H1 2016 Results

-

Adjusted revenue up +10.8% to

€1,617.3 million

-

Adjusted organic revenue up

+6.6%, with a lower Q2 at +3.4%

-

Adjusted operating margin of

€264.5 million, down -7.4%

-

Adjusted EBIT, before

impairment charge, of €120.5 million, down -10.5%

-

Net income Group share of €80.4

million, up +1.1%

-

Adjusted free cash flow of

€98.3 million, down -10.0%

-

Adjusted organic revenue growth

rate expected to be low-single digit in Q3 2016

Paris,

28th July, 2016 -

JCDecaux SA (Euronext Paris: DEC), the number one outdoor

advertising company worldwide, announced today its 2016 half year

financial results.

Following the adoption of IFRS 11

from 1st January,

2014, the operating data presented below is adjusted to include our

prorata share in companies under joint

control. Please refer to the paragraph "Adjusted data" on

page 6 of this release for the definition of adjusted data and

reconciliation with IFRS.

Commenting on the 2016 first half

results, Jean-Charles Decaux, Chairman of the

Executive Board and Co-CEO of JCDecaux, said:

"We are pleased

to report an increase of 10.8% of our H1 2016 revenue at

€1,617.3 million. Our organic revenue

growth of 3.4% in Q2 is in line with our guidance and leads to an

organic growth rate of 6.6% in H1 mainly driven again by a strong

performance across all segments and geographies as well as our

prime digital asset portfolio. Our digital revenues continued to be

up very strongly and now represent 11.5% of our total revenue with

a growing contribution from our Street Furniture division which

starts to benefit from the installation of large Street Furniture

digital networks such as London. More cities,

such as New York City, Sydney and Stockholm, will follow

in the second half of this year.

As anticipated,

our operating margin declined to 16.4% of revenue due to both the

integration of CEMUSA, requiring some operational restructuring and

investments to turnaround the business, and the contract structure

of the world's largest bus shelter advertising franchise with TfL

in London. These two strategic decisions are paving the way to

accelerate the growth of our digital portfolio in some of the most

important advertising markets worldwide. The margin decline in

Street Furniture was partially offset by a margin expansion in our

Billboard division mainly due to the contribution of the Rest of

the World including the integration of our billboard platform in

Africa and the recovery of our business in Russia while Transport

margin was almost flat. Free cash flow generation remained

solid.

Following the

closing in April, we are now integrating OUTFRONT Media business in

Latin America in order to strengthen our No.1 position in this

region where we are now present in 12 countries with

62,000 advertising panels.

Furthermore, we

have won the iconic contract of Tokyo's advertising bus shelters

for a period of 15 years. We now hold a key strategic position in

the 3rd largest

advertising market in the world, with the only national Street

Furniture advertising network across 41 cities in Japan, including

the 20 largest cities, with a total of more than 8,000 advertising

panels at maturity. As the inventor of the advertising bus shelter

and the world leader in Street Furniture, we are delighted to have

renewed Paris, won London, become the partner of New York City

and added Tokyo.

GDP growth

forecast revisions for 2016 have now confirmed the global economic

slowdown we mentioned at the end of Q1 with the additional

uncertainty concerning the impact of Brexit. As a result, we

currently expect our Q3 adjusted organic revenue growth rate to be

low-single digit.

In a media

landscape increasingly fragmented, out-of-home advertising

reinforces its attractiveness. With our accelerating exposure to

faster-growth markets, our growing premium digital portfolio

combined with a new data-led audience targeting

platform, our ability to win new contracts and the high quality of

our teams across the world, we believe we are well positioned to

outperform the advertising market and increase our leadership

position in the outdoor advertising industry through profitable

market share gains. The strength of our balance sheet is a key

competitive advantage that will allow us to pursue further external

growth opportunities as they arise."

ADJUSTED

REVENUE

Adjusted revenue for the six

months ending 30th June 2016

increased by +10.8% to €1,617.3 million from

€1,459.7 million in the same period last year. On an organic

basis (i.e. excluding the negative impact from foreign

exchange variations and the positive impact from changes in

perimeter), adjusted revenue grew by +6.6%. Adjusted advertising

revenue, excluding revenue related to sale, rental and maintenance,

increased by +6.9% on an organic basis in the first half of

2016.

