| PRESS

RELEASE |

|

| |

|

| |

April 18, 2017 |

|

| |

|

|

| FIRST-QUARTER

2017 REVENUE |

|

|

| |

| Solid like-for-like growth in operating revenue

(up 10.0%) |

|

| |

-

Total revenue rose

by 29.6% as reported to €322.7 million, reflecting:

-

Like-for-like growth of 9.6%

-

Scope effects, mainly related to

the acquisitions of Embratec and UTA, contributing 16.6% to

growth

-

A slightly positive currency effect

over the period, adding 3.4%

-

Operating revenue

increased by 10.0% like-for-like to €304.9 million,

reflecting:

-

Growth of 6.7% in Employee Benefits

and an increase of 27.1% in Expense Management (on a like-for-like

basis)

-

Balanced geographic distribution of

like-for-like growth, with operating revenue up 8.9% in Europe,

11.8% in Latin America and 9.1% in the Rest of the World (on a

like-for-like basis)

-

A more balanced

Group profile, with Expense Management accounting for 24.8% of

operating revenue versus 12.8% in the prior year

-

Full-year 2017

target confirmed: like-for-like growth of more than 7% in operating

revenue

-

Significant events

since the beginning of 2017:

-

Edenred became the number two

Europe-wide issuer of multi-brand fuel cards by increasing its

stake in UTA to 51%

-

The shift to digital accelerated in

France with the acquisition of assets related to Moneo Resto, a

fully digital meal voucher solution

-

The first initiative was carried

out in the Corporate Payment business line with the launch of a new

accounts payable management solution in Europe

-

The Group further strengthened its

debt profile through the success of its €500 million 10-year bond

issue

|

|

Total revenue up 9.6%

like-for-like to €322.7 million

| In € millions |

First-quarter 2017 |

First-quarter 2016 |

% change |

| Reported |

Like-for-like[1] |

Operating

revenue

Financial revenue

Total revenue |

304.9

17.8

322.7 |

233.2

15.8

249.1 |

+30.7%

+12.7%

+29.6% |

+10.0%

+3.1%

+9.6% |

Total revenue

for the first three months of 2017 amounted to €322.7 million, representing a 9.6% like-for-like increase. Total revenue includes

operating revenue (up 10.0% like-for-like) and financial

revenue (up 3.1% like-for-like).

On a reported basis, total revenue

was up 29.6%, which reflects the 16.6%

positive scope effect, mainly related to the consolidation of

Embratec in Brazil and UTA in Germany and the 3.4% favorable

currency effect due to the combined impact of the appreciation of

certain currencies against the euro, particularly the Brazilian

real (up 28.7%), and the depreciation against the euro of other

currencies, such as the Mexican peso (down 8.1%), the Venezuelan

bolivar (down 68.4%), the British pound (down 10.4%) and the

Turkish lira (down 17.5%).

| |

First-quarter 2017 |

| In € millions |

Total revenue |

Reported

growth |

Like-for-like growth |

| Europe |

161.4 |

+20.3% |

+7.9% |

| Latin

America |

140.8 |

+47.2% |

+12.1% |

| Rest of the

World |

20.5 |

+6.3% |

+9.0% |

| TOTAL |

322.7 |

+29.6% |

+9.6% |

By region, like-for-like growth in

total revenue stood at 7.9% in Europe, 12.1% in Latin America and

9.0% in the Rest of the World.

Operating revenue: up 10.0%

like-for-like to €304.9 million

Operating revenue for the first

quarter of 2017 was up 10.0% like-for-like at

€304.9 million. On a reported basis,

operating revenue rose by 30.7%, taking into account the scope

effects, mainly related to Embratec in Brazil and UTA in Germany

for 17.5%, and positive currency effects for 3.2%.

Operating revenue

by business line:

| |

First-quarter 2017 |

| In € millions |

Operating revenue |

Reported

growth |

Like-for-like

growth |

| Employee Benefits |

197.7 |

+10.4% |

+6.7% |

| Expense

Management |

75.7 |

+154.2% |

+27.1% |

|

Complementary solutions |

31.5 |

+29.4% |

+13.3% |

| TOTAL |

304.9 |

+30.7% |

+10.0% |

In Employee Benefits, operating

revenue amounted to €197.7 million in the first quarter of

2017, up 6.7% like-for-like from €179.1 million in the

prior-year period. The business line accounted for 64.8% of

consolidated operating revenue, versus 76.8% in first-quarter

2016.

Growth in Employee Benefits was

solid in Europe and particularly robust in Hispanic Latin America.

Brazil, on the other hand, recorded a decline in operating revenue

from Employee Benefits solutions, in an environment shaped by a

further rise in unemployment.

