- 10.3% organic sales growth for the

first nine months of 2016, powered by the Americas and Asia-Pacific

regions:

- Sales reached €1,512 million

- Up 7.1% as reported

- All strategic lines contributed to

the dynamic performance

- FilmArray®:

480bps-contribution to consolidated organic growth for the first

nine months of 2016

Alexandre Mérieux, Chief Executive Officer, said: "bioMérieux

confirmed its strong sales dynamic over the third quarter and

continues to enhance its portfolio of innovative solutions for its

customers. Given this favorable environment and as announced upon

publication of its half-year results, bioMérieux should exceed its

annual 8% organic sales growth target."

Regulatory News:

bioMérieux (Paris:BIM), a world leader in the field of in vitro

diagnostics, today released its business review for the nine months

ended September 30, 2016.

SALES

Consolidated sales came in at €1,512 million for the nine months

ended September 30, 2016, up 10.3% like-for-like from €1,412

million for the same period one year earlier, and up 7.1% as

reported. Reported sales growth reflected a €32 million negative

currency effect, as well as the change in scope mainly resulting

from the deconsolidation of bioTheranostics as of January 1,

2016.

Analysis of sales

In € millions

Sales – Nine months ended September 30, 2015

1,412 Currency effect (31.9) -2.3% Organic growth (at

constant exchange rates and scope of consolidation) 143.7 +10.3%

}+9.5%

Changes in scope of consolidation* (11.6) -0.8%

Sales – Nine

months ended September 30, 2016 1,512 +7.1%

* Deconsolidation of bioTheranostics and consolidation of

Applied Maths as of January 1, 2016. Consolidation of Hyglos as of

June 1, 2016.

Organic growth remained strong in third-quarter 2016, as sales

gained 9.1% on the prior-year period. FilmArray® sales soared 78%,

spurred by accelerated growth of instrument sales. Business in

emerging countries, which accounted for around 25% of the Group's

sales in the third quarter, advanced 10.4% on the year-earlier

period.

Year-on-year trends in third-quarter and YTD nine-month sales

can be summarized by region as

follows:

Sales by

Region

In € millions

Q3 2016 Q3 2015 % changeas reported

% changeat constant exchange rates and scope of

consolidation

9 monthsendedSep. 30,

2016

9 months ended Sep. 30, 2015 % changeas reported

% changeat constant exchange rates and scope of

consolidation Europe(1)

201.6 203.8

-1.1%

+1.0% 618.8 618.8 +0.0%

+1.7% Americas

216.0 186.0 +16.1%

+17.6% 634.1 544.3 +16.5%

+19.6% North America

179.1 151.7 +18.0%

+18.4% 534.5 443.5 +20.9%

+20.5% Latin America

36.9 34.2 +7.8%

+14.2%

99.6 100.8 -1.2%

+14.0% Asia-Pacific

90.9 81.1 +12.0%

+11.6%

253.2 229.9 +10.1%

+12.2%

Total sales from the regions 508.5

470.9 +8.0%

+9.4% 1,506.2

1,393.0 +8.1%

+10.4% bioTheranostics 5.1 14.0

Applied Maths

1.1 2.5 R&D-related revenue

1.2 2.3

3.0

4.5

TOTAL 510.8

478.3 +6.8%

+9.1% 1,511.7

1,411.5 +7.1%

+10.3%

(1) Including the Middle East and Africa.

- The Americas (42% of the YTD

consolidated total) continued to enjoy strong momentum in the

third quarter of 2016, with sales rising 17.6% year-on-year to

€216 million for the period. Sales gained 19.6% year-on-year over

the nine months to September 30, representing €634 million.

- In North America (35% of the YTD

consolidated total), sales came in at €179 million, up more

than 18% year-on-year. Growth in this region continues to be

primarily driven by the rapid development of molecular biology,

mainly through the installation of new FilmArray® systems. Growth

was also buoyed by sales of VIDAS® immunoassay reagents and to a

lesser extent by microbiology reagents.

- In Latin America, third-quarter

sales came in at €37 million, up 14.2% year-on-year in a volatile

currency environment. The good sales dynamic observed in Brazil and

Argentina gathered pace in the third quarter, while the region's

other countries confirmed the trends apparent at the beginning of

the year.

