TIDMESO TIDMEO.P TIDMEL.P

RNS Number : 5178M

EPE Special Opportunities Limited

15 September 2023

EPE Special Opportunities Limited

("ESO" or the "Company")

Interim Report and Unaudited Condensed Financial Statements for

the six months ended 31 July 2023

The Board of EPE Special Opportunities is pleased to announce

the Company's Interim Report and Unaudited Condensed Financial

Statements for the six months ended 31 July 2023.

Summary

-- The Company's portfolio has continued to experience headwinds

from an adverse macro-economic environment in the six months ended

31 July 2023. The Board and Investment Advisor note that there are

indications that the trading environment is stabilising and are

hopeful of improvements in the coming period. In the near term

however, ongoing market uncertainty presents a difficult

environment for acquisitions or disposals within the portfolio

given the lack of alignment in pricing expectations between buyers

and sellers. The Board and Investment Advisor remain focused on

managing the portfolio through the continuing turbulence and

ensuring it is well placed to take advantage of improvements in

market conditions as they develop over the next year, with value

creation plans extending beyond the likely period of market

dislocation.

-- The net asset value ("NAV") per share of the Company as at 31

July 2023 was 308 pence, representing a decrease of 6 per cent. on

the NAV per share of 328 pence as at 31 January 2023.

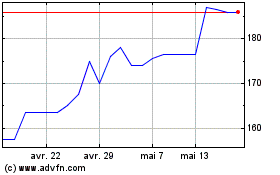

-- The share price of the Company as at 31 July 2023 was 148

pence, representing a decrease of 13 per cent. on the share price

of 170 pence as at 31 January 2023.

-- In September 2023, Luceco plc ("Luceco") released its results

for the six months ended 30 June 2023. The group announced sales of

GBP101 million and adjusted operating profit of GBP11 million,

ahead of expectations. The business reported net debt of 1.3x LTM

EBITDA as at 30 June 2023, providing facility headroom to support

organic investment and M&A.

-- The Rayware Group ("Rayware") has faced a difficult trading

environment with sales impacted by customer destocking and weakened

consumer demand, and profitability impacted by freight costs and

supply chain disruption. The business appointed a new Head of US

Sales and Marketing in June 2023, Naddia Prandelli, to support the

business' growth strategy in the market. In July 2023, ESO

Investments 1 Limited invested GBP2.6 million to reduce the

business' indebtedness and has undertaken to provide GBP2.5m of

funding by way of a contingent guarantee to Rayware's third party

lenders, should such an injection be required in due course.

-- Whittard of Chelsea ("Whittard") has performed pleasingly,

with strong growth in the business' retail estate supported by

improved domestic and tourist volumes. Whittard has continued to

develop its international presence, with the business' South Korean

franchise partner opening a new store in Samsung Town in April 2023

and new wholesale accounts secured in North America.

-- David Phillips is focused on achieving further sales growth,

led by the business' built-to-rent ("BTR") and other project-based

divisions. The business is targeting improved profitability as

actions taken in the last two years in response to the inflationary

environment begin to deliver returns.

-- Pharmacy2U has successfully maintained its growth trajectory,

supported by strong growth in its NHS online prescription channel.

In November 2022, the business appointed a new chairperson, Deidre

Burns, and a new CEO, Kevin Heath.

-- Since the investment in October 2023, Denzel's has

successfully completed the appointment of a number of key roles,

including Head of Marketing and Head of E-commerce. The business

has continued to grow its distribution with the introduction of new

product ranges and has launched a new website.

-- In April 2023, EPIC Acquisition Corp ("EAC") announced the

extension of its business combination period, with an initial

three-month extension to 25 July 2023 and the option to further

extend by one month at a time up until a final business combination

date of 25 January 2024. EAC announced a further extension to 25

September 2023 in August 2023. EAC continues to actively source and

review a pipeline of targets.

-- In July 2023, the Company completed the realisation of its

holdings in Atlantic Credit Opportunities Fund and in August 2023

completed the realisation of its holdings in Prelude Structured

Alternatives Master Fund LP.

-- The Company had cash balances of GBP16.3 million(1) as at 31

July 2023. The Board continue to focus in particular on maintaining

satisfactory liquidity during the current period of market

uncertainty. In July 2023, the Company agreed the extension of the

maturity of GBP4.0 million of unsecured loan notes to July 2024. In

July 2023, the Company completed the buyback of 7.5 million zero

dividend preference ("ZDP") shares. Following this buyback, the

Company has 12.5 million ZDP shares remaining in issue, maturing in

December 2026. The Company has no other third-party debt

outstanding.

-- As at 31 July 2023, the Company's unquoted portfolio was

valued at a weighted average EBITDA to enterprise value multiple of

7.0x (excluding assets investing for growth) and the portfolio has

a low level of third party leverage with net debt at 1.2x EBITDA in

aggregate.

Mr Clive Spears, Chairman, commented: "We have experienced a

difficult macro-economic environment in the period, and as such

have adopted a prudent approach to positioning the portfolio for

long term growth and ensuring the Company is well equipped to

navigate these challenges. The Board would like to extend its

thanks to the Investment Advisor and the management teams of the

Company's portfolio for their hard work during a challenging

period. The Board looks forward to updating shareholders with

further progress at the year end."

The Company's Interim Report and Unaudited Condensed Financial

Statements can be viewed at the Company's website at the following

address:

https://www.epespecialopportunities.com/reports-and-accounts.php.

The person responsible for releasing this information on behalf

of the Company is Amanda Robinson of Langham Hall Fund Management

(Jersey) Limited.

Note 1: Company liquidity is stated inclusive of cash held by

subsidiaries in which the Company is the sole investor.

Enquiries:

EPIC Investment Partners LLP +44 (0) 207 269 8865

Alex Leslie

Langham Hall Fund Management (Jersey) Limited +44 (0) 15 3488 5200

Amanda Robinson

Cardew Group Limited +44 (0) 207 930 0777

Richard Spiegelberg

Numis Securities Limited +44 (0) 207 260 1000

Nominated Advisor: Stuart Skinner

Corporate Broker: Charles Farquhar

The Chairman's Statement

The Company's portfolio has continued to experience headwinds

from an adverse macro-economic environment in the six months ended

31 July 2023. The Board and Investment Advisor note that there are

indications that the trading environment is stabilising and are

hopeful of improvements in the coming period. In the near term

however, ongoing market uncertainty presents a difficult

environment for further acquisitions or disposals within the

portfolio given the lack of alignment in pricing expectations

between buyers and sellers. The Board and Investment Advisor remain

focused on managing the portfolio through the continuing turbulence

and ensuring it is well placed to take advantage of improvements in

market conditions as they develop over the next year, with value

creation plans extending beyond the likely period of market

dislocation.

The net asset value ("NAV") per share of the Company as at 31

July 2023 was 308 pence, representing a decrease of 6 per cent. on

the NAV per share of 328 pence as at 31 January 2023. The share

price of the Company as at 31 July 2023 was 148 pence, representing

a decrease of 13 per cent. on the share price of 170 pence as at 31

January 2023. The share price of the Company represents a discount

of 52% to the NAV per share of the Company as at 31 July 2023. The

Company seeks to manage the discount to NAV via capital management,

including ordinary share buyback programs, as well as achieving

further diversification of the investment portfolio and scale in

the Company.

The Company has focused on positioning the portfolio to navigate

market conditions, while progressing value creation plans;

-- Luceco plc ("Luceco") released its results for the six months

ended 30 June 2023 announcing sales of GBP101 million and adjusted

operating profit of GBP11 million, ahead of expectations.

