U.S. Dollar Higher On Fed Remarks

26 Juin 2024 - 3:06PM

RTTF2

The U.S. dollar moved up against its major counterparts in the

New York session on Wednesday, as hawkish comments from Fed

officials lowered expectations for rate cuts this year.

On Tuesday, Fed Governor Michelle Bowman has warned of upside

risks to the inflation outlook while her colleague Lisa Cook said

it will be appropriate to reduce interest rates "at some

point."

Investors await the release of the U.S. personal consumption

expenditures (PCE) price index, the Fed's preferred measure of

inflation, to assess rate cut trajectory.

Reports on durable goods orders, pending home sales, weekly

jobless claims and final GDP are due on Thursday.

President Joe Biden and former President Donald Trump will

participate in the first presidential debate to be held on

Thursday.

Data from the Commerce Department showed that U.S. new home

sales saw a substantial decrease in the month of May.

New home sales plunged by 11.3 percent to an annual rate of

619,000 in May after jumping by 2.0 percent to a revised rate of

698,000 in April.

Economists had expected new home sales to rise to an annual rate

of 640,000 from the 634,000 originally reported for the previous

month.

The greenback climbed to a multi-year high of 160.82 against the

yen and a 2-week high of 0.8983 against the franc, off its early

lows of 159.60 and 0.8938, respectively. The greenback is seen

finding resistance around 163.00 against the yen and 0.92 against

the franc.

The greenback appreciated to a 1-1/2-month high of 1.2617

against the pound and near a 2-month high of 1.0666 against the

euro, from its early lows of 1.2693 and 1.0717, respectively. The

next possible resistance for the greenback is seen around 1.24

against the pound and 1.05 against the euro.

The greenback rose to a 2-day high of 1.3703 against the loonie

and a 1-1/2-month high of 0.6076 against the kiwi, reversing from

its early lows of 1.3647 and 0.6128, respectively. The currency is

likely to locate resistance around 1.39 against the loonie and 0.58

against the kiwi.

The greenback recovered to 0.6640 against the aussie, from an

early 2-week low of 0.6688. Next key resistance for the currency is

seen around the 0.64 level.

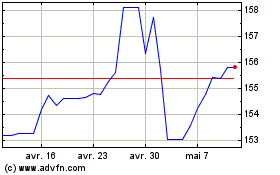

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Mai 2024 à Juin 2024

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Juin 2023 à Juin 2024