code: FR0000063935 - Reuters code: BOND.PA -

Bloomberg code: BON FP

DISCLAIMER

The circulation of this press release, the purchase commitment, the

implementation of this commitment and participation in this

procedure may be subject to legal or regulatory restrictions in

some countries. This procedure is not intended for persons subject

to such restrictions, either directly or indirectly, and is not

likely to be accepted by a country where this procedure is subject

to such restrictions.

This press release must not be

published, distributed or circulated in the United States of

America. It is not an offer for the purchase of transferable

securities in the United States of America or any country in which

such a procedure or request would be illegal, and a redeemable

equity warrant sale order cannot be accepted in or from the United

States of America. The commitment to make purchases on the market

in France cannot be accepted by any means or support emanating from

or in the United States of America. Any person participating in the

transaction will be considered as having accepted the restrictions

referred to above.

This press release is not an

invitation to take part in the redeemable equity warrant buyback

procedure in any country where it is illegal to make such an

invitation pursuant to applicable statutory and regulatory

provisions. In particular, the redeemable equity warrant buyback

procedure is not offered and will not be offered, directly or

indirectly in the United States in any form and by any means. The

persons in possession of this press release must familiarize

themselves with and abide by all statutory and regulatory

restrictions.

This financial press release is

published by, and under the sole responsibility of, Bonduelle

SCA.

[1] This figure

breaks down as:

-

731,967 redeemable equity warrants (2007) converted into redeemable

equity warrants (2009)

- 699,999

redeemable equity warrants issued in 2009

2009 redeemable equity warrants

repurchase and buy out procedure

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: BONDUELLE via Globenewswire

HUG#1907064

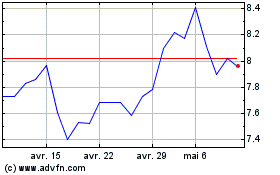

Bonduelle (EU:BON)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

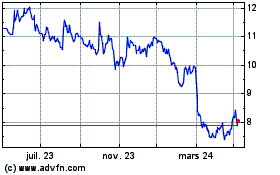

Bonduelle (EU:BON)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024