Mobix Labs, Inc. (“Mobix Labs” or the “Company”),

a fabless semiconductor company developing disruptive

next-generation connectivity technologies for 5G infrastructure,

satellite communications and defense industries, and Chavant

Capital Acquisition Corp. (Nasdaq: CLAY) (“Chavant”), a publicly

traded special purpose acquisition company, today announced that

the U.S. Securities and Exchange Commission (the “SEC”) has

declared effective the Registration Statement on Form S-4 (as

amended, the “Registration Statement”) filed by Chavant and

relating to the previously announced proposed business combination

between Mobix Labs and Chavant (the “Business Combination”).

The extraordinary general meeting of shareholders

of Chavant for the approval of the Business Combination (the

“Meeting”) and related matters is scheduled for December 14, 2023

at 10 a.m. EST. Further information regarding the Meeting is set

forth in the proxy statement/prospectus included in the

Registration Statement. A definitive proxy statement/prospectus was

mailed to Chavant shareholders of record as of close of business on

November 14, 2023 (the “Record Date”). Notice of the Meeting was

mailed on or about November 15, 2023 to Chavant shareholders of

record as of the Record Date. Chavant shareholders of record as of

the Record Date will be entitled to notice of, and to vote at or

before, the Meeting.

Following the closing of the Business Combination,

which is expected to occur on or shortly after the Meeting, the

Company expects that its shares of common stock and warrants will

trade on The Nasdaq Stock Market (“Nasdaq”) under the ticker

symbols “MOBX” and “MOBXW,” respectively.

About Mobix LabsBased in Irvine,

California, Mobix Labs is a fabless semiconductor company

developing disruptive next generation wireless and connected

solutions that are designed to cater to a broad range of

applications in markets including 5G infrastructure, satellite

communications, automotive, consumer electronics, e-mobility,

healthcare, infrastructure and defense. The Company believes its

pipeline of current and potential customers and strategic

partnerships presents a significant potential for a growing

addressable market. Its portfolio of intellectual property is

protected by extensive trade secrets and over 90 issued and pending

patents.

About ChavantChavant is a blank

check company whose business purpose is to effect a merger, capital

stock exchange, asset acquisition, stock purchase, reorganization,

or similar transaction or business combination with one or more

businesses. Chavant is led by Dr. Jiong Ma, Chief Executive Officer

and President, Dr. André-Jacques Auberton-Hervé, Chairman of the

board of directors, and Michael Lee, Chief Financial Officer.

Chavant’s board of directors includes Dr. Patrick Ennis, a Venture

Partner at Madrona Venture Group, Dr. Karen Kerr, founder and

Managing Director of Exposition Ventures, and Dr. Bernhard Stapp,

President of CS-management GmbH.

Important Information and Where to Find

ItThis press release relates to the Business Combination.

Chavant has filed the Registration Statement, which includes a

proxy statement and prospectus of Chavant, with the SEC in

connection with the Business Combination. Chavant will also file

other documents regarding the Business Combination with the SEC.

The Registration Statement was declared effective on November 13,

2023. A definitive proxy statement/prospectus has been sent to all

Chavant shareholders as of the Record Date, seeking any required

shareholder approvals.

Before making any voting decision, investors and

securityholders of Chavant are urged to read the entire

Registration Statement, the definitive proxy statement/prospectus

and all other relevant documents filed or that will be filed with

the SEC in connection with the Business Combination as they become

available, as well as any amendments or supplements to these

documents, because they will contain important information about

Chavant, Mobix Labs and the Business Combination.

Investors and securityholders will be able to

obtain free copies of the Registration Statement, the definitive

proxy statement/prospectus and all other relevant documents filed

or that will be filed with the SEC by Chavant through the website

maintained by the SEC at www.sec.gov. The documents filed by

Chavant with the SEC may also be obtained free of charge from

Chavant upon written request to: Chavant Capital Acquisition Corp.,

445 Park Avenue, New York, NY 10022.

NEITHER THE SEC NOR ANY STATE SECURITIES REGULATORY

AGENCY HAS APPROVED OR DISAPPROVED THE BUSINESS COMBINATION, PASSED

UPON THE MERITS OR FAIRNESS OF THE BUSINESS COMBINATION OR PASSED

UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS PRESS

RELEASE. ANY REPRESENTATION TO THE CONTRARY CONSTITUTES A CRIMINAL

OFFENSE.

