Pound Rises Amid

27 Août 2024 - 8:48AM

RTTF2

The British pound strengthened against other major currencies in

the European session on Tuesday, as European stocks edged up

slightly ahead of key U.S. inflation figures and earnings from AI

darling Nvidia due later in the week.

Declining possibility that the Bank of England (BoE) will lower

interest rates in September, also led to the strength of the

currency.

French politics were in focus after President Emmanuel Macron

refused to name a prime minister from the left-wing New Popular

Front alliance (NFP), which won the most seats in last month's snap

election.

In economic releases, the German economy contracted, as

initially estimated, in the second quarter due to weak household

consumption and investment, official data revealed.

GDP fell 0.1 percent sequentially, in line with the flash

estimate, following a 0.2 percent rise in the first quarter,

according to final results from Destatis.

Meanwhile, hopes of a consumer-driven recovery in the second

half of the year got another hit with German consumer confidence

dropping.

A monthly survey data from the market research group Gfk

revealed that the forward-looking consumer confidence index fell to

-22.0 from revised -18.6 in August.

In the Asian trading session today, the pound held steady

against the euro, the Swiss franc and the U.S. dollar. Meanwhile,

the pound traded higher against the yen.

In the European trading today, the pound rose to nearly a

2-1/2-year high of 1.3247 against the U.S. dollar, from an early

low of 1.3180. The GBP/USD pair may test resistance near the 1.34

region.

Against the euro and the yen, the pound advanced to nearly a

4-week high of 0.8438 and a 4-day high of 191.93 from early lows of

0.8469 and 190.55, respectively. If the pound extends its uptrend,

it is likely to find resistance around 0.82 against the euro and

194.00 against the yen.

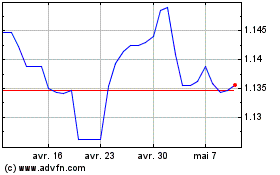

The pound edged up to 1.1212 against the Swiss franc, from an

early low of 1.1170. On the upside, 1.14 is seen as the next

resistance level for the GBP/CHF pair.

Looking ahead, Canada wholesale sales data for July, U.S.

Redbook report, U.S. house price index for June, U.S. Consumer

Board's consumer confidence for August, U.S. Richmond Fed

manufacturing index for August and U.S. Dallas Fed services index

for August are due to be released in the New York session.

Sterling vs CHF (FX:GBPCHF)

Graphique Historique de la Devise

De Août 2024 à Sept 2024

Sterling vs CHF (FX:GBPCHF)

Graphique Historique de la Devise

De Sept 2023 à Sept 2024