Pound Rises As U.K. Jobless Rate Hits Lowest Since 1975

12 Juillet 2017 - 7:44AM

RTTF2

The British pound strengthened against other major currencies in

the European session on Wednesday, after data showed that the U.K.

unemployment rate declined to the lowest since 1975.

Data from the Office for National Statistics showed that the ILO

jobless rate came in at 4.5 percent in three months to May versus

4.9 percent in the same period of previous year. The expected rate

was 4.6 percent. This was the lowest since 1975.

The number of unemployed decreased by 64,000 from previous three

months to 1.49 million.

The employment rate was 74.9 percent, the highest since

comparable records began in 1971.

Including bonus, average weekly earnings for employees increased

by 1.8 percent on a yearly basis. Excluding bonus, earnings rose 2

percent compared with a year earlier.

The claimant count rate remained unchanged at 2.3 percent in

June.

Investors remained focused on Federal Reserve chairperson Janet

Yellen's speech before congress later today for additional clues on

the possible pace of rate hikes.

In the Asian trading today, the pound had fallen against its

major rivals.

In the European trading, the pound rose to 0.8904 against the

euro and 145.88 against the yen, from an early 8-month low of

0.8949 and nearly a 2-week low of 145.27, respectively. If the

pound extends its uptrend, it is likely to find resistance around

0.87 against the euro and 148.00 against the yen.

Against the U.S. dollar and the Swiss franc, the pound advanced

to 1.2865 and 1.2397 from an early 2-week lows of 1.2812 and

1.2339, respectively. The pound may test resistance near 1.30

against the greenback and 1.26 against the franc.

Looking ahead, U.S. crude oil inventories data is set to be

published in the New York session.

At 10:00 am ET, Federal Reserve Chair Janet Yellen is expected

to testify on the Semiannual Monetary Policy Report before the

House Financial Services Committee, in Washington DC.

The Bank of Canada will announce its monetary policy decision

and monetary policy report followed by a press conference at 10:00

am ET. Economists expect the Central Bank to raise its main policy

rate to 0.75 percent from 0.5 percent.

At 2:00 pm ET, U.S. Federal Reserve releases its Beige Book

report.

At 2:15 pm ET, Federal Reserve Bank of Kansas City President

Esther George is expected to speak on the economic outlook and the

Federal Reserve's balance sheet before an economic forum hosted by

the Federal Reserve Bank of Kansas City Denver Branch.

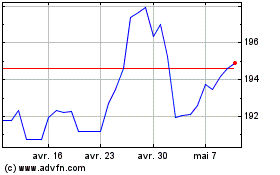

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024