In the second quarter, adjusted

revenue increased by +7.2% to €868.8 million. On an organic

basis, adjusted revenue grew by +3.4% compared to

Q2 2015.

Adjusted advertising revenue, excluding revenue related to sale,

rental and maintenance, increased by +3.8% on an organic basis in

Q2 2016.

Adjusted

revenue

| €m |

H1 2016 |

H1 2015 |

Change 16/15 |

| Q1 |

Q2 |

H1 |

Q1 |

Q2 |

H1 |

Q1 |

Q2 |

H1 |

| Street

Furniture |

333.4 |

392.5 |

725.9 |

291.3 |

364.2 |

655.5 |

+14.5% |

+7.8% |

+10.7% |

|

Transport |

312.0 |

342.7 |

654.7 |

268.9 |

325.3 |

594.2 |

+16.0% |

+5.3% |

+10.2% |

|

Billboard |

103.1 |

133.6 |

236.7 |

88.8 |

121.2 |

210.0 |

+16.1% |

+10.2% |

+12.7% |

| Total |

748.5 |

868.8 |

1,617.3 |

649.0 |

810.7 |

1,459.7 |

+15.3% |

+7.2% |

+10.8% |

Adjusted organic

revenue growth (a)

|

Change 16/15 |

| Q1 |

Q2 |

H1 |

| Street

Furniture |

+9.7% |

+2.4% |

+5.7% |

|

Transport |

+12.9% |

+5.9% |

+9.0% |

|

Billboard |

+5.9% |

0.0% |

+2.5% |

| Total |

+10.5% |

+3.4% |

+6.6% |

(a) Excluding acquisitions/divestitures and the impact of

foreign exchange

Adjusted revenue

by geographic area

| €m |

H1 2016 |

H1 2015 |

Reported growth |

Organic growth(a) |

|

Europe(b) |

428.6 |

389.8 |

+10.0% |

0.0% |

|

Asia-Pacific |

387.9 |

364.6 |

+6.4% |

+10.2% |

|

France |

310.4 |

299.8 |

+3.5% |

+3.5% |

| Rest of

the World |

183.8 |

145.4 |

+26.4% |

+12.0% |

| United

Kingdom |

183.1 |

163.6 |

+11.9% |

+18.5% |

| North

America |

123.5 |

96.5 |

+28.0% |

+0.6% |

| Total |

1,617.3 |

1,459.7 |

+10.8% |

+6.6% |

(a) Excluding acquisitions/divestitures and the impact of

foreign exchange

(b) Excluding France and the United

Kingdom

Please note that the geographic

comments below refer to organic revenue growth.

STREET

FURNITURE

First half adjusted revenue

increased by +10.7% to €725.9 million (+5.7% on an organic

basis), driven by a strong performance in the UK, thanks to the TfL

bus shelters contract, and in France. The roll-out of the world's

largest digital Street Furniture network with

1,000 84" screens in London is taking longer than

expected due to the complexity surrounding the installation of this

major construction project with the involvement of several

contractual partners in the operational model from TfL. As a

result, we started Q3 2016 with 200 screens (in line with

our last forecast given in our Q1 financial release) instead of 500

in our original plan. The expected advertising revenue loss against

our original forecast will be significant against our UK Street

Furniture business plan for H2 2016. Given the uncertainty

surrounding the impact of the Brexit decision on the UK economy and

advertising revenue, we are reviewing the number of screens we are

deploying until we can evaluate the economic conditions and have

improved visibility. We are confident that the increase in the key

central locations like Oxford Street (Europe's busiest shopping

street) where we already operate 44 screens and other

important retail zones such as Kensington & Chelsea will partly

compensate.

First half adjusted advertising

revenue, excluding revenue related to sale, rental and maintenance

were up +6.8% on an organic basis compared to the first half of

2015.

In the second quarter, adjusted

revenue increased by 7.8% to €392.5 million. On an organic

basis, adjusted revenue increased by +2.4% compared to the same

period last year. Adjusted advertising revenue, excluding revenue

related to sale, rental and maintenance were up +3.0% on an organic

basis in Q2 2016 compared to Q2 2015.

TRANSPORT

First half adjusted revenue

increased by +10.2% to €654.7 million (+9.0% on an organic

basis), driven by Asia-Pacific (with a slowdown between Q1 and Q2

in Greater China), the Rest of the World, the UK and France.

