abrdn Life

Sciences Investors

SCHEDULE OF INVESTMENTS

December

31, 2023

(Unaudited)

| Convertible Preferreds and Warrants (Restricted) (a)(b) – 5.4% | |

Shares | | |

Value | |

| Biotechnology – 3.4% | |

| | | |

| | |

| Abcuro, Inc. Series B | |

| 232,252 | | |

$ | 1,274,994 | |

| Arbor Biotechnologies, Series B, 8.00% | |

| 38,624 | | |

| 640,000 | |

| Arkuda Therapeutics, Inc. Series A, 6.00% | |

| 1,008,829 | | |

| 101 | |

| Arkuda Therapeutics, Inc. Series B, 6.00% | |

| 447,566 | | |

| 490,129 | |

| Flamingo Therapeutics, Inc. Series A3 (c) | |

| 107,120 | | |

| 722,539 | |

| Hotspot Therapeutics, Inc. Series B, 6.00% | |

| 1,291,668 | | |

| 2,833,532 | |

| Hotspot Therapeutics, Inc. Series C, 6.00% | |

| 284,119 | | |

| 623,272 | |

| Incendia Therapeutics, Inc. Series A | |

| 832,650 | | |

| 1,599,995 | |

| Invetx, Inc. Series A, 8.00% | |

| 3,229,167 | | |

| 2,163,865 | |

| Invetx, Inc. Series B, 8.00% | |

| 1,387,853 | | |

| 930,000 | |

| Priothera Ltd. Series A, 6.00% (c) | |

| 152,534 | | |

| 589,365 | |

| Quell Therapeutics, Series B (c) | |

| 731,121 | | |

| 1,520,001 | |

| ReCode Therapeutics, Series B, 5.00% | |

| 150,183 | | |

| 1,386,670 | |

| | |

| | | |

| 14,774,463 | |

| Health Care Equipment & Supplies – 0.1% | |

| | | |

| | |

| IO Light Holdings, Inc. Series A2 | |

| 421,634 | | |

| 453,594 | |

| | |

| | | |

| | |

| Pharmaceuticals – 1.9% | |

| | | |

| | |

| Amolyt Pharma SAS Series C (c) | |

| 686,930 | | |

| 1,622,840 | |

| Biotheryx, Inc. Series E, 8.00% | |

| 609,524 | | |

| 704,000 | |

| Curasen Therapeutics, Inc. Series A | |

| 7,801,332 | | |

| 3,740,739 | |

| Endeavor Biomedicines, Inc. Series B, 8.00% | |

| 296,855 | | |

| 1,399,998 | |

| HiberCell, Inc. Series B | |

| 1,305,163 | | |

| 605,073 | |

| HiberCell, Inc. Series C | |

| 719,652 | | |

| 333,631 | |

| HiberCell, Inc. Series C Warrants (expiration date 09/15/28, exercise price $0.46) | |

