Today's Logistics Report: 'Tis Delivery Season; Nimble Warehousing; Braking Trucking's Rest Rules

24 Décembre 2018 - 7:44PM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Retailers and parcel carriers are delivering strong results

along with signals of steep changes in sales and shipping patterns

this holiday season. Early measures suggest stores met lofty sales

expectations, the WSJ's Sarah Nassauer and Paul Ziobro report, as

Americans crowded stores and retailers wrapped up one of the

strongest holiday seasons in years. U.S. retail sales rose 5.2%

from Nov. 1 to Dec. 19, and Mastercard SpendingPulse says online

sales rose 18.3% during that time and accounted for a record 13% of

total sales. In-store sales grew 4.3%. The delivery backbone of the

online economy has held up, with ShipMatrix Inc. reporting on-time

performance at FedEx Corp. and the U.S. Postal Service was on track

with last year while United Parcel Service Inc. improved its

deliveries thanks to extra capacity and new technology. Those

efforts suggest carriers have new lessons from this season to take

into 2019.

More retailers are turning toward flexibility over fixed assets

when it comes to warehousing. The companies and their logistics

providers are taking a cue from gig-economy principles by turning

to on-demand distribution capacity, the WSJ Logistics Report's

Jennifer Smith writes, as they look to stay nimble while digital

commerce raises the stakes in supply chains. The idea is to tap

into unused warehouse space in a crowded U.S. real-estate market

where capacity near population centers fetches a growing price

premium. Online startup retailers have been prime targets for such

pop-up spots, but they're now attracting big retailers trying to

set logistics strategies in the face of volatile demand. Walmart

Inc., for instance, used the Flexe Inc. marketplace to get some 1.5

million square feet of temporary space for e-commerce fulfillment

this season. Logistics providers are noticing, and establishing

their own on-demand warehouse services.

Federal highway safety regulators delivered an interstate

victory to trucking companies. A new U.S. Transportation Department

ruling effectively runs California's attempts to its own rules for

trucker rest breaks off the road. The WSJ Logistics Report's Erica

E. Phillips writes the ruling in response to a petition from the

American Trucking Associations says the state rules "cause an

unreasonable burden on interstate commerce," and are preempted by

the federal hours-of-service regulations. That's a win for trucking

companies in a long-running battle over California's efforts to

impose rules that are tougher than federal restrictions in various

areas of transportation. California lawmakers recently passed

legislation toughening rules on port trucking by making shipping

customers partly responsible for labor-law violations. Trucking

groups have mobilized against the rules on meals and rest breaks,

but they haven't been able to get Congress to act to clarify that

federal rules preempt California's standards.

SUPPLY CHAIN STRATEGIES

A Pennsylvania woolen mill that helped weave the fabric of

American history for nearly two centuries is spinning its final

chapter. The Woolrich mill in Woolrich, Penn., is succumbing to the

driving forces of global business and shutting down after more than

170 years of operation, the WSJ's Ruth Simon reports, idling a

plant that fashioned blankets for Union soldiers as well as the

flannel shirts that have clothed 21st century youth. The shutdown

this year comes as bigger events around the world roiled the

business, highlighting the broad forces that are transforming U.S.

manufacturing. But some descendants of Woolrich's founder who ceded

control of the business also believe it unraveled because of the

lack of investment over the years. That helped leave Woolrich in

the hands of a private-equity owner who will keep the business name

intact but shutter a factory now deemed too costly to operate.

QUOTABLE

IN OTHER NEWS

The pace of U.S. economic output growth was revised down

slightly to 3.4% in the third quarter. (WSJ)

A gauge of U.S. business investment in capital goods fell 0.6%

from October to November. (WSJ)

Household spending in the U.S. increased in November for the

ninth straight month. (WSJ)

A measure of U.S. consumer confidence rose in December.

(WSJ)

U.S. inflation slowed sharply in November after a short-lived

pickup the previous month. (WSJ)

Canadian firms are maintaining plans to increase their

investment in machinery and equipment. (WSJ)

U.K. police released without charge two suspects held for

disruptions caused by drones at London Gatwick Airport. (WSJ)

Gasoline production and supplies are soaring even though prices

have fallen to the lowest level since August 2017. (WSJ)

JD.com founder Liu Qiangdong is facing strong criticism in China

even though U.S. prosecutors declined to charge him in a

sexual-assault investigation. (WSJ)

Dutch chemicals company Nouryon BV plans to continue raising

prices to offset rising raw materials costs. (WSJ)

Foxconn Technology Group is preparing to launch a $9 billion

chip-making project in China. (Nikkei Asian Review)

Grocery stores have gained a bigger share of online sales with

services like curbside pickup and home delivery. (Supermarket

News)

Danish electronics supplier Bang & Olufsen says troubles

bringing in a new logistics provider will cut into its profits.

(Logistics Manager)

New York's City Council approved zoning and other changes aimed

at restoring apparel production in the city. (Sourcing Journal)

Federal authorities set the maximum $12,934 fine on XPO

Logistics Inc. for a warehouse accident in Lockport, N.Y., that

killed two workers. (Buffalo News)

Several northeastern states agreed to develop a cap-and-trade

system to cut transport-sector carbon emissions. (Fleet Owner)

Daimler Trucks North America delivered its first electric

Freightliner truck to Penske Truck Leasing. (Commercial Carrier

Journal)

Europe and Asia-Pacific maritime authorities will issue warnings

to vessels that appear unprepared to comply with impending

sulfur-emissions restrictions. (Lloyd's List)

Ports America will invest $66.5 million under a 50-year lease to

operate a Port of New Orleans container terminal. (American

Shipper)

Germany's Port of Hamburg will start deepening and widening the

River Elbe next year. (Seatrade Maritime)

Macquarie is nearing a sale of Poland's DCT Gdansk terminal to a

group of investors including Poland's sovereign wealth fund.

(Reuters)

An auditor's report says Kenya could lose control of the Port of

Mombasa if it defaults on infrastructure loans from China.

(Maritime Executive)

Canadian National Railway Ltd. reached a tentative contract

agreement with the union representing track and bridge workers.

(Progressive Railroading)

Airfreight volume at Germany's cargo-focused Frankfurt-Hahn

Airport rose 58.4% in the first 10 months of 2018. (Air Cargo

News)

China's CRRC Corp. completed the first subway cars at its

Massachusetts assembly plant. (Springfield Republic)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@CostasParis, @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

(END) Dow Jones Newswires

December 24, 2018 13:29 ET (18:29 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

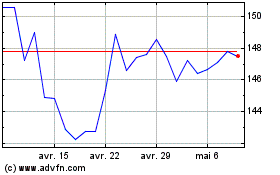

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Sept 2024 à Oct 2024

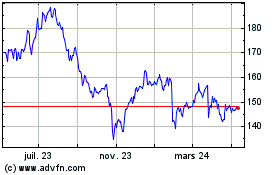

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Oct 2023 à Oct 2024