0001587523false00015875232024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 7, 2024

Knowles Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-36102 | 90-1002689 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1151 Maplewood Drive, Itasca, IL

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (630) 250-5100

(Former Name or Former Address, if Changed since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | | KN | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 Results of Operations and Financial Condition. |

| |

On February 7, 2024, Knowles Corporation issued a press release announcing its results of operations for the year and quarter ended December 31, 2023 and posted on its website at http://investor.knowles.com presentation slides which summarize certain of its results of operations for the year and quarter ended December 31, 2023. Knowles Corporation's quarterly financial conference call and webcast will be held on February 7, 2024. A copy of the press release is being furnished as Exhibit 99.1 hereto and a copy of the presentation slides is being furnished as Exhibit 99.2 hereto. |

|

| The information furnished under this Item 2.02 and the related exhibits included in Item 9.01 of this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing. |

| | | | | | | | |

| Item 9.01 Financial Statements and Exhibits. |

| | |

| (d) Exhibits. | | |

| | |

| The following exhibits are furnished as part of this report: |

| Exhibit Number | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | KNOWLES CORPORATION |

| | |

| Date: | February 7, 2024 | By: /s/ Robert J. Perna |

| | Robert J. Perna |

| | Senior Vice President, General Counsel & Secretary |

Exhibit 99.1

| | |

Financial Contact: Sarah Cook Knowles Investor Relations Email: investorrelations@knowles.com |

Knowles Reports Q4 & Full Year 2023 Financial Results and Provides Outlook for Q1 2024

Q4 Cash from Operations above the High End of Guidance Range

Full Year operating cash flow and free cash flow margins of 17% and 15% of Revenues, respectively

Completed the acquisition of Cornell Dubilier in Q4

Full Year 2023 Share Repurchases of $48 million

ITASCA, Ill., February 7, 2024 — Knowles Corporation (NYSE: KN), ("Knowles" the "Company"), a leading global supplier of high performance components and solutions, including capacitors and radio frequency ("RF") filters, advanced medtech microphones and balanced armature speakers, and MEMS microphones for the consumer electronic market, today announced results for the fourth quarter and year ended December 31, 2023.

“Revenue of $215 million was in line with our expectations and up 9% versus the fourth quarter of 2022 with all three segments increasing on a year over year basis. I am pleased to report Knowles delivered Net Cash from Operating Activities of $60 million, which was well above the high end of the guidance,” commented Jeffrey Niew, president and CEO of Knowles. “We closed the year with solid execution across our businesses even though we experienced challenges in our industrial and distribution end markets. We are also excited to have successfully completed the acquisition of Cornell Dubilier and while it has only been two months since we closed, we are confident in the synergy opportunities resulting from the acquisition. Reflecting on 2023, it was another year where we made significant progress in transitioning our company’s portfolio to higher value markets and products."

Mr. Niew continued, “As we look to the first quarter of 2024, we expect to see strong year over year organic growth despite excess channel inventory in some of our end markets. The Cornell Dubilier acquisition is anticipated to further add to growth and profitability. In total, revenue is expected to be up 35% and Non-GAAP Diluted EPS is expected to grow significantly from first quarter 2023 levels."

Financial Highlights

The following table highlights the Company’s financial performance on both a GAAP and supplemental non-GAAP basis (in millions, except per share data):

| | | | | | | | | | | | |

| Q4-23 | Q3-23 | Q4-22 | |

| Revenues | $215.2 | $175.1 | $197.1 | |

| Gross profit | $78.4 | $77.5 | $75.3 | |

| (as a % of revenues) | 36.4% | 44.3% | 38.2% | |

| Non-GAAP gross profit | $80.2 | $78.1 | $79.6 | |

| (as a % of revenues) | 37.3% | 44.6% | 40.4% | |

| Diluted earnings (loss) per share* | $0.52 | $0.18 | $(2.28) | |

| Non-GAAP diluted earnings per share | $0.28 | $0.31 | $0.33 | |

| Net cash provided by operating activities | $60.4 | $39.9 | $46.8 | |

* Current period results include $0.42 per share of one-time tax benefits, partially offset by $0.07 per share in stock-based compensation expense, $0.06 per share in acquisition-related costs, $0.04 per share in intangibles amortization expense, and $0.01 per share in restructuring charges that are excluded from non-GAAP results.

First Quarter 2024 Outlook

The forward looking guidance for the quarter ending March 31, 2024 is as follows:

| | | | | | | | | | | |

| GAAP | Adjustments | Non-GAAP |

| Revenues | $190 to $200 million | — | $190 to $200 million |

| | | |

| Diluted earnings per share | $0.02 to $0.06 | $0.14 | $0.16 to $0.20 |

| Net cash provided by operating activities | $0 to $10 million | — | $0 to $10 million |

Q1 2024 GAAP results are expected to include approximately $0.06 per share in stock-based compensation and $0.05 per share in amortization of intangibles, and $0.03 per share in integration and production transfer costs related to the acquisition of Cornell Dubilier that are excluded from non-GAAP results.

Non-GAAP Financial Measures

In addition to the GAAP results included in this press release, Knowles has presented supplemental non-GAAP financial measures including non-GAAP gross profit, earnings before interest and income taxes, adjusted earnings before interest and income taxes, non-GAAP diluted earnings per share, free cash flow, free cash flow margin, operating cash flow as a percent of revenue, net debt, as well as other metrics on a non-GAAP basis that exclude certain amounts that are included in the most directly comparable GAAP measure to facilitate evaluation of Knowles’ operating performance. Non-GAAP results are not presented in accordance with GAAP. Non-GAAP information should be considered a supplement to, and not a substitute for, financial statements prepared in accordance with GAAP. In addition, the non-GAAP financial measures included in this press release do not have standard meanings and may vary from similarly titled non-GAAP financial measures used by other companies. Knowles believes that non-GAAP measures are useful as supplements to its GAAP results of operations to evaluate certain aspects of its operations and financial performance, and its management team primarily focuses on non-GAAP items in evaluating Knowles’ performance for business planning purposes. Knowles also believes that these measures assist it with comparing its performance between various reporting periods on a consistent basis, as these measures remove from operating results the impact of items that, in Knowles’ opinion, do not reflect its core operating performance including, for example, stock-based compensation, certain intangibles amortization expense, impairment charges, restructuring, production transfer costs, and other charges which management considers to be outside our core operating results. Knowles believes that its presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that Knowles uses internally for purposes of assessing its core operating performance. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see the reconciliation table accompanying this release.

Webcast and Conference Call Information

Investors can listen to a live or replay webcast of the Company’s quarterly financial conference call at http://investor.knowles.com. The live webcast will begin today at 3:30 p.m. Central time. The webcast replay will be available after 7:00 p.m. Central time today.

Investors can also listen to the conference call at 3:30 p.m. Central time today by calling (888) 596-4144 (United States) or (646) 968-2525 (International). The conference call replay will be available after 7:00 p.m. Central time today through 11:59 p.m. Central time on February 14, 2024 at (800) 770-2030 (United States) or (609) 800-9909 (International). The conference ID is 3966457 followed by # key.

