Brunel International NV: Growth continues in Germany, slow start in The Netherlands

05 Mai 2017 - 8:00AM

Amsterdam, 5 May 2017

Key points Q1 2017

-

Revenue down by 18% to EUR 196 million

and gross profit down by 2% to EUR 47 million

-

EBIT down by 37% to EUR 5.7

million

-

Energy division renamed to Global

Business

| Brunel International (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

Q1 2017 |

Q1 2016 |

Change % |

|

| Revenue |

196.4 |

238.4 |

-18% |

a |

| Gross Profit |

47.2 |

47.9 |

-1% |

|

| Gross margin |

24.0% |

20.1% |

|

|

| Operating costs |

41.5 |

38.8 |

7% |

b |

| EBIT |

5.7 |

9.1 |

-37% |

|

| EBIT % |

2.9% |

3.8% |

|

|

|

|

|

|

|

|

| Average directs |

8,984 |

9,771 |

-8% |

|

| Average indirects |

1,460 |

1,503 |

-3% |

|

| Ratio direct /

Indirect |

6.2 |

6.5 |

|

|

| |

|

|

|

|

| a -19 % at constant currencies |

|

| b 6 % at constant currencies |

|

To reflect the diversification in

our global infrastructure the division "Energy" has been renamed

"Global Business".

The revenue decline in Q1 in our divisions Global

Business and The Netherlands was partly offset by growth in

Germany. The gross margin improved due to a change in the mix,

helped by additional working days in Europe. Operating costs

increased due to further investments in our organisation in Europe,

partly offset by savings in our Global Business.

In Q1, our Global Business

division achieved a slightly lower than expected further decline in

headcount. Revenue decreased by 18% compared to Q4 2016. The gross

margin increased from 10.9% to 11.6%. Operating costs decreased by

7%.

Revenue in Europe continued to grow year on year, driven by strong

performance in Germany.

The Netherlands faced a slow start of the

year, in combination with the continued impact of the reduction in

number of freelancers during 2016. Q1 2017 included two additional

working days compared to Q1 2016. Revenue per working day decreased

by 14%, and the gross margin adjusted for working days is 27.8%. A

higher bench and higher illness caused the decrease in gross

margin.

Germany

continues to grow, helped by three additional working days in Q1.

Revenue per working day increased by 8% and the gross margin

adjusted for working days remained stable at 34.1%.

A lower bench offset more vacation and illness.

Outlook

Given the current market circumstances in Global Business, it

remains difficult to provide an outlook for the rest of the year.

Germany will continue to grow, while The Netherlands will return to

growth in the second half of the year.

Jan Arie van Barneveld, CEO of

Brunel International N.V.: "I'm optimistic that

after a challenging first half year our results will start

improving. The developments in our Global Business suggest we will

see the trough somewhere in the middle of this year. With The

Netherlands exceeding last year's headcount somewhere in Q2, all

divisions will contribute to the improvement of our

results."

Brunel Q1 2017 trading update

Brunel Q1 2017 trading update appendix

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Brunel International NV via Globenewswire

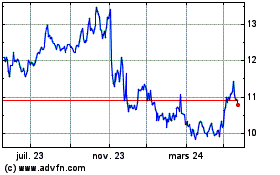

Brunel International NV (EU:BRNL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

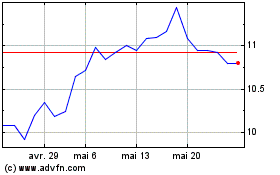

Brunel International NV (EU:BRNL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024