CREDIT AGRICOLE SA : press release

24 Avril 2017 - 7:46PM

Press

release

Montrouge, 24 April 2017

Crédit

Agricole S.A. has begun preliminary discussions via Crédit Agricole

Cariparma SpA, its retail banking subsidiary in Italy, with the

Bank of Italy and the Interbank Deposit Protection Fund (the

"FITD") with a view to acquiring the Cesena ("Cassa di

Risparmio di Cesena" or "Caricesena"), Rimini ("Cassa di

Risparmio di Rimini" or "Carim") and San Miniato ("Cassa di

Risparmio di San Miniato" or "Carismi") Savings Banks.

These

discussions fit with Crédit Agricole's strategic goals in Italy as

presented when the Medium-Term Plan "Ambition 2020" was published

and confirmed again recently. Organic growth is the priority avenue

of development for its retail banking business in Italy. However,

the Group reserves the right to consider in a prudent manner any

opportunities arising that meet specific criteria related, among

others, to size, balance sheet quality, attractiveness of the

business franchise, geographical positioning and potential

synergies.

The

deal currently being weighed up meets these stringent strategic

guidelines. The addition of the three savings banks to Crédit

Agricole Cariparma SpA would increase the size of its customer base

by around 20%. It would also help it to expand into attractive

regions of Italy, without altering its geographical positioning

since the savings banks operate in neighbouring areas to its own

territories. The deal would not adversely affect Crédit Agricole

Cariparma SpA's finances either, since all three targets' bad debts

("sofferenze") would be deconsolidated prior

to a possible sale, while they have a significant surplus of

customer deposits.

The

project is still in its very early stages. Its completion is

contingent upon a positive outcome to the due diligence process,

which is set to begin shortly and, at the appropriate juncture,

approval from the relevant authorities. Based on the information

currently available, its negative impact on Crédit Agricole S.A.'s

and the Crédit Agricole Group's CET1 ratios would be less than

10bp.

Crédit

Agricole press contacts

Charlotte de Chavagnac 01 57 72 11 17 -

charlotte.dechavagnac@credit-agricole-sa.fr

Alexandre Barat 01 43 23 07 31 -

alexandre.barat@credit-agricole-sa.fr

All our press releases are available at

https://www.credit-agricole.com/en

https://twitter.com/Credit_Agricole

PR CASA ENG 24 04 2017

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: CREDIT AGRICOLE SA via Globenewswire

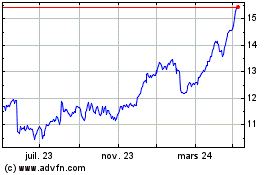

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

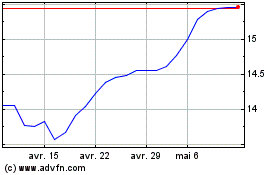

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024