Form 8-K - Current report

11 Juin 2024 - 11:00PM

Edgar (US Regulatory)

false

0001497770

0001497770

2024-06-09

2024-06-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or

15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 9, 2024

Walker &

Dunlop, Inc.

(Exact name of registrant as specified in its charter)

| Maryland |

|

001-35000 |

|

80-0629925 |

(State or other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

7272 Wisconsin Avenue

Suite 1300

Bethesda, MD |

|

20814 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (301) 215-5500

Not applicable

(Former name or former address if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act.

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| Common Stock, par value $0.01 per share |

WD |

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing.

On June 7, 2024, Walker & Dunlop, Inc. (the

“Company”) was informed that Michael D. Malone, a member of the Company’s Board of Directors (the “Board”),

passed away on June 7, 2024. The Company is deeply saddened by Mr. Malone’s unexpected passing and extends its sincere condolences

to his family. Mr. Malone joined the Board in November 2012 and served as Lead Director, Chair of the Compensation Committee of the Board

and a member of the Audit and Risk Committee of the Board (the “Audit Committee”).

Following the death of Mr. Malone, the Audit Committee

was reduced to two members. Due to the reduced number of Audit Committee members, the Company was no longer compliant with Section 303A.07(a)

of the New York Stock Exchange (“NYSE”) Listed Company Manual, which requires that the audit committee of an NYSE-listed company

consist of at least three members.

On June 10, 2024, the Company notified the NYSE

of the resulting non-compliance with Section 303A.07(a). As discussed in Item 5.02 below, the Company has since taken action to add a

third Board member to the Audit Committee and is back in compliance with Section 303A.07(a).

Item 5.02. Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 9, 2024, at the recommendation of the Nominating

and Corporate Governance Committee of the Board, the Board elected Gary S. Pinkus to the Board, effective immediately, to serve until

the next annual meeting of stockholders of the Company and until his successor is duly elected and qualified. The Board also appointed

Mr. Pinkus to serve on the Audit Committee, effective immediately.

Mr. Pinkus has served as Chairman of McKinsey &

Company (“McKinsey”) in North America since 2018. Prior to that role, he served as the managing partner of McKinsey’s

North America practice from 2015 to 2018, managing partner of McKinsey’s West Coast practice from 2006 to 2013 and managing partner

of McKinsey’s San Francisco office from 2003 to 2006. Mr. Pinkus is also the former global leader of McKinsey’s Private Equity

& Principal Investors Practice, which he helped found more than two decades ago. He has served on McKinsey’s Shareholders Council

since 2009 and has chaired McKinsey’s Senior Partners Committee since 2019. Mr. Pinkus also previously chaired McKinsey’s

Risk, Audit and Governance Committee, Strategy Committee and Finance and Infrastructure Committee. He currently serves on the Board of

Trustees of Wake Forest University and as Chair of the U.S. Ski and Snowboard Finance Committee. Mr. Pinkus holds a B.A. in

English and Quantitative Economics from Stanford University and an M.B.A. from Harvard Business School.

The Board has determined that Mr. Pinkus is an

independent director under NYSE listing standards and the Company’s Corporate Governance Guidelines and meets the heightened independence

standards for service on the Audit Committee set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended. The

Board has also determined that Mr. Pinkus qualifies as an “audit committee financial expert” as that term is defined by the

applicable Securities and Exchange Commission regulations and that Mr. Pinkus is “financially literate” as that term is defined

by the NYSE listing standards.

In connection with his election to the Board, the

Company entered into an indemnification agreement with Mr. Pinkus providing for the indemnification of and advancement of expenses to

the maximum extent permitted by Maryland law for claims, suits or proceedings arising out of a director’s service to the Company.

Mr. Pinkus will receive the same fees for his service

on the Board and Audit Committee as the Company’s other independent directors, which fees were disclosed in the Company’s

proxy statement for its 2024 Annual Meeting of Stockholders. Mr. Pinkus’ annual cash compensation and restricted stock award will

be pro-rated from the date of Mr. Pinkus’ election to the Board.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Walker & Dunlop, Inc.

(Registrant) |

| |

|

|

| Date: June 11, 2024 |

By: |

/s/ Gregory A. Florkowski |

| |

|

Name: |

Gregory A. Florkowski |

| |

|

Title: |

Executive Vice President and Chief Financial Officer |

v3.24.1.1.u2

Cover

|

Jun. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 09, 2024

|

| Entity File Number |

001-35000

|

| Entity Registrant Name |

Walker &

Dunlop, Inc.

|

| Entity Central Index Key |

0001497770

|

| Entity Tax Identification Number |

80-0629925

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity Address, Address Line One |

7272 Wisconsin Avenue

|

| Entity Address, Address Line Two |

Suite 1300

|

| Entity Address, City or Town |

Bethesda

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20814

|

| City Area Code |

301

|

| Local Phone Number |

215-5500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

WD

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

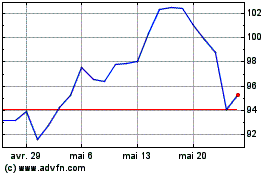

Walker & Dunlop (NYSE:WD)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

Walker & Dunlop (NYSE:WD)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024