TIDMALPH

RNS Number : 0642O

Alpha Group International PLC

28 September 2023

Not for publication, distribution or release, directly or

indirectly, in whole or in part, in or into the United States,

Australia, Canada, Japan or Republic of South Africa or any other

jurisdiction in which such release, publication or distribution

would be unlawful.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014, as

it forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 (as amended).

28 September 2023

Alpha Group International plc

("Alpha" or the "Group")

Proposed secondary placing of Ordinary Shares in Alpha

Alpha Group International plc today announces that in response

to institutional demand it has been notified by Morgan Tillbrook

("Selling Shareholder") of his intention to sell approximately

GBP14m of ordinary shares of GBP0.002 each in the Company ("Placing

Shares") at a price of GBP19.00 per Placing Share (the "Placing")

.

Following the completion of the bookbuild, Morgan Tillbrook has

agreed not to sell or otherwise dispose of any of his holding of

Ordinary Shares for 180 days, except with the prior written consent

of Liberum Capital Limited ("Liberum") and Peel Hunt LLP ("Peel

Hunt") (together, the "Joint Bookrunners") and the Company,

followed by an orderly market period of 180 days .

The sale of the Placing Shares will be effected by way of an

accelerated bookbuild to institutional investors, which will be

launched immediately following this announcement. Liberum and Peel

Hunt are acting as Joint Bookrunners in relation to the

Placing.

The timing for the close of the bookbuild process and the

distribution of allocations will be at the absolute discretion of

the Joint Bookrunners. The results of the Placing will be announced

as soon as practicable thereafter.

The Company will not receive any proceeds from the Placing.

Enquiries:

Alpha Group International plc Via Alma PR

Morgan Tillbrook, Founder and CEO

Tim Powell, CFO

Liberum (Nominated Adviser. Joint Broker

and Joint Bookrunner)

Max Jones

Ben Cryer

Kane Collings +44 (0) 20 3100 2000

Peel Hunt (Joint Broker, and Joint Bookrunner)

Neil Patel

Paul Gillam

Richard Chambers +44 (0) 20 7418 8900

Alma PR (Financial Public Relations)

Josh Royston

Andy Bryant

Kieran Breheny +44 (0) 20 3405 0205

Market Abuse Regulation

This announcement is released by Alpha Group International plc

and contains inside information for the purposes of the Market

Abuse Regulation (EU) 596/2014 ("MAR") and is disclosed in

accordance with the Company's obligations under Article 17 of MAR.

The person who arranged for the release of this announcement on

behalf of Alpha Group International plc was Tim Powell, Chief

Financial Officer.

Important Notices

MEMBERS OF THE GENERAL PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN

THE PLACING. THIS ANNOUNCEMENT AND ANY OFFER OF SECURITIES TO WHICH

IT RELATES ARE ONLY ADDRESSED TO AND DIRECTED AT (1) IN ANY MEMBER

STATE OF THE EUROPEAN ECONOMIC AREA, PERSONS WHO ARE QUALIFIED

INVESTORS WITHIN THE MEANING OF ARTICLE 2(E) OF REGULATION (EU)

2017/1129 (THE "PROSPECTUS REGULATION"); (2) IN THE UNITED KINGDOM,

PERSONS WHO (I) HAVE PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO

INVESTMENTS WHO FALL WITHIN ARTICLE 19(5) OF THE FINANCIAL SERVICES

AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 (AS AMED)

(THE "ORDER") OR FALL WITHIN ARTICLE 49(2)(A) TO (D) OF THE ORDER

AND (II) ARE "QUALIFIED INVESTORS" AS DEFINED IN SECTION 86 OF

FSMA; (3) TO PERSONS TO WHOM AN OFFER OF THE PLACING SHARES MAY

OTHERWISE LAWFULLY BE MADE; AND (4) IN THE UNITED STATES OR TO ANY

US PERSONS (AS SUCH TERM IS DEFINED IN REGULATION S ("REGULATION

S") UNDER THE US SECURITIES ACT OF 1933, AS AMED (THE "SECURITIES

ACT")), TO QUALIFIED INSTITUTIONAL BUYERS AS DEFINED IN RULE 144A

UNDER THE SECURITIES ACT WHO ARE ALSO QUALIFIED PURCHASERS ("QP")

AS DEFINED IN SECTION 2(A)(51) OF THE US INVESTMENT COMPANY ACT OF

1940, AS AMED (THE "INVESTMENT COMPANY ACT") (ALL SUCH PERSONS

REFERRED TO IN (1), (2), (3) AND (4) TOGETHER BEING REFERRED TO AS

"RELEVANT PERSONS"). THE INFORMATION REGARDING THE PLACING SET OUT

IN THIS ANNOUNCEMENT MUST NOT BE ACTED ON OR RELIED ON BY PERSONS

WHO ARE NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY

TO WHICH THIS ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT

PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS.

