Renault to Sell Back $824 Million Stake to Nissan as It Seeks Rating Upgrade -- Update

12 Décembre 2023 - 1:55PM

Dow Jones News

By Adria Calatayud and David Sachs

Renault plans to sell a 5% stake in Nissan Motor back to the

Japanese carmaker for up to 765 million euros ($823.6 million),

commencing a draw-down of its shares as part of a plan to gain an

investment-grade rating.

The French company said Tuesday that the sale of the Nissan

shares could result in a capital loss of up to EUR1.5 billion which

would hit net profit in its own accounts. This is the maximum

amount and could be adjusted at year-end, Renault said.

Renault, which has a stake of around 43% in Nissan, aims to

whittle its holdings down to about 15% as part an agreement between

the longtime partners to thin out their relationship. Tuesday's

sale commenced that process, which Renault hopes will help it

achieve an investment-grade rating, Bernstein analysts said in a

research note.

Bernstein said the deal could grow Renault's cash balance by

around EUR4.2 billion.

Renault said the 5% stake in Nissan it is selling back to its

Japanese partner is part of a 28.4% stake it transferred to a

French trust last month. The sale will be implemented as part of a

Nissan share buyback.

Renault's estimates for the value of the sale and its expected

impact assume 211 million Nissan shares are sold at a share price

of 568.5 Japanese yen ($3.89),it said.

Write to Adria Calatayud at adria.calatayud@dowjones.com and to

David Sachs at david.sachs@wsj.com

(END) Dow Jones Newswires

December 12, 2023 07:40 ET (12:40 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

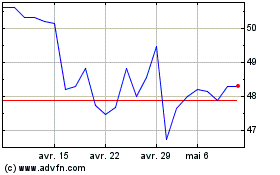

Renault (EU:RNO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

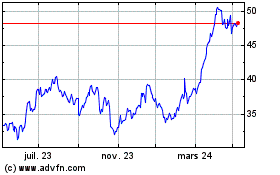

Renault (EU:RNO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024