A.M. Best Affirms Ratings of Horace Mann Educators Corporation and Its Subsidiaries

25 Avril 2012 - 6:24PM

Business Wire

A.M. Best Co. has affirmed the financial strength rating

(FSR) of A- (Excellent) and issuer credit ratings (ICR) of “a-” of

the property/casualty group, Horace Mann Insurance Group

(Horace Mann P/C), and its members. Additionally, A.M. Best has

affirmed the FSR of A (Excellent) and ICR of “a” of the life/health

insurance company, Horace Mann Life Insurance Company

(Horace Mann Life). Concurrently, A.M. Best has affirmed the ICR of

“bbb” and debt ratings of the parent company, Horace Mann

Educators Corporation (HMEC) (NYSE: HMN). The outlook for all

ratings is stable. All companies are headquartered in Springfield,

IL. (See below for a detailed listing of the companies and

ratings.)

The affirmation of the ratings for Horace Mann P/C acknowledges

its strong overall capitalization, moderate operating earnings and

continued expertise in writing personal lines products in the

educators’ market, which has enabled the group to obtain numerous

endorsements from local, state and national educational

associations. Horace Mann P/C further benefits from its exclusive

agency force, many of whom are former educators, which affords

strong ties to local education communities.

These strengths are partially offset by the susceptibility of

Horace Mann P/C’s property book of business to catastrophe and

non-catastrophe weather losses, which resulted in increased

underwriting deficits in recent years. Additionally, Horace Mann

P/C maintains above average underwriting leverage relative to

industry norms, although underwriting leverage has trended downward

in recent years. Furthermore, Horace Mann P/C has made significant

stockholder dividend payments to HMEC over the previous five-year

period, which somewhat tempered surplus growth. However,

stockholder dividend payments have decreased in recent years, which

have helped to augment the surplus position.

As Horace Mann P/C’s rating outlook is stable, positive rating

actions could occur if there is a sustained favorable trend in

operating results. Negative rating actions could occur if there is

a deterioration in the group’s operating results similar to what

occurred in 2011 and/or a material decline in its risk-adjusted

capitalization, driven by operating losses or stockholder

dividends.

Horace Mann Life’s ratings reflect its important role within

HMEC and the benefits the company derives from HMEC’s strong

business franchise in the K-12 educators’ market. The ratings also

reflect Horace Mann Life’s strong risk-adjusted capital position,

despite increased stockholder dividends in recent periods. In

addition, the company has recorded favorable operating results due

to strong annuity sales and investment yields that have improved

following the reinvestment of much of its cash position, which

accumulated during the recent financial crisis for liquidity

purposes.

Partially offsetting these strengths is Horace Mann Life’s

significant block of annuity business with high interest rate

guarantees, its increasing exposure to interest sensitive

liabilities in recent periods primarily due to strong fixed annuity

sales and the lack of growth in the company’s ordinary life

insurance line of business.

Horace Mann Life is well positioned at its current rating level.

A material deterioration in the operating performance of its

property/casualty affiliate or excessive stockholder dividends

taken by HMEC that would result in a material decline in

risk-adjusted capitalization may result in a ratings downgrade.

The FSR of A- (Excellent) and ICRs of “a-” have been affirmed

for Horace Mann Insurance Group and its following

members:

- Horace Mann Insurance

Company

- Horace Mann Property & Casualty

Insurance Company

- Teachers Insurance Company

- Horace Mann Lloyds

The following debt ratings have been affirmed:

Horace Mann Educators Corporation—

-- “bbb” on $75 million 6.05% senior unsecured notes, due

2015

-- “bbb” on $125 million 6.85% senior unsecured notes, due

2016

The following indicative ratings have been affirmed on

securities available under the $300 million shelf registration:

Horace Mann Educators Corporation—

-- “bbb” on senior unsecured debt

-- “bbb-” on subordinated debt

-- “bb+” on preferred stock

The methodology used in determining these ratings is Best’s

Credit Rating Methodology, which provides a comprehensive

explanation of A.M. Best’s rating process and contains the

different rating criteria employed in the rating process. Key

criteria utilized include: “Rating Members of Insurance Groups”;

“Risk Management and the Rating Process for Insurance Companies”;

“Understanding BCAR for Property/Casualty Insurers”; “Catastrophe

Analysis in A.M. Best Ratings”; “Understanding BCAR for Life/Health

Insurers”; and “Insurance Holding Company and Debt Ratings.” Best’s

Credit Rating Methodology can be found at

www.ambest.com/ratings/methodology.

Founded in 1899, A.M. Best Company is the world’s oldest and

most authoritative insurance rating and information source. For

more information, visit www.ambest.com.

Copyright © 2012 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

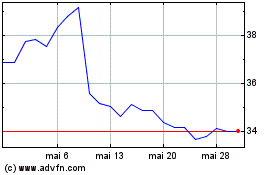

Horace Mann Educators (NYSE:HMN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Horace Mann Educators (NYSE:HMN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024