About Knowles

Knowles is market leader and global provider of high performance capacitors and radio frequency ("RF") filtering products, and advanced micro-acoustic microphones and balanced armature speakers, audio solutions, serving the medtech, defense, consumer electronics, electric vehicle, industrial, and communications markets. Knowles' focus on the customer, combined with unique technology, proprietary manufacturing techniques, and global operational expertise, enables us to deliver innovative solutions across multiple applications. Knowles, founded in 1946 and headquartered in Itasca, Illinois, has approximately 7,700 employees at facilities located in 15 countries around the world. For more information, visit knowles.com.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995, such as statements about our future plans, objectives, expectations, financial performance, and continued business operations. The words “believe,” “expect,” “anticipate,” “project,” “estimate,” “budget,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “objective,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” and similar expressions, among others, generally identify forward-looking statements, which speak only as of the date the statements were made. The statements in this news release, including those statements related to our expectations regarding the integration of Cornell Dubilier, are based on currently available information and the current expectations, forecasts, and assumptions of Knowles’ management concerning risks and uncertainties that could cause actual outcomes or results to differ materially from those outcomes or results that are projected, anticipated, or implied in these statements. Other risks and uncertainties include, but are not limited to: if we are unsuccessful in identifying or completing a strategic alternative for our Consumer MEMS Microphone segment, unforeseen changes in MEMS microphone demand from our largest customers, particularly our top five customers, who represent a significant portion of revenues for our Consumer MEMS Microphone segment; our ongoing ability to execute our strategy to diversify our end markets and customers; our ability to stem or overcome price erosion in our segments; fluctuations in our stock's market price; fluctuations in operating results and cash flows; our ability to prevent or identify quality issues in our products or to promptly remedy any such issues that are identified; the timing of OEM product launches; risks associated with increasing our inventories in advance of anticipated orders by customers; global economic instability, including due to inflation, rising interest rates, negative impacts caused by pandemics and public health crises, or the impacts of geopolitical uncertainties; the impact of changes to laws and regulations that affect the Company’s ability to offer products or services to customers in different regions; our ability to achieve reductions in our operating expenses; the ability to qualify our products and facilities with customers; our ability to obtain, enforce, defend or monetize our intellectual property rights; disruption caused by a cybersecurity incident, including a cyber attack, cyber breach, theft, or other unauthorized access; difficulties or delays in and/or the Company’s inability to realize expected synergies from its acquisitions; increases in the costs of critical raw materials and components; availability of raw materials and components; managing new product ramps and introductions for our customers; our dependence on a limited number of large customers; our ability to maintain and expand our existing relationships with leading OEMs in order to maintain and increase our revenue; increasing competition and new entrants in the market for our products; our ability to develop new or enhanced products or technologies in a timely manner that achieve market acceptance; our reliance on third parties to manufacture, assemble, and test our products and sub-components; escalating international trade tensions, new or increased tariffs and trade wars among countries; financial risks, including risks relating to currency fluctuations, credit risks and fluctuations in the market value of the Company; a sustained decline in our stock price and market capitalization may result in the impairment of certain intangible or long-lived assets; market risk associated with fluctuations in commodity prices, particularly for various precious metals used in our manufacturing operation, changes in tax laws, changes in tax rates and exposure to additional tax liabilities; and other risks, relevant factors, and uncertainties identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, subsequent Reports on Forms 10-Q and 8-K and our other filings we make with the U.S. Securities and Exchange Commission. Knowles disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

INVESTOR SUPPLEMENT - FOURTH QUARTER 2023

KNOWLES CORPORATION

CONSOLIDATED STATEMENTS OF EARNINGS

(in millions, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| Revenues | | $ | 215.2 | | | $ | 175.1 | | | $ | 197.1 | |

| Cost of goods sold | | 136.6 | | | 102.7 | | | 117.2 | |

| | | | | | |

| (Gain) loss on sale of fixed assets | | — | | | (5.2) | | | 0.5 | |

| Restructuring charges - cost of goods sold | | 0.2 | | | 0.1 | | | 4.1 | |

| Gross profit | | 78.4 | | | 77.5 | | | 75.3 | |

| Research and development expenses | | 19.0 | | | 19.8 | | | 18.0 | |

| Selling and administrative expenses | | 45.4 | | | 34.6 | | | 33.3 | |

| Impairment charges | | — | | | — | | | 231.1 | |

| Restructuring charges | | 0.4 | | | 1.5 | | | (0.2) | |

| Operating expenses | | 64.8 | | | 55.9 | | | 282.2 | |

| Operating earnings (loss) | | 13.6 | | | 21.6 | | | (206.9) | |

| Interest expense, net | | 3.2 | | | 0.6 | | | 1.2 | |

| Other expense (income), net | | 0.2 | | | (0.5) | | | 0.4 | |

| Earnings (loss) before income taxes | | 10.2 | | | 21.5 | | | (208.5) | |

| (Benefit from) provision for income taxes | | (37.2) | | | 4.9 | | | (0.5) | |

| | | | | | |

| | | | | | |

| Net earnings (loss) | | $ | 47.4 | | | $ | 16.6 | | | $ | (208.0) | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Net earnings (loss) per share: | | | | | | |

| Basic | | $ | 0.53 | | | $ | 0.18 | | | $ | (2.28) | |

| Diluted | | $ | 0.52 | | | $ | 0.18 | | | $ | (2.28) | |

| | | | | | |

| Weighted-average common shares outstanding: | | | | | | |

| Basic | | 90.0 | | | 90.8 | | | 91.0 | |

| Diluted | | 90.7 | | | 91.4 | | | 91.0 | |

KNOWLES CORPORATION

CONSOLIDATED STATEMENTS OF EARNINGS

(in millions, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | |

| | Year Ended |

| December 31, 2023 | | | December 31, 2022 |

| Revenues | | $ | 707.6 | | | | $ | 764.7 | |

| Cost of goods sold | | 435.5 | | | | 455.7 | |

| | | | | |

| (Gain) loss on sale of fixed assets | | (10.0) | | | | 0.5 | |

| Restructuring charges - cost of goods sold | | (1.3) | | | | 32.2 | |

| Gross profit | | 283.4 | | | | 276.3 | |

| Research and development expenses | | 78.5 | | | | 81.7 | |

| Selling and administrative expenses | | 150.3 | | | | 128.9 | |

| Impairment charges | | — | | | | 470.9 | |

| Restructuring charges | | 3.5 | | | | 9.6 | |

| Operating expenses | | 232.3 | | | | 691.1 | |

| Operating earnings (loss) | | 51.1 | | | | (414.8) | |

| Interest expense, net | | 5.4 | | | | 3.9 | |

| Other expense (income), net | | 0.7 | | | | (0.5) | |

| Earnings (loss) before income taxes | | 45.0 | | | | (418.2) | |

| (Benefit from) provision for income taxes | | (27.4) | | | | 11.9 | |

| | | | | |

| | | | | |

| Net earnings (loss) | | $ | 72.4 | | | | $ | (430.1) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net earnings (loss) per share: | | | | | |

| Basic | | $ | 0.80 | | | | $ | (4.69) | |

| Diluted | | $ | 0.79 | | | | $ | (4.69) | |

| | | | | |

| Weighted-average common shares outstanding: | | | | | |

| Basic | | 90.9 | | | | 91.7 | |

| Diluted | | 91.6 | | | | 91.7 | |

KNOWLES CORPORATION

RECONCILIATION OF GAAP FINANCIAL MEASURES TO NON-GAAP FINANCIAL MEASURES (1)