-- The Rayware Group ("Rayware") has faced a difficult trading

environment with sales impacted by customer destocking and weakened

consumer demand, and profitability impacted by freight costs and

supply chain disruption.

-- Whittard of Chelsea ("Whittard") has performed pleasingly,

with strong growth in the business' retail estate supported by

improved domestic and tourist volumes.

-- David Phillips has focused on achieving further sales growth,

led by the business' built-to-rent ("BTR") and other project-based

divisions.

-- Pharmacy2U has successfully maintained its growth trajectory,

supported by strong growth in its NHS online prescription

channel.

-- Denzel's has continued to grow its distribution with the

introduction of new product ranges and has launched a new

website.

-- EPIC Acquisition Corp ("EAC") announced the extension of its

business combination period in April 2023, with an initial

three-month extension to 25 July 2023 and the option to further

extend by one month at a time up until to a final business

combination date of 25 January 2024. EAC announced a further

extension to 25 September 2023 in August 2023.

The Company successfully completed the following investments and

realisations in the period;

-- In July 2023, the Company, through its subsidiary ESO

Investments 1 Limited, invested GBP2.6 million in Rayware, reducing

the business' senior debt and committed to provide up to GBP2.5m of

funding via a contingent guarantee to Rayware's third party

lenders.

-- In July 2023, the Company completed the realisation of its

holdings in Atlantic Credit Opportunities Fund and in August 2023

completed the realisation of its holdings in Prelude Structured

Alternatives Master Fund LP.

The Company had cash balances of GBP16.3 million(1) as at 31

July 2023. The Board continue to focus in particular on maintaining

satisfactory liquidity during the current period of market

uncertainty. In July 2023, the Company agreed the extension of the

maturity of GBP4.0 million of unsecured loan notes to July 2024. In

July 2023, the Company completed the buyback of 7.5 million zero

dividend preference ("ZDP") shares. Following this buyback, the

Company has 12.5 million ZDP shares remaining in issue, maturing in

December 2026 and implying a final redemption value of GBP16.1

million. The Company has no other third-party debt outstanding.

The Board would like to extend its thanks to the Investment

Advisor and the management teams of the Company's portfolio

companies for their hard work during a challenging period. The

Board looks forward to updating shareholders with further progress

at the year end.

Clive Spears

Chairman

14 September 2023

(1) Company liquidity is stated inclusive of cash held by

subsidiaries in which the Company is the sole investor.

Investment Advisor's Report

The Company's portfolio has faced a difficult backdrop of

inflationary and recessionary pressures, with the Investment

Advisor working alongside management teams to position the

portfolio to navigate this environment. Furthermore, the Company

has taken prudent actions to de-risk its capital structure in the

period. The Company improved its liquidity by electing to extend

the maturity of its GBP4.0 million unsecured loan notes to July

2024. This supported the retirement of 7.5 million of its ZDP

shares, decreasing the redemption amount payable at maturity in

December 2026.

The Net Asset Value ("NAV") per share of the Company as at 31

July 2023 was 308 pence, representing a decrease of 6 per cent. on

the NAV per share of 328 pence as at 31 January 2023. The share

price of the Company as at 31 July 2023 was 148 pence, representing

a decrease of 13 per cent. on the share price of 170 pence as at 31

January 2023.

The Company maintains strong liquidity and prudent levels of

third party leverage. The Company had cash balances of GBP16.3

million(1) as at 31 July 2023, which are available to support the

portfolio, meet committed obligations and deploy into attractive

investment opportunities. Net debt in the underlying portfolio

stands at 1.2x EBITDA in aggregate.

The Company's unquoted private equity portfolio is valued at a

weighted average enterprise value to EBITDA multiple of 7.0x for

mature assets (excluding assets investing for growth). The

valuation has been derived by reference to quoted comparables,

after the application of a liquidity discount to adjust for the

portfolio's scale and unquoted nature. Given the use of quoted

comparables and actual financial results, the valuation reflects

the fair value of assets as at the balance sheet date. The

Investment Advisor notes that the fair market value of the

portfolio remains exposed to a volatile macro environment and

equity market valuations.

In July 2023, the Company completed the repurchase of 7.5

million of its ZDP shares in the market (or 38 per cent. of the

Company's issued ZDP share capital) at a weighted average share

price of 105 pence.

Luceco released its results for the six months ended 30 June

2023 in September 2023. The business announced trading ahead of

expectations, with sales of GBP101 million in the period. The

business reported adjusted operating profit of GBP11 million for

the interim period and provided guidance for the full year at the

upper end of market expectations. Performance benefitted from the

end of customer destocking and improving gross margin. Net debt was

1.3x LTM EBITDA as at 30 June 2023, at the lower end of the

business' target range. The business noted that its latest

acquisitions, SyncEV and D W Windsor, were both performing well

following their integration.

Rayware's trading has been impacted by customer destocking,

decreased consumer confidence and inflationary pressures. The

business appointed a new Head of US Sales and Marketing in June

2023, Naddia Prandelli, who has over 20 years experience in branded

homewares sales. In July 2023, the Company, through its subsidiary

ESO Investments 1 Limited, invested GBP2.6 million, reducing the

business' senior debt and committed to provide up to GBP2.5m of

funding via a contingent guarantee to Rayware's third party

lenders.

Whittard of Chelsea has delivered strong sales growth, with the

business' retail channel trading ahead of budget and the prior

year, despite market headwinds. Consumers' return to offline

channels has, however, implied a partial normalisation in the

business' online performance. Whittard's South Korean franchise

partner progressed its store rollout in the period, opening a new

store in Samsung Town. The business also continued to expand its

marketing channels, launching their first UK TV advertising

campaign in February 2023.

David Phillips has developed a strong pipeline of projects

across its build-to-rent and fitted furniture divisions, providing

top line momentum in the coming period. The business has maintained

prudent cost control and improved produce pricing and sourcing

strategies, which are expected to improve profitability in the near

term.

Pharmacy2U has delivered strong sales growth within its NHS

online prescription channel, trading ahead of budget and the prior

year. In November 2022, the business appointed Deirdre Burns as

chairperson and Kevin Heath as CEO. Deirdre has broad-ranging

experience as a chairperson of private equity backed companies

across the health and care sectors. Kevin has more than 20 years'

experience in pharmacy, having previously held senior positions at

Walgreens Boots Alliance, including as an executive board

director.

Denzel's has utilised the investment raised in October 2022 to

help accelerate the development of its team and operational

platform, whilst continuing to grow sales year-on-year. Notable new

hires include the Head of Marketing and Head of E-commerce. The

business recently re--launched its website to improve functionality

and offer an enhanced subscription offering to customers. Future

growth plans are focused on the launch of new products and

expansion of offline and online sales channels.

EAC announced the extension of its business combination period

in April 2023, with an initial three-month extension to 25 July

2023 and the option to further extend by one month at a time up

until to a final business combination date of 25 January 2024. EAC

announced a further extension to 25 September 2023 in August 2023.

EAC continues to actively source and review a pipeline of potential

business combination targets.

The Investment Advisor continues to monitor the Company's credit

fund investments. European Capital Private Debt Fund has completed

its investment period and is distributing capital to the Company.

In July 2023, the Company completed the realisation of its holdings

in Atlantic Credit Opportunities Fund and in August 2023 completed

the realisation of its holdings in Prelude Structured Alternatives

Master Fund LP.

