- Solid growth in sales, up 10.7% at

constant exchange rates and scope of consolidation

- €1,674 million in sales

- Up 10.8% as reported

- In microbiology, growth accelerated

to nearly 8%

- Contribution from all regions to the

Group's strong sales dynamic, particularly the Asia-Pacific region,

with sales in China and India up almost 15%

Alexandre Mérieux, Chief Executive Officer, said: "Third-quarter

growth for bioMérieux once again reflected the strong sales dynamic

we have enjoyed for several quarters. Robust growth for the

microbiology lines and sustained growth for the molecular biology

lines pushed sales up by more than 10% for the first nine months of

the year, placing us firmly on track to achieving our annual

targets."

Regulatory News:

bioMérieux (Paris:BIM), a world leader in the field of in vitro

diagnostics, today released its business review for the nine months

ended September 30, 2017.

SALES

Consolidated sales came in at €1,674 million for the nine months

ended September 30, 2017, up 10.8% as reported on the €1,512

million posted for the same period in 2016. The positive currency

effects seen in the first six months of the year were almost

entirely offset by the negative currency effects reported in the

third quarter as the euro strengthened against a number of

currencies, notably the U.S. dollar. At constant exchange rates and

scope of consolidation, organic growth came to 10.7%

year-on-year.

Analysis of sales

In € millions

Sales - Nine months ended September 30, 2016

1,512 Currency effect(1) +1 +0.1% Organic growth (at

constant exchange rates and scope of consolidation) +162 +10.7%

Sales - Nine months ended September 30, 2017

1,674 +10.8%

(1) Currency effects are established by

converting actual numbers at the average rates of year y-1.

Inpractice, those rates are either average rates communicated by

the ECB, or hedged rates if hedginginstruments have been set

up.

Third-quarter 2017 sales for bioMérieux rose 9.6% on

third-quarter 2016, lifted by another period of fast-paced growth

for the BIOFIRE FILMARRAY® line, both in the United States and in

the rest of the world. Sales were also underpinned by solid growth

for microbiology lines VITEK® and BACT/ALERT®, especially in China

and the United States, as well as by the rapid development of

industrial applications across all regions worldwide.

Sales for the third quarter and first nine months of 2017 may be

summarized by region as follows:

Sales by Region

In € millions

Q32017

Q32016

% changeas reported

% changeat constantexchangerates

andscope ofconsolidation

9monthsendedSep.

30,2017

9monthsendedSep. 30,2016

% changeas reported

% changeat constantexchangerates

andscope ofconsolidation

Europe(1)

206.8 201.6 +2.5%

+3.4% 638.9 618.8

+3.2%

+3.9% Americas

229.6 216.0 +6.3%

+12.3%

743.6 634.1 +17.3%

+16.5% North America

191.4

179.1 +6.9%

+13.1% 630.1 534.5 +17.9%

+17.6%

Latin America

38.2 36.9 +3.6%

+8.3% 113.5 99.6

+14.0%

+10.9% Asia-Pacific

102.0 90.9

+12.2%

+17.8% 286.8 253.2

+13.2%

+13.7% Total sales from the regions

538.4 508.5 +5.9%

+9.7%

1,669.3 1,506.2 +10.8%

+10.8%

Applied Maths

0.5 1.1

2.8 2.5 R&D-related revenue

1.1 1.2

2.3

3.0

Total consolidated

sales 540.0 510.8 +5.7%

+9.6% 1,674.4 1,511.7 +10.8%

+10.7%

(1) Including the Middle East and

Africa.

- Operations in the Americas (44%

of the YTD consolidated total) continued to deliver a robust

performance in the third quarter of 2017, with sales rising 12.3%

year-on-year on an organic basis to €230 million. Reported sales

for the quarter climbed by around 6% as the U.S. dollar weakened

against the euro, and increased 16.5% year-on-year over the nine

months ended September 30 to stand at €744 million.

