Checking In On The PIMCO Total Return ETF (BOND) - ETF News And Commentary

12 Avril 2012 - 1:25PM

Zacks

At the beginning of March, the ETF industry experienced a

landmark event; the launch of the exchange-traded version of the

PIMCO Total Return Fund, now with the ticker BOND.

The new product suggested to many that the ETF industry had arrived

and that major mutual fund managers were finally seeing the promise

and growth of the ETF space.

The fund has also seen an incredible amount of interest from

investors in just its first month on the market. The ETF has

already amassed more than $340 million in assets and sees nearly

200,000 shares a day change hands (also read The Best Bond ETF You

Have Never Heard Of).

All of this comes despite the fund charging more than what

investors see in some of the other classes of the fund as well as

other index based bond ETFs. In fact, with an expense ratio of 55

basis points, is nearly five times as pricey as low cost options

targeting the space such as BND or

SCHZ.

Additionally, there is some concern that BOND will not be able

to match its mutual fund counterparts due to a variety of reasons.

First, there are worries that front-running—since the ETF has to

update holdings on a daily basis-- could be an issue as small

traders can move easier into positions than the behemoth total

return fund. Also, BOND isn’t allowed to use derivative securities

in its portfolio, a technique that is often a hallmark of Bill

Gross’ strategy in the mutual fund versions.

However, despite these very real concerns, the total return ETF

has thrived so far in its first month of trading. BOND has actually

widely outperformed its cheaper PIMCO Total Return II

Institutional Investor Fund

(PMBIX) by about 1.1% in

the past month while the PIMCO Total Return II P Fund

(PTTRX) also

underperformed BOND by a similar margin (also see Time To Get

Regional With Bond ETFs).

This suggests that at least initially, BOND has been able to

live up to the hype and actually provide investors with a better

investing experience than the mutual fund counterparts. While there

is no telling if this trend will continue, it is encouraging none

the less, especially for retail investors who can save a few basis

points by switching to the PIMCO Total Return ETF.

The quality performance could also spur more mutual fund

companies to create similar alternative ETFs for their fund

lineups. After all, if BOND can gain so much in assets and still

perform quite well despite the lack of complex derivatives, many

are likely to believe that they can do the same as well (see more

at the Zacks ETF Center).

Yet although BOND has outperformed so far, investors should note

that there are a decent amount of differences between the ETF and

the mutual fund versions of the product, at least when looking at

the most recent info available. In fact, the ETF has a slightly

lower effective duration of 5.28 years compared to a 5.68 year

reading for the mutual fund.

Beyond this interest rate sensitivity difference, there are also

a few holdings differences as well. According to the most recent

info on the PIMCO site, emerging market bonds make up nearly 10% of

the portfolio in PTTRX while they account for just 2% of the ETF.

Additionally, mortgage securities make up 72% of the ETF compared

to 52% in the fund while Treasury bonds account for 56% of BOND

compared to about 40% for the mutual fund counterpart (see ETFs vs.

Mutual Funds).

This suggests that there are still some key differences between

the mutual funds and ETF versions of the product, although

investors can’t sure how severe the differences are thanks to less

stringent disclosure requirements inherent in mutual funds.

Nevertheless, while BOND and PTTRX will generally be similar, a

bit of performance deviation will be likely, especially given the

dissimilar holdings in the two products. So far this has been in

BOND’s favor, but there is no telling whether this trend will

continue in this increasingly popular total return ETF from bond

giant PIMCO.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

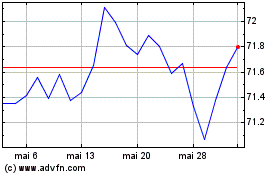

Vanguard Total Bond Market (NASDAQ:BND)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

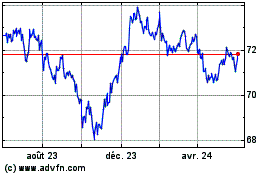

Vanguard Total Bond Market (NASDAQ:BND)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024