In the second quarter, adjusted

revenue increased by +5.3% to €342.7 million. On an organic

basis, adjusted revenue increased by +5.9% compared to the same

period last year.

BILLBOARD

First half adjusted revenue

increased by +12.7% to €236.7 million (+2.5% on an organic

basis) driven by the Rest of the World with a market consolidation

in Russia which continues following the default in Moscow billboard

rent payments from some local operators paving the way for their

billboard panels to be taken down and leading to market share

gains. Finally, the lack of consolidation in Western Europe

continues to be a drag on revenue growth.

In the second quarter, adjusted

revenue increased by +10.2% to €133.6 million compared to

Q2 2015. On an organic basis, adjusted revenue were flat

compared to the same period last year.

ADJUSTED

OPERATING MARGIN (1)

In the first half of 2016,

adjusted operating margin decreased by -7.4% to €264.5 million

from €285.7 million in the first half of 2015. The adjusted

operating margin as a percentage of revenue was 16.4%, -320bp below

prior year.

| |

H1 2016 |

H1 2015 |

Change 16/15 |

| |

€m |

% of revenue |

€m |

% of revenue |

Change (%) |

Margin rate (bp) |

| Street

Furniture |

162.6 |

22.4% |

198.3 |

30.3% |

-18.0% |

-790bp |

|

Transport |

82.7 |

12.6% |

75.8 |

12.8% |

+9.1% |

-20bp |

|

Billboard |

19.2 |

8.1% |

11.6 |

5.5% |

+65.5% |

+260bp |

| Total |

264.5 |

16.4% |

285.7 |

19.6% |

-7.4% |

-320bp |

Street

Furniture: In the first half of 2016, adjusted operating margin

decreased by -18.0% to €162.6 million. As a percentage of

revenue, the adjusted operating margin decreased by -790bp to

22.4%, compared to the first half of 2015, mainly impacted by the

integration of CEMUSA, requiring some operational restructuring and

investments to turnaround the business, and the contract structure

of the world's largest bus shelter advertising franchise with TfL

in London.

Transport: In

the first half of 2016, adjusted operating margin increased by

+9.1% to €82.7 million. As a percentage of revenue, the

adjusted operating margin decreased by -20bp to 12.6% compared to

the first half of 2015, primarily due to the impact of CEMUSA's

airports concession in Spain which posted a negative margin.

Billboard: In

the first half of 2016, adjusted operating margin increased by

+65.5% to €19.2 million. As a percentage of revenue, adjusted

operating margin increased by +260bp to 8.1% compared to the first

half of 2015, driven by an accretive contribution of Continental

Outdoor Media and Russia.

ADJUSTED EBIT

(2)

In the first half of 2016,

adjusted EBIT before impairment charge decreased by -10.5% to

€120.5 million compared to €134.6 million in the first

half of 2015. As a percentage of revenue, this represented a -170bp

decrease to 7.5%, from 9.2% in H1 2015. The consumption of

maintenance spare parts was slightly up in H1 2016 compared to H1

2015. Net amortization and provisions were down compared to the

same period last year, thanks to a reversal on provisions for

onerous contracts, related to the Purchase Accounting of CEMUSA.

Other operating income and expenses impacted the P&L

negatively, mainly due to the restructuring costs spent for

CEMUSA's turnaround.

No impairment charge on goodwill and tangible, intangible assets

and investments under equity method has been recorded in the first

half of 2016 like in H1 2015. A €0.6 million reversal on

provisions for onerous contracts and a €0.1 million reversal

of amortization of tangible and intangible assets have been

recognized in H1 2016 (a €1.2 million reversal on

provisions for onerous contracts were booked in H1 2015).

Adjusted EBIT, after impairment

charge decreased by -10.8% to €121.2 million compared to

€135.8 million in H1 2015.

NET FINANCIAL

INCOME / (LOSS) (3)

In the first half of 2016, net

financial income was -€13.2 million compared to

-€13.1 million in the first half of 2015.

EQUITY

AFFILIATES

In the first half of 2016, the

share of net profit from equity affiliates was €45.7 million,

higher compared to the same period last year

(€29.4 million).

NET INCOME GROUP

SHARE

In the first half of 2016, net

income Group share before impairment charge increased by +1.8% to

€80.0 million compared to €78.6 million in H1 2015.

