H1 2017 Results

-

Adjusted revenue up +1.5% to

€1,641.4 million

-

Adjusted organic revenue up

+0.4%, with an accelerating Q2 at +1.5%

-

Adjusted operating margin of

€255.0 million, down -3.6%

-

Adjusted EBIT, before

impairment charge, of €115.1 million, down -4.5 %

-

Net income Group share of €74.1

million, down -7.8%

-

Adjusted free cash flow of

€30.1 million, down -69.4%

-

Adjusted organic revenue growth

rate expected to be around +3% in Q3 2017

Paris,

27th July, 2017 -

JCDecaux SA (Euronext Paris: DEC), the number one outdoor

advertising company worldwide, announced today its 2017 half year

financial results.

Following the adoption of IFRS 11

from 1st January,

2014, the operating data presented below is adjusted to include our

prorata share in companies under joint

control. Please refer to the paragraph "Adjusted data" on

pages 5 and 6 of this release for the definition of adjusted

data and reconciliation with IFRS.

Commenting on the 2017 first half

results, Jean-François Decaux, Chairman of the

Executive Board and Co-CEO of JCDecaux, said:

"Our H1 2017

revenue of €1,641.4 million which is up +1.5% on a reported

basis and +0.4% on an organic basis was driven by a better than

expected Q2 with an organic growth rate of +1.5% reflecting a solid

June with an improvement of our Chinese business. Street

Furniture's good performance was mainly due to a very strong

increase in our digital revenue coming from the ongoing

digitisation of our premium Street Furniture assets around the

world including London and New York City while our Transport

segment was virtually flat being negatively impacted by the revenue

decline in both Greater China and the Rest of the World. Our

Billboard segment declined despite a good performance from our

digital billboards reflecting the lack of consolidation of the

Billboard market in Europe. Our digital revenue, which now

represent 15.6% of our total revenue, continued to grow strongly

leading to market share gains especially in the UK and in the

US.

As anticipated,

our Street Furniture operating margin increased by +100bp to 23.4%

due to both the strong digital revenue increase of our bus-shelter

contract in London where we now operate nearly 700

84'' screens and the positive impact of the ongoing turnaround

of CEMUSA. However, the overall operating margin declined by -90bp

to 15.5% being negatively impacted by a margin reduction in both

Transport and Billboard.

As far as organic

growth is concerned, we won several significant advertising

contracts in faster-growth markets such as the Guangzhou Baiyun

International airport (Terminal 2), São Paulo-Guarulhos

International airport, São Paulo metro, Tocumen International

airport in Panama and Street Furniture in Dubai as well as the

global franchise for Rotterdam bus shelters, buses, trams and

metro.

Following our

merger with Top Media in December 2016 in Central America, we

continued to further consolidate the Latin American fragmented OOH

market with the merger of our OOH business into a joint-venture

with América Móvil in Mexico in order to strengthen our position in

the 2nd largest

advertising market in the region. The closing of this transaction

is subject to the satisfaction of certain conditions, including the

approval of the Mexican Federal Competition Commission.

Bearing in mind

the reduced visibility, we currently expect our Q3 adjusted organic

revenue growth rate to accelerate to reach around +3%, reflecting

the return to growth in China and the good momentum in both the US

and Europe, while France remains challenging and the UK starts to

slow down.

In a media

landscape increasingly fragmented, out-of-home advertising

reinforces its attractiveness. With our accelerating exposure to

faster-growth markets, our growing premium digital portfolio

combined with a new data-led audience targeting

platform, our ability to win new contracts and the high quality of

our teams across the world, we believe we are well positioned to

outperform the advertising market and increase our leadership

position in the outdoor advertising industry through profitable

market share gains. The strength of our balance sheet is a key

competitive advantage that will allow us to pursue further external

growth opportunities as they arise."

ADJUSTED

REVENUE

Adjusted revenue for the six

months ending 30th June 2017

increased by +1.5% to €1,641.4 million from

€1,617.3 million in the same period last year. On an organic

basis (i.e. excluding the positive impact from foreign

exchange variations and the positive impact from changes in

perimeter), adjusted revenue grew by +0.4%. Adjusted advertising

revenue, excluding revenue related to sale, rental and maintenance,

increased by +0.5% on an organic basis in the first half of

2017.