(in millions, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Year Ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| | | | | | | | | |

| Gross profit | $ | 78.4 | | | $ | 77.5 | | | $ | 75.3 | | | $ | 283.4 | | | $ | 276.3 | |

| Gross profit as % of revenues | 36.4 | % | | 44.3 | % | | 38.2 | % | | 40.1 | % | | 36.1 | % |

| Stock-based compensation expense | 0.4 | | | 0.5 | | | 0.2 | | | 2.1 | | | 1.6 | |

| | | | | | | | | |

| Restructuring charges | 0.2 | | | 0.1 | | | 4.1 | | | (1.3) | | | 32.2 | |

Production transfer costs (2) | 0.4 | | | — | | | — | | | 0.4 | | | — | |

Acquisition-related costs (3) | 0.8 | | | — | | | — | | | 0.8 | | | — | |

| | | | | | | | | |

| Non-GAAP gross profit | $ | 80.2 | | | $ | 78.1 | | | $ | 79.6 | | | $ | 285.4 | | | $ | 310.1 | |

| Non-GAAP gross profit as % of revenues | 37.3 | % | | 44.6 | % | | 40.4 | % | | 40.3 | % | | 40.6 | % |

| Research and development expenses | $ | 19.0 | | | $ | 19.8 | | | $ | 18.0 | | | $ | 78.5 | | | $ | 81.7 | |

| Stock-based compensation expense | (1.3) | | | (1.1) | | | (1.4) | | | (5.9) | | | (5.6) | |

| Intangibles amortization expense | (2.1) | | | (1.6) | | | (1.6) | | | (6.9) | | | (6.4) | |

Other (4) | (0.1) | | | (0.1) | | | (0.2) | | | (0.3) | | | (0.4) | |

| Non-GAAP research and development expenses | $ | 15.5 | | | $ | 17.0 | | | $ | 14.8 | | | $ | 65.4 | | | $ | 69.3 | |

| Selling and administrative expenses | $ | 45.4 | | | $ | 34.6 | | | $ | 33.3 | | | $ | 150.3 | | | $ | 128.9 | |

| Stock-based compensation expense | (5.5) | | | (5.3) | | | (5.4) | | | (21.0) | | | (21.4) | |

| Intangibles amortization expense | (2.6) | | | (1.4) | | | (1.4) | | | (6.6) | | | (5.8) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Acquisition-related costs (3) | (5.6) | | | (3.0) | | | — | | | (8.6) | | | — | |

Other (4) | (0.4) | | | (0.1) | | | 0.7 | | | (0.6) | | | 0.6 | |

| Non-GAAP selling and administrative expenses | $ | 31.3 | | | $ | 24.8 | | | $ | 27.2 | | | $ | 113.5 | | | $ | 102.3 | |

| Operating expenses | $ | 64.8 | | | $ | 55.9 | | | $ | 282.2 | | | $ | 232.3 | | | $ | 691.1 | |

| Stock-based compensation expense | (6.8) | | | (6.4) | | | (6.8) | | | (26.9) | | | (27.0) | |

| Intangibles amortization expense | (4.7) | | | (3.0) | | | (3.0) | | | (13.5) | | | (12.2) | |

| Impairment charges | — | | | — | | | (231.1) | | | — | | | (470.9) | |

| Restructuring charges | (0.4) | | | (1.5) | | | 0.2 | | | (3.5) | | | (9.6) | |

| | | | | | | | | |

| | | | | | | | | |

Acquisition-related costs (3) | (5.6) | | | (3.0) | | | — | | | (8.6) | | | — | |

Other (4) | (0.5) | | | (0.2) | | | 0.5 | | | (0.9) | | | 0.2 | |

| Non-GAAP operating expenses | $ | 46.8 | | | $ | 41.8 | | | $ | 42.0 | | | $ | 178.9 | | | $ | 171.6 | |

| | | | | | | | | |

| Net earnings (loss) | $ | 47.4 | | | $ | 16.6 | | | $ | (208.0) | | | $ | 72.4 | | | $ | (430.1) | |

| Interest expense, net | 3.2 | | | 0.6 | | | 1.2 | | | 5.4 | | | 3.9 | |

| (Benefit from) provision for income taxes | (37.2) | | | 4.9 | | | (0.5) | | | (27.4) | | | 11.9 | |

| Earnings (loss) before interest and income taxes | 13.4 | | | 22.1 | | | (207.3) | | | 50.4 | | | (414.3) | |

Earnings (loss) before interest and income taxes as % of revenues | 6.2 | % | | 12.6 | % | | (105.2) | % | | 7.1 | % | | (54.2) | % |

| Stock-based compensation expense | 7.2 | | | 6.9 | | | 7.0 | | | 29.0 | | | 28.6 | |

| Intangibles amortization expense | 4.7 | | | 3.0 | | | 3.0 | | | 13.5 | | | 12.2 | |

| Impairment charges | — | | | — | | | 231.1 | | | — | | | 470.9 | |

| Restructuring charges | 0.6 | | | 1.6 | | | 3.9 | | | 2.2 | | | 41.8 | |

Production transfer costs (2) | 0.4 | | | — | | | — | | | 0.4 | | | — | |

Acquisition-related costs (3) | 6.4 | | | 3.0 | | | — | | | 9.4 | | | — | |

Other (4) | 0.5 | | | 0.2 | | | (0.5) | | | 0.9 | | | 3.2 | |

| Adjusted earnings before interest and income taxes | $ | 33.2 | | | $ | 36.8 | | | $ | 37.2 | | | $ | 105.8 | | | $ | 142.4 | |

Adjusted earnings before interest and income taxes as % of revenues | 15.4 | % | | 21.0 | % | | 18.9 | % | | 15.0 | % | | 18.6 | % |

| Net earnings (loss) | 47.4 | | | 16.6 | | | (208.0) | | | 72.4 | | | (430.1) | |

| Interest expense, net | 3.2 | | | 0.6 | | | 1.2 | | | 5.4 | | | 3.9 | |

| (Benefit from) provision for income taxes | (37.2) | | | 4.9 | | | (0.5) | | | (27.4) | | | 11.9 | |

| Earnings (loss) before interest and income taxes | 13.4 | | | 22.1 | | | (207.3) | | | 50.4 | | | (414.3) | |

Non-GAAP reconciling adjustments (6) | 19.8 | | | 14.7 | | | 244.5 | | | 55.4 | | | 556.7 | |

| Depreciation expense | 8.0 | | | 7.6 | | | 9.2 | | | 33.0 | | | 41.7 | |

| Adjusted earnings before interest, income taxes, depreciation, and amortization ("EBITDA") | 41.2 | | | 44.4 | | | 46.4 | | | 138.8 | | | 184.1 | |

Adjusted EBITDA as a % of revenues | 19.1 | % | | 25.4 | % | | 23.5 | % | | 19.6 | % | | 24.1 | % |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Quarter Ended | | Year Ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| (Benefit from) provision for income taxes | $ | (37.2) | | | $ | 4.9 | | | $ | (0.5) | | | $ | (27.4) | | | $ | 11.9 | |

Income tax effects of non-GAAP reconciling adjustments (5) | 41.3 | | | 2.0 | | | 5.8 | | | 45.6 | | | 7.3 | |

| | | | | | | | | |

| Non-GAAP provision for income taxes | $ | 4.1 | | | $ | 6.9 | | | $ | 5.3 | | | $ | 18.2 | | | $ | 19.2 | |

| | | | | | | | | |

| Net earnings (loss) | $ | 47.4 | | | $ | 16.6 | | | $ | (208.0) | | | $ | 72.4 | | | $ | (430.1) | |

Non-GAAP reconciling adjustments (6) | 19.8 | | | 14.7 | | | 244.5 | | | 55.4 | | | 556.7 | |

| | | | | | | | | |

Income tax effects of non-GAAP reconciling adjustments (5) | 41.3 | | | 2.0 | | | 5.8 | | | 45.6 | | | 7.3 | |

| | | | | | | | | |

| Non-GAAP net earnings | $ | 25.9 | | | $ | 29.3 | | | $ | 30.7 | | | $ | 82.2 | | | $ | 119.3 | |

| | | | | | | | | |

| | | | | | | | | |

| Diluted earnings (loss) per share | $ | 0.52 | | | $ | 0.18 | | | $ | (2.28) | | | $ | 0.79 | | | $ | (4.69) | |