Taking into account the impact

from the impairment charge, net income Group share increased by

+1.1% to €80.4 million compared to €79.5 million in H1

2015.

ADJUSTED CAPITAL

EXPENDITURE

In the first half of 2016,

adjusted net capex (acquisition of property, plant and equipment

and intangible assets, net of disposals of assets) was at

€78.9 million compared to €107.9 million during the same

period last year with the Paris bus shelter investment.

ADJUSTED FREE

CASH FLOW (4)

In the first half of 2016,

adjusted free cash flow was €98.3 million compared to

€109.2 million in the same period last year. This decrease is

due to a lower operating margin, partly offset by favourable

movements from change in working capital and lower capex. Adjusted

free cash flow remained solid.

DIVIDEND

The dividend of €0.56 per share

for the 2015 financial year, approved at the Annual General Meeting

of Shareholders on 19th May 2016,

was paid on 26th May 2016,

for a total amount of €118.9 million.

NET DEBT

(5)

Net debt as of 30th June 2016

amounted to €547.0 million compared to a net debt position of

€62.7 million as of 30th June 2015.

BOND

ISSUE

JCDecaux has successfully placed

7-year notes for a principal amount of €750 million, maturing

on 1st June 2023.

The spread has been fixed at 80 basis points above the swap rate

leading to a coupon of 1.000%. Subscribed more than 3 times, this

note has been placed quickly with high quality investors.

The proceeds of this note will be dedicated to general corporate

purposes and particularly in anticipation of the maturity of the

current bond issue in February 2018 for €500 million.

ADJUSTED

DATA

Under IFRS 11, applicable from

1st January,

2014, companies under joint control are accounted for using the

equity method.

However in order to reflect the business reality of the Group,

operating data of the companies under joint control continue to be

proportionately integrated in the operating management reports used

to monitor the activity, allocate resources and measure

performance.

Consequently, pursuant to IFRS 8, Segment Reporting presented in

the financial statements complies with the Group's internal

information, and the Group's external financial communication

therefore relies on this operating financial information. Financial

information and comments are therefore based on "adjusted" data

which are reconciled with IFRS financial statements. As regards the

P&L, it concerns all aggregates down to the EBIT. As regards

the cash flow statement, it concerns all aggregates down to the

free cash flow.

In the first half of 2016, the

impact of IFRS 11 on our adjusted aggregates is:

-

-€202.6 million on adjusted revenue

(-€172.0 million in H1 2015) leaving IFRS revenue at

€1,414.7 million (€1,287.7 million in

H1 2015).

-

-€54.6 million on adjusted operating margin

(-€45.4 million in H1 2015) leaving IFRS operating margin

at €209.9 million (€240.3 million in H1 2015).

-

-€45.8 million on adjusted EBIT before

impairment charge (-€32.9 million in H1 2015) leaving

IFRS EBIT before impairment charge at €74.7 million

(€101.7 million in H1 2015).

-

-€45.8 million on adjusted EBIT after

impairment charge (-€32.9 million in H1 2015) leaving

IFRS EBIT after impairment charge at €75.4 million

(€102.9 million in H1 2015).

-

+€5.4 million on adjusted capital

expenditure (€19.4 million in H1 2015) leaving IFRS

capital expenditure at €73.5 million (€88.5 million in

H1 2015).

-

-€36.7 million on adjusted free cash flow

(-€13.7 million in H1 2015) leaving IFRS free cash flow

at €61.6 million (€95.5 million in H1 2015).

The full reconciliation between

IFRS figures and adjusted figures is provided on page 8 of

this release.

NOTES

-

Operating Margin: Revenue

less Direct Operating Expenses (excluding Maintenance spare parts)

less SG&A expenses.

-

EBIT: Earnings Before

Interests and Taxes = Operating Margin less Depreciation,

amortization and provisions (net) less Impairment of goodwill less

Maintenance spare parts less Other operating income and

expenses.

-

Net financial income /

(loss): Excluding the net impact of discounting and revaluation

of debt on commitments to purchase minority interests

(-€1.0 million and +€3.6 million in H1 2016 and

H1 2015 respectively).

-

Free cash flow: Net cash

flow from operating activities less capital investments (property,

plant and equipment and intangible assets) net of disposals.

