The domestic bond market in the U.S. has witnessed material

shifts in the recent past. Perceived as one of the ‘safest’

investment avenues in the world, the U.S. Dollar denominated

Treasury Bonds have a long tradition of being the ultimate savior

for the investors seeking refuge from the turmoil in the global

economy.

To start with, let us consider the past five years. The gloomy

days of the 2008 sub-prime crisis are still fresh in the memories

of investors worldwide. Not only did it threaten to doom the entire

U.S. financial system, but also caused massive losses across major

stock exchanges across the globe. (read 3 Safe Havens to Weather

the Storm)

In October 2008, when Lehman Brothers filed a bankruptcy

petition (which marked the beginning of the crisis), the benchmark

10 year Treasury rates were hovering near 3.82% levels around. As a

result of global risk aversion and widespread fear among investors,

the yields dropped sharply to end the year at around 2.25%

level.

Similarly, the 20 year Treasury rates plummeted to 3.05% from

4.50% and the 30 year Treasury rates to 2.69% from 4.21% as of

those dates. Of course the rates rebounded on account of fresh

stimulus from monetary authorities to tackle the ongoing crisis and

restore growth. (read How Low Can Yields Go?)

Looking at the present scenario--the U.S Treasury Bonds

(especially the long dated ones) have witnessed a significant rally

in the past one year, mainly thanks to the Eurozone debt crisis and

economic slowdown in most parts of the world. Due to a sharp

increase in volatility in the equity markets across the board the

investors shifted to a ‘flight to safety’ mode. (see Three Low

Volatility ETFs For Stormy Markets)

The sovereign rating of the U.S. was downgraded to ‘AA+’ by

rating agency Standard and Poor’s back in August last fiscal.

Technically it was supposed to push interest rates upwards due to

the added default risk premium; however, rates continued to plunge

on account of the worsening debt situation across the Atlantic,

making the U.S. Treasury bonds the ultimate safe haven.

As a result, income seeking bond investors are forced to look at

other investment options for their current income needs, during

times of low yields.

Thankfully, there are a variety of choices available to

investors in the exchange traded funds category. Preferred stocks

ETFs can make for a great source of current income. PFF

currently yields 5.80% and is up by

10.86% on year-to-date basis. Also,

PGF has a solid annual distribution yield

of 6.62% and has returned 13.40% so far this year. (read

Complete Guide to Preferred Stock ETF Investing)

However, preferred stock ETFs are not very popular investment

vehicles, mainly thanks to the highly complex and hybrid nature of

these instruments. Moreover, the issuers of preferred stocks are

mostly from the banking industry, who issue these securities to

strengthen their Tier I capital. Many investors are still hesitant

to invest in the banking industry, given the current volatile state

of the economy.

We would like to highlight seven products from the ETF industry,

targeting the bond space. These presently yield more than the

benchmark 10 year Treasury rates of 1.83%. These

ETFs provide investors with a basket of securities from various

issuers across different maturity buckets.

However, these seven ETFs vary across different genres, weighted

average duration and residual maturities. Therefore each of these

products demands a different risk appetite and time horizon. Below

is a table which summarizes the types, performances and interest

rate sensitivity of each of these products, followed by a brief

discussion about each of these ETFs.

|

ETF

|

Type

|

1 Year Returns (as on 30th June)

|

Year Till Date Returns (as on 30th

June)

|

Average Duration

|

Average Maturity

|

Yield

|

|

ELD

|

Emerging Market Bond

|

-2.28%

|

4.66%

|

4.4 yrs

|

5.14 yrs

|

3.61%

|

|

BND

|

Total Bond Market

|

6.87%

|

2.60%

|

5.1 yrs

|

7.1 yrs

|

2.93%

|

|

BIV

|

Total Market (Intermediate Term)

|

9.64%

|

3.92%

|

6.4 yrs

|

7.3 yrs

|

3.57%

|

|

EMB

|

Emerging Market Bond

|

9.74%

|

7.60%

|

7.59 yrs

|

12.08 yrs

|

4.45%

|

|

LQD

|

Corporate Bond

|

11.40%

|

5.14%

|

7.78 yrs

|

12.06 yrs

|

3.89%

|

|

VCLT

|

Corporate Bond

|

19.89%

|

5.72%

|

13.9 yrs

|

24.4 yrs

|

4.28%

|

|

EDV

|

Government Treasury

|

64.45%

|

8.06%

|

26.3 yrs

|

24.7 yrs

|

2.65%

|

In the past one year we have seen a considerable fall in yields,

not only across Treasury bonds but also across corporate bonds.

Therefore not surprisingly, as we climb up the yield curve, the

returns tend to improve (as can be seen from the table above). For

example, BND which has an average duration of 5.1 years and an

average maturity of 7.1 years has returned 6.78% in the past one

year. However, during the same time period, EDV has returned 64.45%

with average duration of 26.3 years and average maturity of 24.7

years.