- Sales in the Europe – Middle East –

Africa region (41% of the YTD consolidated total) came to

€202 million for the third quarter, up 1% year-on-year. YTD

sales for the nine months ended September 30 came in at €619

million for the period, a rise of 1.7% compared to the first nine

months of 2015.

- In Western Europe (35% of the

YTD consolidated total), third-quarter sales were 0.7% higher

yearon-year, at €170 million. Germany reported sales growth of

around 5%, offset by the slowdown in France and in certain Southern

European countries. Although organic growth remains satisfactory,

sales in the United Kingdom fell sharply as reported in the third

quarter, hit by a negative currency effect. Market conditions

encountered by the Company in Western Europe are expected to remain

complex in the next quarter.

- Year-on-year sales growth in the

Eastern Europe – Middle East – Africa region was 2.7% for

the third quarter, with good performances in Africa (particularly

Algeria and Tunisia) more than offsetting slower growth in Turkey

and declining sales in the Middle East.

- In the Asia-Pacific region (17%

of the YTD consolidated total), sales ended the third quarter at

€91 million, up 11.6% year-on-year. Sales were 12.2% higher

year-on-year over the nine months ended September 30, at €253

million.

- China, India and South

Korea are the main drivers of growth in the region, posting

gains of close to or over 15%. Sales were driven mainly by the

fast-paced development of industrial applications and by advances

in reagents for VIDAS® immunoassay and clinical microbiology lines.

bioMérieux nevertheless expects growth to slow in the fourth

quarter after this sharp acceleration.

- Sales in Southeast Asia and

particularly Indonesia slowed in the third quarter due to a high

basis of comparison in the same period of last year.

Year-on-year third-quarter and YTD nine-month sales trends can

be summarized by application as

follows:

Sales by

Application

In € millions

Q3 2016 Q3 2015 % changeas reported

% changeat constant exchange rates and scope of

consolidation

9 monthsendedSep. 30,

2016

9 months ended Sep. 30, 2015 % changeas reported

% changeat constant exchange rates and scope of

consolidation

Clinical Applications 405.6

374.3 +8.4%

+9.8% 1,203.7

1,114.9 +8.0%

+10.3% Microbiology

222.6

216.2 +3.0%

+4.2% 649.3 632.5 +2.7%

+5.2%

Immunoassays(1)

108.4 105.7 +2.6%

+4.4% 327.5

315.9 +3.7%

+6.2% Molecular Biology(2)

73.5 50.3

+46.3%

+48.0% 223.0 158.2 +40.9%

+42.1% Other

1.1 2.2 -50.6%

-47.4% 3.9 8.2 -52.6%

-52.3% Industrial Applications 93.6 87.5 +7.0%

+8.7% 275.2 260.3 +5.7%

+8.1% bioTheranostics

5.1 14.0 BioFire Defense

9.3 9.1 +1.7%

+1.9%

27.3 17.9 +52.9%

+53.0% Applied Maths

1.1

2.5 R&D-related revenue

1.2 2.3

3.0 4.5

TOTAL 510.8 478.3

+6.8%

+9.1% 1,511.7 1,411.5

+7.1%

+10.3%

(1) Including VIDAS®: up 6.7% at constant exchange rates and

scope of consolidation in the third quarter and up 8.3% over

nine months.(2) Including FilmArray® sales in an amount of €56

million in the third quarter and €169 million for the nine months

ended September 30.

- Sales of clinical applications,

which account for approximately 80% of the consolidated total,

stood at €406 million for the third quarter, up 9.8% year-on-year.

Clinical application sales represented €1,204 million for the

nine months to September 30, up 10.3% year-on-year.

- Microbiology sales in

third-quarter 2016 were chiefly driven by sales of the BacT/ALERT®

blood culture line and the latest VIRTUO™ line, which increased by

more than 12% year-on-year, and to a lesser extent by culture

media. Sales of the VITEK® automated bacterial identification and

antibiotic susceptibility line continued to grow in all

regions.

- In immunoassays, VIDAS® sales

climbed 6.7% in third-quarter 2016, led by growing sales of

reagents in the Asia-Pacific and Americas regions. This momentum

was driven mainly by growth in high medical value markers and by

the line’s expansion in emerging markets.