The Investment Advisor would like to express its appreciation to

the management and employees of the portfolio for their dedication

during a challenging period. The Investment Advisor thanks the

Board and the Company's shareholders for their continued

support.

EPIC Investment Partners LLP

Investment Advisor to the Company

14 September 2023

(1) Company liquidity is stated inclusive of cash held by

subsidiaries in which the Company is the sole investor

Report of the Directors

Principal activity

EPE Special Opportunities Limited (the "Company") was

incorporated in the Isle of Man as a company limited by shares

under the Laws with registered number 108834C on 25 July 2003.

On 23 July 2012, the Company re-registered under the Isle of Man

Companies Act 2006, with registration number 008597V. On 11

September 2018, the Company re--registered under the Bermuda

Companies Act 1981, with registration number 53954. The Company's

ordinary shares are quoted on AIM, a market operated by the London

Stock Exchange, and the Growth Market of the Aquis Stock Exchange

(formerly the NEX Exchange). The Company's Unsecured Loan Notes

("ULN") are quoted on the Aquis Stock Exchange.

The Company's Zero Dividend Preference Shares ("ZDP") are

admitted to trade on the main market of the London Stock Exchange

(standard listed). It was identified that the 31 January 2023

accounts did not include certain disclosures and requirements

necessitated by the main market listing of the ZDP shares. Detailed

review is being performed by management to consider obligations and

reporting requirements in accordance with the Listing Rules and DTR

for the standard listed segment (shares) on the London Stock

Exchange. The format of the Interim Review has been updated to

include the required disclosures, and the annual report will also

be updated on this basis going forward.

The principal activity of the Company and its Subsidiaries is to

arrange income yielding financing for growth, buyout and

special situations and holding the investments with a view to

exiting in due course at a profit.

Incorporation

The Company was incorporated on 25 July 2003 and on 11 September

2018, registered under the Bermuda Companies Act 1981. The

Company's registered office is:

Clarendon House, 2 Church Street, Hamilton HM11, Bermuda.

Place of business

Prior to 15 May 2023, the Company operated out of and was

controlled from:

Liberation House, Castle Street, St Helier, Jersey JE1 2LH

On 15 May 2023, the Company's place of business was amended

to:

Gaspe House, 66-72 Esplanade, St Helier, Jersey, Channel

Islands, JE1 2LH

Results of the financial year

Results for the year are set out in the Condensed Statement of

Comprehensive Income and in the Condensed Statement of Changes in

Equity below.

Dividends

The Board does not recommend a dividend in relation to the

current year (2022: nil) (see note 10 for further details).

Corporate governance principles

The Directors, place a high degree of importance on ensuring

that the Company maintains high standards of Corporate

Governance and have therefore adopted the Quoted Companies

Alliance 2018 Corporate Governance Code (the "QCA Code").

The Board holds at least four meetings annually and has

established Audit and Risk and Investment committees. The Board

does not intend to establish remuneration and nomination committees

given the current composition of the Board and the nature of the

Company's operations. The Board reviews annually the remuneration

of the Directors and agrees on the level of Directors' fees.

Composition of the Board

The Board currently comprises five non-executive directors, all

of whom are independent. Clive Spears is Chairman of the Board,

David Pirouet is Chairman of the Audit and Risk Committee and

Heather Bestwick is Chair of the Investment Committee.

Audit and Risk Committee

The Audit and Risk Committee comprises David Pirouet (Chairman

of the Committee) and all other Directors. The Audit and Risk

Committee provides a forum through which the Company's external

auditors report to the Board.

The Audit and Risk Committee meets at least twice a year and is

responsible for considering the appointment and fee of the external

auditors and for agreeing the scope of the audit and reviewing its

findings. It is responsible for monitoring compliance with

accounting and legal requirements, ensuring that an effective

system of internal controls is maintained and for reviewing the

annual and interim financial statements of the Company before their

submission for approval by the Board. The Audit and Risk Committee

has adopted and complied with the extended terms of reference

implemented on the Company's readmission to AIM in August 2010, as

reviewed by the Board from time to time.

The Board is satisfied that the Audit and Risk Committee

contains members with sufficient recent and relevant financial

experience.

Principal risks and uncertainties

The Company has a robust approach to risk management that

involves ongoing risk assessments, communication with our Board of

Directors and Investment Advisor, and the development and

implementation of a risk management framework along with reports,

policies and procedures. We continue to monitor relevant emerging

risks and consider the market and macro impacts on our key

risks.

Risk Description Mitigation

Performance risk In the event the Company's The Board independently

investment portfolio underperforms reviews any investment

the market, the Company recommendation made by

may underperform vs. the the Investment Advisor

market and peer benchmarks. in light of the investment

objectives of the Company

and the expectations of

shareholders.

The Investment Advisor

maintains board representation

on all majority owned

portfolio investments

and maintains ongoing

discussions with management

and other key stakeholders

in investments to ensure

that there are controls

in place to ensure the

success of the investment.

------------------------------------ ---------------------------------

Portfolio Concentration The Company's investment The Directors and Investment

Risk policy is to hold a concentrated Advisor keep the portfolio

portfolio of 2-10 assets. under review and focus

In a concentrated portfolio, closely on those holdings

if the valuation of any which represent the largest

asset decreases it may proportion of total value.

have a material impact

on the Company's NAV.

------------------------------------ ---------------------------------

Liquidity Management Liquidity risk is the The Board and Investment

risk that the Company Advisor closely monitors

will encounter difficulty cash flow forecasts in

in meeting the obligations conjunction with liability

associated with its financial maturity. Liquidity forecasts

liabilities that are settled are carefully considered

by delivering cash or before capital deployment

another financial asset. decisions are made.

------------------------------------ ---------------------------------

Credit Risk Credit risk is the risk Loan investments are entered

that an issuer or counterparty into as part of the investment

will be unable or unwilling strategy of the Company

to meet a commitment that and its Subsidiaries,

it has entered into with and credit risk is managed

the Company. The Company, by taking security where

through its interests available (typically a

in Subsidiaries, has advanced floating charge) and the

loans to a number of private Investment Advisor taking

companies which exposes an

the Company to credit active role in the management

risk. The loans are advanced of the borrowing companies.

to unquoted private companies, In addition to the repayment

which have no credit risk of loans advanced, the

rating. Company and Subsidiaries

will often

arrange additional preference

share structures and take

significant equity stakes

so as to create shareholder

value. It is the performance

of the combination of

all securities including

third party

debt that determines the

Company's view of each

investment.

------------------------------------ ---------------------------------

Operational Risk The Company outsources The primary responsibility

investment advisory and for the development and

administrative functions implementation of controls

to over operational risk

service providers. Inadequate rests with the Board of

or failed internal processes Directors. This responsibility

could lead to operational is supported by the development

performance risk and regulatory of overall standards for

risk. the management of operational

risk, which encompasses

the controls and processes

at the service providers

and the establishment

of service levels with

the service providers.

The Directors' assessment

of the adequacy of the

controls and processes

in place at the service

providers with respect

to operational risk is

carried out via regular

discussions with the service

providers as well as site

visits to their offices.

The

Company also undertakes

periodic third-party reviews

of service providers'

activities.

------------------------------------ ---------------------------------

Investment Committee

The Board established an Investment Committee, which comprises

Heather Bestwick (Chair of the Committee) and all the other

Directors. The purpose of this committee is to review the portfolio

of the Company, new investment opportunities and evaluate the

performance of the Investment Advisor.

The Board is satisfied that the Investment Committee contains

members with sufficient recent and relevant experience.