| 719,652 | | |

| 0 | |

| | |

| | | |

| 8,406,281 | |

| Total Convertible Preferreds and Warrants (Cost $33,567,461) | |

| | | |

| 23,634,338 | |

| | |

PRINCIPAL

AMOUNT | | |

| |

| Non-Convertible Notes (Restricted) (b) – 0.1% | |

| | | |

| | |

| Pharmaceuticals – 0.1% | |

| | | |

| | |

| Curasen Therapeutics, Inc. | |

$ | 362,738 | | |

| 362,738 | |

| Total Non-Convertible Notes (Cost $362,859) | |

| | | |

| 362,738 | |

| | |

SHARES | | |

| |

| Common Stocks - 84.7% | |

| | | |

| | |

| Biotechnology – 70.8% | |

| | | |

| | |

| 89bio, Inc. (a) | |

| 157,704 | | |

| 1,761,554 | |

| Affimed N.V. (a)(c) | |

| 208,624 | | |

| 130,390 | |

| Akero Therapeutics, Inc. (a) | |

| 31,492 | | |

| 735,338 | |

| Alkermes plc (a) | |

| 149,528 | | |

| 4,147,907 | |

| Alnylam Pharmaceuticals, Inc. (a) | |

| 63,183 | | |

| 12,093,858 | |

| ALX Oncology Holdings, Inc. (a) | |

| 66,211 | | |

| 985,882 | |

| Amgen, Inc. | |

| 142,104 | | |

| 40,928,794 | |

| Apellis Pharmaceuticals, Inc. (a) | |

| 50,992 | | |

| 3,052,381 | |

| ARCA biopharma, Inc. (a) | |

| 32,461 | | |

| 55,184 | |

| Arcutis Biotherapeutics, Inc. (a) | |

| 62,005 | | |

| 200,276 | |

| Ardelyx, Inc. (a) | |

| 378,872 | | |

| 2,349,006 | |

| argenx SE ADR (a) | |

| 17,625 | | |

| 6,705,079 | |

The accompanying notes are an integral part of this Schedule of Investments.

abrdn Life

Sciences Investors

December

31, 2023

(Unaudited, continued)