- Molecular biology sales in the

third quarter jumped by almost 50%, buoyed by growth in the

FilmArray® line on the back of an expansion in installations

(installed base of almost 3,500 units), and the success of the

Gastro-Intestinal Panel. Ex-U.S. sales continued to enjoy

fast-paced growth, representing around 10% of total FilmArray®

sales for the first nine months of the year. In the third quarter,

bioMérieux obtained clearance from the Chinese Food and Drug

Administration (CFDA) to market and sell its FilmArray® 2.0

system. The panels are still being reviewed by the local

authorities.

- Industrial applications sales

came in at €94 million in third-quarter 2016, up 8.7%

year-on-year. Sales were €275 million for the first nine months of

the year, up 8.1% on the same period in 2015, buoyed by a good

contribution from all regions and certain dynamic countries

including the United States, China, Argentina and Italy. The robust

performance of the VIDAS®, VITEK® and culture media lines drove an

increase in sales to the food industry, which outpaced the increase

in sales of culture media and flow cytometry solutions to the

pharmaceutical industry.

- Over the first nine months of 2016, the

product mix continued to benefit from organic growth in sales of

reagents and services, which rose by 10.9%

year-on-year, and from a 4% gain in instruments.

OTHER INFORMATION

Net debt amounted to €272 million at September 30,

2016, including the €42 million lease financing agreement booked

after the commissioning of the Marcy l’Etoile, France site

extension, versus €219 million at December 31, 2015.

THIRD-QUARTER OPERATING HIGHLIGHTS

- Production and quality

system

On July 8, France's ANSM drug regulatory agency notified

bioMérieux that it had lifted the injunction letter issued in

February 2015 following completion by bioMérieux of compliance work

on certain production units at the facility in Craponne,

France.

- Next generation

BacT/ALERT® VIRTUO™ blood culture system gets

CE-marked and is submitted to the FDA for 510(k) clearance

In July, bioMérieux announced the CE-marking of an updated

release of its innovative BacT/ALERT® VIRTUO™ automated blood

culture system, featuring new capabilities.

The next generation system features blood level detection that

directly measures the blood volume added to each blood culture

bottle at loading time, to track and ensure collection of the

recommended blood volume. The new system can also combine up to

three additional incubator subunits connected to a command module

in a single BacT/ALERT® VIRTUO™ bank, thereby creating an

integrated configuration. This scalable configuration can incubate

between 428 and 1,712 cells, enabling the management of high

volumes of up to 100,000 blood culture bottles per year with a

single entry point.

This new BacT/ALERT® VIRTUO™ system has been submitted to the

U.S. Food and Drug Administration (FDA) for 510(k) clearance.

- Pathogen identification capability

on VITEK® MS broadened to mycobacteria, Nocardia, and

molds

bioMérieux has announced the launch of the first CE-marked

database and reagent kits for the identification of mycobacteria,

Nocardia, and molds in a mass spectrometry system. These

difficult-to-identify organisms require days or weeks of specific

culture conditions for appropriate growth and subsequent advanced

methods for reliable identification to species level.

The VITEK® MS extended database now enables the identification

within minutes of 1,046 species representing 15,172 distinct

strains of bacteria, yeasts and molds. It is part of a fully

integrated solution combining identification with VITEK® MS and

antibiotic susceptibility testing with VITEK® 2, resulting in

superior laboratory workflow management.

SUBSEQUENT EVENTS

- Launch of EviSight™ Compact, a new

automated diagnostic solution for microbial detection in

pharmaceutical production

On October 6, bioMérieux announced the launch of EviSight™

Compact, an intelligent incubation system providing real-time

culture media reading. For use in pharmaceutical industry R&D

and production settings, EviSight™ Compact combines incubation,

intelligent automated detection and enumeration of colonies of

bacteria, yeasts and molds in a single system. This innovative

launch results from bioMérieux's acquisition of Advencis

(Strasbourg, France) in October 2014.

- BIOASTER, bioMérieux, ESPCI, GSK,

Hospices Civils de Lyon and Sanofi join forces against

sepsis

On October 10, bioMérieux announced that it had signed up to the

REALISM (REAnimation Low Immune Status Markers) research program

alongside BIOASTER, the French institute for microbiology

technology innovation, ESPCI (Paris College of Physics and

Industrial Chemistry), GSK, the Hospices Civils de Lyon (HCL) and

Sanofi. The program is to be conducted within BIOASTER and the

joint research laboratory HCL-bioMérieux, and aims to identify and

validate new biomarkers for improving care of patients presenting a

high risk of sepsis. The highly original combination of public and

private research combines medical expertise, academic research as

well as diagnostic and pharmaceutical innovation in order to fight

this public health threat.