In the second quarter, adjusted

revenue increased by +1.7% to €883.8 million. On an organic

basis, adjusted revenue grew by +1.5% compared to

Q2 2016.

Adjusted advertising revenue, excluding revenue related to sale,

rental and maintenance, increased by +1.3% on an organic basis in

Q2 2017.

Adjusted

revenue

| €m |

H1 2017 |

H1 2016 |

Change 17/16 |

| Q1 |

Q2 |

H1 |

Q1 |

Q2 |

H1 |

Q1 |

Q2 |

H1 |

| Street

Furniture |

343.1 |

403.4 |

746.5 |

333.4 |

392.5 |

725.9 |

+2.9% |

+2.8% |

+2.8% |

|

Transport |

302.1 |

349.1 |

651.2 |

312.0 |

342.7 |

654.7 |

-3.2% |

+1.9% |

-0.5% |

|

Billboard |

112.4 |

131.3 |

243.7 |

103.1 |

133.6 |

236.7 |

+9.0% |

-1.7% |

+3.0% |

| Total |

757.6 |

883.8 |

1,641.4 |

748.5 |

868.8 |

1,617.3 |

+1.2% |

+1.7% |

+1.5% |

Adjusted organic

revenue growth (a)

|

Change 17/16 |

| Q1 |

Q2 |

H1 |

| Street

Furniture |

+1.9% |

+2.8% |

+2.4% |

|

Transport |

-3.3% |

+2.6% |

-0.2% |

|

Billboard |

-3.3% |

-5.0% |

-4.3% |

| Total |

-1.0% |

+1.5% |

+0.4% |

(a) Excluding

acquisitions/divestitures and the impact of foreign

exchange

Adjusted revenue

by geographic area

| €m |

H1 2017 |

H1 2016 |

Reported growth |

Organic growth(a) |

|

Europe(b) |

437.7 |

428.6 |

+2.1% |

+2.5% |

|

Asia-Pacific |

372.9 |

387.9 |

-3.9% |

-3.8% |

|

France |

297.1 |

310.4 |

-4.3% |

-4.3% |

| Rest of

the World |

216.6 |

183.8 |

+17.8% |

-0.9% |

| United

Kingdom |

175.9 |

183.1 |

-3.9% |

+6.1% |

| North

America |

141.2 |

123.5 |

+14.3% |

+10.8% |

| Total |

1,641.4 |

1,617.3 |

+1.5% |

+0.4% |

(a) Excluding

acquisitions/divestitures and the impact of foreign

exchange

(b) Excluding France and the United

Kingdom

Please note that the geographic

comments below refer to organic revenue growth.

STREET

FURNITURE

First half adjusted revenue

increased by +2.8% to €746.5 million (+2.4% on an organic

basis), driven by Europe and the Rest of the World.

First half adjusted advertising revenue, excluding revenue related

to sale, rental and maintenance were up +2.3% on an organic basis

compared to the first half of 2016.

In the second quarter, adjusted

revenue increased by +2.8% to €403.4 million. On an organic

basis, adjusted revenue increased by +2.8% compared to the same

period last year. Adjusted advertising revenue, excluding revenue

related to sale, rental and maintenance were up +2.4% on an organic

basis in Q2 2017 compared to Q2 2016.

TRANSPORT

First half adjusted revenue

decreased by -0.5% to €651.2 million (-0.2% on an organic

basis), mainly due to a revenue decline in Greater China and in the

Middle East partially offset by a good performance in Europe and a

strong double-digit growth in North America.

In the second quarter, adjusted

revenue increased by +1.9% to €349.1 million. On an organic

basis, adjusted revenue increased by +2.6 % compared to the same

period last year.

BILLBOARD

First half adjusted revenue

increased by +3.0% to €243.7 million (-4.3% on an organic

basis). Reported growth was fuelled by the contribution of OUTFRONT

Media Latam in Q1 2017 (consolidated in our accounts since

1st April,

2016).

In the second quarter, adjusted

revenue decreased by -1.7% to €131.3 million. On an organic

basis, adjusted revenue decreased by -5.0% compared to the same

period last year.

