CREDIT AGRICOLE SA : Crédit Agricole Group announces the successful sale of 56,720,400 Amundi preferential subscription righ...

15 Mars 2017 - 7:45AM

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED

STATES, AUSTRALIA, CANADA OR JAPAN

Montrouge, March 15, 2017

Press

release

Crédit Agricole Group announces the successful

sale of 56,720,400 Amundi preferential subscription rights for

approximately 67 million euros

Crédit

Agricole SA and Crédit Agricole Immobilier completed today the sale

of 56,720,400 preferential subscription rights, by way of a private

placement to institutional investors, for an amount of c. 67

million euros.

After

the completion of the Amundi's rights offering, Crédit Agricole

Group is expected to hold approximately 70% of Amundi's share

capital[1] .

The

settlement and delivery for the placement is expected to take place

on March 17 2017.

This

press release does not constitute an offer to sell or a

solicitation of offers to purchase any securities by the Crédit

Agricole Group and no public offering of the preferential

subscription rights is being made in France or any other

jurisdiction.

Disclaimer

This press release and the information contained

herein do not constitute an offer to sell or purchase, or the

solicitation of an offer to sell or purchase, securities of

Amundi.

No communication or information relating to the

placement of preferential subscription rights referred to herein

may be distributed to the public in any jurisdiction in which

registration or approval is required. No action has been (or will

be) taken in any jurisdiction where such registration or approval

would be required. The placement of preferential subscription

rights may be subject to specific legal or regulatory restrictions

in certain jurisdictions. Amundi and Group Crédit Agricole take no

responsibility for any violation of any such restrictions by any

person. The distribution of this press release in certain

jurisdictions may be restricted by law.

This press release does not constitute a

prospectus within the meaning of Directive 2003/71/EC as amended

(the "Prospectus Directive").

In France, the offer and sale of the securities

described in this announcement will be exclusively carried out

through a private placement, in accordance with article L.411-2 II

of the French Financial and Monetary Code and the related

applicable regulations. The offer and sale of the preferential

subscription rights described in this announcement do not

constitute a public offering within the meaning of article L.411-1

of the French Financial and Monetary Code and will not require the

preparation of a prospectus submitted to the visa of the Autorité

des marchés financiers.

With respect to each member State of the European

Economic Area other than France (the "Member State"), no action has

been undertaken or will be undertaken to make an offer to the

public of securities requiring a publication of a prospectus in any

Member State. As a result, the securities of Amundi may only be

offered in the Member States (a) to qualified investors, as defined

by the Prospectus Directive; or (b) in any other circumstances, not

requiring Amundi to publish a prospectus as provided under Article

3(2) of the Prospectus Directive.

For the purposes of this paragraph, "securities

offered to the public" in a given Member State means any

communication, in any form and by any means, of sufficient

information about the terms and conditions of the offer and the

securities so as to enable an investor to make a decision to buy or

subscribe for the securities, as the same may be varied in that

Member State.

The above selling restrictions are in addition to

any other selling restrictions which may be applicable in the

Member States.

The distribution of this press release is directed

only at (i) persons outside the United Kingdom, subject to

applicable laws, or (ii) persons having professional experience in

matters relating to investments who fall within the definition of

"investment professionals" in Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 as

amended (the "Order") or (iii) high net worth bodies corporate,

unincorporated associations and partnerships and trustees of high

value trusts as described in Article 49(2) (a) to (d) of the Order

(all such persons together being referred to as "relevant

persons"). The rights issue is only available to, and any

invitation, offer or agreement to subscribe, purchase or otherwise

acquire such rights will be engaged in only with, relevant persons.

Any person who is not a relevant person should not act or rely on,

this press release or any information contained

herein.

This press release does not constitute an offer or

invitation to sell or purchase, or a solicitation of any offer to

purchase or subscribe for, any securities of Amundi in the United

States of America. Securities may not be offered, subscribed or

sold in the United States of America absent registration under the

U.S. Securities Act of 1933, as amended (the "U.S. Securities

Act"), except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements thereof. The

securities of Amundi have not been and will not be registered under

the U.S. Securities Act and Amundi does not intend to make a public

offer of its securities in the United States of

America.

This announcement may not be published, forwarded,

distributed or released, in whole or in part, directly or

indirectly, in or into the United States, Australia, Canada, Japan

or any other jurisdiction in which it would be unlawful to do

so.

Press

contacts

Charlotte de Chavagnac 01 57 72 11 17 -

charlotte.dechavagnac@credit-agricole-sa.fr

Alexandre Barat 01 43 23 07 31 -

alexandre.barat@credit-agricole-sa.fr

All our press releases are available at

https://www.credit-agricole.com/en

https://twitter.com/Credit_Agricole

[1]

Subject to any exercise of the underwriting

commitment provided by Crédit Agricole SA.

Pricing_PR_CASA_15_march_2017_(English_Version)

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: CREDIT AGRICOLE SA via Globenewswire

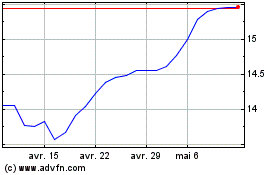

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

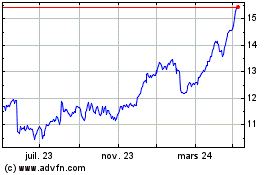

Credit Agricole (EU:ACA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024