ALSTOM SA: Alstom discloses preliminary financial information for

its first half of fiscal year 2023/24, ending September 30, 2023

Alstom discloses preliminary financial

information for its first half of fiscal

year 2023/24, ending September

30, 2023

- Book-to-bill at 1.0. FY

2023/24 outlook above 1.0 confirmed

- Strong sales organic growth

at 6.5%. FY 2023/24 outlook above 5% confirmed

- Improved profitability at

5.2%. FY 2023/24 outlook around 6% confirmed

- Production ramp-up

acceleration, a Rolling Stock program delay in the UK and order

intake delays result in €(1,150) million Free Cash Flow for H1

2023/24

- FY 2023/24 Free Cash Flow

now expected to be in a range of €(500) to €(750) million –

previously announced as “significantly positive”

- Mid-term guidance

confirmed

4 October 2023 – The Board of

Directors of Alstom has met on October 3rd and 4th, 2023 and has

reviewed the preliminary unaudited financial results for the first

half of fiscal year 2023/24 and approved the following press

release.

Key figures

|

(in € billion) |

Half-year ended 30 September

2023 |

|

Orders received1 |

8.4 |

|

Sales |

8.3 |

|

Book to bill ratio1 |

1x |

|

Adjusted EBIT margin1 |

5.2% |

|

Free Cash Flow1 |

(1.15) |

|

Liquidity1 |

3.5 |

The preliminary figures published in this press

release are unaudited.

“Supported by a positive market momentum, Alstom

is accelerating on its organic growth trajectory. We are engaged in

a steep ramp-up, in particular in the rolling stock activity. This,

combined with legacy projects being finalized at the same time, is

weighing on the free cash flow in this first half. The management

team is strongly engaged on the operational excellence and cash

focus plans. We remain committed to mid-term profitability and cash

generation targets.” said Henri Poupart-Lafarge,

Alstom Chairman and Chief Executive Officer.

***

First half 2023/24 review and revised FY

2023/24 outlook

During the first half of fiscal 2023/24, Alstom

recorded €8.4 billion in orders compared to €10.1 billion over the

same period last fiscal year. Last year performance was notably

driven by a landmark project in Germany (Baden-Württemberg) for

€2.5 billion.

Order intake in the second quarter of fiscal

year 2023/24 stands at €4.5 billion, including notably 40 Coradia

Stream high-capacity trains for Germany with a 30-year maintenance

contract for €900 million, locomotives for Railpool and Akiem for

more than €400 million, and coaches in the US for about €300

million.

The book-to-bill ratio is 1.0 for the first half

of this fiscal year, a slight improvement compared to the first

quarter.

Market momentum is confirmed and as announced,

Alstom expects order intake to be stronger in the second half of

the year, notably thanks to deals won but not yet booked and some

orders shifting from the first to the second half of fiscal year

2023/24.

We confirm our guidance of book-to-bill

above 1 for FY 2023/24

Alstom recorded €8.3 billion sales in the first

half of this fiscal year, compared to €8.0 billion over the same

period last fiscal year. This represents 6.5% organic sales growth

and 2.7% on a reported basis, supported by the ramp-up in Rolling

stock, a strong performance in Services and Signalling and the

expected catch-up on Systems. Sales at zero gross margin reached

approximately €1.0 billion sales during the first half and the

target of €1.7 billion for this fiscal year is confirmed.

We confirm our guidance of organic sales growth above 5%

for FY 2023/24

The adjusted EBIT margin stands at 5.2% for the

first half of this fiscal year, compared to 4.9% in the same period

last fiscal year, in line with the trajectory. Profitability was

positively impacted by continuous progress on accelerating

production as well as delivering against planned synergies.

However, the Aventra2 program in the UK, one of

the legacy non-performing contracts, has not been completed as per

original plans during this first half and is now expected to be

completed beginning of fiscal year 2024/25. The negative impact has

been recognized on first half adjusted EBIT.

