Time To Get Regional With Bond ETFs - Top Yielding ETFs

10 Janvier 2012 - 12:01PM

Zacks

Bond ETF investing is continuing to gain popularity with a

number of investors thanks to the strong performance in the asset

class during 2011. Broad funds such as AGG and BND, which both

track a broad benchmark of fixed income securities that trade in

the U.S., have both put up solid performances over the last twelve

months of 4.6% and 4.3%, respectively. This is in sharp contrast to

SPY which finished the year flat and only managed to do so after a

late surge in the fourth quarter of the year. Given this stock

underperformance and the broad uncertainty starting off 2012, it

may be worth it for most investors to take another look at the bond

ETF space for their portfolios.

While AGG and BND are both decent choices, a relatively new trio

of bond ETFs could merit further inspection. All three of these

products allow investors to gain assorted fixed income exposure

while also diversifying out of dollars as well. This could help

investors to not only boost yields, but gain a more varied profile

in their bond components as well (also see Go Local With Emerging

Market Bond ETFs). Furthermore, all three offer exposure to more

than just one country suggesting that even if a single nation’s

bond market falters, it isn’t likely to hurt the overall

performance of the fund too much. If this strategy sounds

promising, any of the following three bond ETFs could make for

great additions to a well-diversified portfolio:

WisdomTree Asia Local Debt Fund (ALD)

For a broad play on the Asia-Pacific bond markets—outside of

Japan—ALD is one of the few options available. The fund seeks to

give investors a high level of total returns consisting of both

income and capital appreciation, investing in local currency

denominated debt in 12 different nations. The basket of nations

includes a 50/50 split among developed markets (South Korea, Hong

Kong, Singapore, Taiwan, Australia, and New Zealand) and emerging

countries (Malaysia, Indonesia, Philippines, Thailand, India, and

China) which should also help the fund balance between safety and

growth (see Top Three Emerging Market Consumer ETFs).

For individual country holdings, six nations roughly make up

about 11% each while all countries are allocated at least 5% of the

portfolio. For the big allocations, assets flow into Malaysia,

Thailand, and Indonesia on the emerging side, and Australia, South

Korea and Singapore on the developed. Given the perceived risky

nature of many of these economies, most bonds are shorter term in

nature. As a result, the effective duration on the fund is just

2.75 years but the 30-Day SEC Yield is at a pretty solid 2.25%.

Market Vectors LatAm Aggregate Bond ETF (BONO)

For those looking to make a play on the Latin American market,

BONO is truly the only option available. The fund tracks the BofA

Merrill Lynch Broad Latin America Bond Index which is composed of

external and local currency Latin American sovereign debt and the

external debt of non-sovereign Latin American issuers denominated

in USD or Euros. The fund holds 32 securities in total and charges

an expense ratio of 49 basis points a year for its services (see

Brazil Small Cap ETF Showdown).

Currently, securities from the two giants of Latin

America—Brazil and Mexico—dominate the holdings of the fund making

up 37% and 29.8% of the benchmark, respectively. Beyond these two,

however, one gets high levels of exposure to smaller economies in

the region such as an 11.5% weighting to Colombia and a 6.5%

weighting to Venezuela. Additionally, it should be noted that this

fund includes far higher weightings to junk securities than either

of its counterparts on the list as well as a solid level of

exposure to corporate bonds. Thanks to the corporates and high

level of junk bond exposure, the fund has a far higher yield than

the other two on the list, paying out 5.8% in 30 Day SEC Yield

terms. However, investors should also note that the fund does put

close to 60% of its assets in U.S. denominated securities,

suggesting that the fund may not be a very good way to diversify

out of greenbacks but it could be the regional bond ETF ticket to

higher yields.

WisdomTree EuroDebt Fund (EU)

This active ETF looks to give investors a high level of total

returns consisting of both income and capital appreciation. EU

seeks to do this by purchasing Treasury debt of a variety of

European countries, all of which have their bonds denominated in

euros. Currently, the fund holds 38 types of securities in total

and it charges investors a rock bottom expense ratio of 35 basis

points a year (read EUFN: The Best ETF For The Euro Crisis).

In terms of individual country holdings, bonds from three

countries—Germany, France, and Luxembourg—are the only ones to take

up more than 12% of the assets, although Finnish, Belgian and broad

euro bonds all make up at least 8% as well. For individual

securities, mid-term French government bonds—which both have

coupons in the 4.0-4.25% range, take the top two spots, both they

are closely trailed by longer-term government bonds which have a

coupon of 4.75%. Despite the focus on longer-term securities in the

top few securities, the rest of the holdings profile has a more

short-term focus. This gives the fund an effective duration of 5.9

years but a slightly lower yield of just 2.1%, meaning that while

interest rate risk isn’t too high, neither is the current

income.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

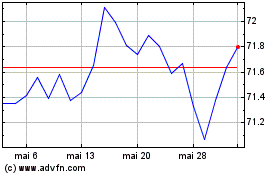

Vanguard Total Bond Market (NASDAQ:BND)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

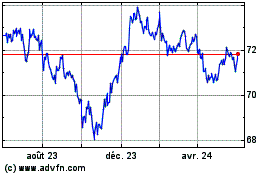

Vanguard Total Bond Market (NASDAQ:BND)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024