- In North America (38% of the YTD

consolidated total), despite a potentially difficult business

environment for laboratories following cuts in certain healthcare

reimbursements, sales made firm progress, driven by the rapid

development of BIOFIRE FILMARRAY® and by the installation of VITEK®

MS mass spectrometry systems for the rapid identification of

disease-causing bacteria. Sales for immunoassay reagents also

continued to grow, albeit at a slower pace than in the two previous

periods as competition for the VIDAS® B•R•A•H•M•S PCT™ assay

intensified. Lastly, sales to industrial customers were buoyant,

resulting in double-digit growth. BioFire Defense sales were

impacted by the deferral of certain research contracts.

- In Latin America, all

subsidiaries contributed to growth for the region, boosted by the

market roll-out of the BIOFIRE FILMARRAY® line. Growth in Brazil

was highly satisfactory, notably thanks to billing for a major

public call for tenders in immunoassays.

- Sales in the Europe – Middle East –

Africa region (38% of the YTD consolidated total) came to

€207 million for the third quarter, up 3.4% year-on-year, and

to €639 million for the first nine months, up 3.9%

year-on-year.

- In Western Europe (32% of the

YTD consolidated total), sales benefited in full from the extensive

range and strong fit of bioMérieux's portfolio of solutions:

subsidiaries in the United Kingdom and Germany focused on

developing their business with industrial customers, with growth in

France, Italy and Switzerland underpinned by clinical applications,

particularly the deployment of the offering for microbiology

laboratory automation systems and molecular biology sales.

- Third-quarter 2017 sales increased by

close to 8% year-on-year in the Eastern Europe – Middle East –

Africa region, where strong performances in Turkey, South

Africa and Middle East countries more than offset the slowdown seen

in Africa as a whole.

- In the Asia-Pacific region (17%

of the YTD consolidated total), sales came to €102 million in the

third quarter of 2017, up by nearly 18% on the same period in 2016,

and increased 13.7% year-on-year over the nine months ended

September 30 to stand at €287 million.

- The performance in China was

outstanding in the third quarter, fueled by solid growth for

reagents and instruments alike. All clinical and industrial lines

contributed to the strong sales dynamic.

- Southeast Asia repeated the

strong sales performance seen in the second quarter, with growth

nearing 40% for the third quarter. In India, the

implementation of the new Goods & Services Tax bill resulted in

slightly weaker growth in the third quarter, essentially triggering

a lag in sales for certain instruments.

Year-on-year trends in third-quarter and YTD nine-month 2017

sales may be summarized by application

as follows:

Sales by Application

In € millions

Q32017

Q32016

% changeas reported

% changeat constantexchangerates

andscope ofconsolidation

9monthsendedSep.

30,2017

9monthsendedSep. 30,2016

% changeas reported

% changeat constantexchangerates

andscope ofconsolidation

Clinical Applications 434.1 405.6 +7.0%

+11.0%

1,351.4 1,203.7 +12.3%

+12.2% Microbiology

236.2 222.6 +6.1%

+9.7% 700.3 649.3 +7.8%

+7.7% Immunoassays(1)

105.9 108.4 -2.3%

+0.9%

338.5 327.5 +3.4%

+3.5% Molecular Biology(2)

90.5 73.5 +23.1%

+29.4% 308.5 223.0 +38.3%

+37.8% Other lines

1.5 1.1 +42.7%

+28.9%

4.2 3.9 +7.9%

+18.3% Industrial Applications

100.1 93.6 +7.0%

+10.6% 302.5 275.2 +9.9%

+10.3% BioFire Defense

4.1 9.3 -56.0%

-52.8%

15.4 27.3 -43.8%

-44.0% Applied Maths

0.5 1.1

2.8 2.5 R&D-related revenue

1.1 1.2

2.3 3.0

Total consolidated sales 540.0

510.8 +5.7%

+9.6% 1,674.4

1,511.7 +10.8%

+10.7%

(1) Including VIDAS®: up 0.1% at constant

exchange rates and scope of consolidation in the third quarter and

up 3.9% over ninemonths.

(2) Including FILMARRAY®: €74 million in

the third quarter and €257 million for the nine months ended

September 30.