We confirm our guidance of aEBIT margin around 6% for FY

2023/24

Free Cash Flow stands at €(1,150) million for

the first half of this fiscal year, compared to €(45) million in

the same period last fiscal year.In addition to the usual

seasonality, Free Cash Flow for the first half of this fiscal year

has been impacted by the following main factors, which explain the

year-on-year variation:

- First,

representing about half of the variation, the strong growth of

Alstom backlog (now over €87 billion) during the last two years has

resulted in a steep acceleration of the production ramp-up,

exceeding 10% per year in average volume increase for our Rolling

Stock activity. This, combined with tight supply chain conditions,

resulted in a significant increase in the level of inventories and

contract assets built in order to avoid production disruption and

delivery delays during the first half of the year, particularly in

Americas and in Europe. Improvements are expected during the second

half of fiscal 2023/24, and full reversal in the coming years.

- Second,

representing around one third of the variation, is the delay in

completing the Aventra program in the UK, which has impacted first

half cash-flow, and this will be only partly recovered in the

second half, as completion is now expected beginning of fiscal year

2024/25.

- Third is the

decrease in the level of downpayments compared to the same period

last year due to weaker than expected orders booked in the first

half of the fiscal year. Alstom expects the level of downpayments

in the second half of this fiscal year to be higher than in the

same period last year, thanks to strong order intake.

FY 2023/24 Free Cash Flow now expected

to be in a range of €(500) to €(750) million, compared to

“significantly positive” as announced previously. Free Cash Flow in

the second half of fiscal 2023/24 will be significantly positive

thanks to the reversal of some of the headwinds of the first half

and new actions initiated in the context of a new Cash Focus

Program launched by Alstom.

***

Mid-term guidance confirmed

Alstom confirms its mid-term guidance as stated

in May 2023. The above-mentioned impacts have no material

consequences on the mid-term trajectory of the Group.

***

Conference call

Alstom will host virtually an analyst and

investor call on Wednesday 4 October 2023 at 6:30 pm (CET), hosted

by Bernard Delpit, CFO.

A live audiocast will also be available on

Alstom’s website: Alstom’s preliminary results for H1 2023/24

(royalcast.com).

To participate in the Q&A session (audio

only), please use the dial-in numbers below:

-

UK +44 (0) 33 0551 0200

-

USA +1 786 697 3501

- France +33 (0) 1

7037 7166

Quote ALSTOM to the operator to

be transferred to the appropriate conference.

1 See definition in appendix2 Aventra designates

a range of commuter trains designed and sold through 6 rolling

stock contracts to 5 different customers, originally signed by

Bombardier and executed in the United Kingdom. This program

represents a total of 443 trains.

Alstom™, Coradia™ and Coradia Stream™ are protected trademarks

of the Alstom Group.

|

|

About Alstom |

|

|

|

Alstom commits to contribute to a low carbon future by developing

and promoting innovative and sustainable transportation solutions

that people enjoy riding. From high-speed trains, metros,

monorails, trams, to turnkey systems, services, infrastructure,

signalling and digital mobility, Alstom offers its diverse

customers the broadest portfolio in the industry. With its presence

in 63 countries and a talent base of over 80,000 people from 175

nationalities, the company focusses its design, innovation, and

project management skills to where mobility solutions are needed

most. Listed in France, Alstom generated revenues of €16.5 billion

for the fiscal year ending on 31 March 2023. For more information,

please visit www.alstom.com |

|

|

|

| |

Contacts |

Press:Coralie COLLET - Tel.: +33 (0) 7 63 63 09 62

coralie.collet@alstomgroup.com Thomas ANTOINE - Tel. :

+33 (0) 6 11 47 28 60thomas.antoine@alstomgroup.com

Investor relations:Martin VAUJOUR – Tel. : +33 (0)

6 88 40 17 57martin.vaujour@alstomgroup.com Estelle MATURELL

ANDINO – Tel.: +33 (0)6 71 37 47 56

estelle.maturell@alstomgroup.com |

|

This press release contains forward-looking

statements which are based on current plans and forecasts of

Alstom’s management. Such forward-looking statements are relevant

to the current scope of activity and are by their nature subject to

a number of important risks and uncertainty factors (such as those

described in the documents filed by Alstom with the French AMF)

that could cause actual results to differ from the plans,

objectives and expectations expressed in such forward-looking

statements. These such forward-looking statements speak only as of

the date on which they are made, and Alstom undertakes no

obligation to update or revise any of them, whether as a result of

new information, future events or otherwise.