ADJUSTED

OPERATING MARGIN (1)

In the first half of 2017,

adjusted operating margin decreased by -3.6% to €255.0 million

from €264.5 million in the first half of 2016. The adjusted

operating margin as a percentage of revenue was 15.5%, -90bp below

prior year.

| |

H1 2017 |

H1 2016 |

Change 17/16 |

| |

€m |

% of revenue |

€m |

% of revenue |

Change (%) |

Margin rate (bp) |

| Street

Furniture |

174.9 |

23.4% |

162.6 |

22.4% |

+7.6% |

+100bp |

|

Transport |

66.0 |

10.1% |

82.7 |

12.6% |

-20.2% |

-250bp |

|

Billboard |

14.1 |

5.8% |

19.2 |

8.1% |

-26.6% |

-230bp |

| Total |

255.0 |

15.5% |

264.5 |

16.4% |

-3.6% |

-90bp |

Street Furniture: In the first half of 2017,

adjusted operating margin increased by +7.6% to

€174.9 million. As a percentage of revenue, the adjusted

operating margin increased by +100bp to 23.4%, compared to the

first half of 2016, driven by the turnaround of CEMUSA and the

ramp-up of the world's largest bus shelter advertising franchise

with TfL in London, however offset by the impact of a revenue

decrease in France.

Transport: In

the first half of 2017, adjusted operating margin decreased by

-20.2% to €66.0 million. As a percentage of revenue, the

adjusted operating margin decreased by -250bp to 10.1% compared to

the first half of 2016, primarily due to the revenue decrease in

Greater China and in the Middle East.

Billboard: In

the first half of 2017, adjusted operating margin decreased by

-26.6% to €14.1 million. As a percentage of revenue, adjusted

operating margin decreased by -230bp to 5.8% compared to the first

half of 2016, driven by a revenue decline in Europe and in the Rest

of the World.

ADJUSTED EBIT

(2)

In the first half of 2017,

adjusted EBIT before impairment charge decreased by -4.5% to

€115.1 million compared to €120.5 million in the first

half of 2016. As a percentage of revenue, this represented a -50bp

decrease to 7.0%, from 7.5% in H1 2016. The consumption of

maintenance spare parts was slightly up in H1 2017 compared to H1

2016. Net amortization and provisions were up compared to the same

period last year, due to a less important reversal on provisions

for onerous contracts in H1 2017, related to the Purchase

Accounting of CEMUSA than in H1 2016. Other operating income

and expenses impacted the P&L positively, mainly due to lower

restructuring costs booked in H1 2017 compared to those booked

in H1 2016, mostly relating to CEMUSA's turnaround, and due to

some assets disposals.

No impairment charge on goodwill and tangible, intangible assets

and investments under equity method has been recorded in the first

half of 2017 like in H1 2016. A €3.0 million reversal of

amortization of tangible and intangible assets and a

€0.6 million reversal on provisions for onerous contracts have

been recognized in H1 2017 (a €0.6 million reversal on

provisions for onerous contracts and a €0.1 million reversal

of amortization of tangible and intangible assets were booked in

H1 2016).

Adjusted EBIT, after impairment

charge decreased by -2.1% to €118.7 million compared to

€121.2 million in H1 2016.

NET FINANCIAL

INCOME / (LOSS) (3)

In the first half of 2017, net

financial income was -€15.3 million compared to

-€13.2 million in the first half of 2016, mainly due to net

interest expenses of the new bond of €750 million issued in

June 2016.

EQUITY

AFFILIATES

In the first half of 2017, the

share of net profit from equity affiliates was €46.5 million,

higher compared to the same period last year

(€45.7 million).

NET INCOME GROUP

SHARE

In the first half of 2017, net

income Group share before impairment charge decreased by -10.0% to

€72.0 million compared to €80.0 million in H1 2016.

Taking into account the impact

from the impairment charge, net income Group share decreased

by

-7.8% to €74.1 million compared to €80.4 million in H1

2016.

