Euro Weakens After Dovish Remarks From ECB's Stournaras

14 Mars 2024 - 12:42PM

RTTF2

The euro was subdued on Thursday, as European Central Bank

Governing Council member Yannis Stournaras proposed four rate cuts

this year, with two moves occurring "before the summer break."

The ECB must start cutting rates soon to ensure that the

monetary policy "does not become too restrictive," Stournaras said

in an interview in London.

"It is appropriate to do two rate cuts before the summer break,

and four moves throughout the year seem reasonable."

Stournaras ruled out the possibility of the first rate cut in

April, as there will be "only little new information" available,

particularly on wages at the start of 2024.

Investors digested hotter-than-expected producer inflation data

for February, which dampened hopes of a Fed rate cut in the near

future.

The euro fell to a 1-week low of 1.0901 against the greenback

and a 2-day low of 0.8535 against the pound, from its early highs

of 1.0954 and 0.8557, respectively. The currency is poised to

challenge support around 1.06 against the greenback and 0.84

against the pound.

The euro declined to 161.10 against the yen and 0.9608 against

the franc, from an early high of 161.91 and an 8-day high of

0.9628, respectively. The currency may locate support around 157.5

against the yen and 0.95 against the franc.

The euro touched 1.4713 against the loonie, setting a 6-day low.

The euro is seen finding support around the 1.46 level.

The euro reached as low as 1.7720 against the kiwi. If the

currency falls further, it is likely to test support around the

1.74 region.

In contrast, the euro rebounded to 1.6549 against the aussie, up

from an early 2-day low of 1.6506. The currency is likely to locate

resistance around the 1.67 level.

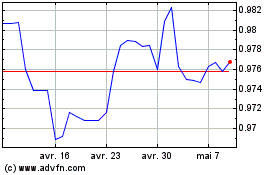

Euro vs CHF (FX:EURCHF)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

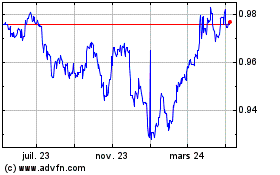

Euro vs CHF (FX:EURCHF)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024