- Sales of clinical applications,

which account for approximately 80% of the consolidated total, rose

by 11.0% year-on-year to €434 million in the third quarter,

and increased 12.2% year-on-year over the nine months ended

September 30 to stand at €1,351 million.

- Microbiology sales in

third-quarter 2017 increased by almost 10%, accelerating on the

back of the remarkable performance of the VITEK® line for automated

identification and antibiotic susceptibility testing, reflecting

both demand for reagents and sales of new instruments. The

BACT/ALERT® blood culture line and the WASP® and WASPLab™

microbiology laboratory automation systems also actively

contributed to microbiology sales during the quarter.

- In immunoassays, VIDAS® sales

were stable year-on-year in the third quarter of 2017. While

performance remained robust in the Asia-Pacific region, notably in

China, business was nonetheless penalized by a decline in sales in

other regions, and more specifically by the drop in instrument

sales and a slowdown in growth for reagent sales in North America.

All told, sales grew by around 4% over the first nine months of

2017.

- The development of bioMérieux's

molecular biology lines remained very robust, driven by

demand for BIOFIRE FILMARRAY® menu panels, particularly the

Gastrointestinal and Meningitis/Encephalitis panels. The deployment

of the solution outside of the United States continued apace. Sales

in the rest of the world accounted for 13% of total sales for the

BIOFIRE FILMARRAY® line, and close to one-third of new systems

installations were carried out outside of the United States over

the quarter.

- Sales of industrial

applications, which represent around 18% of consolidated sales,

increased 10.6% year-on-year to €100 million in third-quarter 2017,

and by more than 10.3% year-on-year over the nine months ended

September 30 to represent €302.5 million. The strong growth seen in

the third quarter was boosted by an acceleration in pharmaceutical

industry sales, notably for culture media, the CHEMUNEX® cytometry

line and the BACT/ALERT® blood culture line. Growth in sales for

the food industry was also sustained, reflecting the rapid

development of VIDAS® and VITEK®.

- Sales of reagents and services

increased 8.6% in the third quarter of 2017 and accounted for

approximately 90% of the consolidated total. Instrument sales

increased sharply by around 19%.

OTHER INFORMATION

- Net debtNet debt amounted to

€180 million at September 30, 2017 versus €275 million at

December 31, 2016.

THIRD-QUARTER OPERATING HIGHLIGHTS

- Successful closeout of FDA warning

letter related to Durham, NC facility

During the quarter, bioMérieux received the closeout letter from

the U.S. Food & Drug Administration related to the 2012 warning

letter of its Durham, North Carolina facility dedicated to the

manufacturing of the BACT/ALERT® blood culture bottles.

bioMérieux is dedicated to advancing public health and continues

to invest in its Durham facility to increase and enhance the

manufacturing capabilities and capacities. Recently, this

manufacturing site has been expanded to add a new production line

in response to the growing demand for our BACT/ALERT® blood culture

products due to the global rise of blood borne infections,

including sepsis and antibiotic-resistant infections.

Since the beginning of 2017, several manufacturing sites (Marcy

L’Etoile, La Balme, Firenze, Lombard, Verniolle, Grenoble) have

been inspected by multiple regulatory agencies, including the US

FDA, Chinese FDA and Brazil’s ANVISA, with only one non-conformity

identified across all site inspections.

- bioMérieux and LUMED sign a

partnership agreement to help hospitals manage the use of

antibiotics and prevent antibiotic-resistant infections

bioMérieux, a world leader in microbiology, and Lumed, a leading

edge software firm specialized in healthcare, have signed a

partnership for the distribution of the APSS (Antimicrobial

Prescription Surveillance System) and DATA software suites designed

by Lumed. Drawing on data imported from each patient's electronic

health record, the APSS is a computerized clinical decision-support

system designed to assist antimicrobial stewardship teams to

monitor clinical information, as soon as information becomes

available, and verify that the ongoing treatment remains

appropriate In a recently published study1, the implementation of

the APSS software in the Sherbrooke University Hospital in Canada

has demonstrated a sustained reduction of 20% of antimicrobial

use.