ADJUSTED CAPITAL

EXPENDITURE

In the first half of 2017,

adjusted net capex (acquisition of property, plant and equipment

and intangible assets, net of disposals of assets) was at

€93.2 million compared to €78.9 million during the same

period last year, mainly due to the digitisation across all

segments.

ADJUSTED FREE

CASH FLOW (4)

In the first half of 2017,

adjusted free cash flow was €30.1 million compared to

€98.3 million in the same period last year. This decrease is

mainly due to a lower operating margin, an increase in our working

capital requirements and higher capex.

DIVIDEND

The dividend of €0.56 per share

for the 2016 financial year, approved at the Annual General Meeting

of Shareholders on 11th May 2017,

was paid on 18th May 2017,

for a total amount of €119.0 million.

NET DEBT

(5)

Net debt as of 30th June 2017

amounted to €551.4 million compared to a net debt position of

€547.0 million as of 30th June 2016.

ADJUSTED

DATA

Under IFRS 11, applicable from

1st January,

2014, companies under joint control are accounted for using the

equity method.

However in order to reflect the business reality of the Group,

operating data of the companies under joint control continue to be

proportionately integrated in the operating management reports used

to monitor the activity, allocate resources and measure

performance.

Consequently, pursuant to IFRS 8, Segment Reporting presented in

the financial statements complies with the Group's internal

information, and the Group's external financial communication

therefore relies on this operating financial information. Financial

information and comments are therefore based on "adjusted" data

which are reconciled with IFRS financial statements. As regards the

P&L, it concerns all aggregates down to the EBIT. As regards

the cash flow statement, it concerns all aggregates down to the

free cash flow.

In the first half of 2017, the

impact of IFRS 11 on our adjusted aggregates is:

-

-€200.6 million on adjusted revenue

(-€202.6 million in H1 2016) leaving IFRS revenue at

€1,440.8 million (€1,414.7 million in

H1 2016).

-

-€59.0 million on adjusted operating margin

(-€54.6 million in H1 2016) leaving IFRS operating margin

at €196.0 million (€209.9 million in H1 2016).

-

-€51.5 million on adjusted EBIT before

impairment charge (-€45.8 million in H1 2016) leaving

IFRS EBIT before impairment charge at €63.6 million

(€74.7 million in H1 2016).

-

-€51.5 million on adjusted EBIT after

impairment charge (-€45.8 million in H1 2016) leaving

IFRS EBIT after impairment charge at €67.2 million

(€75.4 million in H1 2016).

-

-€6.4 million on adjusted capital

expenditure (-€5.4 million in H1 2016) leaving IFRS

capital expenditure at €86.8 million (€73.5 million in

H1 2016).

-

-€31.5 million on adjusted free cash flow

(-€36.7 million in H1 2016) leaving IFRS free cash flow

at -€1.4 million (€61.6 million in H1 2016).

The full reconciliation between

IFRS figures and adjusted figures is provided on page 8 of

this release.

ORGANIC GROWTH

DEFINITION

The Group's organic growth

corresponds to the adjusted revenue growth excluding foreign

exchange impact and perimeter effect. The reference fiscal year

remains unchanged regarding the reported figures, and the organic

growth is calculated by converting the revenue of the current

fiscal year at the average exchange rates of the previous year and

taking into account the perimeter variations prorata temporis, but including revenue variations from

the gains of new contracts and the losses of contracts previously

held in our portfolio.

NOTES

-

Operating Margin: Revenue

less Direct Operating Expenses (excluding Maintenance spare parts)

less SG&A expenses.

-

EBIT: Earnings Before

Interests and Taxes = Operating Margin less Depreciation,

amortization and provisions (net) less Impairment of goodwill less

Maintenance spare parts less Other operating income and

expenses.

-

Net financial income /

(loss): Excluding the net impact of discounting and revaluation

of debt on commitments to purchase minority interests

(-€1.1 million and -€1.0 million in H1 2017 and

H1 2016 respectively).

-

Free cash flow: Net cash

flow from operating activities less capital investments (property,

plant and equipment and intangible assets) net of disposals.

-

Net debt: Debt net of

managed cash less bank overdrafts, excluding the non-cash IAS 32

impact (debt on commitments to purchase minority interests),

including the non-cash IAS 39 impact on both debt and hedging

financial derivatives.

