CREDIT AGRICOLE SA : Unchanged ECB capital requirements for Crédit Agricole Group and Crédit Agricole S.A.

22 Décembre 2017 - 5:45PM

Unchanged ECB capital

requirements for Crédit Agricole Group and Crédit Agricole

S.A.

Crédit Agricole Group and Crédit

Agricole S.A. have been recently notified by the European Central

Bank (ECB) of the new minimum capital requirements following the

results of the Supervisory Review and Evaluation Process (SREP),

confirming the current level of pillar 2 requirements.

Since the opinion of the European

Banking Authority (EBA) on Friday 18 December 2015, both Pillar 1

and Pillar 2 capital requirements must be fulfilled before common

equity tier 1 capital (CET1) is allocated to meet combined buffer

requirements.

As a result, distributions on

shares and additional Tier 1 hybrid instruments and payment of

variable compensation to identified staff by institutions that fail

to meet the Pillar 2 minimal capital requirements (including any

systemic surcharge) will be restricted or prohibited, as the case

may be. The EBA also recommended that Pillar 2 capital requirements

be made public.

Crédit Agricole Group will need to

meet a minimum consolidated CET1 ratio (including the Pillar 1,

Pillar 2 and conservation buffer requirements) of at least 7.875%,

phased in, as of 1 January 2018. In addition, the G-SIB buffer

required by the Financial Stability Board to be applied on top of

these requirements will result in a 0.75% surcharge on a

transitional basis from 1 January 2018 (bringing the minimum

capital requirement at this date to 8.625%) and is expected to

reach 1% on a fully loaded basis in 2019.

In this context, Crédit Agricole

Group demonstrates a best-in-class solvency level among European

banking peers with a consolidated CET1 capital ratio as at 30

September 2017 standing at 14.9% calculated by applying CRD IV

transitional arrangements for 2017, that is a 627 basis points

buffer above the 8.625% minimum level applicable as at 1 January

2018. On a fully loaded basis the consolidated

CET1 capital ratio as at 30 September 2017 standing at 14.9% as

well result in a 540 basis points buffer above the level applicable

in 2019.

Crédit Agricole S.A. will need to

meet a minimum consolidated CET1 ratio (including the Pillar 1,

Pillar 2 and conservation buffer requirements) of 7.875%, phased

in, as of 1 January 2018.

No additional capital buffer

applies to Crédit Agricole S.A.. Crédit Agricole S.A., as the

central body of Crédit Agricole Group, fully benefits from the

solidarity mechanism as well as internal flexibility on capital

circulation within the very strongly capitalised Crédit Agricole

Group.

Crédit Agricole S.A.'s aim is to

operate with solid cushions above the minimum consolidated ECB

requirements that will be applicable from 1 January 2018. Crédit

Agricole S.A.'s consolidated CET1 capital ratio as at 30 September

2017 was 12.0% calculated by applying CRD IV transitional

arrangements for 2017, which makes it already perfectly compliant

with these requirements. Crédit Agricole S.A.'s target is to have a consolidated CET1 ratio of

approximately 11%, on a fully loaded basis, which translated into

250 basis points above the 8.5% fully loaded minimum ECB

requirement.

CRÉDIT

AGRICOLE PRESS CONTACT

Charlotte de

Chavagnac + 33 1 57

72 11

17

charlotte.dechavagnac@credit-agricole-sa.fr

Alexandre

Barat

+ 33 1 43 23 07

31

alexandre.barat@credit-agricole-sa.fr

Find our press release on: www.credit-agricole.com

UK 22 12 17 PR CA SREP

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: CREDIT AGRICOLE SA via Globenewswire

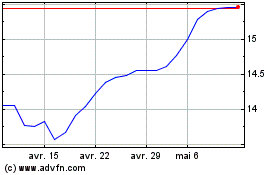

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

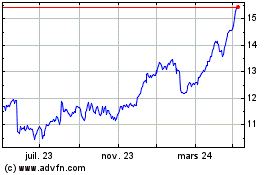

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024