The agreement gives bioMérieux the rights to market the software

in Canada, the United States and Europe, and thereby enrich its

line-up of solutions dedicated to antimicrobial resistance, which

is a major global healthcare threat.

- Launch of new tests to assess

antibiotic susceptibility: ETEST®

Ceftolozane/Tazobactam and ETEST®

Ceftazidime/Avibactam

bioMérieux has recently launched two new test strips to

determine, using Minimum Inhibitory Concentration (or MIC) values,

the susceptibility of Multi-Drug Resistant Organisms (MDRO) to

antibiotics. ETEST® Ceftolozane/Tazobactam and ETEST®

Ceftazidime/Avibactam strips are used to assess the susceptibility

of Gram-negative aerobic bacteria such as Enterobacteriaceae and

P. aeruginosa to new antibiotics indicated in the treatment of

infections in adult patients for whom there are limited therapeutic

options. MDROs are a serious and growing healthcare threat. In this

context, MIC is a key piece of information for selecting

appropriate antibiotic therapy and optimizing dosage, particularly

for patients with a critical health condition.

_______________1 Antimicrob Chemother doi:10.1093/jac/dkw468

INVESTOR CALENDAR

Fourth-quarter 2017 sales: January 23, 2018, before start of

trading

The above forward-looking statements are based, entirely or

partially, on assessments or judgments that may change or be

modified, due to uncertainties and risks related to the Company's

economic, financial, regulatory and competitive environment,

notably those described in the 2016 Registration Document.

Accordingly, the Company cannot give any assurance nor make any

representation as to whether the objectives will be met. The

Company does not undertake to update or otherwise revise any

forecasts or objectives presented herein, except in compliance with

the disclosure obligations applicable to companies whose shares are

listed on a stock exchange.

ABOUT BIOMÉRIEUX

Pioneering Diagnostics

A world leader in the field of in vitro diagnostics for more

than 50 years, bioMérieux is present in more than 150 countries

through 42 subsidiaries and a large network of distributors. In

2016, revenues reached €2,103 million, with over 90% of

international sales.

bioMérieux provides diagnostic solutions (systems, reagents,

software) which determine the source of disease and contamination

to improve patient health and ensure consumer safety. Its products

are mainly used for diagnosing infectious diseases. They are also

used for detecting microorganisms in agri-food, pharmaceutical and

cosmetic products.

bioMérieux is listed on the Euronext Paris stock market

Symbol: BIM - ISIN Code: FR0013280286

Reuters: BIOX.PA/Bloomberg: BIM.FP

Corporate website: www.biomerieux.com. Investor website:

www.biomerieux-finance.com.

APPENDIX: QUARTERLY SALES DATA

Sales by Region in € millions

First quarter Second quarter

Third quarter YTD 2017 2016

2017 2016 2017 2016 2017

2016 Europe(1) 216.9 206.9 215.2 210.3 206.8

201.6 638.9 618.8 Americas 267.5 212.8 246.5 205.3 229.6

216.0 743.6 634.1 North America 230.9 182.9 207.7 172.5 191.4 179.1

630.1 534.5 Latin America 36.6 29.9 38.8 32.9 38.2 36.9 113.5 99.6

Asia-Pacific 81.6 67.4 103.2 95.0

102.0 90.9 286.8 253.2

Total sales

from the regions 566.0 487.1

564.9 510.6 538.4

508.5 1,669.3 1,506.2 Applied

Maths 1.6 0.6 0.6 0.7 0.5

1.1 2.8 2.5 R&D-related revenue 0.4

0.8 0.8 1.0 1.1 1.2 2.3

3.0

Total consolidated sales 568.0

488.5 566.4 512.3

540.0 510.8 1,674.4 1,511.7

(1) Including the Middle East and

Africa.

