U.S. Dollar Weakens As Soft Data Lifts Rate Cut Hopes

03 Juillet 2024 - 3:27PM

RTTF2

The U.S. dollar moved down against its major counterparts in the

New York session on Wednesday, amid growing hopes of a rate cut by

the Federal Reserve in September following the release of weak

labour market data and ISM services PMI.

Data from payroll processor ADP showed that U.S. private sector

employment increased slightly less than expected in the month of

June.

ADP said private sector employment climbed by 150,000 jobs in

June after rising by an upwardly revised 157,000 jobs in May.

Economists had expected private sector employment to increase by

160,000 jobs compared to the addition of 152,000 jobs originally

reported for the previous month.

Data from the Labor Department showed a modest increase in

first-time claims for U.S. unemployment benefits in the week ended

June 29.

The report said initial jobless claims rose to 238,000, an

increase of 4,000 from the previous week's revised level of

234,000.

Economists had expected jobless claims to inch up to 235,000

from the 233,000 originally reported for the previous week.

A report released by the Institute for Supply Management showed

an unexpected contraction in U.S. service sector activity in the

month of June.

The ISM said its services PMI slid to 48.8 in June from 53.8 in

May, with a reading below 50 indicating contraction. Economists had

expected the index to edge down to 52.5.

Weaker-than-expected economic data raised the likelihood of a

rate cut in September.

The greenback dropped to 2-day lows of 160.76 against the yen

and 0.8985 against the franc, from an early 38-year high of 161.95

and nearly a 5-week high of 0.9050, respectively. The greenback is

poised to challenge support around 147.00 against the yen and 0.88

against the franc.

The greenback weakened to near 3-week lows of 1.0816 against the

euro and 1.2777 against the pound, off its early highs of 1.0736

and 1.2667, respectively. The greenback is likely to face support

around 1.10 against the euro and 1.31 against the pound.

The greenback declined to near a 6-month low of 0.6733 against

the aussie and 8-day lows of 1.3617 against the loonie and 0.6129

against the kiwi, down from its early highs of 0.6662, 1.3686 and

0.6069, respectively. The currency is seen finding support around

0.68 against the aussie, 1.34 against the loonie and 0.63 against

the kiwi.

The Fed minutes from the June 11-12 meeting will be published at

2 pm ET.

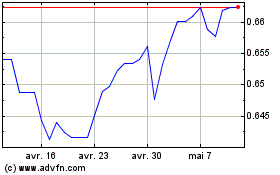

AUD vs US Dollar (FX:AUDUSD)

Graphique Historique de la Devise

De Juin 2024 à Juil 2024

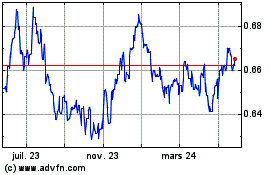

AUD vs US Dollar (FX:AUDUSD)

Graphique Historique de la Devise

De Juil 2023 à Juil 2024