Directors

The Directors of the Company holding office during the financial

year and to date are:

Mr. C.L. Spears (Chairman)

Mr. N.V. Wilson

Ms. H. Bestwick

Mr. D.R. Pirouet

Mr. M.M Gray

Related Party Transactions

Details in respect of the Company's related party transactions

during the period are included in note 15 to the financial

statements.

Staff and Secretary

At 31 January 2023 the Company employed no staff (2022:

none).

Independent Review

The current year is the second year in which

PricewaterhouseCoopers CI LLP are undertaking the interim review

for the Company's condensed interim financial statements..

PricewaterhouseCoopers CI LLP have indicated willingness to

continue in office.

On behalf of the Board

Heather Bestwick

Director

14 September 2023

Statement of Directors' Responsibilities

in respect of the Interim Report and the Financial

Statements

The Directors are responsible for preparing the Interim Report

& Unaudited Condensed Financial Statements, in accordance with

International Accounting Standard 34, "Interim Financial

Reporting", as issued by the IASB and Disclosure Guidance and

Transparency Rules sourcebook of the United Kingdom's Financial

Conduct Authority. The Directors confirm that, to the best of their

knowledge;

-- The condensed set of financial statements contained in these

interim results have been prepared in accordance with International

Accounting Standard 34, "Interim Financial Reporting", as issued by

the IASB; and

-- The Chairman's Statement, Investment Advisor's Report, Report

of the Directors and Statement of Directors' Responsibilities

(collectively referred herein as "interim management report")

includes a fair review of the information required by DTR 4.2.7 R

of the FCA's Disclosure Guidance and Transparency Rules, being an

indication of important events that have occurred during the first

six months of the financial year and a description of the principal

risks and uncertainties for the remaining six months of the

financial year; and

-- The interim financial statements include a fair review of the

information required by DTR 4.2.8 of the Disclosure Guidance and

Transparency Rules, being material relating party transactions that

have taken place in the first six months of the year and any

material changes in the related-party transactions described in the

annual report.

The maintenance and integrity of the Company's website is the

responsibility of the Directors; the work carried out by the

authors does not involve consideration of these matters and,

accordingly, the auditors accept no responsibility for any changes

that might have occurred to the interim financial statements since

they were initially presented on the website.

This interim report was approved by the Board and the above

Director's Responsibility Statement was signed on behalf of the

Board.

Heather Bestwick

Director

14 September 2023

Independent Review Report to EPE Special Opportunities

Limited

Report on the condensed interim financial statements

Our conclusion

We have reviewed EPE Special Opportunities Limited's condensed

interim financial statements (the "interim financial statements")

in the Interim Report & Unaudited Condensed Financial

Statements of EPE Special Opportunities Limited for the 6 month

period ended 31 July 2023 (the "period").

Based on our review, nothing has come to our attention that

causes us to believe that the interim financial statements are not

prepared, in all material respects, in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as issued by the IASB and the Disclosure Guidance and

Transparency Rules sourcebook of the United Kingdom's Financial

Conduct Authority.

The interim financial statements comprise:

-- the Condensed Statement of Assets and Liabilities as at 31 July 2023;

-- the Condensed Statement of Comprehensive Income for the period then ended;

-- the Condensed Statement of Cash Flows for the period then ended;

-- the Condensed Statement of Changes in Equity for the period then ended; and

-- the explanatory notes to the interim financial statements.

The interim financial statements included in the Interim Report

& Unaudited Condensed Financial Statements of EPE Special

Opportunities Limited have been prepared in accordance with

International Accounting Standard 34, 'Interim Financial

Reporting', as issued by the IASB and the Disclosure Guidance and

Transparency Rules sourcebook of the United

Kingdom's Financial Conduct Authority.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, 'Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity' issued by the Financial Reporting Council for use in the

United Kingdom ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and,

consequently, does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

We have read the other information contained in the Interim

Report & Unaudited Condensed Financial Statements and

considered whether it contains any apparent misstatements or

material inconsistencies with the information in the interim

financial statements.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed. This conclusion is based on

the review procedures performed in accordance with ISRE (UK) 2410.

However, future events or conditions may cause the company to cease

to continue as a going concern.

Our responsibilities and those of the directors

The Interim Report & Unaudited Condensed Financial

Statements, including the interim financial statements, is the

responsibility of, and has been approved by the directors. The

directors are responsible for preparing the Interim Report &

Unaudited Condensed Financial Statements in accordance with the

Disclosure Guidance and Transparency Rules sourcebook of the United

Kingdom's Financial Conduct Authority. In preparing the Interim

Report & Unaudited Condensed Financial Statements, including

the interim financial statements, the directors are responsible for

assessing the company's ability to continue as a going concern,

disclosing, as applicable, matters related to going concern and

using the going concern basis of accounting unless the directors

either intend to liquidate the company or to cease operations, or

have no realistic alternative but to do so.

Our responsibility is to express a conclusion on the interim

financial statements in the Interim Report & Unaudited

Condensed Financial Statements based on our review. Our conclusion,

including our Conclusions relating to going concern, is based on

procedures that are less extensive than audit procedures, as

described in the Basis for conclusion paragraph of this report.

This report, including the conclusion, has been prepared for and

only for the company for the purpose of complying with the

Disclosure Guidance and Transparency Rules sourcebook of the United

Kingdom's Financial Conduct Authority and for no other purpose. We

do not, in giving this conclusion, accept or assume responsibility

for any other purpose or to any other person to whom this report is

shown or into whose hands it may come save where expressly agreed

by our prior consent in writing .

PricewaterhouseCoopers CI LLP

Chartered Accountants

Jersey, Channel Islands

14 September 2023

The maintenance and integrity of the EPE Special Opportunities

Limited website is the responsibility of the directors; the work

carried out by the auditors does not involve consideration of these

matters and, accordingly, the auditors accept no responsibility for

any changes that may have occurred to the financial statements

since they were initially presented on the website.

Legislation in Jersey governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions

Condensed Statement of Comprehensive Income

For the six months ended 31 July 2023

1 Feb 2022

1 Feb 2023 1 Feb 2022 to 31 Jan

to 31 Jul 2023 to 31 Jul 2022 2023

Total (unaudited) Total (unaudited) Total (audited)

Note GBP GBP GBP

------------------------- ---------------------------- ----------------------- -----------------------

Income

Interest income 106,478 16,106 79,899

Net fair value movement

on investments* (3,539,864) (59,814,999) (39,438,551)

------------------------- ---------------------------- -----------------------

Total loss (3,433,386) (59,798,893) ( 39,358,652)

------------------------- ---------------------------- ----------------------- -----------------------

Expenses

Investment advisor's

4 fees (909,805) (911,590) (1,755,442)

15 Directors' fees (86,000) (86,000) (172,000)

Share based payment

5 expense (136,481) (354,193) (555,225)

6 Other expenses (302,814) (277,527) (557,416)

Total expense (1,435,100) (1,629,310) (3,040,083)

------------------------- ---------------------------- ----------------------- -----------------------

Loss before finance

costs and tax (4,868,486) (61,428,203) (42,398,735)

------------------------- ---------------------------- ----------------------- -----------------------

Finance charges

Interest on unsecured

13 loan note instruments (149,540) (159,842) (309,382)

Zero dividend

preference

13 shares finance charge (483,389) (546,507) (1,128,093)

Loss for the period/year

before taxation (5,501,415) (62,134,552) (43,836,210)

Taxation - - -

------------------------- ---------------------------- ----------------------- -----------------------

Loss for the period/year (5,501,415) (62,134,552) (43,836,210)

------------------------- ---------------------------- ----------------------- -----------------------

Other comprehensive

income - - -

------------------------- ---------------------------- ----------------------- -----------------------

Total comprehensive

loss (5,501,415) (62,134,552) (43,836,210)

------------------------- ---------------------------- ----------------------- -----------------------

Basic loss per ordinary

11 share (pence) (18.47) (197.13) (141.77)

------------------------- ---------------------------- ----------------------- -----------------------

Diluted loss per

11 ordinary share (pence) (18.47) (197.13) (141.77)

------------------------- ---------------------------- ----------------------- -----------------------

*The net fair value movements on investments is allocated to the

capital reserve and all other income and expenses are allocated to

the revenue reserve in the Condensed Statement of Changes in

Equity. All items derive from continuing activities.