% Change in Sales by Region

First quarter Second quarter Third quarter

YTD As reported Like-for-like As

reported Like-for-like As reported

Like-for-like As reported Like-for-like Europe(1)

+4.9% +5.4% +2.3% +2.8% +2.5%

+3.4% +3.2% +3.9% Americas +25.8% +20.6% +20.1%

+17.0% +6.3% +12.3% +17.3% +16.5% North America +26.3% +21.9%

+20.4% +17.7% +6.9% +13.1% +17.9% +17.6% Latin America +22.4%

+12.1% +18.0% +13.3% +3.6% +8.3% +14.0% +10.9% Asia-Pacific

+21.0% +17.5% +8.7% +7.1% +12.2%

+17.8% +13.2% +13.7%

Total sales from the

regions +16.2% +13.7%

+10.7% +9.3% +5.9%

+9.7% +10.8% +10.8% Applied

Maths

R&D-related revenue

Total consolidated sales +16.3%

+13.7% +10.5% +9.1%

+5.7% +9.6% +10.8%

+10.7%

(1) Including the Middle East and

Africa.

Sales by Application in € millions

First quarter Second quarter

Third quarter YTD 2017 2016

2017 2016 2017 2016 2017

2016 Clinical Applications 460.7 405.3 456.6 405.3

434.1 405.6 1,351.4 1,203.7 Microbiology 229.2 219.9

234.8 219.9 236.2 222.6 700.3 649.3 Immunoassays 111.7 115.1 120.8

115.1 105.9 108.4 338.5 327.5 Molecular biology(1) 118.6 69.3 99.4

69.3 90.5 73.5 308.5 223.0 Other lines 1.2 1.1 1.5 1.1 1.5 1.1 4.2

3.9 Industrial Applications 100.2 95.5 102.2

95.5 100.1 93.6 302.5 275.2

BioFire Defense 5.1 9.8 6.2 9.8

4.1 9.3 15.4 27.3 Applied Maths 1.6

0.7 0.6 0.7 0.5 1.1 2.8

2.5 R&D-related revenue 0.4 1.0 0.8

1.0 1.1 1.2 2.3 3.0

Total

consolidated sales 568.0 512.3

566.4 512.3 540.0

510.8 1,674.4 1,511.7

(1) Including FILMARRAY® sales.

% Change in Sales by Application

First quarter Second quarter

Third quarter YTD As reported

Like-for-like(2) As reported Like-for-like(2)

As reported Like-for-like(2) As reported

Like-for-like Clinical Applications +17.3% +14.7% +12.7%

+11.2% +7.0% +11.0% +12.3% +12.2% Microbiology

+10.8% +8.1% +6.8% +5.5% +6.1% +9.7% +7.8% +7.7% Immunoassays +7.4%

+5.9% +5.0% +4.0% -2.3% +0.9% +3.4% +3.5% Molecular biology(1)

+47.8% +43.4% +43.5% +40.3% +23.1% +29.4% +38.3% +37.8% Other lines

-30.7% -2.4% +33.0% +37.5% +42.7% +28.9% +7.9% +18.3% Industrial

Applications +16.7% +14.5% +7.1% +6.4%

+7.0% +10.4% +9.9% +10.3% BioFire

Defense -38.3% -40.4% -36.8% -38.6%

-56.0% -52.8% -43.8% -44.0% Applied

Maths

R&D-related revenue

Total consolidated sales +16.3%

+13.7% +10.5% +9.1%

+5.7% +9.6% +10.8%

+10.7%

(1) Including FILMARRAY® sales.

(2) At constant exchange rates and scope

of consolidation.

NB: Unless otherwise stated, growth

is expressed year-on-year at constant exchange rates and scope of

consolidation (like-for-like).

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171017006858/en/

Investor RelationsbioMérieuxSylvain Morgeau, + 33

4 78 87 22 37investor.relations@biomerieux.comorMedia

RelationsbioMérieuxAurore Sergeant, + 33 4 78 87 20

53media@biomerieux.comorImage SeptLaurence Heilbronn, + 33 1

53 70 74 64lheilbronn@image7.frorClaire Doligez, + 33 1 53 70 74

48cdoligez@image7.fr

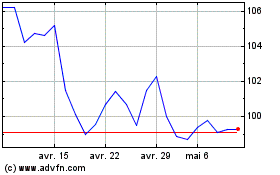

Biomerieux (EU:BIM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Biomerieux (EU:BIM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024