Fixed income securities at the longer end of the yield curve

(having a higher duration) tend to outperform their shorter end

peers in a falling interest rates scenario since they are more

sensitive to interest rates.

For investors seeking true emerging market exposure in the fixed

income security space, the WisdomTree Emerging Markets

Local Debt ETF (ELD) is truly the appropriate option. The

ETF tracks the performance of domestic debt securities denominated

in local currencies from a variety of emerging markets. Though

emerging markets have a higher economic growth rate than developed

markets, investing in emerging market debt securities would mean

taking an additional amount of risk in the form of default risk

premium. This is also because most emerging markets sovereign debt

ratings are inferior to those of developed nations. (read Emerging

Markets Sovereign Bond ETFs: Safe With Attractive Yields)

Of course, investors are compensated for this in the form of

higher yields. Also, investments in ELD would constitute of high

levels of currency risk, as the assets of the ETF are denominated

in a variety of currencies.

Nevertheless, with a distribution yield of 3.61%, ELD ensures

high levels of current income and diversification in terms of

country exposure. Brazil, Chile, Columbia, Mexico, Peru and Poland

are some of the countries which the ETF is exposed to.

ELD was launched in August of 2010 and has managed to amass

$1.20 billion in total assets. It charges investors 55 basis points

in fees and expenses and has an average daily volume of 221,947

shares.

Also targeting the emerging market bond space is the

iShares J.P. Morgan USD Emerging Markets Bond

(EMB). It tracks the performance of the U.S. Dollar

denominated emerging market bonds as defined by the J.P. Morgan

EMBI Global Core Index. The index limits exposure to countries

which have higher debt and allocates more to countries with lower

debt levels. (see Japanese Bond ETF Investing 101)

It also takes into account various other factors pertaining to

liquidity and issuing bodies in order to include securities in its

portfolio. EMB allocates almost evenly across a variety of emerging

markets, some of which include Brazil (7.62%), Mexico (7.32%),

Russia (7.24%), Turkey (7.06%) and Philippines (6.95%).

The ETF charges 60 basis points in fees and expenses and has

total assets of $5.20 billion. However, while comparing it to its

counterpart ELD, it has certain added advantages like1) absence of

currency risk which may somewhat limit returns potential, 2) a

superior distribution yield of 4.45%. EMB was launched in December

of 2007 and has an average daily volume of 664,865 shares.

Now let us look at the total bond market

ETFs. The Vanguard Total Bond Market ETF

(BND) and the Vanguard Intermediate-Term Bond ETF

(BIV) are two offerings by Vanguard in the total bond

market space. Total bond market ETFs provide hybrid exposure across

the entire bond market and measure the performance of investment

grade debt securities which are issued by corporates, government

and other institutions.

BIV targets the intermediate end of the yield curve and holds

securities of residual maturities between 5 to 10 years. It tracks

the Barclays Capital U.S. 5-10 Year Government/Credit Bond Index

and the portfolio comprises of 52.7% of U.S Government Bonds. BIV

also adds an international flavor to its portfolio

as around 47.3% of the portfolio is comprised of securities issued

by other international bond market participants.

On the other hand BND tracks the pre expense price and yield

performance of the Barclays Capital U.S. Aggregate Bond Index. The

index measures the performance of only those investment grade

securities which are traded in the U.S domestic bond

market. A major portion of its portfolio is allocated

towards the U.S treasuries (69.7%).

The difference in allocations towards the U.S. Treasuries

between BIV and BND explains the difference in yields. Since U.S.

Treasuries are generally low yielding, the fund that allocates more

towards them i.e. BND has a lower yield of 2.93%, whereas BIV which

allocated less than BND to the U.S sovereign bonds have a superior

yield of 3.57%. (see Three Impressive Small Cap Dividend ETFs)

Both the ETFs charge expense ratios which are lower than the

category average of 0.23%. BND charges 10 basis points whereas BIV

charges 0.11% in fees and expenses. From a holdings perspective,

both the ETFs hold a relatively large number of securities in their

portfolio. BND holds 5230 securities whereas the portfolio for BIV

consists of around 1338 investment grade securities.

Both these total bond market ETFs share a similar position in

the yield curve. Although both ETFs were launched around the same

time on April 2007, in terms of popularity and liquidity BND

clearly is the leader. BND’s total assets are $17.36 billion

compared to BIV with $3.15 billion in total assets. BND has an

average daily volume of 1.18 million shares whereas roughly 262,541

shares of its cousin exchange hands each day.