This press release does not constitute or form

part of a prospectus or any offer or invitation for the sale or

issue of, or any offer or inducement to purchase or subscribe for,

or any solicitation of any offer to purchase or subscribe for any

shares or other securities in the Company in France, the United

Kingdom, the United States or any other jurisdiction. Any offer of

the Company’s securities may only be made in France pursuant to a

prospectus having received the visa from the AMF or, outside

France, pursuant to an offering document prepared for such purpose.

The information does not constitute any form of commitment on the

part of the Company or any other person. Neither the information

nor any other written or oral information made available to any

recipient, or its advisers will form the basis of any contract or

commitment whatsoever. In particular, in furnishing the

information, the Company, the Banks, their affiliates,

shareholders, and their respective directors, officers, advisers,

employees or representatives undertake no obligation to provide the

recipient with access to any additional information.

APPENDIX - NON-GAAP FINANCIAL

INDICATORS DEFINITIONS

This section presents financial indicators used

by the Group that are not defined by accounting standard

setters.

Orders receivedA

new order is recognised as an order received only when the contract

creates enforceable obligations between the Group and its customer.

When this condition is met, the order is recognised at the contract

value. If the contract is denominated in a currency other than the

functional currency of the reporting unit, the Group requires the

immediate elimination of currency exposure using forward currency

sales. Orders are then measured using the spot rate at inception of

hedging instruments.

Book-to-Bill The book-to-bill

ratio is the ratio of orders received to the amount of sales traded

for a specific period.

Adjusted EBITAdjusted EBIT

(“aEBIT”) is the Key Performance Indicator to present the level of

recurring operational performance. This indicator is also aligned

with market practice and comparable to direct competitors. Starting

September 2019, Alstom has opted for the inclusion of the share in

net income of the equity-accounted investments into the aEBIT when

these are considered to be part of the operating activities of the

Group (because there are significant operational flows and/or

common project execution with these entities). This mainly includes

Chinese joint-ventures, namely CASCO, Alstom Sifang (Qingdao)

Transportation Ltd, Jiangsu ALSTOM NUG Propulsion System Co. Ltd.

(former Bombardier NUG Propulsion) and Changchun Changke Alstom

Railway Vehicles Company Ltd.

aEBIT corresponds to Earning Before Interests

and Tax adjusted for the following elements:

- net

restructuring expenses (including rationalisation costs).

- tangibles and

intangibles impairment.

- capital gains or

loss/revaluation on investments disposals or controls changes of an

entity.

- any other

non-recurring items, such as some costs incurred to realise

business combinations and amortisation of an asset exclusively

valued in the context of business combination, as well as

litigation costs that have arisen outside the ordinary course of

business.

- and including

the share in net income of the operational equity-accounted

investments.

A non-recurring item is a “one-off” exceptional

item that is not supposed to occur again in following years and

that is significant.Adjusted EBIT margin corresponds to Adjusted

EBIT expressed as a percentage of sales.

Free cash flow Free Cash Flow

is defined as net cash provided by operating activities less capital

expenditures including capitalised development costs, net of

proceeds from disposals of tangible and intangible assets. Free

Cash Flow does not include any proceeds from disposals of

activity.The most directly comparable financial measure to Free

Cash Flow calculated and presented in accordance with IFRS is net

cash provided by operating activities.

LiquidityLiquidity is defined as

the sum of cash and cash equivalents and undrawn Revolving Credit

facilities, less the outstanding level of Negotiable European

Commercial Papers and overdraft at the end of the period.

- PR Alstom H1 Preliminary Results 04.10.23 - EN - Final

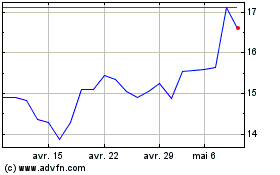

Alstom (EU:ALO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Alstom (EU:ALO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024