Condensed Statement of Assets and Liabilities

As at 31 July 2023

31 July 2023 31 July 2022

(unaudited) 31 January 2023 (audited) (unaudited)

Note GBP GBP GBP

---------------------- ------------------------ ------------------------------ -----------------------

Non-current assets

Investments at fair

value through profit

7 or loss 93,730,728 100,412,977 79,938,043

93,730,728 100,412,977 79,938,043

---------------------- ------------------------ ------------------------------ -----------------------

Current assets

Cash and cash

9 equivalents 16,241,165 22,226,008 26,532,104

Trade and other

receivables and

prepayments 64,814 87,899 83,710

---------------------- ------------------------ ------------------------------ -----------------------

16,305,979 22,313,907 26,615,814

---------------------- ------------------------ ------------------------------ -----------------------

Current liabilities

Trade and other

payables (629,655) (596,790) (555,256)

Unsecured loan note

13 instruments (3,987,729) (3,987,729) (3,987,729)

---------------------- ------------------------ ------------------------------ -----------------------

(4,617,384) (4,584,519) (4,542,985)

---------------------- ------------------------------

Net current assets 11,688,595 17,729,388 22,072,829

---------------------- ------------------------ ------------------------------ -----------------------

Non-current

liabilities

Zero dividend

13 preference shares (13,329,390) (20,721,001) (20,139,415)

------------------------------

(13,329,390) (20,721,001) (20,139,415)

---------------------- ------------------------ ------------------------------ -----------------------

Net assets 92,089,933 97,421,364 81,871,457

---------------------- ------------------------ ------------------------------ -----------------------

Equity

10 Share capital 1,730,828 1,730,828 1,730,828

Share premium 13,619,627 13,619,627 13,619,627

16 Capital reserve 93,599,525 97,139,389 76,762,941

Revenue reserve and

16 other equity (16,860,047) ( 15,068,480) (10,241,939)

------------------------------

Total equity 92,089,933 97,421,364 81,871,457

Net asset value per

12 share (pence) 308.23 328.41 259.74

---------------------- ------------------------ ------------------------------ -----------------------

The financial statements were approved by the Board of Directors

on 14 September 2023 and signed on its behalf by:

Clive Spears David Pirouet

Director Director

Condensed Statement of Changes in Equity

For the six months ended 31 July 2023

Six months ended 31 July 2023 (unaudited)

Share Share Capital Revenue Total

capital premium reserve reserve

Note GBP GBP GBP GBP GBP

----------------- ----------- -------------- -------------------- ------------------- ------------------

Balance at 1

February

2023 1,730,828 13,619,627 97,139,389 (15,068,480) 97,421,364

Total

comprehensive

loss for the

period - - (3,539,864) (1,961,551) (5,501,415)

----------------- ----------- -------------- -------------------- ------------------- ------------------

Contributions by

and

distributions to

owners

Share-based

payment

5 charge - - - 136,481 136,481

Share ownership

scheme

participation - - - 33,503 33,503

Total

transactions

with owners - - - 169,984 169,984

----------------- ----------- -------------- -------------------- ------------------- ------------------

Balance at 31

July

2023 1,730,828 13,619,627 93,599,525 (16,860,047) 92,089,933

----------------- ----------- -------------- -------------------- ------------------- ------------------

Year ended 31 January 2023 (audited)

Share Share Capital Revenue Total

capital premium reserve reserve

GBP GBP GBP GBP GBP

----------------- ----------- -------------- -------------------- ------------------- ------------------

Balance at 1

February

2022 1,730,828 13,619,627 136,577,940 (8,303,418) 143,624,977

Total

comprehensive

loss for the

year - - (39,438,551) (4,397,659) (43,836,210)

----------------- ----------- -------------- -------------------- ------------------- ------------------

Contributions by

and

distributions to

owners

Share-based

payment

5 charge - - - 555,225 555,225

Share ownership

scheme

participation - - - 149,568 149,568

Purchase of

shares - - - (2,587,375) (2,587,375)

Share

acquisition for

JOSP scheme - - - (484,821) (484,821)

Total

transactions

with owners - - - (2,367,403) (2,367,403)

----------------- ----------- -------------- -------------------- ------------------- ------------------

Balance at 31

January

2023 1,730,828 13,619,627 97,139,389 (15,068,480) 97,421,364

----------------- ----------- -------------- -------------------- ------------------- ------------------

Six months ended 31 July 2022 (unaudited)

Share Share Capital Revenue Total

capital premium reserve reserve

GBP GBP GBP GBP GBP

----------------- ----------- -------------- -------------------- ------------------- ------------------

Balance at 1

February

2022 1,730,828 13,619,627 136,577,940 (8,303,418) 143,624,977

Total

comprehensive

loss for the

period - - (59,814,999) (2,319,553) (62,134,552)

----------------- ----------- -------------- -------------------- ------------------- ------------------

Contributions by

and

distributions to

owners

Share-based

payment

5 charge - - - 354,193 354,193

Share ownership

scheme

participation - - - 149,568 149,568

Share

acquisition for

JOSP scheme - - - (122,729) (122,729)

----------------- ----------- -------------- -------------------- ------------------- ------------------

Total

transactions

with owners - - - 381,032 381,032

----------------- ----------- -------------- -------------------- ------------------- ------------------

Balance at 31

July

2022 1,730,828 13,619,627 76,762,941 (10,241,939) 81,871,457

----------------- ----------- -------------- -------------------- ------------------- ------------------

Condensed Statement of Cash Flows

For the six months ended 31 July 2023

1 Feb 2023 1 Feb 2022 1 Feb 2022

to 31 July to 31 Jan 2023 to 31 Jul

2023 (unaudited) (audited) 2022 (unaudited)

Note GBP GBP GBP

----------------------------- ---------------------------- --------------------- ------------------

Operating activities

Interest income received 106,478 79,899 16,106

Expenses paid (1,241,554) (2,853,467) (1,678,661)

7 Purchase of investments (2,600,000) (3,174,948) (1,100,000)

7 Proceeds from investments 5,742,385 3,848,880 1,872,018

---------------------------- --------------------- ------------------

Net cash generated from

/ (used in) operating

activities 2,007,309 (2,099,636) (890,537)

----------------------------- ---------------------------- --------------------- ------------------

Financing activities

Unsecured loan note interest

paid (149,540) (299,080) (149,540)

Purchase of shares - (3,072,196) (122,729)

Buyback of zero dividend (7,875,000) - -

preference shares

Share ownership scheme

participation 33,503 149,568 149,568

Net cash used in financing

activities (7,991,037) (3,221,708) (122,701)

----------------------------- ---------------------------- --------------------- ------------------

Decrease in cash and

cash equivalents (5,983,728) (5,321,344) (1,013,238)

Effect of exchange rate

fluctuations on cash and

cash equivalents (1,115) 2,310 300

Cash and cash equivalents

at start of period/year 22,226,008 27,545,042 27,545,042

----------------------------- ---------------------------- --------------------- ------------------

Cash and cash equivalents

at end of period/year 16,241,165 22,226,008 26,532,104

----------------------------- ---------------------------- --------------------- ------------------

Comparative cash flow of Expenses paid for the period ended 31

July 2022 has been updated for consistency of presentation with the

subsequent periods. Effect of exchange rate fluctuations on cash

and cash equivalents has been broken out from Expenses paid.

