NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR

INDIRECTLY, IN THE UNITED STATES OF AMERICA, AUSTRALIA, CANADA OR

JAPAN

This press release

does not constitute a solicitation to purchase or an offer of the

Bonds or the Shares (as defined below and together, the "Securities") in the United States of America or to, or

for the account or benefit of, U.S. Persons (as defined in

Regulation S under the US Securities Act of 1933, as amended). The

Securities may not be offered or sold in the United States of

America or to, or for the account or benefit of, U.S. Persons

unless they are registered or exempt from registration under the US

Securities Act of 1933, as amended. Michelin does not intend to

register all or any portion of the offering in the United States of

America or to conduct a public offering of the Securities in the

United States of America. The Securities may not be offered or sold

or otherwise made available to retail investors (no key information

document under PRIIPS Regulation will be prepared).

Clermont-Ferrand, January 19,

2018

Determination of

the initial conversion price of the non-dilutive cash-settled

convertible bonds due 2023

Following the placement on January

5, 2018 by Michelin of USD 600 million non-dilutive cash-settled

convertible bonds due 2023 (the "Bonds"):

-

the initial conversion price of the Bonds has

been set at EUR 167.4083;

-

the reference FX rate (EUR/USD) has been

determined to be equal to 1.21225;

-

the exercise price has been determined to be

equal to EUR 164,982.4706 (rounded in accordance with the

conditions of the Bonds); and

-

the initial conversion ratio has been determined

to be equal to 985.5095 per USD 200,000 principal amount of the

Bonds (rounded in accordance with the conditions of the

Bonds.

The initial conversion price

represents a premium of 30 % over the share reference price for the

Michelin share of EUR 128.7756, which was determined in the manner

described in the press announcements released on January 5,

2018.

Settlement and delivery of the

Bonds took place on January 10, 2018.

Investor Relations

Valérie Magloire

+33 (0) 1 78 76 45 37

+33 (0) 6 76 21 88 12 (cell)

valerie.magloire@michelin.com

Edouard de Peufeilhoux

+33 (0) 4 73 32 74 47

+33 (0) 6 89 71 93 73 (cell)

edouard.de-peufeilhoux@michelin.com

Matthieu Dewavrin

+33 (0) 4 73 32 18 02

+33 (0) 6 71 14 17 05 (cell)

matthieu.dewavrin@michelin.com

Humbert de Feydeau

+33 (0) 4 73 32 68 39

+33 (0) 6 82 22 39 78 (cell)

humbert.de-feydeau@fr.michelin.com

|

Media Relations

Corinne Meutey

+33 (0) 1 78 76 45 27

+33 (0) 6 08 00 13 85 (cell)

corinne.meutey@michelin.com

Individual Shareholders

Jacques Engasser

+33 (0) 4 73 98 59 08

jacques.engasser@michelin.com

|

DISCLAIMER

Available

information

The issue of the Bonds was not

subject to a prospectus approved by the French Financial Market

Authority (Autorité des marchés financiers)

(the "AMF"). Detailed information on Michelin,

including its Shares, business, results, prospects and related risk

factors are described in Michelin's registration document, the

French version of which was filed with the AMF on March 8, 2017

under number D.17-0131 (the "Reference

Document"). The Reference Document and Michelin's interim

financial report as at June 30, 2017, are available together with

all the press releases and other regulated information about

Michelin, on Michelin's website (https://www.michelin.com).

Important information

This press release may not be

published, distributed or released directly or indirectly in the

United States of America, Australia, Canada or Japan. The

distribution of this press release may be restricted by law in

certain jurisdictions and persons into whose possession any

document or other information referred to herein comes, should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction.

No communication or information

relating to the offering may be transmitted to the public in a

country where there is a registration obligation or where an

approval is required. No action has been or will be taken in any

country in which such registration or approval would be required.

The issuance or the subscription of the Bonds may be subject to

legal and regulatory restrictions in certain jurisdictions; none of

Michelin and the Joint Bookrunners assumes any liability in

connection with the breach by any person of such restrictions.

This press release is an

advertisement and not a prospectus within the meaning of Directive

2003/71/EC of the European Parliament and the Council of

November 4, 2003 as amended (the "Prospectus Directive").

The Bonds will be offered only by

way of a private placement in France to persons referred to in

Article L.411-2-II of the French monetary and financial code

(Code monétaire et financier) and outside

France (excluding the United States of America, Australia, Canada

and Japan), and there will be no public offering in any country

(including France). This press release does not constitute a

recommendation concerning the issue of the Bonds. The value of the

Bonds and the Shares can decrease as well as increase. Potential

investors should consult a professional adviser as to the

suitability of the Bonds for the person concerned.