Next information:

Q3 2017 revenue: 7th November,

2017 (after market)

Key Figures for

JCDecaux

-

2016 revenue: €3,393m, H1 2017

revenue: €1,641m

-

JCDecaux is listed on the

Eurolist of Euronext Paris and is part of the Euronext 100 and

Euronext Family Business indexes

-

JCDecaux is part of the

FTSE4Good and Dow Jones Sustainability Europe indexes

-

N°1 worldwide in street

furniture (559,070 advertising panels)

-

N°1 worldwide in transport

advertising with more than 220 airports and 260 contracts in

metros, buses, trains and tramways (354,680 advertising

panels)

-

N°1 in Europe for billboards

(169,860 advertising panels)

-

N°1 in outdoor advertising in

Europe (721,130 advertising panels)

-

N°1 in outdoor advertising in

Asia-Pacific (219,310 advertising panels)

-

N°1 in outdoor advertising in

Latin America (70,680 advertising panels)

-

N°1 in outdoor advertising in

Africa (29,820 advertising panels)

-

N°1 in outdoor advertising in

the Middle-East (16,230 advertising panels)

-

Leader in self-service bike

rental scheme: pioneer in eco-friendly mobility

-

1,117,890 advertising panels in

more than 75 countries

-

Present in 4,280 cities with

more than 10,000 inhabitants

-

Daily audience: more than

410 million people

-

13,030 employees

Forward looking

statements

This news release may contain some forward-looking statements.

These statements are not undertakings as to the future performance

of the Company. Although the Company considers that such statements

are based on reasonable expectations and assumptions on the date of

publication of this release, they are by their nature subject to

risks and uncertainties which could cause actual performance to

differ from those indicated or implied in such

statements.

These risks and uncertainties include without limitation the risk

factors that are described in the annual report registered in

France with the French Autorité des Marchés Financiers.

Investors and holders of shares of the Company may obtain copy of

such annual report by contacting the Autorité des Marchés

Financiers on its website www.amf-france.org or directly on the

Company website www.jcdecaux.com.

The Company does not have the obligation and undertakes no

obligation to update or revise any of the forward-looking

statements.

Communications Department:

Agathe Albertini

+33 (0) 1 30 79 34 99 - agathe.albertini@jcdecaux.com

Investor Relations: Arnaud

Courtial

+33 (0) 1 30 79 79 93 - arnaud.courtial@jcdecaux.com

RECONCILIATION

BETWEEN ADJUSTED FIGURES AND IFRS FIGURES

| Profit & Loss |

H1 2017 |

H1 2016 |

| €m |

Adjusted |

Impact of

companies under joint control |

IFRS |

Adjusted |

Impact of

companies under joint control |

IFRS |

| Revenue |

1,641.4 |

(200.6) |

1,440.8 |

1,617.3 |

(202.6) |

1,414.7 |

| Net

operating costs |

(1,386.4) |

141.6 |

(1,244.8) |

(1,352.8) |

148.0 |

(1,204.8) |

| Operating margin |

255.0 |

(59.0) |

196.0 |

264.5 |

(54.6) |

209.9 |

|

Maintenance spare parts |

(24.4) |

0.7 |

(23.7) |

(21.6) |

0.5 |

(21.1) |

|

Amortisation and provisions (net) |

(123.0) |

6.6 |

(116.4) |

(98.4) |

8.3 |

(90.1) |

| Other

operating income / expenses |

7.5 |

0.2 |

7.7 |

(24.0) |

- |

(24.0) |

| EBIT before impairment charge |

115.1 |

(51.5) |

63.6 |

120.5 |

(45.8) |

74.7 |

| Net

impairment charge (1) |

3.6 |

- |

3.6 |

0.7 |

- |

0.7 |

| EBIT after impairment charge |

118.7 |

(51.5) |

67.2 |

121.2 |

(45.8) |

75.4 |

(1) Including

impairment charge on net assets of companies under joint

control.