(Loss) earnings per share non-GAAP reconciling adjustment | (0.24) | | | 0.13 | | | 2.61 | | | 0.09 | | | 5.95 | |

| Non-GAAP diluted earnings per share | $ | 0.28 | | | $ | 0.31 | | | $ | 0.33 | | | $ | 0.88 | | | $ | 1.26 | |

| | | | | | | | | |

| | | | | | | | | |

| Diluted average shares outstanding | 90.7 | | | 91.4 | | | 91.0 | | | 91.6 | | | 91.7 | |

Non-GAAP adjustment (7) | 2.2 | | | 2.6 | | | 2.5 | | | 2.3 | | | 2.9 | |

Non-GAAP diluted average shares outstanding (7) | 92.9 | | | 94.0 | | | 93.5 | | | 93.9 | | | 94.6 | |

Notes:

(1) In addition to the GAAP financial measures included herein, Knowles has presented certain non-GAAP financial measures that exclude certain amounts that are included in the most directly comparable GAAP measures. Knowles believes that non-GAAP measures are useful as supplements to its GAAP results of operations to evaluate certain aspects of its operations and financial performance, and its management team primarily focuses on non-GAAP items in evaluating Knowles' performance for business planning purposes. Knowles also believes that these measures assist it with comparing its performance between various reporting periods on a consistent basis, as these measures remove from operating results the impact of items that, in Knowles' opinion, do not reflect its core operating performance. Knowles believes that its presentation of non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that Knowles uses internally for purposes of assessing its core operating performance.

(2) Production transfer costs represent duplicate costs incurred to migrate manufacturing to facilities primarily in the United States. These amounts are included in the corresponding Gross profit and Earnings (loss) before interest and income taxes for each period presented.

(3) These expenses are related to the acquisition of Cornell Dubilier by the Precision Devices segment. These expenses principally include costs incurred by the Company to carry out this transaction as well as ongoing costs to facilitate integration.

(4) In 2023, Other expenses include non-recurring professional service fees related to an execution of a reorganization. In addition, Other expenses include the ongoing net lease cost (income) related to facilities not used in operations. In 2022, Other expenses represent an adjustment to pre-spin-off pension obligations of $3.4 million, which was recorded during the second quarter of 2022 in the Other expense (income), net line on the Consolidated Statements of Earnings, and the ongoing net lease cost related to facilities not used in operations.

(5) Income tax effects of non-GAAP reconciling adjustments are calculated using the applicable tax rates in the jurisdictions of the underlying adjustments. In 2023, these adjustments include one-time tax benefits.

(6) The non-GAAP reconciling adjustments are those adjustments made to reconcile Earnings (loss) before interest and income taxes to Adjusted earnings before interest and income taxes.

(7) The number of shares used in the diluted per share calculations on a non-GAAP basis excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method.

KNOWLES CORPORATION

CONSOLIDATED BALANCE SHEETS

(in millions, except share and per share amounts)

(unaudited)

| | | | | | | | | | | |

| | December 31, 2023 | | December 31, 2022 |

| Current assets: | | | |

| Cash and cash equivalents | $ | 87.3 | | | $ | 48.2 | |

| | | |

Receivables, net of allowances of $0.2 and $1.1 | 135.3 | | | 134.7 | |

| Inventories, net | 196.4 | | | 169.5 | |

| Prepaid and other current assets | 9.8 | | | 10.0 | |

| | | |

| Total current assets | 428.8 | | | 362.4 | |

| Property, plant, and equipment, net | 175.4 | | | 161.8 | |

| Goodwill | 540.7 | | | 471.0 | |

| Intangible assets, net | 189.4 | | | 85.1 | |

| Operating lease right-of-use assets | 13.1 | | | 12.6 | |

| Other assets and deferred charges | 115.4 | | | 91.0 | |

| | | |

| Total assets | $ | 1,462.8 | | | $ | 1,183.9 | |

| | | |

| Current liabilities: | | | |

| Current maturities of long-term debt | $ | 47.1 | | | $ | — | |

| Accounts payable | 51.3 | | | 41.4 | |

| Accrued compensation and employee benefits | 33.0 | | | 26.9 | |

| Operating lease liabilities | 5.1 | | | 8.4 | |

| Other accrued expenses | 25.0 | | | 19.9 | |

| Federal and other taxes on income | 3.1 | | | 2.5 | |

| Total current liabilities | 164.6 | | | 99.1 | |

| Long-term debt | 224.1 | | | 45.0 | |

| Deferred income taxes | 0.7 | | | 0.9 | |

| Long-term operating lease liabilities | 8.2 | | | 7.2 | |

| Other liabilities | 31.1 | | | 38.8 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| | | |

| | | |

| Stockholders' equity: | | | |

Preferred stock - $0.01 par value; 10,000,000 shares authorized; none issued | — | | | — | |

Common stock - $0.01 par value; 400,000,000 shares authorized; 97,297,703 and 89,092,871 shares issued and outstanding at December 31, 2023, respectively, and 96,431,604 and 91,078,376 shares issued and outstanding at December 31, 2022, respectively | 1.0 | | | 1.0 | |

Treasury stock - at cost; 8,204,832 and 5,353,228 shares at December 31, 2023 and 2022, respectively | (151.2) | | | (103.3) | |

| Additional paid-in capital | 1,689.9 | | | 1,665.5 | |

| Accumulated deficit | (375.8) | | | (448.2) | |

| Accumulated other comprehensive loss | (129.8) | | | (122.1) | |

| | | |

| Total stockholders' equity | 1,034.1 | | | 992.9 | |

| | | |

| Total liabilities and stockholders' equity | $ | 1,462.8 | | | $ | 1,183.9 | |

KNOWLES CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited) | | | | | | | | | | | | | |

| | Years Ended December 31, |

| | 2023 | | 2022 | | |

| Operating Activities | | | | | |

| Net earnings (loss) | $ | 72.4 | | | $ | (430.1) | | | |

| Adjustments to reconcile net earnings (loss) to cash from operating activities: | | | | | |

| | | | | |

| Depreciation and amortization | 46.5 | | | 53.9 | | | |

| Stock-based compensation | 29.0 | | | 28.6 | | | |

| Impairment charges | — | | | 470.9 | | | |

| | | | | |

| Non-cash restructuring charges | (1.8) | | | 13.5 | | | |

| Non-cash interest expense and amortization of debt issuance costs | 2.0 | | | 0.7 | | | |

| Deferred income taxes | (40.3) | | | 1.6 | | | |

| | | | | |

| (Gain) loss on sale or disposal of fixed assets | (10.0) | | | 0.5 | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Other, net | (0.9) | | | (5.9) | | | |

| Changes in assets and liabilities (excluding effects of foreign exchange): | | | | | |

| Receivables, net | 12.7 | | | 11.1 | | | |

| Inventories, net | 11.5 | | | (22.8) | | | |

| Prepaid and other current assets | (0.4) | | | 2.0 | | | |

| Accounts payable | 6.2 | | | (41.2) | | | |

| Accrued compensation and employee benefits | 4.0 | | | (15.0) | | | |

| Other accrued expenses | (2.0) | | | (0.3) | | | |

| Accrued taxes | (0.4) | | | 1.3 | | | |

| Other non-current assets and non-current liabilities | (5.8) | | | 17.5 | | | |