| | |

SHARES | | |

VALUE | |

| Biotechnology – continued | |

| | | |

| | |

| Ascendis Pharma A/S ADR (a) | |

| 45,830 | | |

$ | 5,772,288 | |

| Avidity Biosciences, Inc. (a) | |

| 129,414 | | |

| 1,171,197 | |

| BeiGene Ltd. ADR (a) | |

| 16,838 | | |

| 3,036,902 | |

| BioCryst Pharmaceuticals, Inc. (a) | |

| 202,491 | | |

| 1,212,921 | |

| Biogen, Inc. (a) | |

| 70,486 | | |

| 18,239,662 | |

| BioMarin Pharmaceutical, Inc. (a) | |

| 112,428 | | |

| 10,840,308 | |

| BioNTech SE ADR (a) | |

| 37,462 | | |

| 3,953,739 | |

| Bridgebio Pharma, Inc. (a) | |

| 77,403 | | |

| 3,124,759 | |

| Caribou Biosciences, Inc. (a) | |

| 181,487 | | |

| 1,039,920 | |

| Chinook Therapeutics, Inc. CVR (Restricted) (a)(b) | |

| 59,063 | | |

| 96,863 | |

| Corbus Pharmaceuticals Holdings, Inc. (a) | |

| 5,143 | | |

| 31,064 | |

| Crinetics Pharmaceuticals, Inc. (a) | |

| 101,196 | | |

| 3,600,554 | |

| Cytokinetics, Inc. (a) | |

| 44,412 | | |

| 3,707,958 | |

| Denali Therapeutics, Inc. (a) | |

| 110,331 | | |

| 2,367,703 | |

| Exelixis, Inc. (a) | |

| 186,118 | | |

| 4,464,971 | |

| Fusion Pharmaceuticals, Inc. (Restricted) (a)(b)(c) | |

| 3,256 | | |

| 28,161 | |

| G1 Therapeutics, Inc. (a) | |

| 223,377 | | |

| 681,300 | |

| Galera Therapeutics, Inc. (a) | |

| 125,773 | | |

| 18,287 | |

| Gilead Sciences, Inc. | |

| 397,778 | | |

| 32,223,996 | |

| Harpoon Therapeutics, Inc. (a) | |

| 25,991 | | |

| 295,518 | |

| HilleVax, Inc. (a) | |

| 27,000 | | |

| 433,350 | |

| I-Mab ADR (a) | |

| 26,109 | | |

| 49,607 | |

| Immunovant, Inc. (a) | |

| 108,558 | | |

| 4,573,549 | |

| Insmed, Inc. (a) | |

| 30,179 | | |

| 935,247 | |

| Intellia Therapeutics, Inc. (a) | |

| 50,605 | | |

| 1,542,946 | |

| Ionis Pharmaceuticals, Inc. (a) | |

| 48,806 | | |

| 2,469,096 | |

| Karuna Therapeutics, Inc. (a) | |

| 12,032 | | |

| 3,808,248 | |

| Mereo Biopharma Group plc ADR (a)(c) | |

| 487,283 | | |

| 1,125,624 | |

| Moderna, Inc. (a) | |

| 107,787 | | |

| 10,719,417 | |

| Mural Oncology plc (a)(c) | |

| 14,952 | | |

| 88,516 | |

| Natera, Inc. (a) | |

| 51,308 | | |

| 3,213,933 | |

| Neurocrine Biosciences, Inc. (a) | |

| 38,692 | | |

| 5,098,058 | |

| Nkarta, Inc. (a) | |

| 28,988 | | |

| 191,321 | |

| Novavax, Inc. (a) | |

| 26,612 | | |

| 127,738 | |

| Praxis Precision Medicines, Inc. (a) | |

| 1,572 | | |

| 35,024 | |

| Pyxis Oncology, Inc. (a) | |

| 226,657 | | |

| 407,983 | |

| Rallybio Corp. (a) | |

| 377,375 | | |

| 901,926 | |

| Regeneron Pharmaceuticals, Inc. (a) | |

| 44,519 | | |

| 39,100,592 | |

| Roivant Sciences Ltd. (a) | |

| 379,710 | | |

| 4,264,143 | |

| Sage Therapeutics, Inc. (a) | |

| 22,773 | | |

| 493,491 | |

| Sarepta Therapeutics, Inc. (a) | |

| 50,018 | | |

| 4,823,236 | |

| Scholar Rock Holding Corp. (a) | |

| 100,880 | | |

| 1,896,544 | |

| TScan Therapeutics, Inc. (a) | |

| 61,943 | | |

| 361,128 | |

| Ultragenyx Pharmaceutical, Inc. (a) | |

| 42,475 | | |

| 2,031,154 | |

| uniQure N.V. (a)(c) | |

| 156,394 | | |

| 1,058,787 | |

| United Therapeutics Corp. (a) | |

| 9,880 | | |

| 2,172,513 | |

| Vaxcyte, Inc. (a) | |

| 61,919 | | |

| 3,888,513 | |

| Vertex Pharmaceuticals, Inc. (a) | |

| 100,095 | | |

| 40,727,655 | |

The accompanying notes are an integral part of this Schedule of Investments.

abrdn Life

Sciences Investors

December

31, 2023

(Unaudited, continued)