Reconciliation of net debt

Cash and cash equivalents On 31 January Cash flows Other non-cash On 31 July

2023 charge 2023

GBP GBP GBP GBP

--------------------------- -------------- ------------ --------------- -------------

Cash at bank 22,226,008 (5,983,728) (1,115) 16,241,165

Unsecured loan note

instruments (3,987,729) 149,540 (149,540) (3,987,729)

Zero dividend preference

shares (20,721,001) 7,875,000 (483,389) (13,329,390)

--------------------------- -------------- ------------ --------------- -------------

Net debt (2,482,722) 2,040,812 (634,044) (1,075,954)

--------------------------- -------------- ------------ --------------- -------------

Notes to the Interim Financial Statements

For the six months ended 31 July 2023

1 The General Information

On 25 July 2003, the Company was incorporated with limited

liability in the Isle of Man. On 23 July 2012, the Company then

re-registered under the Isle of Man Companies Act 2006, with

registration number 008597V. On 11 September 2018, the Company

re-registered under the Bermuda Companies Act 1981, with

registration number 53954. The Company moved its operations to

Jersey with immediate effect on 17 May 2017 and has subsequently

operated from Jersey only.

The Company's ordinary shares are quoted on AIM, a market

operated by the London Stock Exchange, and the Growth Market of the

Aquis Stock Exchange (formerly the NEX Exchange). The Company's

zero dividend preference shares are admitted to trade on the main

market of the London Stock Exchange (standard listed). The

Company's unsecured loan notes are quoted on the Aquis Stock

Exchange.

The interim financial statements are as at and for the six

months ended 31 July 2023, comprising the Company and investments

in its subsidiaries. The interim financial statements are

unaudited.

The financial statements of the Company as at and for the year

ended 31 January 2023 are available upon request from the Company's

business office at 3(rd) Floor, Gaspe House, 66-72 Esplanade, St

Helier, Jersey, Channel Islands, JE1 2LH and the registered office

at Clarendon House, 2 Church Street, Hamilton HM11, Bermuda, or at

www.epespecialopportunities.com .

The Company's portfolio investments are held in two majority

owned subsidiaries entities, ESO Investments 1 Limited and ESO

Investments 2 Limited and one wholly owned subsidiary entity, ESO

Alternative Investments LP (together the "Subsidiaries").

Direct interests in the individual portfolio investments are

held by the following Subsidiaries;

-- ESO Investment 1 Limited: Rayware, Whittard, David Phillips and Denzel's

-- ESO Investments 2 Limited: Luceco and Pharmacy2U

-- ESO Alternative Investments LP: European Capital Private Debt

Fund LP, EPE Junior Aggregator LP, EPIC Acquisition Corp. and EAC

Sponsor Limited

The principal activity of the Company is to arrange income

yielding financing for growth, buyout and special situations

investments with a view to exiting in due course at a profit.

The Company has no employees.

The following significant changes occurred during the six months

ended 31 July 2023:

-- In July 2023, the Company completed the realisation of its

holdings in Atlantic Credit Opportunities Fund.

-- The valuation methodology for EPIC Acquisition Corp. and EAC

Sponsor Limited was amended to a liquidation valuation, implying a

reduction in the aggregate value of the holdings. As a result, the

designation of the level of fair value hierarchy of EPIC

Acquisition Corp was amended to Level 3 from Level 2 as at 31

January 2023 (see note 8).

-- In July 2023, the Company completed the buyback of 7.5

million zero dividend preference shares ("ZDP"). Following this

buyback, the Company has 12.5 million ZDP shares remaining in

issue, maturing in December 2026 (see note 15).

-- The movement in the value of investments and fair value

movement are deemed as significant changes during the period (see

note 8).

2 Basis of preparation

a. Statement of compliance

These interim financial statements for the six months ended 31

July 2023 have been prepared in accordance with IAS 34 Interim

Financial Reporting and should be read in conjunction with

Company's last annual financial statements as at and for the year

ended 31 January 2023. They do not include all of the information

required for a complete set of financial statements prepared in

accordance with IFRS Standards. However, selected explanatory notes

are included to explain events and transactions that are

significant to an understanding of the changes in the Company's

financial position and performance since the last annual financial

statements.

The accounting policies and methods of computation applied by

the Company in these interim financial statements are the same as

those applied in its annual financial statements as at and for the

year ended 31 January 2023.

The annual financial statements of the Company are prepared in

accordance with International Financial Reporting Standards and

applicable legal and regulatory requirements of Bermuda law.

These interim financial statements were authorised for issue by

the Company's Board of Directors on 14 September 2023.

b. Going concern

The Company's management has assessed the Company's ability to

continue as a going concern and is satisfied that the Company has

adequate resources to continue in business for at least twelve

months from the date of approval of interim financial statements.

Furthermore, the management is not aware of any material

uncertainties that may cast significant doubt upon the Company's

ability to continue as a going concern. Therefore, the financial

statements continue to be prepared on a going concern basis.

c. Segmental reporting

The Directors are of the opinion that the Company is engaged in

a single segment of business and geographic area, being arranging

financing for growth, buyout and special situations investments in

the United Kingdom. Information presented to the Board of Directors

for the purpose of decision making is based on this single segment.

All significant operating decisions are based upon the analysis of

the Company's investments as a single operating segment. The

financial information from this segement are equivalent to the

financial information of the Company as a whole, which are

evaluated on a regular basis by the Board of Directors.

d. Critical accounting estimates and assumption

Critical accounting estimates and assumptions made by Directors

and the Investment Advisor in the application of IFRS that have a

significant effect on the financial statements and estimates with a

significant risk of material adjustments in the year relate to the

determination of fair value of financial instruments with

significant unobservable inputs (see note 8).

e. Critical judgements

The critical judgements made by the Directors and the Investment

Advisor in preparing these financial statements are:

-- Classification of the zero dividend preference share as a

non-current liability in the Condensed Statement of Assets and

Liabilities. Please refer to note 13 for further details.

-- Categorisation of ESO Alternative Investments LP, ESO

Investments 1 Limited and ESO Investments 2 Limited as

Subsidiaries. The Company is deemed to have control over these

subsidiaries.

3 Financial risk management

The financial risk management objectives and policies are

consistent with those disclosed in the financial statements as at

and for the year ended 31 January 2023.

4 Investment advisory, administration and performance fees

Investment advisory fees

The investment advisory fee payable to EPIC Investment Partners

LLP ("EPIC") is assessed and payable at the end of each fiscal

quarter and is calculated as 2 per cent. of the Company's NAV where

the Company's NAV is less than GBP100 million; otherwise the

investment advisory fee shall be calculated as the greater of

GBP2.0 million or the sum of 2 per cent. of the Company's NAV

comprising Level 2 and Level 3 portfolio assets, 1 per cent. of the

Company's NAV comprising Level 1 assets, no fees on assets which

are managed or advised by a third party-manager, 0.5 per cent. of

the Company's net cash (if greater than nil), and 2 per cent. of

the Company's net cash (if less than nil) (i.e. reducing fees for

net debt positions).

