UberRush Not Yet a FedEx Killer

14 Octobre 2015 - 8:44PM

Dow Jones News

By Laura Stevens

Reports of FedEx Corp.'s demise at the hands of UberRush have

been greatly exaggerated.

The expanded launch of Uber Technologies Inc.'s new service is

being heralded in some quarters as a potential threat to both FedEx

and United Parcel Service Inc.'s bread-and-butter services of

delivering packages.

UberRush is now available in New York, Chicago and San

Francisco, as part of what Uber's chief executive has called an

effort to build an "urban logistics network" tapping an army of

more than 200,000 drivers to deliver packages and other goods

within cities as part of both UberRush and UberEats.

That does put Uber in a position to snatch away some parcel

delivery orders. But the smartphone-enabled courier service is

focused on quick, same-day deliveries, which make only a small

portion of its larger rivals' business. Drivers go from point A to

point B, and the service is limited to a small geographical area -

much more suited to delivering flowers, Starbucks or lunch than,

say, a book or costume jewelry from Amazon.

Both FedEx and UPS have spent decades developing intricate

hub-and-spoke systems to fly and truck packages across the U.S.

efficiently. Huge hubs process thousands of packages a minute on

automated conveyor belts. UPS delivers an average of 15.6 million

packages a day in the U.S.; FedEx nearly 10 million.

"I don't think there's any real competitive threat there," said

Jack Atkins, a transportation analyst with Stephens Inc. "On the

whole, when you think about the network that UPS and FedEx have set

up in the United States, it's impossible to replicate."

While deliveries by upstarts like Uber Rush are no doubt

disruptive, they're unlikely to put the delivery giants out of

business -- or even make a material impact anytime soon.

In the past, FedEx's CEO and founder Fred Smith has said that

while Uber is "terrific, " he thinks it's unlikely it will become a

major competitor in the delivery space. Companies like Uber may

compete for local, same-day deliveries, he said, a service FedEx

already offers in more than 20 major metro markets.

"Great company, great concept, but I don't think it's...likely

to be a major player in the logistics business," Mr. Smith said on

an earnings conference call earlier this year.

Write to Laura Stevens at laura.stevens@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 14, 2015 14:29 ET (18:29 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

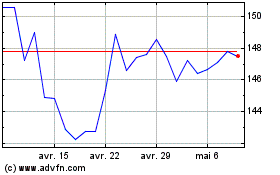

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

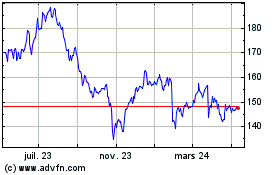

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024