Why This Crypto Bull Run Might Not Live Up To The Past: Analyst

03 Mai 2024 - 3:30PM

NEWSBTC

In a detailed analysis shared with his 788,000 followers on X

(formerly Twitter), renowned analyst Pentoshi has forecasted a more

restrained outlook for the current crypto bull run, suggesting that

it may not mirror the explosive growth seen in previous cycles. His

insights provide a deep dive into the underlying factors that could

temper the market’s performance. Why Crypto Investors Have To

Expect Diminishing Returns Pentoshi began his analysis by stating,

“This cycle should have the largest diminishing returns of any

cycle,” attributing this prediction to several key market

conditions. Primarily, he noted that the base market capitalization

for cryptocurrencies has increased significantly in each successive

cycle, setting a higher starting point that makes further

exponential growth increasingly challenging. “Each cycle has set a

floor about 10x the previous lows in terms of market cap,” Pentoshi

explained. He provided a historical context, recounting that when

he entered the crypto market in 2017, the market cap for altcoins

was only around $12-15 billion, a figure that ballooned to over $1

trillion during peak periods. He argued, “That growth isn’t

repeatable,” pointing out that the decentralized finance (DeFi)

sector, which was then nascent, played a significant role in

driving previous cycles’ exceptional returns. Related Reading: Buy

Crypto In May, Go Away: Arthur Hayes Shares His Top Altcoin Picks

Another significant factor Pentoshi highlighted is the dramatic

increase in the number of altcoins and the corresponding market

dilution. “Today, however, there are a lot more alts, and a lot

more dilution,” he remarked, indicating that the proliferation of

new tokens spreads investment thinner across the market, reducing

the potential for individual tokens to achieve substantial price

increases. Pentoshi also touched upon the demographic shifts in

crypto ownership. He contrasted the early days of crypto adoption,

when approximately 2% of Americans were involved in the market, to

the present, where over 25% of Americans have some form of crypto

investment. “It just requires more capital to move the markets, and

there will continue to be a lot more alts, spreading it out

further,” he noted, emphasizing the logistical and financial

challenges of replicating past growth rates in a much more

saturated market. An often-overlooked aspect of market dynamics,

according to Pentoshi, is the role of token liquidity and its

impact on price stability. He detailed that recently, tokens

amounting to about $250 million were unlocked daily, though not

necessarily sold. “Assuming they all got sold, that is the inflows

you’d need just to keep prices stable for 24 hours,” he explained,

highlighting the delicate balance required to maintain current

market levels, let alone drive prices upward. Related Reading:

Crypto Prediction Website Reveals When The Cardano Price Will Reach

$45 Looking forward, Pentoshi was conservative in his expectations

for the Total3 index, which tracks the top 125 altcoins (excludes

Bitcoin and Ethereum). He estimated, “My best guess is that this

cycle we don’t see Total 3 go 2x past the 21′ cycle ATH. So 2.2T

max for Total3.” This projection underscores his broader thesis

that while the market continues to offer daily opportunities, the

era of “easy, outsized gains” might be behind us. Pentoshi

concluded his analysis with advice for investors, suggesting a more

cautious approach to market participation. “If you believe the

cycle is 50% over, you should be taking out more than you are

putting in and building up some cash and buying other assets with

lower risk in the meantime,” he advised, stressing the importance

of securing gains and diversifying holdings to mitigate risk.

Reflecting on the psychological aspects of investing, he added,

“Most people never really learn. Because if you can’t control your

greed, and defeat it, you are destined to give back your gains

repeatedly.” His parting words were a reminder of the cyclical and

often predatory nature of financial markets, urging investors to

secure profits and protect themselves from foreseeable downturns.

At press time, TOTAL3 stood at $635.565 billion, which is still

more than -43 % below the last cycle high. Featured image from

iStock, chart from TradingView.com

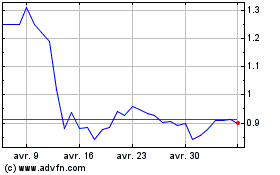

Flow (COIN:FLOWUSD)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Flow (COIN:FLOWUSD)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024