In Expense Management,

like-for-like growth in operating revenue came out at 27.1% with

particularly strong gains in Mexico, Argentina and, to a lesser

extent, Brazil. Expense Management operating revenue reached €75.7

million versus €29.8 million in the prior-year period.

On top of a solid like-for-like

performance, the increase by more than 2.5 times in Expense

Management operating revenue was also attributable to scope effects

relating to the integration of Embratec assets in May 2016 and to

the full consolidation of UTA since January, 2017. These

acquisitions have enabled the Group to achieve a more balanced

business profile, in line with the Fast Forward strategic plan. As

a result, Expense Management accounted for 24.8% of the Group's

operating revenue in first-quarter 2017 versus 12.8% in

first-quarter 2016.

The Group's Complementary

Solutions generated operating revenue of €31.5 million, versus

€24.4 million in the first quarter of 2016, reflecting

like-for-like growth of 13.3%. This business line accounted for

10.3% of Group operating revenue in first-quarter 2017, compared

with 10.5% in the prior-year period.

Operating revenue

by region:

| |

First-quarter 2017 |

| In € millions |

Operating revenue |

Reported

growth |

Like-for-like

growth |

| Europe |

155.1 |

+22.1% |

+8.9% |

| Latin

America |

130.4 |

+48.1% |

+11.8% |

| Rest of the

World |

19.4 |

+6.8% |

+9.1% |

| TOTAL |

304.9 |

+30.7% |

+10.0% |

In Europe,

operating revenue amounted to €155.1 million for the first quarter,

up 8.9% like-for-like, and represented

50.9% of Group operating revenue.

In France,

operating revenue rose 9.2% like-for-like, reflecting a good

overall performance from all product lines: Ticket

Restaurant® meal voucher

solutions, ProWebCE's solutions for works councils, and expense

management solutions for the light vehicle segment by

LCCC[2].

The rest of

Europe also put in a solid performance, with operating revenue

up 8.8% like-for-like. Growth reached more than 15%

like-for-like in Central Europe, on the back

of strong sales momentum, particularly in Romania. Organic growth remained strong in most of the

other European countries, particularly Belgium

and Italy.

In Latin

America, operating revenue came in at €130.4

million, up 11.8% like-for-like,

accounting for 42.7% of Group operating revenue.

In Brazil,

like-for-like operating revenue fell 0.9% in the first quarter,

hampered by the still challenging economic environment. In Employee

Benefits, the issue volume remained virtually unchanged from the

prior-year period on a like-for-like basis despite rising

unemployment, but operating revenue was down like-for-like. In

contrast, Expense Management - whose weighting more than doubled in

May 2016 following the acquisition of Embratec assets - posted

double-digit growth in operating revenue thanks to the success of

the ongoing integration of its operations under the Ticket Log

brand.

In Hispanic Latin

America, like-for-like operating revenue surged by 37.2%, with

like-for-like growth of more than 20% in Mexico. Operating revenue for the Employee Benefits

business line grew by more than 30% like-for-like, driven by strong

performances in Argentina, Mexico and Uruguay, as well as sharp

growth in Venezuela on the back of rising inflation. The Expense

Management business line delivered solid like-for-like growth of

more than 40%, led mainly by Mexico - which benefited from a strong

business performance, a favorable basis of comparison with the

prior-year period and a rise in fuel prices - and Argentina.

Operating revenue in the Rest of the World, which represented 6.4% of the

Group's operating revenue, climbed 9.1%

like-for-like in the first quarter of 2017, reflecting in

particular another period of strong like-for-like growth in

Turkey.

Financial revenue: up 3.1%

like-for-like to €17.8 million

| |

First-quarter 2017 |

| In € millions |

Financial revenue |

Reported

growth |

Like-for-like

growth |

| Europe |

6.4 |

-11.2% |

-9.9% |

| Latin

America |

10.4 |

+37.4% |

+14.8% |

| Rest of the

World |

1.0 |

-2.8% |

+7.3% |

| TOTAL |

17.8 |

+12.7% |

+3.1% |

Financial

revenue rose 3.1% like-for-like to

€17.8 million. The change is the result

of a 14.8% like-for-like increase in Latin

America, and a 9.9% like-for-like decline in Europe due to lower interest rates.

Significant

events since the beginning of the year

In January 2017, Edenred took a

further step to develop its Expense Management business line by

increasing its stake in UTA from 34% to 51%, thereby becoming the

number two Europe-wide player in multi-brand fuel cards, toll

solutions and maintenance and service solutions. Edenred now

manages 2.6 million fuel cards and toll solutions worldwide

and close to 6.3 billion liters of fuel. The Group's cards are

accepted at 70,000 affiliated service stations. UTA is fully

consolidated in Edenred's financial statements since January, 2017.