| | |

SHARES | | |

VALUE | |

| Biotechnology – continued | |

| | | |

| | |

| Xencor, Inc. (a) | |

| 97,385 | | |

$ | 2,067,484 | |

| Xenon Pharmaceuticals, Inc. (a)(c) | |

| 32,036 | | |

| 1,475,578 | |

| Zentalis Pharmaceuticals, Inc. (a) | |

| 40,156 | | |

| 608,363 | |

| | |

| | | |

| 309,744,484 | |

| Health Care Equipment & Supplies (a) – 0.3% | |

| | | |

| | |

| Cercacor Laboratories, Inc. (Restricted) (b) | |

| 130,000 | | |

| 139,894 | |

| Guardant Health, Inc | |

| 44,542 | | |

| 1,204,861 | |

| | |

| | | |

| 1,344,755 | |

| Health Care Providers & Services – 1.1% | |

| | | |

| | |

| Charles River Laboratories International, Inc. (a) | |

| 14,134 | | |

| 3,341,278 | |

| InnovaCare, Inc. Escrow Shares (Restricted) (b) | |

| 148,148 | | |

| 19,200 | |

| Medpace Holdings, Inc. (a) | |

| 5,284 | | |

| 1,619,704 | |

| | |

| | | |

| 4,980,182 | |

| Life Sciences Tools & Services – 2.7% | |

| | | |

| | |

| Adaptive Biotechnologies Corp. (a) | |

| 286,007 | | |

| 1,401,434 | |

| Avantor, Inc. (a) | |

| 37,094 | | |

| 846,856 | |

| Codexis, Inc. (a) | |

| 160,581 | | |

| 489,772 | |

| Illumina, Inc. (a) | |

| 60,493 | | |

| 8,423,045 | |

| Thermo Fisher Scientific, Inc. | |

| 984 | | |

| 522,298 | |

| | |

| | | |

| 11,683,405 | |

| Medical Devices and Diagnostics – 0.2% | |

| | | |

| | |

| Danaher Corp. | |

| 3,115 | | |

| 720,624 | |

| | |

| | | |

| | |

| Pharmaceuticals – 9.6% | |

| | | |

| | |

| Amylyx Pharmaceuticals, Inc. (a) | |

| 58,996 | | |

| 868,421 | |

| AstraZeneca plc ADR (c) | |

| 270,376 | | |

| 18,209,824 | |

| Edgewise Therapeutics, Inc. (a) | |

| 150,418 | | |

| 1,645,573 | |

| Eli Lilly & Co. | |

| 7,661 | | |

| 4,465,750 | |

| Endo International plc (a) | |

| 29,100 | | |

| 15 | |

| Fulcrum Therapeutics, Inc. (a) | |

| 256,888 | | |

| 1,733,994 | |

| Intra-Cellular Therapies, Inc. (a) | |

| 39,475 | | |

| 2,827,199 | |

| IQVIA Holdings, Inc. (a) | |

| 1,647 | | |

| 381,083 | |

| Jazz Pharmaceuticals plc (a) | |

| 13,116 | | |

| 1,613,268 | |

| Marinus Pharmaceuticals, Inc. (a) | |

| 167,418 | | |

| 1,819,834 | |

| Oculis Holding AG (a)(c) | |

| 236,704 | | |

| 2,603,744 | |

| Royalty Pharma plc Class A | |

| 155,069 | | |

| 4,355,888 | |

| Spectrum Pharmaceuticals, Inc. CVR (a)(b) | |

| 34,880 | | |

| 0 | |

| Tarsus Pharmaceuticals, Inc. (a) | |

| 72,032 | | |

| 1,458,648 | |

| Tetraphase Pharmaceuticals, Inc. CVR (a)(b) | |

| 14,218 | | |

| 853 | |

| | |

| | | |

| 41,984,094 | |

| Total Common Stocks (Cost $320,137,184) | |

| | | |

| 370,457,544 | |

| | |

| | | |

| | |

| Exchange Traded Funds – 2.1% | |

| | | |

| | |

| SPDR S&P Biotech ETF | |

| 104,675 | | |

| 9,346,431 | |

| Total Exchange Traded Funds (Cost $7,887,491) | |

| | | |

| 9,346,431 | |

The accompanying notes are an integral part of this Schedule of Investments.

abrdn Life

Sciences Investors

December

31, 2023

(Unaudited, continued)

| | |

SHARES | | |

VALUE | |

| Short-Term Investments - 5.8% | |

| | | |

| | |

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 5.32% (d) | |

| 25,392,839 | | |

$ | 25,392,839 | |

| Total Short-Term Investments (Cost $25,392,839) | |

| | | |

| 25,392,839 | |

Total

Investments Before Milestone Interests - 98.1%

(Cost $387,347,800) | |

| | | |

| 429,193,890 | |

| | |

INTERESTS | |

| |

| | |

| |

| |

| Milestone Interests (Restricted) (a)(b) - 2.7% | |

|

| | |

|

| Biotechnology – 0.0% | |

| |

| | |

| Amphivena Milestone Interest | |

1 | |

| 0 | |

| Rainier Therapeutics Milestone Interest | |

1 | |

| 0 | |

| | |

| |

| | |

| Pharmaceuticals – 2.7% | |

| |

| | |

| Afferent Milestone Interest | |

1 | |

| 121,980 | |

| Ethismos Research Milestone Interest | |

1 | |

| 0 | |

| Impact Biomedicines Milestone Interest | |

1 | |

| 1,080,565 | |

| Neurovance Milestone Interest | |

1 | |

| 10,788,961 | |

| | |

| |

| 11,991,506 | |

| Total Milestone Interests (Cost $1,793,833) | |

| |

| 11,991,506 | |

| Total Investments - 100.8% (Cost $389,141,633) | |

| |

| 441,185,396 | |

| Other Liabilities In Excess Of Assets - (0.8)% | |

| |

| (3,595,474 | ) |

| Net Assets - 100% | |

| |

$ | 437,589,922 | |

The percentage shown for each investment category in the Schedule of

Investments is based on net assets.

| (a) |

Non-income producing security. |

| (b) |

Security fair valued using significant unobservable inputs. See Investment Valuation and Fair Value Measurements. |

| (c) |

Foreign security. |

| (d) |

Registered investment company advised by State Street Global Advisors. The rate shown is the annualized seven-day yield as of December 31, 2023. |

ADR American Depository Receipt

CVR Contingent Value Right

The accompanying notes are an integral part of this Schedule of Investments.

