UPDATE: TomTom's Transition Not Progressing Quickly Enough

30 Septembre 2011 - 11:37AM

Dow Jones News

The diversification of Dutch navigation-equipment maker TomTom

NV (TOM2.AE) isn't progressing quickly enough, but the underlying

fundamentals of its business remain sound, Chief Executive Harold

Goddijn said in an interview Friday with television broadcaster

CNBC.

"We need to get through the transition. It's not going fast

enough, but in the meantime the underlying fundamentals are OK,"

Goddijn said. "It's hard work, but we'll get there and we'll have a

broader-based company going forward."

TomTom, which competes with Cayman Islands-based Garmin Ltd.

(GRMN), has suffered as demand for its devices has fallen because

consumers are increasingly navigating with smartphones and free

applications, such as Google Inc.'s (GOOG) maps.

TomTom is seeking to boost its growth with products other than

personal navigation devices. It has deals with car makers and sells

its own applications for smartphones. TomTom also is diversifying

into other products, such as devices that monitor sports, and

offers subscription services to the people who own its devices.

"It's very difficult to predict and say what the world will look

like in five years from now, but I think fundamentally what we're

doing is sound. We get traction in new businesses, so I think we

need to get through this transition," Goddijn said.

On Thursday, Corinne Vigreux, TomTom's managing director, said

she expects the decline in sales of its personal navigation devices

to stabilize as its customers start replacing devices with fancier

ones.

TomTom's shares have lost over 65% of their value this year as

the company had to cut its sales guidance twice. In the second

quarter, results were hit by a EUR512 million impairment charge on

mapping unit Tele Atlas, which it bought in 2007 for EUR2.9

billion. TomTom now has guidance for full year sales of between

EUR1.23 billion and EUR1.28 billion and earnings per share of

EUR0.25 to EUR0.30, excluding impairments.

When TomTom was listed in 2005 it was valued at close to EUR2

billion, or EUR17.50 per share. It shares reached an all-time high

of nearly EUR70 at the end of 2007, but have spiralled downward

since because the company overstretched its balance sheet when it

bought TeleAtlas.

It had to issue new shares in 2009 to raise over EUR400 million

to ease its debt burden. Dutch investment fund Cyrte Investments BV

and Janivo Holding BV bought an 8% stake for EUR6.12 per share,

while TomTom's management also still owns a large stake in the

company.

At 0903 GMT, TomTom's shares traded up EUR0.02, or 0.6%, at

EUR2.72, giving it a market cap of EUR603 million.

-By Robin van Daalen, Dow Jones Newswires; +31 20 571 52 01;

robin.vandaalen@dowjones.com

(Inti Landauro in Paris contributed to this article.)

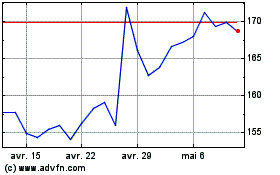

Alphabet (NASDAQ:GOOGL)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Alphabet (NASDAQ:GOOGL)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024