UPS Results Ride the Surge in Online Shopping

31 Janvier 2019 - 2:47PM

Dow Jones News

By Paul Ziobro

United Parcel Service Inc. posted higher revenue in the fourth

quarter as it handled more packages and squeezed higher prices from

shipments, even as costs tied to expanding the network cut into

profits.

The delivery giant said it expects its bottom line to improve

this year with operating profits up double digits across all off

its divisions, as it expects upgrades to its network to start

paying off.

UPS shares rose 4.6% in premarket trading to $105.85.

UPS has been spending billions of dollars to open new sorting

centers and upgrade its facilities to better handle the increase in

online orders rushing into its network. Those investments helped

the company hold up well during its latest holiday season, as the

extra capacity and new technology to reroute packages around

problem spots created fewer backlogs than prior years. UPS

delivered 21 million packages a day in the U.S. during the fourth

quarter and said its on-time delivery performance was a record.

Domestic operating profit fell during the period, even as its

revenue rose 6.3%, due to costs tied to opening 14 new facilities

in the quarter.

UPS diffused some concerns about the impact of any global trade

disruptions or potential slowdown in places like Europe. Last

month, rival FedEx Corp. warned that weak economic conditions

overseas would hurt its international business. "Our broad

portfolio, diverse revenue base and flexible network help buffer

the impacts of global economic softening," UPS CEO David Abney

said.

In the fourth quarter, UPS posted a profit of $453 million, or

52 cents a share, up from $1.1 billion, or $1.26 a share, a year

earlier. Excluding items like mark-to-market pension adjustments

and restructuring costs, adjusted earnings were $1.94 a share,

compared with $1.66 last year.

Revenue rose 4.6% to $19.8 billion.

Analysts were looking for UPS to post adjusted earnings of $1.90

a share on revenue of $19.97 billion, according to FactSet.

For the coming year, UPS projects adjusted earnings between

$7.45 and $7.75 a share. It said operating profits will rise at a

percent rate in the low teens, with all segments up double

digits.

The company also projects another big year of capital expenses

as it continues to add more automation. It projects capital

expenditures between 8.5% and 10% of revenue.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

January 31, 2019 08:32 ET (13:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

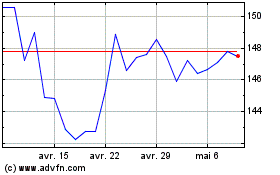

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

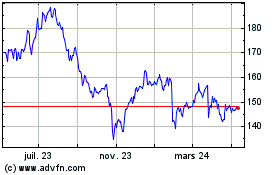

United Parcel Service (NYSE:UPS)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024