abrdn Life

Sciences Investors

December

31, 2023

(Unaudited)

1. Summary of Significant Accounting Policies

a. Security Valuation:

The

Fund values its securities at current market value or fair value, consistent with regulatory requirements. "Fair value" is defined

in the Fund's Valuation and Liquidity Procedures as the price that could be received to sell an asset or paid to transfer a liability

in an orderly transaction between willing market participants without a compulsion to transact at the measurement date. Pursuant to Rule

2a-5 under the Investment Company Act of 1940, as amended (the "1940 Act"), the Board of Trustees (the “Board”)

designated abrdn Inc. (the “Investment Adviser” or the “Adviser”) as the valuation designee ("Valuation Designee")

for the Fund to perform the fair value determinations relating to Fund investments for which market quotations are not readily available.

With respect to the Fund's investments in securities of early and /or later stage financing of a privately held companies ("Venture

Capital Securities"), the Private Venture Valuation Committee ("PV Valuation Committee"), which is a Committee of the Board,

performs fair value determinations for the Fund.

Long-term debt and other fixed-income

securities are valued at the last quoted or evaluated bid price on the valuation date provided by an independent pricing service provider.

If there are no current day bids, the security is valued at the previously applied bid. Pricing services generally price debt securities

assuming orderly transactions of an institutional “round lot” size and the strategies employed by the Valuation Designee generally

trade in round lot sizes. In certain circumstances, some trades may occur in smaller “odd lot” sizes which may be effected

at lower, or higher, prices than institutional round lot trades. Short-term debt securities (such as commercial paper and U.S. treasury

bills) having a remaining maturity of 60 days or less are valued at the last quoted or evaluated bid price on the valuation date provided

by an independent pricing service, or on the basis of amortized cost, if it represents the best approximation of fair value. Debt and

other fixed-income securities are generally determined to be Level 2 investments.

Equity securities that are traded

on an exchange are valued at the last quoted sale price or the official close price on the principal exchange on which the security is

traded at the “Valuation Time” subject to application, when appropriate, of the valuation factors described in the paragraph

below. Under normal circumstances, the Valuation Time is as of the close of regular trading on the New York Stock Exchange ("NYSE")

(usually 4:00 p.m. Eastern Time). In the absence of a sale price, the security is valued at the mean of the bid/ask price quoted at the

close on the principal exchange on which the security is traded. Securities traded on NASDAQ are valued at the NASDAQ official closing

price.

Convertible

preferred shares, warrants or convertible note interests in Venture Capital Securities, milestone

interests, and other restricted securities are typically valued in good faith, based upon the recommendations made by the PV Valuation

Committee or the Valuation Designee pursuant to fair valuation policies and procedures approved by the Board.

Derivatives are valued at fair

value. Exchange traded derivatives are generally Level 1 investments and over-the-counter and centrally cleared derivatives are generally

Level 2 investments. Forward foreign currency contracts are generally valued based on the bid price of the forward rates and the current

spot rate. Forward exchange rate quotations are available for scheduled settlement dates, such as 1-, 3-, 6-, 9- and 12-month periods.

An interpolated valuation is derived based on the actual settlement dates of the forward contracts held. Exchange-traded options are valued

at the last quoted sales price. In the absence of a sales price, options are valued at the mean of the bid/ask price quoted at the close

on the exchange on which the options trade. When market quotations or exchange rates are not readily available, or if the Adviser concludes

that such market quotations do not accurately reflect fair value, the fair value of a Fund’s assets are determined in good faith

in accordance with the Valuation Procedures.