- FilmArray® Respiratory

Panel EZ receives FDA clearance for professional use outside

laboratories

On October 11, bioMérieux announced that BioFire Diagnostics,

LLC, its molecular biology affiliate, received U.S. FDA 510(k)

clearance and Clinical Laboratory Improvement Amendments (CLIA)

waiver for the FilmArray® Respiratory Panel EZ (FilmArray® RP EZ).

The CLIA waiver permits use of the test outside traditional

clinical laboratories in sites such as physician's offices and

urgent care centers.

FilmArray® RP EZ detects 11 viral and 3 bacterial pathogens

associated with upper respiratory infections from a single patient

sample and is a simplified version of the CE-marked FDA-cleared

FilmArray® Respiratory Panel. The FilmArray® RP EZ will be

available on the U.S. market only, BioFire anticipates commercial

launch in November 2016.

- Lyme disease diagnostic

tests

Like other IVD companies, bioMérieux has been summoned to appear

before the Paris Regional Court (Tribunal de Grande Instance de

Paris) by 45 patients claiming compensation for anxiety prejudice

allegedly “generated by a lack of reliability of serodiagnostic

tests” for Lyme disease.

bioMérieux will object to the requests made under the subpoena,

which, in light of the available information, appears to be

unfounded. The Company is unable to reliably estimate the financial

consequences of this civil case at this stage in the

proceedings.

INVESTOR CALENDAR

Fourth-quarter 2016 sales: January 19, 2017, before start of

trading

The above forward-looking statements are based, entirely or

partially, on assessments or judgments that may change or be

modified, due to uncertainties and risks related to the Company's

economic, financial, regulatory and competitive environment,

notably those described in the 2015 Registration Document.

Accordingly, the Company cannot give any assurance nor make any

representation as to whether the objectives will be met. The

Company does not undertake to update or otherwise revise any

forecasts or objectives presented herein, except in compliance with

the disclosure obligations applicable to companies whose shares are

listed on a stock exchange.

ABOUT BIOMÉRIEUX

Pioneering Diagnostics

A world leader in the field of in vitro diagnostics for more

than 50 years, bioMérieux is present in more than 150 countries

through 42 subsidiaries and a large network of distributors. In

2015, revenues reached €1,965 million with 90% of sales

outside of France.

bioMérieux provides diagnostic solutions (reagents, instruments,

software) which determine the source of disease and contamination

to improve patient health and ensure consumer safety. Its products

are mainly used for diagnosing infectious diseases. They are also

used for detecting microorganisms in agri-food, pharmaceutical and

cosmetic products.

bioMérieux is listed on the Euronext Paris stock market(Symbol:

BIM/Reuters: BIOX.PA/Bloomberg: BIM.FP – ISIN: FR0010096479).

Corporate website: www.biomerieux.com. Investor website:

www.biomerieux-finance.com.

APPENDIX: QUARTERLY SALES DATA

Sales by Region in € millions

First quarter Second quarter Third quarter

Full-year 2016 2015 2016

2015 2016 2015 2016 2015 Europe(1)

206.9 204.0 210.3 210.9 201.6

203.8 618.8 618.8 Americas 212.8 176.5 205.3 181.9

216.0 186.0 634.1 544.3 North America 182.9 144.7 172.5 147.1 179.1

151.7 534.5 443.5 Latin America 29.9 31.8 32.9 34.8 36.9 34.2 99.6

100.8 Asia-Pacific 67.4 61.9 95.0 86.9

90.9 81.1 253.2 229.9

Total sales

from the regions 487.1 442.4

510.6 479.6 508.5

470.9 1,506.2 1,393.0

bioTheranostics 4.1 4.8

5.1 14.0 Applied Maths

0.6 0.7 1.1

2.5 R&D-related revenue 0.8

1.4 1.0 0.8 1.2 2.3 3.0

4.5

TOTAL 488.5 447.9

512.3 485.3 510.8

478.3 1,511.7 1,411.5

(1) Including the Middle East and Africa.