|

| |

|

|

|

|

|

|

| Cash-flow Statement |

H1 2017 |

H1 2016 |

| €m |

Adjusted |

Impact of

companies under joint control |

IFRS |

Adjusted |

Impact of

companies under joint control |

IFRS |

| Funds from operations net of maintenance costs |

137.6 |

20.7 |

158.3 |

160.7 |

(24.8) |

135.9 |

| Change in

working capital requirement |

(14.3) |

(58.6) |

(72.9) |

16.5 |

(17.3) |

(0.8) |

| Net cash flow from operating activities |

123.3 |

(37.9) |

85.4 |

177.2 |

(42.1) |

135.1 |

| Capital

expenditure |

(93.2) |

6.4 |

(86.8) |

(78.9) |

5.4 |

(73.5) |

| Free cash flow |

30.1 |

(31.5) |

(1.4) |

98.3 |

(36.7) |

61.6 |

| |

Half-year

consolidated financial statements - H1 2017

Condensed

interim consolidated financial statements

| STATEMENT OF FINANCIAL POSITION |

|

|

|

|

| Assets |

| |

|

|

| In million euros |

30/06/2017 |

31/12/2016 |

|

Goodwill |

1,343.7 |

1,360.8 |

| Other

intangible assets |

287.9 |

312.7 |

| Property,

plant and equipment |

1,117.0 |

1,150.7 |

|

Investments under the equity method |

454.0 |

510.2 |

| Financial

investments |

0.3 |

0.7 |

| Financial

derivatives |

0.0 |

0.0 |

| Other

financial assets |

95.4 |

103.7 |

| Deferred

tax assets |

127.9 |

134.9 |

| Current

tax assets |

1.2 |

1.1 |

| Other

receivables |

26.6 |

30.2 |

| NON-CURRENT ASSETS |

3,454.0 |

3,605.0 |

| Other

financial assets |

3.7 |

5.1 |

|

Inventories |

131.5 |

112.9 |

| Financial

derivatives |

0.0 |

0.9 |

| Trade and

other receivables |

954.9 |

907.8 |

| Current

tax assets |

47.2 |

19.1 |

| Treasury

financial assets |

255.3 |

281.0 |

| Cash and

cash equivalents |

560.3 |

693.1 |

| CURRENT ASSETS |

1,952.9 |

2,019.9 |

| TOTAL ASSETS |

5,406.9 |

5,624.9 |

| Equity and Liabilities |

| |

|

|

| In million euros |

30/06/2017 |

31/12/2016 |

| Share

capital |

3.2 |

3.2 |

|

Additional paid-in capital |

598.2 |

596.7 |

|

Consolidated reserves |

1,683.2 |

1,583.1 |

|

Consolidated net income (Group share) |

74.1 |

224.7 |

| Other

components of equity |

(80.9) |

5.3 |

| EQUITY ATTRIBUTABLE TO OWNERS OF THE PARENT

COMPANY |

2,277.8 |

2,413.0 |

|

Non-controlling interests |

17.9 |

21.0 |

| TOTAL EQUITY |

2,295.7 |

2,434.0 |

|

Provisions |

403.0 |

408.9 |

| Deferred

tax liabilities |

85.8 |

75.7 |

| Financial

debt |

793.4 |

1,303.0 |

| Debt on

commitments to purchase non-controlling interests |

79.1 |

78.2 |

| Other

payables |

13.8 |

16.1 |

| Financial

derivatives |

0.0 |

0.0 |

| NON-CURRENT LIABILITIES |

1,375.1 |

1,881.9 |

|

Provisions |

68.9 |

83.0 |

| Financial

debt |

561.8 |

83.0 |

| Debt on

commitments to purchase non-controlling interests |

21.9 |

32.0 |

| Financial

derivatives |

3.9 |

2.2 |

| Trade and

other payables |

1,050.1 |

1,058.2 |

| Income

tax payable |

21.6 |

45.2 |

| Bank

overdrafts |

7.9 |

5.4 |

| CURRENT LIABILITIES |

1,736.1 |

1,309.0 |

| TOTAL LIABILITIES |

3,111.2 |

3,190.9 |

| TOTAL EQUITY AND LIABILITIES |

5,406.9 |

5,624.9 |

STATEMENT OF COMPREHENSIVE

INCOME