This announcement and the information contained herein is for

information purposes only and does not constitute or form part of

any offer or an invitation to acquire or dispose of securities in

the United States, Australia, Canada, Japan or South Africa or in

any other jurisdiction in which such an offer or invitation is

unlawful ("Restricted Jurisdictions"). Neither this announcement

nor any copy of it may be taken, transmitted or distributed,

directly or indirectly, in or into or from any Restricted

Jurisdiction. Any failure to comply with this restriction may

constitute a violation of securities laws in the relevant

Restricted Jurisdiction.

The Placing Shares are not being made available to the public

and none of the Placing Shares are being offered or sold in any

jurisdiction where it would be unlawful to do so. The Placing

Shares have not been and will not be registered under the relevant

laws of any of the Restricted Jurisdictions or any state, province

or territory thereof and may not be offered, sold, resold,

delivered or distributed, directly or indirectly in or into any

Restricted Jurisdiction or to, or for the account or benefit of,

any person with a registered address in, or who is a resident of or

ordinarily resident in, or a citizen of, any Restricted

Jurisdiction except pursuant to an applicable exemption.

The Placing Shares have not been, and will not be, registered

under the US Securities Act of 1933, as amended (the "Securities

Act"), or under the securities laws of any state or other

jurisdiction of the United States, and, absent registration, may

not be offered or sold in the United States or to, or for the

account or benefit of, US Persons (as defined in Regulation S under

the Securities Act) except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and the securities laws of any relevant state or

other jurisdiction of the United States. There will be no public

offering of the Placing Shares in the United States or elsewhere.

Any offers and sales of the Placing Shares to US persons (as such

term is defined in Regulation S under the Securities Act) will be

made only to persons who are "qualified institutional buyers" as

defined in Rule 144A under the Securities Act who are also

qualified purchasers ("QP") as defined in Section 2(a)(51) of the

US Investment Company Act of 1940, as amended (the "Investment

Company Act") .

The Placing Shares have not been approved or disapproved by the

US Securities and Exchange Commission, any state securities

commission or other regulatory authority in the United States, nor

have any of the foregoing authorities passed upon or endorsed the

merits of the Placing or the accuracy or adequacy of this

announcement. Any representation to the contrary is a criminal

offence in the United States.

No prospectus or offering document has been or will be prepared

in connection with the Placing. Any investment decision to buy

securities in the Placing must be made solely on the basis of

publicly available information. Such information is not the

responsibility of and has not been independently verified by the

Company, the Selling Shareholder or Liberum or any of their

respective affiliates.

The distribution of this announcement and the offering or sale

of the Placing Shares in certain jurisdictions may be restricted by

law. No action has been taken by the Company, the Selling

Shareholder or the Joint Bookrunners or any of their respective

affiliates that would, or which is intended to, permit a public

offer of the Placing Shares in any jurisdiction or possession or

distribution of this announcement or any other offering or

publicity material relating to the Placing Shares in any

jurisdiction where action for that purpose is required. Persons

into whose possession this announcement comes are required by the

Company, the Selling Shareholder or the Joint Bookrunners to inform

themselves about and to observe any applicable restrictions.

Liberum which is authorised and regulated by the Financial

Conduct Authority in the United Kingdom, is acting only for the

Selling Shareholder in connection with the Placing and will not be

responsible to anyone other than the Selling Shareholder for

providing the protections offered to the clients of Liberum, nor

for providing advice in relation to the Placing or any matters

referred to in this announcement.

Peel Hunt which is authorised and regulated by the Financial

Conduct Authority in the United Kingdom, is acting only for the

Selling Shareholder in connection with the Placing and will not be

responsible to anyone other than the Selling Shareholder for

providing the protections offered to the clients of Peel Hunt, nor

for providing advice in relation to the Placing or any matters

referred to in this announcement.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEBLGDCXBDDGXI

(END) Dow Jones Newswires

September 28, 2023 12:15 ET (16:15 GMT)

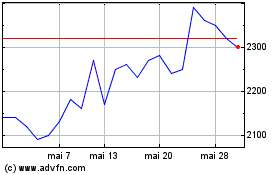

Alpha (LSE:ALPH)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Alpha (LSE:ALPH)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024