| Net cash provided by operating activities | 122.7 | | | 86.3 | | | |

| | | | | |

| Investing Activities | | | | | |

| Acquisitions of businesses | (136.9) | | | (0.7) | | | |

| Acquisition of asset | (0.3) | | | — | | | |

| Capital expenditures | (16.9) | | | (32.1) | | | |

| Proceeds from the sale of property, plant, and equipment | 12.5 | | | 0.1 | | | |

| Purchase of investments | (0.4) | | | (0.4) | | | |

| | | | | |

| Proceeds from the sale of investments | 0.4 | | | 0.4 | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net cash used in investing activities | (141.6) | | | (32.7) | | | |

| | | | | |

| Financing Activities | | | | | |

| | | | | |

| Borrowings under revolving credit facility | 150.0 | | | 23.0 | | | |

| Payments under revolving credit facility | (35.0) | | | (48.0) | | | |

| Repurchase of common stock | (47.5) | | | (44.0) | | | |

| Tax on stock option exercises and restricted and performance stock unit vesting | (6.2) | | | (6.9) | | | |

| Payments of finance lease obligations | (2.5) | | | (4.8) | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Payments of debt issuance costs | (2.2) | | | — | | | |

| Proceeds from exercise of stock-based awards | 1.6 | | | 7.5 | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net cash provided by (used in) financing activities | 58.2 | | | (73.2) | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Effect of exchange rate changes on cash and cash equivalents | (0.2) | | | (1.1) | | | |

| | | | | |

| Net increase (decrease) in cash and cash equivalents | 39.1 | | | (20.7) | | | |

| Cash and cash equivalents at beginning of period | 48.2 | | | 68.9 | | | |

| | | | | |

| | | | | |

| Cash and cash equivalents at end of period | $ | 87.3 | | | $ | 48.2 | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

KNOWLES CORPORATION

RECONCILIATION OF GAAP LIQUIDITY MEASURES TO NON-GAAP LIQUIDITY MEASURES

(in millions)

(unaudited)

| | | | | |

Net cash provided by operating activities to Free cash flow (1) | |

| | Year Ended December 31, 2023 |

| |

| Net cash provided by operating activities | $ | 122.7 | |

| Net cash provided by operating activities as % of revenues | 17.3 | % |

| Less: Capital expenditures | (16.9) | |

| Free cash flow | $ | 105.8 | |

| Free cash flow as % of revenues | 15.0 | % |

| |

Debt to Net debt (2) | |

| December 31, 2023 |

| Current maturities of long-term debt | $ | 47.1 | |

| Long-term debt | 224.1 | |

| Total debt | 271.2 | |

| Less: Cash and cash equivalents | (87.3) | |

| Net debt | $ | 183.9 | |

(1) In addition to measuring cash flow generation and usage based upon the operating, investing, and financing classifications included in the Consolidated Statements of Cash Flows, Knowles also measures free cash flow and free cash flow as a percentage of revenues. Free cash flow is defined as cash provided by operating activities less capital expenditures. Knowles believes these measures are useful in measuring its cash generated from operations that is available to repay debt, fund acquisitions, and repurchase Knowles’ common stock. Free cash flow and free cash flow as a percentage of revenues are not presented in accordance with GAAP and may not be comparable to similarly titled measures used by other companies in our industry. As such, free cash flow and free cash flow as a percentage of revenues should not be considered in isolation from, or as an alternative to, any other liquidity measures determined in accordance with GAAP.

(2) In addition to evaluating its financial position based upon the financial measures included in the Consolidated Balance Sheets, Knowles also uses net debt. Net debt is defined as total debt, which includes current maturities of long-term debt and long-term debt, less cash and cash equivalents. Knowles believes this measure is useful in evaluating its financial position. Net debt is not presented in accordance with GAAP and may not be comparable to similarly titled measures used by other companies in our industry. As such, net debt should not be considered in isolation from, or as an alternative to, any other liquidity measures determined in accordance with GAAP.

4th Quarter and Full Year 2023 Earnings Release Supplemental Information February 7, 2024

2 Safe Harbor Forward Looking Statements This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995, such as statements about our future plans, objectives, expectations, financial performance, and continued business operations. The words “believe,” “expect,” “anticipate,” “project,” “estimate,” “budget,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “objective,” ”path,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” and similar expressions, among others, generally identify forward- looking statements, which speak only as of the date the statements were made. The statements in this presentation, including those statements related to our expectations regarding the integration Cornell Dubilier, are based on currently available information and the current expectations, forecasts, and assumptions of Knowles’ management concerning risks and uncertainties that could cause actual outcomes or results to differ materially from those outcomes or results that are projected, anticipated, or implied in these statements. Other risks and uncertainties include, but are not limited to: if we are unsuccessful in identifying or completing a strategic alternative for our Consumer MEMS Microphone segment, unforeseen changes in MEMS microphone demand from our largest customers, particularly our top five customers, who represent a significant portion of revenues for our Consumer MEMS Microphone segment; our ongoing ability to execute our strategy to diversify our end markets and customers; our ability to stem or overcome price erosion in our segments; fluctuations in our stock's market price; fluctuations in operating results and cash flows; our ability to prevent or identify quality issues in our products or to promptly remedy any such issues that are identified; the timing of OEM product launches; risks associated with increasing our inventories in advance of anticipated orders by customers; global economic instability, including due to inflation, rising interest rates, negative impacts caused by pandemics and public health crises, or the impacts of geopolitical uncertainties; the impact of changes to laws and regulations that affect the Company’s ability to offer products or services to customers in different regions; our ability to achieve reductions in our operating expenses; the ability to qualify our products and facilities with customers; our ability to obtain, enforce, defend or monetize our intellectual property rights; disruption caused by a cybersecurity incident, including a cyber attack, cyber breach, theft, or other unauthorized access; difficulties or delays in and/or the Company’s inability to realize expected synergies from its acquisitions; increases in the costs of critical raw materials and components; availability of raw materials and components; managing new product ramps and introductions for our customers; our dependence on a limited number of large customers; our ability to maintain and expand our existing relationships with leading OEMs in order to maintain and increase our revenue; increasing competition and new entrants in the market for our products; our ability to develop new or enhanced products or technologies in a timely manner that achieve market acceptance; our reliance on third parties to manufacture, assemble, and test our products and sub-components; escalating international trade tensions, new or increased tariffs and trade wars among countries; financial risks, including risks relating to currency fluctuations, credit risks and fluctuations in the market value of the Company; a sustained decline in our stock price and market capitalization may result in the impairment of certain intangible or long-lived assets; market risk associated with fluctuations in commodity prices, particularly for various precious metals used in our manufacturing operation, and changes in tax laws, changes in tax rates and exposure to additional tax liabilities; and other risks, relevant factors, and uncertainties identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, subsequent Reports on Forms 10-Q and 8-K and our other filings we make with the U.S. Securities and Exchange Commission. These forward- looking statements speak only as of the date of this presentation, and Knowles disclaims any intention or obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Disclaimer The financial results disclosed in this presentation include certain measures calculated and presented in accordance with GAAP. In addition to the GAAP results included in this presentation, Knowles has presented supplemental, non-GAAP gross profit, adjusted earnings before interest and income taxes, adjusted earnings before interest and income taxes margin, adjusted earnings before interest, taxes, depreciation, and amortization; adjusted earnings before interest, taxes, depreciation, and amortization margin; non-GAAP gross profit margin, non-GAAP diluted earnings per share, non-GAAP operating expense; free cash flow; and free cash flow margin to facilitate evaluation of Knowles’ operating performance. These non-GAAP financial measures exclude certain amounts that are included in the most directly comparable GAAP measure. In addition, these non-GAAP financial measures do not have standard meanings and may vary from similarly titled non-GAAP financial measures used by other companies. Knowles uses non-GAAP measures as supplements to its GAAP results of operations in evaluating certain aspects of its business, and its executive management team focuses on non-GAAP items as key measures of Knowles’ performance for business planning purposes. These measures assist Knowles in comparing its performance between various reporting periods on a consistent basis, as these measures remove from operating results the impact of items that, in Knowles’ opinion, do not reflect its core operating performance. Knowles believes that its presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that Knowles uses internally for purposes of assessing its core operating performance. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see the reconciliation tables in the Appendix.