INCOME STATEMENT

|

In million euros |

1st half of

2017 |

1st half of

2016 |

| REVENUE |

1,440.8 |

1,414.7 |

| Direct

operating expenses |

(990.2) |

(968.6) |

| Selling,

general and administrative expenses |

(254.6) |

(236.2) |

| OPERATING MARGIN |

196.0 |

209.9 |

|

Depreciation, amortisation and provisions (net) |

(112.8) |

(89.4) |

|

Impairment of goodwill |

0.0 |

0.0 |

|

Maintenance spare parts |

(23.7) |

(21.1) |

| Other

operating income |

12.4 |

4.2 |

| Other

operating expenses |

(4.7) |

(28.2) |

| EBIT |

67.2 |

75.4 |

| Financial

income |

3.7 |

3.1 |

| Financial

expenses |

(20.1) |

(17.3) |

| NET FINANCIAL INCOME (LOSS) |

(16.4) |

(14.2) |

| Income

tax |

(18.1) |

(20.4) |

| Share of

net profit of companies under the equity method |

46.5 |

45.7 |

| PROFIT FROM CONTINUING OPERATIONS |

79.2 |

86.5 |

| Gain or

loss on discontinued operations |

0.0 |

0.0 |

| CONSOLIDATED NET INCOME |

79.2 |

86.5 |

| - Including non-controlling interests |

5.1 |

6.1 |

| CONSOLIDATED NET INCOME (GROUP SHARE) |

74.1 |

80.4 |

| Earnings

per share (in euros) |

0.349 |

0.378 |

| Diluted

earnings per share (in euros) |

0.348 |

0.378 |

| Weighted

average number of shares |

212,551,825 |

212,445,454 |

| Weighted

average number of shares (diluted) |

212,684,037 |

212,772,099 |

STATEMENT OF OTHER COMPREHENSIVE

INCOME

| In million euros |

1st half of

2017 |

1st half of

2016 |

| CONSOLIDATED NET INCOME |

79.2 |

86.5 |

|

Translation reserve adjustments on foreign operations (1) |

(71.4) |

(38.2) |

|

Translation reserve adjustments on net foreign investments |

(5.8) |

3.9 |

| Cash flow

hedges |

(1.5) |

1.4 |

| Tax on

the other comprehensive income subsequently released to net

income |

0.6 |

0.0 |

| Share of

other comprehensive income of companies under equity method (after

tax) |

(12.9) |

(0.6) |

| Other comprehensive income subsequently released to net

income |

(91.0) |

(33.5) |

| Change in

actuarial gains and losses on post-employment benefit plans and

assets ceiling |

(1.1) |

(13.8) |

| Tax on

the other comprehensive income not subsequently released to net

income |

0.4 |

3.7 |

| Share of

other comprehensive income of companies under equity method (after

tax) |

2.1 |

(6.4) |

| Other comprehensive income not subsequently released to net

income |

1.4 |

(16.5) |

| Total other comprehensive income |

(89.6) |

(50.0) |

| TOTAL COMPREHENSIVE INCOME |

(10.4) |

36.5 |

| - Including non-controlling interests |

0.4 |

5.6 |

| TOTAL COMPREHENSIVE INCOME - GROUP SHARE |

(10.8) |

30.9 |

(1) For the first half of 2017, translation

reserve adjustments on foreign transactions were mainly related to

changes in exchange rates, of which

€(32.0) million in Hong Kong, €(7.6) million in Turkey, €(6.4)

million in the United States, €(5.1) million in the United Kingdom,

€(5.1) million in Panama and €(4.4) million in the United Arab

Emirates. The item included a €7.3 million transfer in the income

statement of translation reserve adjustments related to the changes

in the scope of consolidation.