UTA's minority shareholders[3] have put

options in Edenred's favor covering the remaining 49% of

capital.

On March 8, 2017, Edenred

announced the launch in Europe of an accounts payable management

solution based notably on the use of virtual payment cards. The

first initiative to be marketed under the Edenred Corporate Payment

brand, the new solution allows companies to automate the management

of their transactions and relations with their suppliers thanks to

a unique digital platform guaranteeing the most appropriate method

of payment (wire transfer or virtual card) and real-time control of

transactions. With this solution, Edenred can also provide its

client companies with a financial incentive to use the virtual

card, enabling them to reduce internal transaction management

costs. Edenred's new offer is structured around the payment

issuance capacity of its subsidiary PrePay Solutions (PPS, 70%

owned by Edenred and 30% by MasterCard) together with CSI's

globalVCard payment platform via a licensing agreement. CSI is a

leading US B2B payments company specializing in customizable

virtual payments.

Edenred placed a €500 million 10-year 1.875% bond issue on

March 22, 2017. The issue was more than three times

oversubscribed, confirming the market's confidence in the Group's

credit quality. The new bond issue will provide financing for

general corporate purposes and, more particularly, for the Group's

growth projects. It will also contribute to repaying the

€510 million 3.625% bond issue due in October 2017. Maturing

in March 2027, the new bond issue has an immediate effect on the

average maturity of the Group's debt, increasing it to

5.4 years from 4.4 years at December 31, 2016, and

reduces its average cost of debt to 2.1% versus 2.5% at December

31, 2016.[4] After

repayment of the €510 million bond issue in October 2017,

Edenred will have a particularly well-balanced debt profile, with

no major repayments due before 2025 and average maturity extended

by around two years to 6.4 years.

Already the leader in France's

digital meal voucher market, with 340,000 Ticket

Restaurant® card holders,

Edenred is stepping up its shift to digital by acquiring the assets

related to Moneo Resto, a fully digital French meal voucher

solution. Moneo Resto has a portfolio of around

1,500 corporate clients, of which 90% are SMEs, for a total of

65,000 employee users. Thanks to this acquisition, more than

400,000 employees in France now have a digital meal voucher

solution issued by Edenred, representing 25% of the total number of

employee beneficiaries of Edenred's meal voucher programs.

Conclusion and

outlook

In the first quarter of 2017, the

Group recorded solid 10.0% like-for-like growth in

operating revenue, mainly reflecting like-for-like growth of

6.7% in Employee Benefits and an increase of 27.1% in Expense

Management. From a geographical perspective, growth was evenly

distributed across the Group's different host regions (Europe,

Latin America and Rest of the World), despite still tough economic

conditions in Brazil.

Total revenue

rose by 29.6% during the period, reflecting like-for-like

growth of 9.6%, scope effects of 16.6% and positive currency

effects of 3.4%.

Over the next few months, the

Group expects to see further mid-single-digit growth in operating

revenue for the Employee Benefits business line and another

double-digit increase in Expense Management operating revenue (on a

like-for-like basis).

Geographically speaking, the Group

expects to maintain a strong level of operating revenue growth in

Europe. In Hispanic Latin America, like-for-like operating revenue

growth is expected to remain robust. In Brazil, the Group expects a

still contrasted performance, with Employee Benefits to stay

adversely impacted by the high unemployment level and Expense

Management to continue its strong momentum.

Edenred confirms that it is

aiming for 2017 performances in line with the medium-term

outlook set out in its Fast Forward three-year strategic plan:

-

Like-for-like growth in operating revenue of

more than 7%.

-

Like-for-like growth of more than 9% in

operating EBIT.

-

Like-for-like growth of over 10% in funds from

operations before non-recurring items (FFO).

UPCOMING

EVENTS

May 4, 2017: Annual Shareholders'

Meeting

July 25, 2017: First-half 2017

results

October 13, 2017: Third-quarter

2017 revenue

___

Edenred, which invented the Ticket

Restaurant® meal voucher

and is the world leader in prepaid corporate services, designs and

manages solutions for companies and public institutions seeking to

provide purchasing power, optimize their expenses and motivate

their teams. The Group's solutions are used across a network of 1.4

million affiliated merchants by 43 million employees working for

750,000 client organizations. The portfolio is built around two

main business lines:

-

Employee benefits (Ticket

Restaurant®, Ticket Alimentación, Ticket CESU, Childcare Vouchers,

etc.)

