Bank Of England Keeps Rate On Hold For Fifth Time

21 Mars 2024 - 10:42AM

RTTF2

The Bank of England maintained its key policy rate for the fifth

straight session on Thursday, with no members seeking a hike as

inflation is expected to ease faster than expected. The Monetary

Policy Committee, led by Governor Andrew Bailey, voted 8-1 to keep

the bank rate unchanged at 5.25 percent. No members called for a

tightening this time.

The current bank rate is the highest since early 2008.

Swati Dhingra sought a quarter point reduction to 5.00 percent.

The policymaker assessed that waiting for more reassurance before

reducing Bank Rate would weigh further on living standards and

supply capacity. Policymakers said the MPC remained prepared to

adjust monetary policy as warranted by economic data to return

inflation to the 2 percent target sustainably.

"…the Committee would keep under review for how long Bank Rate

should be maintained at its current level," the central bank

said.

The MPC stuck to its stance saying that monetary policy will

need to remain restrictive for sufficiently long. The BoE's status

quo decision came after the US Federal Reserve retained its policy

rate on Wednesday.

In Europe, the Swiss National Bank surprised markets earlier on

Thursday with an unexpected interest rate cut. The SNB had lowered

the policy rate by a quarter-point.

UK inflation has fallen to a near two-and-a-half year low of 3.4

percent in February on easing food price inflation.

The BoE projected CPI inflation to fall slightly below the 2

percent target in the second quarter of 2024, marginally weaker

than previously expected owing to the freeze in fuel duty announced

in the Budget.

Capital Economics' economist Ruth Gregory said inflation will

fall further and faster than the BoE expects and this will change

the central bank's tune in the coming months. The economist

forecast the apex bank to cut the rate in June and the rate to fall

to 3.00 percent next year.

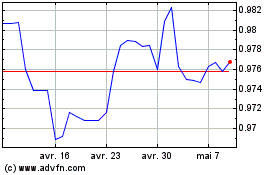

Euro vs CHF (FX:EURCHF)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs CHF (FX:EURCHF)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024