• Revenue of $215 million up 9% versus the prior year driven by the Cornell Dubilier acquisition • Non-GAAP Diluted EPS of $0.28, down $0.05 versus the prior year driven by lower factory capacity utilization in Precision Devices • Cash from operations of $60 million up $14 million versus the prior year driven by lower Net Working Capital * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation 3 Delivering on expectations despite challenging macroeconomic conditions 197.1 215.2 4Q 22 4Q 23 REVENUE ($M) 46.8 60.4 4Q 22 4Q 23 NET CASH PROVIDED BY OPERATING ACTIVITIES ($) 29.1% Non-GAAP DILUTED EPS* ($) 0.33 0.28 4Q 22 4Q 23 -15.2%9.2% Q4 2023 Year-over-Year

• Successfully completed the acquisition of Cornell Dubilier which significantly expands our total available market for capacitors in key markets and drives opportunities for future growth. • 10% revenue growth year over year driven by Cornell Dubilier acquisition • Gross Profit Margin down from the prior year due to lower factory capacity utilization 4 Q4 2023 Segment Performance Precision Devices * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation REVENUE ($M) Non-GAAP GROSS PROFIT MARGIN* (%) 63.3 69.7 4Q 22 4Q 23 10.1% 48.5 35.4 4Q 22 4Q 23 -1310 bps

• Revenue up 9% due to increased demand in the hearing health market. • Gross Profit Margin expansion driven by favorable factory productivity improvements, product mix and FX benefits Q4 2023 Segment Performance MedTech & Specialty Audio * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation 5 61.8 67.4 4Q 22 4Q 23 REVENUE ($M) 9.1% Non-GAAP GROSS PROFIT MARGIN* (%) 51.6 54.2 4Q 22 4Q 23 +260 bps

• Revenue is up 8% versus the prior year driven by higher shipments into mobile and compute • Delivered three quarters consecutive of sequential revenue growth in 2023 Q4 2023 Segment Performance Consumer MEMS Microphones * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation 6 72.0 78.1 4Q 22 4Q 23 REVENUE ($M) 8.4% Non-GAAP GROSS PROFIT MARGIN* (%) 24.0 24.7 4Q 22 4Q 23 70 bps

Full Year 2023 Cash Generation Proven ability to deliver strong free cash flow * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation 7 82.7 96.2 133.5 54.2 105.8 20 19 20 20 20 21 20 22 20 23 FREE CASH FLOW* ($M) FREE CASH FLOW MARGIN* (%) 9.7 12.6 15.4 7.1 15.0 20 19 20 20 20 21 20 22 20 23 7 Gross Margin Expansion • Focused on markets that value our technology and manufacturing differentiation Expense Control • Committed to continuous improvement in processes to drive efficiencies CapEx Discipline • Optimized investments across areas with attractive returns focusing more heavily on Precision Devices and MedTech and Specialty Audio

July 28, 2021 Outlook Q1 2024 Guidance 8 GAAP ADJUSTMENTS NON-GAAP Revenue $190 to $200 million — $190 to $200 million Diluted earnings per share $0.02 to $0.06 $0.14 $0.16 to $0.20 Net cash provided by operating activities $0 to $10 million — $0 to $10 million Q1 2024 GAAP results are expected to include approximately $0.06 per share in stock-based compensation and $0.05 per share in amortization of intangibles, and $0.03 per share in integration and production transfer costs related to the acquisition of Cornell Dubilier that are excluded from Non-GAAP results.

9 Appendix

July 28, 2021 Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures (1) 10 Quarter Ended December 31, (in millions, except per share amounts) 2023 2022 Revenues $ 215.2 $ 197.1 Gross profit $ 78.4 $ 75.3 Gross profit margin 36.4 % 38.2 % Stock-based compensation expense 0.4 0.2 Restructuring charges 0.2 4.1 Production transfer costs (1) 0.4 — Acquisition-related costs (2) 0.8 — Non-GAAP gross profit $ 80.2 $ 79.6 Non-GAAP gross profit as a % of revenues 37.3 % 40.4 % Operating expenses $ 64.8 $ 282.2 Stock-based compensation expense (6.8) (6.8) Intangibles amortization expense (4.7) (3.0) Impairment charges — (231.1) Restructuring charges (0.4) 0.2 Acquisition-related costs (2) (5.6) — Other (3) (0.5) 0.5 Non-GAAP operating expenses $ 46.8 $ 42.0 Non-GAAP operating expenses as a % of revenues 21.7 % 21.3 % Net earnings (loss) $ 47.4 $ (208.0) Interest expense, net 3.2 1.2 Benefit from income taxes (37.2) (0.5) Earnings (loss) before interest and income taxes 13.4 (207.3) Earnings (loss) before interest and income taxes as a % of revenues 6.2 % (105.2) % Stock-based compensation expense 7.2 7.0 Intangibles amortization expense 4.7 3.0 Impairment charges — 231.1 Restructuring charges 0.6 3.9 Production transfer costs (1) 0.4 — Acquisition-related costs (2) 6.4 — Other (3) 0.5 (0.5) Adjusted earnings before interest and income taxes $ 33.2 $ 37.2 Adjusted earnings before interest and income taxes as a % of revenues 15.4 % 18.9 % Notes: (1) Production transfer costs represent duplicate costs incurred to migrate manufacturing to facilities primarily in the United States. These amounts are included in the corresponding Gross profit and Earnings (loss) before interest and income taxes for each period presented. (2) These expenses are related to the acquisition of Cornell Dubilier by the Precision Devices segment. These expenses principally include costs incurred by the Company to carry out this transaction as well as ongoing costs to facilitate integration. (3) In 2023, Other expenses include non-recurring professional service fees related to an execution of a reorganization. In addition, Other expenses include the ongoing net lease cost (income) related to facilities not used in operations. In 2022, Other expenses represent the ongoing net lease cost related to facilities not used in operations.

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures 11 Quarter Ended December 31, (in millions, except per share amounts) 2023 2022 Net earnings (loss) $ 47.4 $ (208.0) Interest expense, net 3.2 1.2 Benefit from income taxes (37.2) (0.5) Earnings (loss) before interest and income taxes 13.4 (207.3) Non-GAAP reconciling adjustments (4) 19.8 244.5 Depreciation expense 8.0 9.2 Adjusted earnings before interest, income taxes, depreciation, and amortization ("EBITDA") $ 41.2 $ 46.4 Adjusted EBITDA as a % of revenues 19.1 % 23.5 % Net earnings (loss) $ 47.4 $ (208.0) Non-GAAP reconciling adjustments (4) 19.8 244.5 Income tax effects of non-GAAP reconciling adjustments (5) 41.3 5.8 Non-GAAP net earnings $ 25.9 $ 30.7 Diluted earnings (loss) per share $ 0.52 $ (2.28) (Loss) earnings per share non-GAAP reconciling adjustment (0.24) 2.61 Non-GAAP diluted earnings per share $ 0.28 $ 0.33 Diluted average shares outstanding 90.7 91.0 Non-GAAP adjustment (6) 2.2 2.5 Non-GAAP diluted average shares outstanding (6) 92.9 93.5 Notes: (4) The non-GAAP reconciling adjustments are those adjustments made to reconcile Earnings (loss) before interest and income taxes to Adjusted earnings before interest and income taxes. (5) Income tax effects of non-GAAP reconciling adjustments are calculated using the applicable tax rates in the jurisdictions of the underlying adjustments. In 2023, these adjustments include one-time tax benefits. (6) The number of shares used in the diluted per share calculations on a non-GAAP basis excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method.