-

Expense management (Ticket Log,

Ticket Car, UTA, Ticket Clean Way, Repom, etc.)

Edenred also

offers complementary solutions for managing transactional

ecosystems, covering corporate payments (Edenred Corporate

Payment), incentives and rewards (Ticket Compliments, Ticket

Kadéos) and public social programs.

Listed on the Euronext Paris stock exchange,

Edenred operates in 42 countries, with close to 8,000 employees. In

2016, the transaction volume managed by Edenred amounted to almost

€20 billion.

Ticket

Restaurant® and all other tradenames of Edenred products and

services are registered trademarks of Edenred SA.

Follow Edenred on Twitter:

www.twitter.com/Edenred

___

CONTACTS

Media Relations

Anne-Sophie Sibout

+33 (0)1 74 31 86 11

anne-sophie.sibout@edenred.com

Anne-Sophie Sergent

+33 (0)1 74 31 86 27

anne-sophie.sergent@edenred.com

|

Investor and Shareholder Relations

Aurélie Bozza

+33 (0)1 74 31 84 16

aurelie.bozza@edenred.com

|

APPENDICES

Operating

revenue

|

|

|

|

| |

Q1 |

| |

2017 |

2016 |

| In € millions |

| |

|

|

|

|

|

Europe |

156 |

128 |

| France |

50 |

45 |

| Rest of Europe |

106 |

83 |

| Latin

America |

130 |

88 |

| Rest of

the world |

19 |

17 |

|

|

|

|

| Total |

305 |

233 |

| |

|

|

| |

|

|

| |

Q1 |

| |

Change reported |

Change L/L |

| In % |

| |

|

|

|

|

|

Europe |

22.1% |

8.9% |

| France |

11.7% |

9.2% |

| Rest of Europe |

27.8% |

8.8% |

| Latin

America |

48.1% |

11.8% |

| Rest of

the world |

6.8% |

9.1% |

|

|

|

|

| Total |

30.7% |

10.0% |

Financial

revenue

| |

Q1 |

|

| In €

millions |

2017 |

2016 |

|

| |

| |

|

|

|

|

|

|

Europe |

6 |

7 |

|

| France |

3 |

3 |

|

| Rest of Europe |

3 |

4 |

|

| Latin

America |

10 |

7 |

|

| Rest of

the world |

2 |

2 |

|

|

|

|

|

|

| |

|

|

|

|

Total |

18 |

16 |

|

| |

|

|

|

| |

|

|

|

| |

Q1 |

|

| |

Change reported |

Change L/L |

|

| In % |

|

| |

|

| |

|

|

|

|

Europe |

-11.2% |

-9.9% |

|

| France |

-8.5% |

-8.5% |

|

| Rest of Europe |

-13.1% |

-10.8% |

|

| Latin

America |

37.4% |

14.8% |

|

| Rest of the

world |

-2.8% |

7.3% |

|

|

|

|

|

|

| Total |

12.7% |

3.1% |

|

Total

revenue

| |

Q1 |

| |

2017 |

2016 |

| In € millions |

| |

|

|

|

|

|

Europe |

162 |

135 |

| France |

53 |

48 |

| Rest of Europe |

109 |

87 |

| Latin

America |

140 |

95 |

| Rest of

the world |

21 |

19 |

|

|

|

|

| Total |

323 |

249 |

| |

|

|

| |

|

|

| |

Q1 |

| |

Change reported |

Change L/L |

| In % |

| |

|

|

|

|

|

Europe |

20.3% |

7.9% |

| France |

10.5% |

8.1% |

| Rest of Europe |

25.7% |

7.8% |

| Latin

America |

47.2% |

12.1% |

| Rest of

the world |

6.3% |

9.0% |

|

|

|

|

| Total |

29.6% |

9.6% |

[1] At constant

scope of consolidation and exchange rates (corresponding to organic

growth).

[2] La

Compagnie des Cartes Carburants

[3] The

founders of UTA (the Eckstein and Van Dedem families) and Daimler

hold 34% and 15% of UTA's share capital respectively.

[4] Excluding

the Brazilian loans, the average cost of debt is 1.5%.

CP CA T1 2017_VENG

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: EDENRED S.A. via Globenewswire

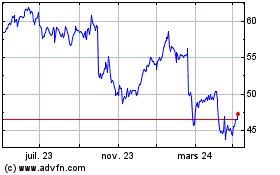

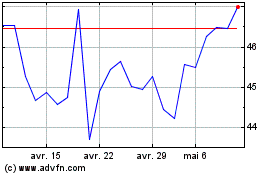

Edenred (EU:EDEN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Edenred (EU:EDEN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024