The charge for the current period was GBP909,805 (for the period

ended 31 July 2022: GBP911,590 ; year ended 31 January 2023:

GBP1,755,442). The amount outstanding as at 31 July 2023 was

GBP462,939 (for the period ended 31 July 2022: GBP411,590; year

ended 31 January 2023: GBP487,107).

Administration fees

EPIC Administration Limited provides accounting and financial

administration services to the Company. The fee payable to EPIC

Administration Limited is assessed and payable at the end of each

fiscal quarter and is calculated as 0.15 per cent. of the Company's

NAV where the Company's NAV is less than GBP100 million (subject to

a minimum fee of GBP35,000); otherwise the advisory fee shall be

calculated as 0.15 per cent. of GBP100 million plus a fee of 0.1

per cent. of the excess of the Company's NAV above GBP100

million.

The charge for the current period was GBP70,000 (for the period

ended 31 July 2022: GBP75,510; for the year ended 31 January 2023:

GBP147,043).

Other administration fees during the period were GBP39,775 (for

the period ended 31 July 2022: GBP37,170; for the year ended 31

January 2023: GBP76,302).

Performance fees paid by Subsidiaries

The Subsidiaries are stated at fair value. Performance fees are

paid to the Investment Advisor based on the performance of the

Subsidiaries and deducted in calculating the fair value of the

Subsidiaries.

Performance fee in ESO Investments 1 Limited

The distribution policy of ESO Investments 1 Limited includes an

allocation of profits to the Investment Advisor such that, for each

investment where a returns hurdle of 8 per cent. per annum has been

achieved, the Investment Advisor is entitled to receive 20 per

cent. of the increase above the base value of investment. As at 31

July 2023, GBP1,679,522 has been accrued in the profit share

account of the Investment Advisor in the records of ESO Investments

1 Limited (31 July 2022: GBPnil accrued; 31 January 2023: GBPnil

accrued).

Performance fee in ESO Investments 2 Limited

The distribution policy of ESO Investments 2 Limited includes an

allocation of profit to the Investment Advisor such that, for each

investment where a returns hurdle of 8 per cent. per annum has been

achieved, the Investment Advisor is entitled to receive 20 per

cent. of the increase above the base value of investment. As at 31

July 2023, GBP8,237,011 has been accrued in the profit share

account of the Investment Advisor in the records of ESO Investments

2 Limited (31 July 2022: GBP6,687,647 accrued; 31 January 2023:

GBP9,112,002 accrued).

Jointly Owned Share Plan ("JOSP") and share-based payments

Directors of the Company and certain employees of the Investment

Advisor (together "Participants") receive remuneration in the form

of equity-settled share-based payment transactions, through a JOSP

scheme (see note 5).

The assets (other than investments in the Company's shares),

liabilities, income and expenses of the trust established to

operate the JOSP scheme (the "Trust") are recognised by the

Company. The Trust's investment in the Company's shares is deducted

from shareholders' funds in the Condensed Statement of Asset and

Liabilities as if they were treasury shares.

5 Share-based payment expense

The cost of equity settled transactions to Participants in the

JOSP Scheme are measured at fair value at the grant date. The fair

value is determined based on the share price of the equity

instrument at the grant date.

The Trust was created to award shares to Participants as part of

the JOSP. Participants are awarded a certain number of shares

("Matching Shares") which are subject to a three-year service

vesting condition from the grant date. In order to receive their

Matching Share allocation Participants are required to purchase

shares in the Company on the open market ("Bought Shares"). The

Participant will then be entitled to acquire a joint ownership

interest in the Matching Shares for the payment of a nominal

amount, on the basis of one joint ownership interest in one

Matching Share for every Bought Share they acquire in the relevant

award period.

The Trust holds the Matching Shares jointly with the Participant

until the award vests. These shares carry the same rights as rest

of the ordinary shares.

The Trust held 1,245,009 (for the period ended 31 July 2022:

1,049,702; for the year ended 31 January 2023: 1,290,202) matching

shares at the period end which have historically not voted.

257,061 shares vested to Participants in the period ended 31

July 2023 (for the period ended 31 July 2022: 862,290 ; for the

year ended 31 January 2023: 862,290). 243,947 shares were awarded

to Participants in the period ended 31 July 2023 (for the period

ended 31 July 2022: 156,173 ; for the year ended 31 January 2023:

156,173).

The share-based payment expense in the Condensed Statement of

Comprehensive Income has been calculated on the basis of the fair

value of the equity instruments at the grant date and the estimated

number of equity instruments to be issued after the vesting period,

less the amount paid for the joint ownership interest in the

Matching Shares.

The total share-based payment expense in the period ended 31

July 2023 was GBP136,481 (for the period ended 31 July 2022:

GBP354,193 ; for the year ended 31 January 2023: GBP555,225). Of

the total share-based payment expense during the period ended 31

July 2023, GBP12,431 related to the Directors (for the period ended

31 July 2022: GBP23,103; for the year ended 31 January 2023:

GBP36,217) and the balance related to members, employees and

consultants of the Investment Advisor.

6 Other expenses

The breakdown of other expenses presented in the Condensed

Statement of Comprehensive Income is as follows:

1 Feb 2023 1 Feb 2022 1 Feb 2022

to 31 Jul 2023 to 31 Jul 2022 to 31 Jan 2023

(unaudited) (unaudited) (audited)

Total Total Total

GBP GBP GBP

------------------------------ ---------------- ------------------- ------------------------

Administration fees (109,775) (112,680) (223,345)

Directors' and officers'

insurance (13,997) (13,543) (27,464)

Professional fees (57,079) (46,736) (94,442)

Board meeting and travel

expenses (768) (847) (1,085)

Auditors' remuneration (39,525) (19,518) (61,350)

Interim review remuneration (17,000) (17,000) (17,000)

Bank charges (694) (922) (1,705)

Foreign exchange movement (1,110) (89) 2,687

Nominated advisor and broker

fees (27,500) (27,745) (62,322)

Listing fees (24,963) (29,115) (52,769)

Sundry expenses (10,403) (9,332) (18,621)

------------------------------- ---------------- ------------------- ------------------------

Other expenses (302,814) (277,527) (557,416)

------------------------------- ---------------- ------------------- ------------------------

7 Investments at fair value through profit or loss

31 July 31 January 31 July

2023 2023 2022

(unaudited) (audited) (unaudited)

GBP GBP GBP

Investments at fair value through

profit and loss* 93,730,728 100,412,977 79,938,043

93,730,728 100,412,977 79,938,043

------------------ -------------- ----------------

Investment roll forward

schedule

31 July 2023 31 January 31 July

(unaudited) 2023 (audited) 2022

(unaudited)

Investments at fair value

as at 1 February 100,412,977 140,525,060 140,525,060

Purchase of investments 2,600,000 3,174,948 1,100,000

Proceeds from investments (5,742,385) (3,848,880) (1,872,018)

Net fair value movements (3,539,864) (39,438,551) (59,814,999)

Reclassification of debtor

balance to investee - 400 -

Investments at fair value 93,730,728 100,412,977 79,938,043

---------------------------- ------------------------ ----------------------------- -------------------------

*Comprises Subsidiaries stated at fair value (ESO Investments 1

Limited, ESO Investments 2 Limited and ESO Alternative Investments

LP.