Historical Segment Data 12 Precision Devices MedTech & Specialty Audio Consumer MEMS Microphones Quarter Ended Quarter Ended Quarter Ended December 31, September 30, June 30, March 31, December 31, December 31, September 30, June 30, March 31, December 31, December 31, September 30, June 30, March 31, December 31, (in millions) 2023 2023 2023 2023 2022 2023 2023 2023 2023 2022 2023 2023 2023 2023 2022 Revenues $ 69.7 $ 50.2 $ 47.8 $ 53.7 $ 63.3 $ 67.4 $ 56.5 $ 60.6 $ 45.5 $ 61.8 $ 78.1 $ 68.4 $ 64.6 $ 45.1 $ 72.0 Gross profit $ 22.5 $ 20.0 $ 18.6 $ 25.1 $ 30.7 $ 36.4 $ 30.9 $ 32.3 $ 19.7 $ 31.8 $ 19.9 $ 27.2 $ 23.3 $ 9.6 $ 13.1 Gross profit margin 32.3 % 39.8 % 38.9 % 46.7 % 48.5 % 54.0 % 54.7 % 53.3 % 43.3 % 51.5 % 25.5 % 39.8 % 36.1 % 21.3 % 18.2 % Stock-based compensation expense 0.1 0.1 0.4 0.1 — 0.1 0.1 0.1 0.1 0.1 0.1 0.2 0.1 0.1 0.1 Restructuring charges 0.9 0.2 — — — — — — — — (0.7) (0.1) (1.7) 0.1 4.1 Production transfer costs 0.4 — — — — — — — — — — — — — — Acquisition-related costs 0.8 — — — — — — — — — — — — — — Non-GAAP gross profit $ 24.7 $ 20.3 $ 19.0 $ 25.2 $ 30.7 $ 36.5 $ 31.0 $ 32.4 $ 19.8 $ 31.9 $ 19.3 $ 27.3 $ 21.7 $ 9.8 $ 17.3 Non-GAAP gross profit margin 35.4 % 40.4 % 39.7 % 46.9 % 48.5 % 54.2 % 54.9 % 53.5 % 43.5 % 51.6 % 24.7 % 39.9 % 33.6 % 21.7 % 24.0 % Research and development expenses $ 4.0 $ 3.1 $ 3.3 $ 3.4 $ 3.1 $ 4.3 $ 4.8 $ 4.7 $ 4.4 $ 4.2 $ 10.6 $ 11.7 $ 11.7 $ 12.1 $ 10.7 Research and development expenses margin 5.7 % 6.2 % 6.9 % 6.3 % 4.9 % 6.4 % 8.5 % 7.8 % 9.7 % 6.8 % 13.6 % 17.1 % 18.1 % 26.8 % 14.9 % Stock-based compensation expense (0.1) (0.2) (0.1) (0.2) (0.1) (0.3) (0.3) (0.3) (0.4) (0.4) (0.9) (0.6) (1.4) (1.1) (0.9) Intangibles amortization expense (0.6) (0.1) (0.1) (0.1) (0.1) — — — — — (1.5) (1.5) (1.5) (1.5) (1.5) Other — — — — — — — — — — (0.1) (0.1) (0.1) — (0.2) Non-GAAP research and development expenses $ 3.3 $ 2.8 $ 3.1 $ 3.1 $ 2.9 $ 4.0 $ 4.5 $ 4.4 $ 4.0 $ 3.8 $ 8.1 $ 9.5 $ 8.7 $ 9.5 $ 8.1 Non-GAAP research and development expenses margin 4.7 % 5.6 % 6.5 % 5.8 % 4.6 % 5.9 % 8.0 % 7.3 % 8.8 % 6.1 % 10.4 % 13.9 % 13.5 % 21.1 % 11.3 % Selling and administrative expenses $ 14.8 $ 9.6 $ 10.4 $ 10.9 $ 11.2 $ 4.1 $ 3.9 $ 4.0 $ 3.9 $ 3.2 $ 4.9 $ 4.4 $ 4.7 $ 5.0 $ 4.9 Selling and administrative expenses margin 21.2 % 19.1 % 21.8 % 20.3 % 17.7 % 6.1 % 6.9 % 6.6 % 8.6 % 5.2 % 6.3 % 6.4 % 7.3 % 11.1 % 6.8 % Stock-based compensation expense (0.5) (0.5) (0.6) (0.6) (0.5) (0.5) (0.5) (0.4) (0.4) (0.3) (0.4) (0.4) (0.4) (0.5) (0.4) Intangibles amortization expense (2.6) (1.4) (1.3) (1.3) (1.3) — — — — — — — — — (0.1) Acquisition-related costs (0.8) — — — — — — — — — — — — — — Other — — — — — — — — — — 0.1 0.7 0.3 0.4 0.7 Non-GAAP selling and administrative expenses $ 10.9 $ 7.7 $ 8.5 $ 9.0 $ 9.4 $ 3.6 $ 3.4 $ 3.6 $ 3.5 $ 2.9 $ 4.6 $ 4.7 $ 4.6 $ 4.9 $ 5.1 Non-GAAP selling and administrative expenses margin 15.6 % 15.3 % 17.8 % 16.8 % 14.8 % 5.3 % 6.0 % 5.9 % 7.7 % 4.7 % 5.9 % 6.9 % 7.1 % 10.9 % 7.1 % Operating expenses $ 19.1 $ 13.8 $ 13.7 $ 14.3 $ 14.3 $ 8.4 $ 8.7 $ 8.7 $ 8.3 $ 7.4 $ 15.5 $ 16.1 $ 17.0 $ 17.8 $ 246.5 Operating expenses margin 27.4 % 27.5 % 28.7 % 26.6 % 22.6 % 12.5 % 15.4 % 14.4 % 18.2 % 12.0 % 19.8 % 23.5 % 26.3 % 39.5 % 342.4 % Stock-based compensation expense (0.6) (0.7) (0.7) (0.8) (0.6) (0.8) (0.8) (0.7) (0.8) (0.7) (1.3) (1.0) (1.8) (1.6) (1.3) Intangibles amortization expense (3.2) (1.5) (1.4) (1.4) (1.4) — — — — — (1.5) (1.5) (1.5) (1.5) (1.6) Impairment charges — — — — — — — — — — — — — — (231.1) Restructuring charges (0.3) (1.1) — — — — — — — — — — (0.6) (0.7) 0.2 Acquisition-related costs (0.8) — — — — — — — — — — — — — — Other — — — — — — — — — — — 0.6 0.2 0.4 0.5 Non-GAAP operating expenses $ 14.2 $ 10.5 $ 11.6 $ 12.1 $ 12.3 $ 7.6 $ 7.9 $ 8.0 $ 7.5 $ 6.7 $ 12.7 $ 14.2 $ 13.3 $ 14.4 $ 13.2 Non-GAAP operating expenses margin 20.4 % 20.9 % 24.3 % 22.5 % 19.4 % 11.3 % 14.0 % 13.2 % 16.5 % 10.8 % 16.3 % 20.8 % 20.6 % 31.9 % 18.3 %