For the first half of 2016, translation reserve

adjustments on foreign transactions were mainly related to changes

in exchange rates, of which

€(28.7) million in the United Kingdom. The item also included a

€1.9 million transfer in the income statement of translation

reserve adjustments related to the changes in the scope of

consolidation.

|

STATEMENT OF CASH FLOWS

|

In million euros |

1st half of 2017 |

1st half of 2016 |

| Net

income before tax |

97.3 |

106.9 |

| Share of

net profit of companies under the equity method |

(46.5) |

(45.7) |

| Dividends

received from companies under the equity method |

85.5 |

36.4 |

| Expenses

related to share-based payments |

1.4 |

2.0 |

|

Depreciation, amortisation and provisions (net) |

111.5 |

83.4 |

| Capital

gains and losses and net income (loss) on changes in scope |

(10.0) |

1.5 |

| Net

discounting expenses |

3.7 |

3.2 |

| Net

interest expense |

9.7 |

6.7 |

| Financial

derivatives, translation adjustments and other |

(15.2) |

(6.6) |

| Change in working capital |

(72.9) |

(0.8) |

|

Change in inventories |

(20.7) |

(33.0) |

|

Change in trade and other receivables |

(75.6) |

(0.4) |

|

Change in trade and other payables |

23.4 |

32.6 |

| CASH PROVIDED BY OPERATING ACTIVITIES |

164.5 |

187.0 |

| Interest

paid |

(21.2) |

(14.2) |

| Interest

received |

2.3 |

2.7 |

| Income

tax paid |

(60.2) |

(40.4) |

| NET CASH PROVIDED BY OPERATING ACTIVITIES |

85.4 |

135.1 |

| Cash

payments on acquisitions of intangible assets and property, plant

and equipment |

(93.8) |

(74.6) |

| Cash

payments on acquisitions of financial assets (long-term

investments) net of cash acquired (1) |

0.3 |

(84.6) |

|

Acquisitions of other financial assets |

(12.5) |

(3.8) |

| Total investments |

(106.0) |

(163.0) |

| Cash

receipts on proceeds on disposal of intangible assets and property,

plant and equipment |

7.0 |

1.1 |

| Cash

receipts on proceeds on disposal of financial assets (long-term

investments) net of cash sold (1) |

(0.1) |

0.0 |

| Proceeds

on disposal of other financial assets |

15.2 |

7.6 |

| Total asset disposals |

22.1 |

8.7 |

| NET CASH USED IN INVESTING ACTIVITIES |

(83.9) |

(154.3) |

| Dividends

paid |

(129.3) |

(128.3) |

| Capital

decrease |

(2.2) |

- |

| Cash

payments on acquisitions of non-controlling interests |

(8.1) |

(14.0) |

| Repayment

of long-term borrowings |

(24.4) |

(80.8) |

| Repayment

of finance lease debt |

(4.5) |

(3.9) |

|

Acquisitions and disposals of treasury financial assets |

24.3 |

22.9 |

| Cash outflow from financing activities |

(144.2) |

(204.1) |

| Cash

receipts on proceeds on disposal of interests without loss of

control |

- |

1.4 |

| Capital

increase |

0.6 |

5.9 |

| Increase

in long-term borrowings |

7.6 |

753.6 |

| Cash inflow from financing activities |

8.2 |

760.9 |

| NET CASH USED IN (PROVIDED BY) FINANCING

ACTIVITIES |

(136.0) |

556.8 |

| CHANGE IN NET CASH POSITION |

(134.5) |

537.6 |

| Net cash position beginning of period |

687.7 |

218.4 |

| Effect of

exchange rate fluctuations and other movements |

(0.8) |

(1.2) |

| Net cash position end of period (2) |

552.4 |

754.8 |

(1) Including €0.1 million of net cash

acquired and sold for the 1st half of 2017, compared to €3.9

million for the 1st half of 2016.

(2) Including €560.3 million in cash and

cash equivalents and €7.9 million in bank overdrafts as of 30 June

2017, compared to €768.3 million and €13.5 million, respectively,

as of 30 June 2016. |

27-07-17 # H1

2017_UK_vDEF

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: JCDecaux via Globenewswire

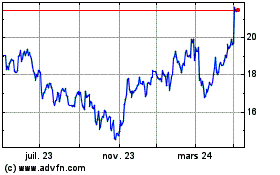

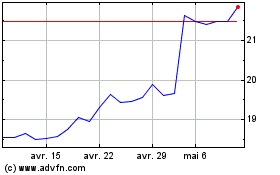

JCDecaux (EU:DEC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

JCDecaux (EU:DEC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024