Form 424B2 - Prospectus [Rule 424(b)(2)]

10 Juin 2024 - 7:11PM

Edgar (US Regulatory)

Filed under Rule 424(b)(2), File No. 333-267245

Pricing Supplement No. 161 - Dated Monday, June 10, 2024 (To: Prospectus dated September 2, 2022 and Prospectus Supplement dated

September 2, 2022)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CUSIP

Number |

|

Principal

Amount |

|

Selling

Price

|

|

Gross

Concession |

|

Net

Proceeds |

|

Coupon

Type |

|

Coupon

Rate |

|

Coupon

Frequency |

|

Maturity

Date |

|

1st Coupon

Date |

|

1st Coupon

Amount |

|

Survivor’s

Option |

|

Product

Ranking |

| 92346MNK3 |

|

$1,558,000.00 |

|

100.00% |

|

1.250% |

|

$1,538,525.00 |

|

Fixed |

|

5.000% |

|

Semi-Annual |

|

06/15/2029 |

|

12/15/2024 |

|

$25.28 |

|

Yes |

|

Senior Unsecured Notes |

| Redemption Information:

Callable at 100% on 6/15/2025 and any time thereafter with 10 calendar days notice. |

|

92346MNL1 |

|

$328,000.00 |

|

100.00% |

|

1.800% |

|

$322,096.00 |

|

Fixed |

|

5.150% |

|

Semi-Annual |

|

06/15/2034 |

|

12/15/2024 |

|

$26.04 |

|

Yes |

|

Senior Unsecured Notes |

| Redemption Information:

Callable at 100% on 6/15/2026 and any time thereafter with 10 calendar days notice. |

|

| Verizon Communications Inc. |

|

|

|

Offering Date: Monday, June 3, 2024 through Monday, June 10, 2024 |

|

Verizon Communications Inc. |

| One Verizon Way |

|

|

|

Trade Date: Monday, June 10, 2024 @ 12:00 PM ET |

|

Verizon InterNotes ® |

| Basking Ridge, New Jersey 07920-1097 |

|

Settle Date: Thursday, June 13, 2024 |

|

Prospectus dated September 2, 2022 and Prospectus |

|

|

|

|

|

|

|

|

Minimum Denomination/Increments: $1,000.00/$1,000.00 |

|

Supplement dated September 2, 2022 |

|

|

|

|

|

|

|

|

Initial trades settle flat and clear SDFS: DTC Book Entry only |

|

|

|

|

|

|

|

|

|

|

|

|

DTC Number 0235 via RBC Dain Rauscher Inc |

|

|

|

|

|

|

|

|

|

|

|

|

Joint Lead Manager and Lead Agent: InspereX

Agents: BofA Securities, Citigroup, Morgan Stanley, RBC Capital Markets, Wells Fargo Advisors

It is expected that delivery of the Notes will be made on or about June 13, 2024,

which will be the third business day following the date hereof (such settlement cycle being referred to as “T+3”). Under Rule 15c6-1 under the Exchange Act, trades in the secondary market are

required to settle in one business day, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes prior to the delivery of the Notes will be required, by virtue of the fact that the Notes

initially settle in T+3, to specify an alternate settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to trade the Notes prior to their date of delivery should consult their own

advisors. Except for Notes sold to level-fee

accounts, Notes offered to the public will be offered at the public offering price set forth in this Pricing Supplement. Agents purchasing Notes on an agency basis for non-level fee client accounts shall

purchase Notes at the public offering price. Notes purchased by the Agents for their own account may be purchased at the public offering price less the applicable concession. Notes purchased by the Agents on behalf of

level-fee accounts may be sold to such accounts at the applicable concession to the public offering price, in which case, such Agents will not retain any portion of the sales price as compensation.

If the maturity date or an interest payment date for any note is not a business day (as

defined in the prospectus supplement), principal, premium, if any, and interest for that note is paid on the next business day, and no interest will accrue from, and after, the maturity date or interest payment date.

The Verizon InterNotes® will be

represented by a Master Note in fully registered form, without coupons. The Master Note will be deposited with, or on behalf of, DTC and registered in the name of a nominee of DTC, as depository, or another depository as may be named in a subsequent

pricing supplement. |

|

|

Exhibit 107

Calculation of Filing Fee Table

FORM S-3

(Form Type)

VERIZON COMMUNICATIONS INC.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered and Carry Forward Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Security

Type |

|

Security

Class Title |

|

Fee

Calculation

or Carry

Forward

Rule |

|

Amount

Registered |

|

Proposed

Maximum

Offering

Price Per

Unit |

|

Maximum

Aggregate

Offering

Price |

|

Fee Rate |

|

Amount of

Registration

Fee |

| |

| Newly Registered

Securities |

| |

|

|

|

|

|

|

|

|

| Fees to be Paid |

|

Debt |

|

Senior

Unsecured Notes |

|

457(r) |

|

$1,558,000 |

|

100.00% |

|

$1,558,000 |

|

$147.60

per

$1 million |

|

$229.96 |

| |

|

|

|

|

|

|

|

|

| Fees to be Paid |

|

Debt |

|

Senior

Unsecured Notes |

|

457(r) |

|

$328,000 |

|

100.00% |

|

$328,000 |

|

$147.60

per

$1 million |

|

$48.41 |

The prospectus supplement to which this exhibit is attached is a final prospectus for the related offering. The maximum amount of

that offering is $1,886,000.

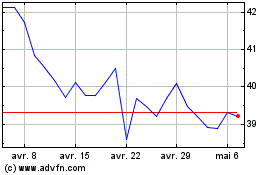

Verizon Communications (NYSE:VZ)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Verizon Communications (NYSE:VZ)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024