Discussion of the performance of individual investments is

presented in the Chairman's Statement and the Investments Advisor's

Report.

8 Fair value of financial instruments

The Company determines the fair value of nancial instruments

with reference to IPEV guidelines and the valuation principles of

IFRS 13 (Fair Value Measurement). The Company measures fair value

using the IFRS 13 fair value hierarchy, which re ects the signi

cance and certainty of the inputs used in deriving the fair value

of an asset:

-- Level 1: Inputs that are quoted market prices (unadjusted) in

active markets for identical instruments;

-- Level 2: Inputs other than quoted prices included within

Level 1 that are observable either directly (i.e. as prices) or

indirectly (i.e. derived from prices). This category includes

instruments valued using quoted market prices in active markets for

similar instruments, quoted prices for identical or similar

instruments in markets that are considered less than active or

other valuation techniques in which all signi cant inputs are

directly or indirectly observable from market data;

-- Level 3: Inputs that are unobservable. This category includes

all instruments for which the valuation technique includes inputs

not based on observable data and the unobservable inputs have a

signi cant effect on the instrument's valuation. This category

includes instruments that are valued based on quoted prices for

similar instruments but for which signi cant unobservable

adjustments or assumptions are required to re ect differences

between the instruments.

The Investment Advisor undertakes the valuation of financial

instruments required for financial reporting purposes. Recommended

valuations are reviewed and approved by the Investment's Advisor's

Valuation Committee for circulation to the Company's Board. The

Risk and Audit committee of the Company's Board meets at least once

every six months, in line with the Company's semi-annual reporting

periods, to review the recommended valuations and approve final

valuations for adoption in the Company's financial statements.

The Company recognises transfers between levels of the fair

value hierarchy at the end of the reporting period during which the

change has occurred.

Valuation framework

The Company employs the valuation framework detailed below with

respect to the measurement of fair values. A valuation of the

Company's investments held via its Subsidiaries are prepared by the

Investment Advisor with reference to IPEV guidelines and the

valuation principles of IFRS 13 (Fair Value Measurement). The

Investment Advisor recommends these valuations to the Board of

Directors. The Risk and Audit committee of the Company's Board

considers the valuations recommended by the Investment Advisor,

determines any amendments required and thereafter adopts the fair

values presented in the Company's nancial statements. Changes in

the fair value of the financial instruments are recorded in the

Condensed Statement of Comprehensive Income in the line item "Net

fair value movement on investments".

Quoted investments

Quoted investments traded in an active market are classified as

Level 1 in the IFRS 13 fair value hierarchy. The investment in

Luceco is a Level 1 asset. For Level 1 assets, the holding value is

calculated from the latest market price (without adjustment).

Quoted investments traded in markets that are considered less

than active are classified as Level 2 in the IFRS 13 fair value

hierarchy. The investment in EPIC Acquisition Corp was considered

to be a Level 2 asset in the year ended 31 January 2023. For the

period ended 31 July 2023, the investment in EPIC Acquisition Corp

is considered to be a Level 3 asset, and therefore no assets are

considered to be Level 2.

Unquoted private equity investments and unquoted fund

investments

Private equity investments and fund investments are classified

as Level 3 in the IFRS 13 fair value hierarchy. The investments in

Whittard, David Phillips, Rayware, Denzel's, Pharmacy2U, European

Capital Private Debt Fund LP, EPE Junior Aggregator LP, EPIC

Acquisition Corp and EAC Sponsor Limited are considered to be Level

3 assets. Various valuation techniques may be applied in

determining the fair value of investments held as Level 3 in the

fair value hierarchy;

-- For underperforming assets, net asset or recovery valuation

is considered more applicable, in particular where the business'

performance be contingent on shareholder financial support;

-- For performing assets, market approach is considered to be

the most appropriate with a specific focus on trading comparables,

applied on a forward basis. Transaction comparables, applied on a

historic basis may also be considered;

-- For assets managed and valued by third party managers, the

valuation methodology of the third-party manager is reviewed. If

deemed appropriate and consistent with reporting standards, the

valuation prepared by the third-party manager will be used.

For the period ended 31 July 2023, a public comparable sales

multiple valuation is employed for the investment in Denzel's. The

valuation methodology has been amended given the elapsed time since

investment, with changes in market conditions and trading outlook

in the intervening period.

The Investment Advisor believe that it is appropriate to apply

an illiquidity discount to the multiples of comparable companies

when using them to calculate valuations for small, private

companies. This discount adjusts for the difference in size between

generally larger comparable companies and the smaller assets being

valued. The illiquidity discount also incorporates the premium the

market gives to comparable companies for being freely traded or

listed securities. The Investment Advisor has determined between 15

per cent. and 25 per cent. to be an appropriate illiquidity

discount with reference to market data and transaction multiples

seen in the market in which the Investment Advisor operates.

Where portfolio investments are held through subsidiary holding

companies, the net assets of the holding company are added to the

value of the portfolio investment being assessed to derive the fair

value of the holding company held by the Company.

EPIC Acquisition Corp and EAC Sponsor Limited

For the period ended 31 July 2023, a recovery valuation is

employed for the holdings in EPIC Acquisition Corp and EAC Sponsor

Limited, calculated on the basis of the value of ESO Alternative

Investments LP's holding in a liquidation scenario. The investments

are considered as Level 3 assets. For the year ended 31 January

2023, EPIC Acquisition Corp was valued on a marked to market basis

and considered a Level 2 asset and EAC Sponsor Limited was valued

on the basis of a probability weighted range of implied values

under potential realisation scenarios and considered a Level 3

asset. The valuation methodology has been amended to a liquidation

value to reflect the limited business combination period time

horizon, with extensions agreed on a rolling monthly basis and with

a final business combination deadline of 25 January 2024. The

liquidation valuation approach implies both assets are considered

Level 3 assets.

Although management believes that its estimates of fair value

are appropriate, the use of different methodologies or assumptions

could lead to different measurements of fair value. For fair value

measurements of EPIC Acquisition Corp and EAC Sponsor Limited's

assets, changing one or more of the assumptions used to reasonably

possible alternative assumptions would have the following effects

on the investment valuations. The key inputs into the preparation

of the valuations of EPIC Acquisition Corp and EAC Sponsor Limited

were the distributions available in a liquidation scenario to EAC

Sponsor Limited. If these inputs had been taken to be 25 per cent.

higher, the value of these assets and profit for the year would

have been GBP38,423 higher. If these inputs had been taken to be 25

per cent. lower, the value of these assets and profit for the year

would have been GBP38,423 lower. This sensitivity excludes amounts

held by EPIC Acquisition Corp. in escrow, which will deliver a

fixed distribution in the event of a liquidation scenario.

Fair value hierarchy - Financial instruments measured at fair

value

The Company's investments in the Subsidiaries at 31 July 2023

are classified as Level 3 (in line with 31 January 2023), given the

variation in classification of the underlying assets. The Company

values these investments on the basis of the net asset value of

these holdings.

The table below analyses the underlying investments held by the

Subsidiaries measured at fair value at the reporting date by the

level in the fair value hierarchy into which the fair value

measurement is categorised. The Board assesses the fair value of

the total investment, which includes debt and equity.

The tables below show the gross amount and the net amount of all

investments held via the subsidiaries per the fair value hierarchy.

The net amount is a result of the application of profit share

adjustments relating to the performance fees discussed in Note

4.

Level 1 Level 3 Total

31 July 2023 GBP GBP GBP

------------------------------------- -------------- ---------------------------------- ------------------

Financial assets at fair value

through profit or loss