Prohibition of

sales to European Economic Area retail

investors

No action has been undertaken or

will be undertaken to make available any Bonds to any retail

investor in the European Economic Area. For the purposes of this

provision:

-

the expression "retail investor" means a person

who is one (or more) of the following:

-

a retail client as defined in point (11) of

Article 4(1) of Directive 2014/65/EU (as amended, "MiFID II");

or

-

a customer within the meaning of Directive

2002/92/EC (as amended, the "Insurance Mediation Directive"),

where that customer would not qualify as a professional client as

defined in point (10) of Article 4(1) of MiFID II; or

-

not a qualified investor as defined in the

Prospectus Directive; and

-

the expression "offer" includes the

communication in any form and by any means of sufficient

information on the terms of the offer and the Bonds to be offered

so as to enable an investor to decide to purchase or subscribe the

Bonds.

Consequently no key information

document required by Regulation (EU) No 1286/2014 (as amended, the

"PRIIPs Regulation") for offering or selling

the Bonds or otherwise making them available to retail investors in

the EEA has been prepared and therefore offering or selling the

Bonds or otherwise making them available to any retail investor in

the EEA may be unlawful under the PRIIPS Regulation.

France

The Bonds have not been and will

not be offered or sold or cause to be offered or sold, directly or

indirectly, to the public in France. Any offer or sale of the Bonds

and distribution of any offering material relating to the Bonds

have been and will be made in France only to (a) persons providing

investment services relating to portfolio management for the

account of third parties (personnes fournissant le

service d'investissement de gestion de portefeuille pour compte de

tiers), and/or (b) qualified investors (investisseurs qualifiés) acting for their own account,

as defined in, and in accordance with, Articles L.411-1, L.411-2

and D. 411-1 of the French monetary and financial Code (Code monétaire et financier).

United Kingdom

This press release is addressed

and directed only (i) to persons located outside the United

Kingdom, (ii) to investment professionals as defined in Article

19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (the "Order"), (iii) to people designated by Article 49(2) (a)

to (d) of the Order or (iv) to any other person to whom this press

release could be addressed pursuant to applicable law (the persons

mentioned in paragraphs (i), (ii), (iii) and (iv) all deemed

relevant persons ("Relevant Persons")). The

Bonds are intended only for Relevant Persons and any invitation,

offer of contract related to the subscription, tender, or

acquisition of the Bonds may be addressed and/or concluded only

with Relevant Persons. All persons other than Relevant Persons must

abstain from using or relying on this document and all information

contained therein.

This press release is not a

prospectus which has been approved by the Financial Conduct

Authority or any other United Kingdom regulatory authority for the

purposes of Section 85 of the Financial Services and Markets Act

2000.

United States of America

This press release may not be

published, distributed or transmitted in the United States of

America (including its territories and dependencies, any State of

the United States of America and the District of Columbia). This

press release does not constitute or form a part of any offer or

solicitation to purchase for securities in the United States of

America or to, or for the account or benefit of, U.S. Persons (as

defined in Regulation S under the US Securities Act of 1933, as

amended (the "Securities Act"). The

securities mentioned herein have not been, and will not be,

registered under the Securities Act, the law of any state of the

United States of America and may not be offered or sold in the

United States of America or to, or for the account or benefit of,

U.S. Persons, except pursuant to an exemption from, or a

transaction not subject to, the registration requirements of the

Securities Act or the law of the above states. The Bonds will be

offered or sold only to non-U.S. persons in offshore transactions

outside of the United States of America, in accordance with

Regulation S of the Securities Act. Michelin does not

intend to register any portion of

the proposed offering in the United States of America and no public

offering will be made in the United States of America.

Australia, Canada

and Japan

The Bonds may not and will not be

offered, sold or purchased in Australia, Canada or Japan. The

information contained in this press release does not constitute an

offer of securities for sale in Australia, Canada or Japan.

The distribution of this press

release in certain countries may constitute a breach of applicable

law.

20180119_CP_Michelin_Prixde

l’emission obligataire 2023_EN

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Michelin via Globenewswire

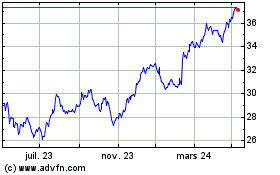

Michelin (EU:ML)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Michelin (EU:ML)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024