% Change in Sales by Region

First quarter Second quarter Third quarter

Full-year As reported Like-for-like

As reported Like-for-like As reported

Like-for-like As reported Like-for-like Europe(1)

+1.4% +2.4% -0.3% +1.7% -1.1%

+1.0% +0.0% +1.7% Americas +20.6% +22.5% +12.9%

+18.8% +16.1% +17.6% +16.5% +19.6% North America +26.4% +24.0%

+17.3% +20.3% +18.0% +18.4% +20.9% +20.5% Latin America -6.0%

+15.9% -5.6% +12.5% +7.8% +14.2% -1.2% +14.0% Asia-Pacific

+8.9% +10.7% +9.3% +13.9% +12.0%

+11.6% +10.1% +12.2%

Total sales from the

regions +10.1% +11.6%

+6.5% +10.4% +8.0%

+9.4% +8.1% +10.4%

bioTheranostics

Applied Maths

R&D-related revenue

TOTAL +9.1% +11.5%

+5.6% +10.3% +6.8%

+9.1% +7.1% +10.3%

(1) Including the Middle East and Africa.

Sales by Application in € millions

First quarter Second quarter Third quarter

Full-year 2016 2015 2016

2015 2016 2015 2016 2015 Clinical

Applications 392.9 356.8 405.3 383.8

405.6 374.3 1,203.7 1,114.9 Microbiology 206.9

198.1 219.9 218.2 222.6 216.2 649.3 632.5 Immunoassays 104.1 97.6

115.1 112.6 108.4 105.7 327.5 315.9 Molecular Biology(1) 80.2 57.6

69.3 50.3 73.5 50.3 223.0 158.2 Other 1.7 3.5 1.1 2.6 1.1 2.2 3.9

8.2 Industrial Applications 86.0 82.5 95.5

90.3 93.6 87.5 275.2 260.3

bioTheranostics 4.1 4.8

5.1 14.0 BioFire Defense

8.2 3.1 9.8 5.6 9.3 9.1

27.3 17.9 Applied Maths 0.6

0.7 1.1 2.5

R&D-related revenue 0.8 1.4 1.0

0.8 1.2 2.3 3.0 4.5

TOTAL

488.5 447.9 512.3

485.3 510.8 478.3

1,511.7 1,411.5

(1) Including FilmArray® sales.

% Change in Sales by Application

First quarter Second quarter Third quarter

Full-year As reported Like-for-like(2)

As reported Like-for-like(2) As reported

Like-for-like(2) As reported Like-for-like

Clinical Applications +10.1% +11.6% +5.6%

+9.6% +8.4% +9.8% +8.0% +10.3%

Microbiology +4.4% +6.7% +0.8% +4.9% +3.0% +4.2% +2.7% +5.2%

Immunoassays +6.6% +8.6% +2.1% +6.1% +2.6% +4.4% +3.7% +6.2%

Molecular Biology(1) +39.2% +37.1% +37.6% +42.0% +46.3% +48.0%

+40.9% +42.1% Other -50.7% -51.6% -57.0% -57.7% -50.6% -47.4%

-52.6% -52.3% Industrial Applications +4.1% +6.1%

+5.8% +9.4% +7.0% +8.7% +5.7%

+8.1% bioTheranostics

BioFire Defense x 2.7 x 2.6

+73.9% +76.6% +1.7% +1.9% +52.9%

+53.0% Applied Maths

R&D-related revenue

TOTAL +9.1% +11.5%

+5.6% +10.3% +6.8%

+9.1% +7.1% +10.3%

(1) Including FilmArray® sales.(2) At constant exchange rates

and scope of consolidation.

NB: Unless otherwise stated, growth

is expressed year-on-year at constant exchange rates and scope of

consolidation (like-for-like).

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161019006547/en/

Investor RelationsbioMérieuxSylvain Morgeau, +33

(0)4 78 87 22 37investor.relations@biomerieux.comorMedia

RelationsbioMérieuxAurore Sergeant, +33 (0)4 78 87 54

75media@biomerieux.comorImage SeptLaurence Heilbronn, +33

(0)1 53 70 74 64lheilbronn@image7.frorClaire Doligez, +33 (0)1 53

70 74 48cdoligez@image7.fr

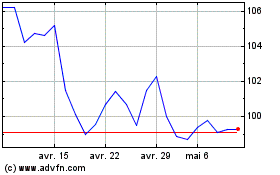

Biomerieux (EU:BIM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Biomerieux (EU:BIM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024