-

Net debt: Debt net of

managed cash less bank overdrafts, excluding the non-cash IAS 32

impact (debt on commitments to purchase minority interests),

including the non-cash IAS 39 impact on both debt and hedging

financial derivatives.

Next information:

Q3 2016 revenue: 3rd November,

2016 (after market)

Key Figures for

JCDecaux

-

2015 revenue: €3,208m, H1

2016 revenue: €1,617m

-

JCDecaux is listed on the

Eurolist of Euronext Paris and is part of the Euronext 100

index

-

JCDecaux is part of the

FTSE4Good index

-

N°1 worldwide in street

furniture (524,580 advertising panels)

-

N°1 worldwide in transport

advertising with more than 230 airports and 280 contracts in

metros, buses, trains and tramways (395,770 advertising

panels)

-

N°1 in Europe for billboards

(177,760 advertising panels)

-

N°1 in outdoor advertising in

Europe (731,390 advertising panels)

-

N°1 in outdoor advertising in

Asia-Pacific (236,760 advertising panels)

-

N°1 in outdoor advertising in

Latin America (62,860 advertising panels)

-

N°1 in outdoor advertising in

Africa (32,840 advertising panels)

-

N°1 in outdoor advertising in

the Middle-East (16,280 advertising panels)

-

N°1 worldwide for self-service

bicycle hire: pioneer in eco-friendly mobility

-

1,129,410 advertising panels in

more than 75 countries

-

Present in 4,435 cities with

more than 10,000 inhabitants

-

Daily audience: more than

390 million people

-

12,850 employees

Forward looking

statements

This news release may contain some forward-looking statements.

These statements are not undertakings as to the future performance

of the Company. Although the Company considers that such statements

are based on reasonable expectations and assumptions on the date of

publication of this release, they are by their nature subject to

risks and uncertainties which could cause actual performance to

differ from those indicated or implied in such

statements.

These risks and uncertainties include without limitation the risk

factors that are described in the annual report registered in

France with the French Autorité des Marchés Financiers.

Investors and holders of shares of the Company may obtain copy of

such annual report by contacting the Autorité des Marchés

Financiers on its website www.amf-france.org or directly on the

Company website www.jcdecaux.com.

The Company does not have the obligation and undertakes no

obligation to update or revise any of the forward-looking

statements.

Communications Department:

Agathe Albertini

+33 (0) 1 30 79 34 99 - agathe.albertini@jcdecaux.com

Investor

Relations: Arnaud Courtial

+33 (0) 1 30 79 79 93 - arnaud.courtial@jcdecaux.com

RECONCILIATION

BETWEEN ADJUSTED FIGURES AND IFRS FIGURES

| Profit & Loss |

H1 2016 |

H1 2015 |

| €m |

Adjusted |

Impact of

companies under joint control |

IFRS |

Adjusted |

Impact of

companies under joint control |

IFRS |

| Revenue |

1,617.3 |

(202.6) |

1,414.7 |

1,459.7 |

(172.0) |

1,287.7 |

| Net

operating costs |

(1,352.8) |

148.0 |

(1,204.8) |

(1,174.0) |

126.6 |

1,047.4 |

| Operating margin |

264.5 |

(54.6) |

209.9 |

285.7 |

(45.4) |

240.3 |

|

Maintenance spare parts |

(21.6) |

0.5 |

(21.1) |

(20.1) |

0.5 |

(19.6) |

|

Amortization and provisions (net) |

(98.4) |

8.3 |

(90.1) |

(124.0) |

11.8 |

(112.2) |

| Other

operating income / expenses |

(24.0) |

- |

(24.0) |

(7.0) |

0.2 |

(6.8) |

| EBIT before impairment charge |

120.5 |

(45.8) |

74.7 |

134.6 |

(32.9) |

101.7 |

| Net

impairment charge (1) |

0.7 |

- |

0.7 |

1.2 |

- |

1.2 |

| EBIT after impairment charge |

121.2 |

(45.8) |

75.4 |

135.8 |

(32.9) |

102.9 |

(1) Including

impairment charge on net assets of companies under joint

control.

