The Best Bond ETF You Have Never Heard Of (FWDB) - Leveraged ETFs

28 Décembre 2011 - 10:17AM

Zacks

While equity ETFs have led the way in terms of development so

far, bond products are finally beginning to catch up to their stock

brethren. 2011 saw the debut of a host of bond ETFs including funds

that track broad emerging markets, China, and various developed

nation fixed income segments as well. While all of these were

welcomed additions to the ETF lineup, one product in particular

seemed to be an extremely intriguing way to play the broad space,

the Madrona Global Bond ETF (FWDB) from AdvisorShares.

FWDB: Global Bond ETF In Focus

FWDB launched in May of 2011 and is pretty unique among bond

ETFs that are on the market today. The product doesn’t track a

benchmark but instead looks to exceed the price and yield

performance of its benchmark, the Barclays Capital Aggregate bond

Index which is the basis for many popular funds such as AGG or BND.

The fund managers hope to achieve this by selecting a diversified

portfolio of fixed income exchange-traded products without regard

to sector or geography. In fact, the fund promises to invest in at

least 12 distinct global bond classes that cover the entire global

investable bond universe (read Go Local With Emerging Market Bond

ETFs).

This is accomplished by using two techniques based on the shape

of the yield curve and where the managers believe it will go in the

future. Yield curve analysis on a class by class basis is employed

in order to determine which section of the curve is most suitable

for investment at this current time, hopefully allocating to the

segment that has the best chance of outperformance. Furthermore,

analysts will also look at how the current curve compares to

historical averages in order to invest in products that could gain

if bonds revert to the mean. This strategy could help keep bonds

well diversified across asset classes and push investors into a

fixed income portfolio that could outperform over the long

term.

Currently, the product is heavy in investment grade corporates

which constitute one-fourth of the portfolio although

mortgage-backed securities and high yield American corporate bonds

comprise 14% and 13% of the portfolio, respectively. Beyond these

sectors, U.S. short-term government debt makes up about 7% of the

total holdings while a smattering of sectors—10 in total—make up at

least 3% of the portfolio as well (see Top Three High Yield Junk

Bond ETFs).

For this exposure, investors do have to pay a higher fee than

other bond ETFs in the space as the net operating expense ratio

comes in at 1.15% thanks to acquired fund fees and various other

expenses. While this might not sound like a lot compared to many

mutual funds, it is in fact close to ten times higher than what AGG

charges to investors. In part due to this high cost, the product

isn’t the most liquid or popular among investors as it trades about

10,000 shares a day and has AUM below $16 million, suggesting that

relatively wide bid ask spreads may be waiting for some investors

(see ETFs vs. Mutual Funds).

Since the fund’s inception, however, it has slightly

underperformed AGG from a performance perspective. Although it is

worth pointing out that the fund doesn’t exactly have a long track

record and that FWDB has outgained AGG by about 30 basis points in

the past three month period. Additionally, the yield on FWDB is far

greater than what AGG is paying out, suggesting that for those

looking for higher payouts but are still wary of taking on more

risk, the fund could be an ideal choice (read German Bond ETFs In

Focus).

This could especially be true if a bear market hits American

Treasury bonds in the near future. AGG has close to one third of

its assets in American T-Bonds and doesn’t offer up any allocations

to TIPS or international securities giving it a heavy focus on U.S.

finances. On the other hand, FWDB has a much more reasonable 16% of

its assets in the U.S. government bond sector and has assets that

are far more spread out both in terms of sector and geographic

representation (also read Can You Fight Inflation With This Real

Return ETF?).

As a result, FWDB could be the best bond ETF for investors

seeking broad allocations to the market over the long-term. Don’t

be fooled by the fund’s short-term underperformance; the techniques

involved in the construction of the fund are sound and could offer

up a better way to play the sector for most investors. So if

turmoil strikes American bonds in the near future or if foreign

securities and corporates are able to outperform in 2012, investors

will likely be glad they cycled into this more diversified, but

often overlooked bond ETF for their fixed income exposure.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

Vanguard Total Bond Market (NASDAQ:BND)

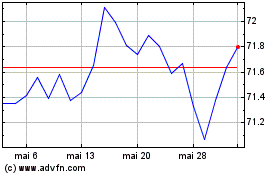

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

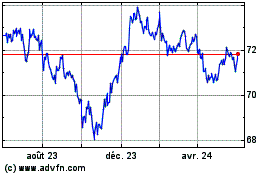

Vanguard Total Bond Market (NASDAQ:BND)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024