Like Treasury bonds, US corporate bonds’ prices also remained

largely unaffected by the sovereign credit rating

action. (see Top Four High Yield Bond ETFs) Nevertheless this

failed to cause any material impact in the corporate bond market in

the U.S. That was because the limelight had already been stolen by

the ongoing debt crisis in its cross Atlantic counterparts.

The iShares iBoxx $ Invest Grade Corporate Bond

(LQD) and the Vanguard Long-Term Corporate Bond

ETF (VCLT) are two products from the plain vanilla

corporate bond ETF space.

Launched in September of 2002, LQD is by far one of the most

popular, highly diversified and best performing corporate bond ETFs

available to investors. Its total assets stand at a whooping $23.46

billion and it has an average daily volume of about 1.98 million

shares. It tracks the iBoxx $ Liquid Investment Grade

Index which measures the performance of the investment

grade corporate bonds in U.S markets.

iBoxx $ Invest Grade Corporate Bond ETF (LQD)has an extremely

well diversified portfolio of 978 securities issued by some of the

biggest names in Corporate America and therefore of high credit

quality. Some of its exposure includes Wells Fargo & Co

(0.49%), AT&T Inc. (0.49%), Wal-Mart Stores Inc (0.48%) General

Electric (0.47%) and American International Group (0.46%). The ETF

is highly exposed to issuers from the financial sector (35.25%)

(read Can You Beat These High Dividend ETFs?).

Around 70% of its portfolio is allocated towards securities

having a residual maturity of less than, or equal to 10 years. It

has an annual distribution yield of 3.89% and has returned 11.40%

in the last one year period as on 30th June 2012. (See

table above). It charges investors a paltry expense ratio of 0.15%

compared to a category average of 18 basis points.

On the other hand VCLT targets the longer end of the yield curve

and measures the performance of corporate bonds issued by various

issuers having a residual maturity of more than 10 years as

measured by the Barclays Capital U.S. Long Corporate

Index.

The ETF was launched in November of 2009 and has been able to

attract an asset base of $958.83 million. It charges investors 14

basis points in fees and expenses and pays out an impressive yield

of 4.28% (see 3 Multi-Asset ETFs for Juicy Yields and Stability)

However, it has a superior interest rate risk as indicated by an

average duration of 13.9 years.

VCLT holds 1109 securities in all, issued by corporates across

various sectors. Industrials (63.8%), Finance (17.8%) and Utilities

(17.4%) are some of the sectors on which it lays maximum emphasis.

Almost 78.3% of its assets are allocated towards securities having

a residual maturity of 20 to 30 years.

Finally, we talk about the Vanguard Extended Duration

Treasury ETF (EDV) which tracks the Barclays

Capital U.S. Treasury STRIPS 20-30 Year Equal Par Bond

Index. The index measures the returns of U.S. Treasury

securities which are highly sensitive to interest rate changes and

of residual maturities ranging from 20 to 30 years.

A STRIPS play on the treasury bonds means that the interest

payments and principal repayments are made independent of each

other and are treated as separate components (see Convertible Bond

ETFs for Income With Growth Potential). While this may seem an

enticing option for investors providing separate plays on the two

payment obligations of a debt security, it is worthwhile noting

that this is an extremely complex investment strategy.

However, the ETF has had a fantastic run in the past one year

returning 64.45% in the past one year as on 30th June

2012. EDV targets the longest maturity bucket in the treasury yield

curve, and has a distribution yield (2.65%) far more superior than

most ETFs targeting the zero-coupon and money market bonds. (see

Comprehensive Guide to Money Market ETFs)

Also, adding to the flavor is the low expense ratio of 13 basis

points which is 0.02% lower than the category average. The ETF

holds only 54 securities in its portfolio. The ETF was launched in

December of 2007 and has an asset base of $208.93 million. However,

investing in EDV requires a steady appetite for risk as an average

duration of 26.3 years indicates that the interest rate risk is

quite high for this product.

VANGD-INT TRM B (BIV): ETF Research Reports

VANGD-TOT BOND (BND): ETF Research Reports

VANGD-EX DUR TR (EDV): ETF Research Reports

WISDMTR-EM LDF (ELD): ETF Research Reports

ISHARS-JPM EM B (EMB): ETF Research Reports

ISHARES GS CPBD (LQD): ETF Research Reports

VANGD-LT CRP B (VCLT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

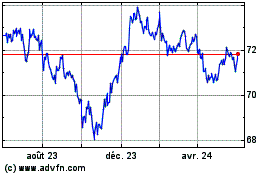

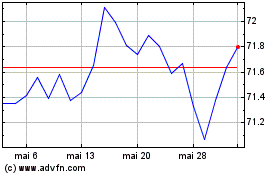

Vanguard Total Bond Market (NASDAQ:BND)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Vanguard Total Bond Market (NASDAQ:BND)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024