Historical Segment Data 13 Precision Devices MedTech & Specialty Audio Consumer MEMS Microphones Quarter Ended Quarter Ended Quarter Ended December 31, September 30, June 30, March 31, December 31, December 31, September 30, June 30, March 31, December 31, December 31, September 30, June 30, March 31, December 31, (in millions) 2023 2023 2023 2023 2022 2023 2023 2023 2023 2022 2023 2023 2023 2023 2022 Revenues $ 69.7 $ 50.2 $ 47.8 $ 53.7 $ 63.3 $ 67.4 $ 56.5 $ 60.6 $ 45.5 $ 61.8 $ 78.1 $ 68.4 $ 64.6 $ 45.1 $ 72.0 Operating earnings (loss) $ 3.4 $ 6.2 $ 4.9 $ 10.8 $ 16.4 $ 28.0 $ 22.2 $ 23.6 $ 11.4 $ 24.4 $ 4.4 $ 11.1 $ 6.3 $ (8.2) $ (233.4) Other expense (income), net — 0.1 0.1 0.1 (0.2) — — — — — — — — — — Earnings (loss) before interest and income taxes 3.4 6.1 4.8 10.7 16.6 28.0 22.2 23.6 11.4 24.4 4.4 11.1 6.3 (8.2) (233.4) Earnings (loss) before interest and income taxes margin 4.9 % 12.2 % 10.0 % 19.9 % 26.2 % 41.5 % 39.3 % 38.9 % 25.1 % 39.5 % 5.6 % 16.2 % 9.8 % -18.2 % -324.2 % Stock-based compensation expense 0.7 0.8 1.1 0.9 0.6 0.9 0.9 0.8 0.9 0.8 1.4 1.2 1.9 1.7 1.4 Intangibles amortization expense 3.2 1.5 1.4 1.4 1.4 — — — — — 1.5 1.5 1.5 1.5 1.6 Impairment charges — — — — — — — — — — — — — — 231.1 Restructuring charges 1.2 1.3 — — — — — — — — (0.7) (0.1) (1.1) 0.8 3.9 Production transfer costs 0.4 — — — — — — — — — — — — — — Acquisition-related costs 1.6 — — — — — — — — — — — — — — Other — — — — — — — — — — — (0.6) (0.2) (0.4) (0.5) Adjusted earnings (loss) before interest and income taxes $ 10.5 $ 9.7 $ 7.3 $ 13.0 $ 18.6 $ 28.9 $ 23.1 $ 24.4 $ 12.3 $ 25.2 $ 6.6 $ 13.1 $ 8.4 $ (4.6) $ 4.1 Adjusted earnings (loss) before interest and income taxes margin 15.1 % 19.3 % 15.3 % 24.2 % 29.4 % 42.9 % 40.9 % 40.3 % 27.0 % 40.8 % 8.5 % 19.2 % 13.0 % -10.2 % 5.7 % Operating earnings (loss) $ 3.4 $ 6.2 $ 4.9 $ 10.8 $ 16.4 $ 28.0 $ 22.2 $ 23.6 $ 11.4 $ 24.4 $ 4.4 $ 11.1 $ 6.3 $ (8.2) $ (233.4) Other expense (income), net — 0.1 0.1 0.1 (0.2) — — — — — — — — — — Earnings (loss) before interest and income taxes 3.4 6.1 4.8 10.7 16.6 28.0 22.2 23.6 11.4 24.4 4.4 11.1 6.3 (8.2) (233.4) Non-GAAP reconciling adjustments 7.1 3.6 2.5 2.3 2.0 0.9 0.9 0.8 0.9 0.8 2.2 2.0 2.1 3.6 237.5 Depreciation expense 2.5 1.9 2.0 1.9 2.0 2.0 2.0 2.1 2.1 2.0 3.0 3.1 3.6 4.6 4.6 Adjusted earnings before interest, income taxes, depreciation, and amortization ("EBITDA") 13.0 11.6 9.3 14.9 20.6 30.9 25.1 26.5 14.4 27.2 9.6 16.2 12.0 — 8.7 Adjusted EBITDA margin 18.7 % 23.1 % 19.5 % 27.7 % 32.5 % 45.8 % 44.4 % 43.7 % 31.6 % 44.0 % 12.3 % 23.7 % 18.6 % 0.0 % 12.1 %

14 Quarter Ended December 31, September 30, June 30, March 31, December 31, (in millions) 2023 2023 2023 2023 2022 Earnings (loss) before interest and income taxes Precision Devices $ 3.4 $ 6.1 $ 4.8 $ 10.7 $ 16.6 MedTech & Specialty Audio 28.0 22.2 23.6 11.4 24.4 Consumer MEMS Audio 4.4 11.1 6.3 (8.2) (233.4) Total segments 35.8 39.4 34.7 13.9 (192.4) Corporate expense / other 22.4 17.3 16.5 17.2 14.9 Interest expense, net 3.2 0.6 0.8 0.8 1.2 Earnings (loss) before income taxes 10.2 21.5 17.4 (4.1) (208.5) (Benefit from) provision for income taxes (37.2) 4.9 3.8 1.1 (0.5) Net earnings (loss) $ 47.4 $ 16.6 $ 13.6 $ (5.2) $ (208.0) Reconciliation of Segment EBIT to Consolidated Net Earnings

Free Cash Flow and Free Cash Flow as a % of revenues 15 Years Ended December 31, (in millions) 2023 2022 2021 2020 2019 Net cash provided by operating activities $ 122.7 $ 86.3 $ 182.1 $ 128.1 $ 123.9 Net cash provided by operating activities as a % of revenues 17.3 % 11.3 % 21.0 % 16.8 % 14.5 % Less: Capital expenditures (16.9) (32.1) (48.6) (31.9) (41.2) Free cash flow (1) $ 105.8 $ 54.2 $ 133.5 $ 96.2 $ 82.7 Free cash flow as a % of revenues (1) 15.0 % 7.1 % 15.4 % 12.6 % 9.7 % (1) In additional to measuring cash flow generation and usage based on liquidity measures determined in accordance with GAAP, Knowles also measures Free cash flow and Free cash flow as a % of revenues. Free cash flow is defined as Net cash provided by operating activities less Capital expenditures. Knowles believes these measures are useful in measuring its Cash flow generated from operations that is available to repay debt, find acquisitions, and repurchase Knowles' common stock. Free cash flow and Free cash flow as a percentage of revenues are not presented in accordance with GAAP and may not be comparable to similarly titled measures used by other companies in our industry. As such, Free cash flow and Free cash flow as a % of revenues should not be considered in isolation from, or as an alternative to, any other liquidity measures determined in accordance with GAAP.

Reconciliation of Net Debt (Cash) 16 (in millions) Year Ended December 31, 2023 Current maturities of long-term debt $ 47.1 Long-term debt 224.1 Total debt 271.2 Less: Cash and cash equivalents (87.3) Net debt $ 183.9

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

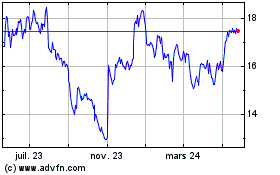

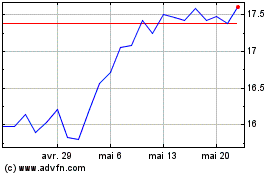

Knowles (NYSE:KN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Knowles (NYSE:KN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024