|

| |

|

|

|

|

|

|

| Cash-flow Statement |

H1 2016 |

H1 2015 |

| €m |

Adjusted |

Impact of

companies under joint control |

IFRS |

Adjusted |

Impact of

companies under joint control |

IFRS |

| Funds from operations net of maintenance costs |

160.7 |

(24.8) |

135.9 |

210.0 |

1.5 |

211.5 |

| Change in

working capital requirement |

16.5 |

(17.3) |

(0.8) |

7.1 |

(34.6) |

(27.5) |

| Net cash flow from operating activities |

177.2 |

(42.1) |

135.1 |

217.1 |

(33.1) |

184.0 |

| Capital

expenditure |

(78.9) |

5.4 |

(73.5) |

(107.9) |

19.4 |

(88.5) |

| Free cash flow |

98.3 |

(36.7) |

61.6 |

109.2 |

(13.7) |

95.5 |

| |

Half-year consolidated financial statements

| STATEMENT OF FINANCIAL POSITION |

|

|

|

| |

|

|

|

| Assets |

|

|

|

| |

|

|

|

| In million euros |

|

30/06/2016 |

31/12/2015 |

| |

|

|

|

|

Goodwill |

|

1,377.0 |

1,271.6 |

| Other

intangible assets |

|

285.5 |

300.2 |

| Property.

plant and equipment |

|

1,090.1 |

1,173.1 |

| Investments

under the equity method |

|

486.2 |

489.3 |

| Financial

investments |

|

0.7 |

0.8 |

| Other

financial assets |

|

108.1 |

108.5 |

| Deferred

tax assets |

|

122.4 |

48.6 |

| Current tax

assets |

|

1.5 |

1.2 |

| Other

receivables |

|

26.7 |

32.9 |

| NON-CURRENT ASSETS |

|

3,498.2 |

3,426.2 |

| Other

financial assets |

|

5.3 |

10.3 |

|

Inventories |

|

132.5 |

99.9 |

| Financial

instruments |

|

5.0 |

3.4 |

| Trade and

other receivables |

|

895.7 |

887.1 |

| Current tax

assets |

|

30.0 |

17.0 |

| Treasury

financial assets |

|

54.2 |

77.7 |

| Cash and

cash equivalents |

|

768.3 |

233.2 |

| CURRENT ASSETS |

|

1,891.0 |

1,328.6 |

| TOTAL ASSETS |

|

5,389.2 |

4,754.8 |

| Equity and Liabilities |

|

|

|

| |

|

|

|

| In million euros |

|

30/06/2016 |

31/12/2015 |

| |

|

|

|

| Share

Capital |

|

3.2 |

3.2 |

| Additional

paid-in capital |

|

594.7 |

587.0 |

|

Consolidated reserves |

|

1,604.4 |

1,492.6 |

|

Consolidated net income (Group share) |

|

80.4 |

233.9 |

| Other

components of equity |

|

(23.7) |

25.7 |

| EQUITY ATTRIBUTABLE TO OWNERS OF THE PARENT

COMPANY |

|

2,259.0 |

2,342.4 |

|

Non-controlling interests |

|

(9.4) |

(18.2) |

| TOTAL EQUITY |

|

2,249.6 |

2,324.2 |

|

Provisions |

|

412.4 |

302.4 |

| Deferred

tax liabilities |

|

95.0 |

80.0 |

| Financial

debt |

|

1,287.8 |

524.3 |

| Debt on

commitments to purchase non controlling interests |

|

89.0 |

86.9 |

| Other

payables |

|

17.3 |

9.9 |

| NON-CURRENT LIABILITIES |

|

1,901.5 |

1,003.5 |

|

Provisions |

|

78.1 |

41.2 |

| Financial

debt |

|

71.7 |

175.5 |

| Debt on

commitments to purchase non-controlling interests |

|

19.4 |

33.8 |

| Financial

instruments |

|

1.5 |

0.2 |

| Trade and

other payables |

|

1,028.6 |

1,118.8 |

| Income tax

payable |

|

25.3 |

42.8 |

| Bank

overdrafts |

|

13.5 |

14.8 |

| CURRENT LIABILITIES |

|

1,238.1 |

1,427.1 |

| TOTAL LIABILITIES |

|

3,139.6 |

2,430.6 |

| TOTAL EQUITY AND LIABILITIES |

|

5,389.2 |

4,754.8 |

STATEMENT OF COMPREHENSIVE

INCOME

INCOME STATEMENT

|

In million euros |

|

1st half of

2016 |

1st half of

2015 |

| REVENUE |

|

1,414.7 |

1,287.7 |

| Direct

operating expenses |

|

(968.6) |

(831.1) |

| Selling.

