Canadian Dollar Slides On Falling Oil Prices

25 Juillet 2016 - 7:58AM

RTTF2

The Canadian dollar slipped against most major currencies in

early European trading on Monday, amid falling oil prices, as the

U.S. rig count increased for the fourth consecutive week, adding to

worries over a supply glut.

Crude for September delivery fell $0.26 to $43.93 per

barrel.

Report from oilfield service company Baker Hughes showed that

the number of active U.S. rigs rose by 14 to 371 last week. The

total U.S. rig count was up by 15 rigs to 462.

Rising rig count is seen as indication for an increase in

domestic crude oil output in the weeks ahead.

Market participants await U.S. stockpiles data on Tuesday and

Wednesday for more indications about supply outlook.

The loonie showed mixed performance in Asian deals. While the

loonie held steady against the greenback and the euro, it rose

against the Japanese yen. Against the aussie, the loonie

declined.

The loonie declined to 1.3171 against the greenback and 1.4471

against the euro, from its previous highs of 1.3121 and 1.4390,

respectively. The next possible support levels for the loonie may

be located around 1.33 against the greenback and 1.46 against the

euro.

Extending early slide, the loonie slipped to a weekly low of

0.9863 against the aussie. On the downside, 1.00 is likely seen as

the next support for the aussie.

The loonie held steady against the yen with the pair trading at

80.73, after moving off from a high of 81.22 hit in the Asian

deals.

Figures from the Cabinet Office showed that Japan's leading

index, which measures the future economic activity, decreased in

May instead of a stable reading reported initially.

The leading index dropped to 99.7 in May from 100.0 in the

previous month. The May figure was revised down from 100.0.

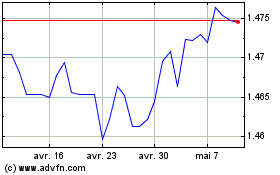

Euro vs CAD (FX:EURCAD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs CAD (FX:EURCAD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024