Foreign equity securities that

are traded on foreign exchanges that close prior to the Valuation Time are valued by applying valuation factors to the last sale price

or the mean price as noted above. Valuation factors are provided by an independent pricing service provider. These valuation factors are

used when pricing the Fund's portfolio holdings to estimate market movements between the time foreign markets close and the time the Fund

values such foreign securities. These valuation factors are based on inputs such as depositary receipts, indices, futures, sector indices/ETFs,

exchange rates, and local exchange opening and closing prices of each security. When prices with the application of valuation factors

are utilized, the value assigned to the foreign securities may not be the same as quoted or published prices of the securities on their

primary markets. A security that applies a valuation factor is determined to be a Level 2 investment because the exchange-traded price

has been adjusted. Valuation factors are not utilized if the independent pricing service provider is unable to provide a valuation factor

or if the valuation factor falls below a predetermined threshold; in such case, the security is determined to be a Level 1 investment.

abrdn Life

Sciences Investors

December

31, 2023

(Unaudited, continued)

In

the event that a security’s, other than a Venture Capital Security, market quotations are not

readily available or are deemed unreliable (for reasons other than because the foreign exchange on which it trades closes before the Valuation

Time), the security is valued at fair value as determined by the Valuation Designee, taking into account the relevant factors and surrounding

circumstances using valuation policies and procedures approved by the Board. A security that has been fair valued by the Valuation Designee

may be classified as Level 2 or Level 3 depending on the nature of the inputs.

Venture Capital Securities are valued based

on a consideration of relevant factors, including both observable and unobservable inputs. Observable and unobservable inputs

considered may include (i) the existence of any contractual restrictions on the disposition of securities; (ii) information obtained

from the company, which may include an analysis of the company's financial statements, products, intended markets or technologies;

(iii) the price of the same or similar security negotiated at arm's length in an issuer's completed subsequent round of financing;

(iv) the price and extent of public trading in similar securities of the issuer or of comparable companies; or (v) a probability and

time value adjusted analysis of contractual terms. Where available and appropriate, multiple valuation methodologies are applied to

confirm fair value. Significant unobservable inputs are often used in the fair value determination. A significant change in any of

these inputs may result in a significant change in the fair value measurement. Additionally, changes in the market environment and

other events that may occur over the life of the investments may cause the gains or losses ultimately realized on these investments

to be different from the valuations used at the date of these financial statements.

In accordance with the authoritative

guidance on fair value measurements and disclosures under GAAP, the Fund discloses the fair value of its investments using a three-level

hierarchy that classifies the inputs to valuation techniques used to measure the fair value. The hierarchy assigns Level 1, the highest

level, measurements to valuations based upon unadjusted quoted prices in active markets for identical assets, Level 2 measurements to

valuations based upon other significant observable inputs, including adjusted quoted prices in active markets for similar assets, and

Level 3, the lowest level, measurements to valuations based upon unobservable inputs that are significant to the valuation. Inputs refer

broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for

example, the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent

in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions

market participants would use in pricing the asset or liability, which are based on market data obtained from sources independent of the

reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market

participants would use in pricing the asset or liability developed based on the best information available in the circumstances. A financial

instrument’s level within the fair value hierarchy is based upon the lowest level of any input that is significant to the fair value

measurement Open-end mutual funds are valued at the respective net asset value (“NAV”) as reported by such company. The prospectuses

for the registered open-end management investment companies in which the Fund invests explain the circumstances under which those companies

will use fair value pricing and the effects of using fair value pricing. Closed-end funds and exchange-traded funds (“ETFs”)

are valued at the market price of the security at the Valuation Time (as defined below). A security using any of these pricing methodologies

is determined to be a Level 1 investment.

The three-level hierarchy of inputs

is summarized below:

Level 1 - quoted prices in active

markets for identical investments;

Level 2 - other significant observable

inputs (including quoted prices for similar securities, interest rates, prepayment speeds, and credit risk); or

Level

3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). Investments

that are included in this category are Venture Capital Securities investments.

Level 3 investments are valued

using significant unobservable inputs. The Fund may also use a discounted cash flow based valuation approach in which the anticipated

future cash flows of the investment are used to estimate the current fair value. The derived value of a Level 3 investment may not represent

the value which is received upon disposition and this could impact the results of operations.

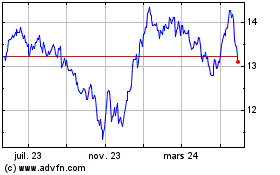

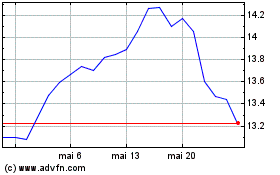

abrdn Life Sciences Inve... (NYSE:HQL)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

abrdn Life Sciences Inve... (NYSE:HQL)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024