general and administrative expenses |

|

(236.2) |

(216.3) |

| OPERATING MARGIN |

|

209.9 |

240.3 |

|

Depreciation. amortisation and provisions (net) |

|

(89.4) |

(111.0) |

| Impairment

of goodwill |

|

0.0 |

0.0 |

| Maintenance

spare parts |

|

(21.1) |

(19.6) |

| Other

operating income |

|

4.2 |

1.9 |

| Other

operating expenses |

|

(28.2) |

(8.7) |

| EBIT |

|

75.4 |

102.9 |

| Financial

income |

|

3.1 |

5.9 |

| Financial

expenses |

|

(17.3) |

(15.4) |

| NET FINANCIAL INCOME (LOSS) (1) |

|

(14.2) |

(9.5) |

| Income

tax |

|

(20.4) |

(30.6) |

| Share of

net profit of companies under the equity method |

|

45.7 |

29.4 |

| PROFIT FROM CONTINUING OPERATIONS |

|

86.5 |

92.2 |

| Gain or

loss on discontinued operations |

|

0.0 |

0.0 |

| CONSOLIDATED NET INCOME |

|

86.5 |

92.2 |

| -

Including non-controlling interests |

|

6.1 |

12.7 |

| CONSOLIDATED NET INCOME (GROUP SHARE) |

|

80.4 |

79.5 |

| Earnings

per share (in euros) |

|

0.378 |

0.354 |

| Diluted

earnings per share (in euros) |

|

0.378 |

0.354 |

| Weighted

average number of shares |

|

212,445,454 |

224,353,599 |

| Weighted

average number of shares (diluted) |

|

212,772,099 |

224,789,653 |

(1) Excluding the

impact of put, the net financial income is €(13.2) million for the

first half of 2016, compared to €(13.1) million for the first half

of 2015.

STATEMENT OF OTHER COMPREHENSIVE

INCOME

|

In million euros |

1st half of

2016 |

1st half of

2015 |

| CONSOLIDATED NET INCOME |

86.5 |

92.2 |

| Translation

reserve adjustments on foreign operations (1) |

(38.2) |

75.7 |

| Translation

reserve adjustments on net foreign investments |

3.9 |

(0.5) |

| Cash flow

hedges |

1.4 |

(0.9) |

| Tax on the

other comprehensive income subsequently released to net income |

0.0 |

0.2 |

| Share of

other comprehensive income of companies under equity method (after

tax) |

(0.6) |

21.9 |

| Other comprehensive income subsequently released to net

income |

(33.5) |

96.4 |

| Change in

actuarial gains and losses on post-employment benefit plans and

assets ceiling |

(13.8) |

0.0 |

| Tax on the

other comprehensive income not subsequently released to net

income |

3.7 |

(0.1) |

| Share of

other comprehensive income of companies under equity method (after

tax) |

(6.4) |

(2.2) |

| Other comprehensive income not subsequently released to net

income |

(16.5) |

(2.3) |

| Total other comprehensive income |

(50.0) |

94.1 |

| TOTAL COMPREHENSIVE INCOME |

36.5 |

186.3 |

| - Including non-controlling interests |

5.6 |

14.3 |

| TOTAL COMPREHENSIVE INCOME - GROUP SHARE |

30.9 |

172.0 |

(1) For the first half

of 2016, translation reserve adjustments on foreign transactions

were mainly related to changes in exchange rates, of

which

€(28.7) million in the United Kingdom. The item also included a

€1.9 million transfer in the income statement of translation

reserve adjustments related to the changes in the scope of

consolidation.

