ETFs as an investment avenue are often associated with passive

fund management style which enables them to be more cost effective

(in terms of expense ratios) than their mutual fund cousins.

However, with the growth of the ETF industry as a whole, ETF

managers are continuously striving for flexibility and new

investors in order to capture more assets.

This paves the way for actively managed ETFs to take center

stage, especially in a highly dynamic market environment. Having

said this, it is prudent to note that there are a number of

actively managed ETFs available in the market today.

However, this article highlights some of the positives of three

such bond ETFs which investors could consider for stability as well

income, especially in this ultra low interest rate environment.

So far this year investors have been fairly upbeat on the bond

ETFs space. In fact some of the biggest names in this front like

iShares iBoxx $ Investment Grade Corporate Bond

(LQD), iShares iBoxx $ High Yield

Corporate Bond (HYG) and Vanguard

Total Bond Market (BND)

have witnessed significant popularity this year in terms of asset

accumulation.

There clearly has been a reversal in investor risk appetite in

the third quarter as investors shifted focus from the traditional

‘low risk’ fixed income ETFs which was pretty much the way to go

for investors in the second quarter, to ETFs tracking riskier asset

classes. However, by no means does it imply that investor appetite

has subsided in the bond ETF space (see Q3 ETF Asset Report:

Investors Back in the Market?).

Yet this is by no means limited to the passive market, as the

actively managed bond ETF space, many products have seen

significant inflows in their asset base in fiscal 2012. In fact the

WisdomTree Emerging Markets Local Debt ETF

(ELD), Peritus High Yield ETF

(HYLD) and PIMCO Total Return ETF

(BOND) have witnessed

positive inflows of around $200 million, $69 million and $2.67

billion respectively in their asset bases so far this year (source:

Index Universe).

The WisdomTree Emerging Markets Local Debt ETF

(ELD) seeks exposure in

sovereign debt securities of emerging markets denominated in their

local currency. ELD is exposed to a variety of emerging markets,

however, it is fairly upbeat on Mexico (10.63%) and Brazil

(10.50%).

Also, allocating a substantial portion of its assets in

countries with stronger balance sheets such as Malaysia (10.27%)

and Russia (7.00%) giving ELD a relatively low amount of worries on

the currency front (read Buy These Emerging Asia ETFs to Beat

China, India).

However, ELD will be subject to number of emerging market

currencies in total, so the risk is by no means removed.

Additionally, investors should note that the product has an

effective portfolio duration of 4.73 years and an average maturity

of 6.15 years, suggesting that it tracks the intermediate term of

the yield curve and will be subject to moderate levels of interest

rate risk.

The ETF goes beyond tracking an index and strives for steady

income and capital appreciation. A one year look suggests that it

has managed to deliver as it is up by 12.64% on a one year basis as

of September 30th 2012.

Additionally the yield is quite solid as it has a distribution

yield of 4.25%. Lastly, even though it is an actively managed ETF,

it charges just 55 basis points in fees and expenses.

From the actively managed high yield ETF space we have the

Peritus High Yield ETF

(HYLD) which primarily

aims at consistently high levels of cash flow streams in the form

of interest income.

It invests in a variety of non-investment grade corporate debt

securities by primarily employing a bottom up approach of

securities selection. Some of the features of its highly active

portfolio management are to select value creating securities and at

the same time ensure minimum exposure to default risk.

It does this by eliminating risky leveraged buy outs (LBOs)

based bonds which the company sees as not worth the headaches.

Additionally, as a means of managing risk, it develops trigger

points which exhibit a ‘position sell’ for individual securities in

its portfolio when it violates a particular level, thereby managing

losses.

Furthermore, as a hedge against negative market movements it can

invest in U.S. Treasuries as and when the need arises (see Two

Intriguing Financial ETFs with a REIT Focus).

Thanks to the active management employed by HYLD, it charges a

hefty expense ratio of 1.36%. Nevertheless, the high costing seems

justified when the one year return (as of 30th September 2012) of

15.48% is taken into account.

Moreover, thanks to the ultra low rate policy of the Fed, it is

an appropriate choice for income starved investors as it pays out a

solid distribution yield of 8.27%. However, it comes at the expense

of credit quality. The product has amassed an asset base of $137.73

million and an average daily volume of about 31,000 shares.

The PIMCO Total Return ETF

(BOND) is the ETF

version of PIMCO’s flagship blockbuster mutual fund the

PIMCO Total Return Institutional Fund

(PTTRX). However, the

$3.21 billion ETF has been outperforming its gigantic $169.32

billion mutual fund cousin since its inception in March of

2012.

The ETF has returned 9.93% since its inception while the mutual

fund has returned 6.23% for the same time period. While having a

much lower asset base certainly has allowed BOND to do well, one

has to wonder if this outperformance can continue into the

future.

Still, just to highlight the disparity between the two, BOND and

PTTRX have a correlation of just 65% between the two since the

launch of the ETF. Also, their one month rolling correlation has

never increased 87% and has even gone to the extent of hitting a

low of 30%, although there is admittedly a small sample size.

The ETF targets to maintain its weighted average duration in

alignment with that of the Barclays Capital U.S. Aggregate Bond

Index, with a maximum deviation of two years either way. The ETF

measures the performance of investment grade debt securities which

are issued by corporates, government and other institutions (see

more in the Zacks ETF Center).

Interestingly, around 86% of the total assets of the ETF is

allocated to Mr. Gross’ “Ring of fire”

(i.e. countries with highest levels of fiscal deficit as a

percentage of their GDP) countries. These are U.S 76%, France 1%,

Japan 2%, Spain 3% and United Kingdom 4%(source xtf.com) (read Time

to Consider Chinese Yuan ETFs?).

Nevertheless the ETF could be an appropriate core holding for

investors seeking an exposure to total bond markets. It charges

investors 55 basis points in fees and expenses and has been one of

the highest asset accumulating ETFs this year.

On average, the product does about 477,000 shares daily and

targets the intermediate end of the yield curve, thereby

maintaining an effective duration of 5.2 years. The ETF has a 30

Day SEC yield of 2.09% so it isn’t exactly a big yielder although

it arguably is a more stable choice in the segment.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

VANGD-TOT BOND (BND): ETF Research Reports

PIMCO-TOT RETRN (BOND): ETF Research Reports

WISDMTR-EM LDF (ELD): ETF Research Reports

ISHARS-IBX HYCB (HYG): ETF Research Reports

PERITUS-HIGH YL (HYLD): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

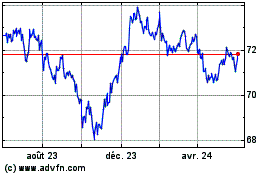

Vanguard Total Bond Market (NASDAQ:BND)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

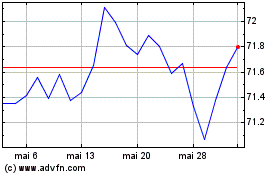

Vanguard Total Bond Market (NASDAQ:BND)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024