For the first half of 2015, translation

reserve adjustments on foreign transactions were mainly related to

changes in exchange rates, of which

€23.8 million in the United Kingdom and €21.2 million in Hong

Kong. |

STATEMENT OF CASH FLOWS

| In million euros |

|

1st half of 2016 |

1st half of 2015 |

| |

|

|

|

| Net income

before tax |

|

106.9 |

122.8 |

| Share of

net profit of companies under the equity method |

|

(45.7) |

(29.4) |

| Dividends

received from companies under the equity method |

|

36.4 |

51.8 |

| Expenses

related to share-based payments |

|

2.0 |

1.5 |

|

Depreciation. amortisation and provisions (net) |

|

83.4 |

110.3 |

| Capital

gains and losses & net income (loss) on changes in scope |

|

1.5 |

0.1 |

| Net

discounting expenses |

|

3.2 |

(1.0) |

| Net

interest expense |

|

6.7 |

5.5 |

| Financial

derivatives. translation adjustments & other |

|

(6.6) |

13.0 |

| Change in working capital |

|

(0.8) |

(27.5) |

|

Change in inventories |

|

(33.0) |

(12.4) |

|

Change in trade and other receivables |

|

(0.4) |

(31.7) |

|

Change in trade and other payables |

|

32.6 |

16.6 |

| CASH PROVIDED BY OPERATING ACTIVITIES |

|

187.0 |

247.1 |

| Interest

paid |

|

(14.2) |

(15.9) |

| Interest

received |

|

2.7 |

3.8 |

| Income

taxes paid |

|

(40.4) |

(51.0) |

| NET CASH PROVIDED BY OPERATING ACTIVITIES |

|

135.1 |

184.0 |

| Cash

payments on acquisitions of intangible assets and property. plant

and equipment |

(74.6) |

(94.0) |

| Cash

payments on acquisitions of financial assets (long-term

investments) net of cash acquired (1) |

(84.6) |

(92.3) |

|

Acquisitions of other financial assets |

|

(3.8) |

(23.2) |

| Total investments |

|

(163.0) |

(209.5) |

| Cash

receipts on proceeds on disposal of intangible assets and property.

plant and equipment |

1.1 |

5.5 |

| Cash

receipts on proceeds on disposal of financial assets (long-term

investments) net of cash sold (1) |

0.0 |

1.5 |

| Proceeds on

disposal of other financial assets |

|

7.6 |

2.0 |

| Total asset disposals |

|

8.7 |

9.0 |

| NET CASH USED IN INVESTING ACTIVITIES |

|

(154.3) |

(200.5) |

| Dividends

paid |

|

(128.3) |

(120.3) |

| Purchase of

treasury shares |

|

0.0 |

(2.4) |

| Cash

payments on acquisitions of non-controlling interests |

|

(14.0) |

(0.2) |

| Repayment

of long-term borrowings |

|

(80.8) |

(170.3) |

| Repayment

of finance lease debt |

|

(3.9) |

(4.0) |

|

Acquisitions and disposals of treasury financial assets |

|

22.9 |

0.0 |

| Cash outflow from financing activities |

|

(204.1) |

(297.2) |

| Cash

receipts on proceeds on disposal of interests without loss of

control |

|

1.4 |

0.0 |

| Capital

increase |

|

5.9 |

16.6 |

| Increase in

long-term borrowings |

|

753.6 |

10.2 |

| Cash inflow from financing activities |

|

760.9 |

26.8 |

| NET CASH USED IN FINANCING ACTIVITIES |

|

556.8 |

(270.4) |

| CHANGE IN NET CASH POSITION |

|

537.6 |

(286.9) |

| Net cash position beginning of period |

|

218.4 |

783.2 |

| Effect of

exchange rate fluctuations and other movements |

|

(1.2) |

14.4 |

| Net cash position end of period (2) |

|

754.8 |

510.7 |

(1) Including €3.9

million of net cash acquired and sold for the 1st half

of 2016, compared to €10.8 million for the 1st half

of 2015.

(2) Including €768.3 million in

cash and cash equivalents and €13.5 million in bank overdrafts as

of 30 June 2016, compared to €526.2 million and €15.5 million,

respectively, as of 30 June 2015.

28-07-16 # H1 2016_UK_

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: JCDecaux via Globenewswire

HUG#2031245

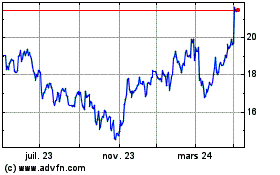

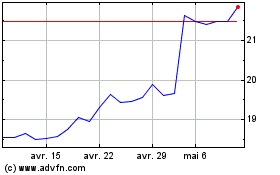

JCDecaux (EU:DEC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

JCDecaux (EU:DEC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024