Forward-Looking Statements

This press release contains certain

“forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995, Section

27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements other than statements of historical fact

contained in this press release, including statements regarding the

anticipated timing of the completion of the Business Combination

and the expectation that the Company’s shares of common stock and

warrants will trade on Nasdaq following the consummation of the

Business Combination, are forward-looking statements. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intends,” “may,” “might,” “plan,” “possible,” “potential,”

“predict,” “project,” “should,” “will,” “would” and similar

expressions may identify forward-looking statements, but the

absence of these words does not mean that a statement is not

forward-looking. All forward-looking statements are subject to

risks, uncertainties, and other factors which could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements. All forward-looking statements are

based upon estimates, forecasts and assumptions that, while

considered reasonable by Chavant and its management, and the

Company and its management, as the case may be, are inherently

uncertain and many factors may cause the actual results to differ

materially from current expectations which include, but are not

limited to:

- the risk that the Business Combination may not be completed in

a timely manner or at all, which may adversely affect the price of

Chavant’s securities;

- the risk that the Business Combination may not be completed by

Chavant’s deadline for the Business Combination and the potential

failure to obtain an extension of the deadline for the Business

Combination if sought by Chavant;

- the failure to satisfy the conditions to the consummation of

the Business Combination, including the adoption of the business

combination agreement by the shareholders of Chavant and the

satisfaction of the minimum cash amount following redemptions by

Chavant’s public shareholders;

- the lack of a third party valuation in determining whether or

not to pursue the Business Combination;

- the occurrence of any event, change or other circumstance that

could give rise to the termination of the business combination

agreement;

- the effect of the announcement or pendency of the Business

Combination on the Company’s business relationships, performance,

and business generally;

- risks that the Business Combination disrupts current plans of

the Company and potential difficulties in the Company’s employee

retention as a result of the Business Combination;

- the outcome of any legal proceedings that may be instituted

against the Company or against Chavant related to the business

combination agreement or the Business Combination;

- failure to realize the anticipated benefits of the Business

Combination;

- the inability to meet and maintain the listing of Chavant’s

securities (or the securities of the post-combination company) on

Nasdaq;

- the risk that the price of Chavant’s securities may be volatile

due to a variety of factors, including changes in the highly

competitive industries in which the Company plans to operate,

variations in performance across competitors, changes in laws,

regulations, technologies including transition to 5G, global supply

chain, U.S./China trade or national security tensions, and

macro-economic and social environments affecting the Company’s

business and changes in the combined capital structure;

- the inability to implement business plans, forecasts, and other

expectations after the completion of the Business Combination, and

identify and realize additional opportunities;

- the risk that Mobix Labs is unable to successfully

commercialize its semiconductor products and solutions, or

experience significant delays in doing so;

- the risk that the Company may never achieve or sustain

profitability;

- the risk that the Company will need to raise additional capital

to execute its business plan, which may not be available on

acceptable terms or at all;

- the risk that the post-combination company experiences

difficulties in managing its growth and expanding operations;

- the risks relating to long sales cycles, concentration of

customers, consolidation and vertical integration of customers, and

dependence on manufacturers and channel partners;

- the risk that the Company may not be able to consummate planned

strategic acquisitions, or fully realize anticipated benefits from

past or future acquisitions or investments;

- the risk that the Company’s patent applications may not be

approved or may take longer than expected, and the Company may

incur substantial costs in enforcing and protecting its

intellectual property;

- inability to complete the PIPE investment in connection with

the Business Combination; and

- other risks and uncertainties set forth in the sections

entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in Chavant’s Annual Report on Form 10-K

for the year ended December, 31, 2022 and Chavant’s Quarterly

Reports on Form 10-Q for subsequent quarterly periods, as such

factors may be updated from time to time in Chavant’s filings with

the SEC, the Registration Statement and the definitive proxy

statement/prospectus contained therein. These filings identify and

address other important risks and uncertainties that could cause

actual events and results to differ materially from those contained

in the forward-looking statements.

Nothing in this press release should be regarded as

a representation by any person that the forward-looking statements

set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved. You

should not place undue reliance on forward-looking statements,

which speak only as of the date they are made. Neither the Company

nor Chavant gives any assurance that the Company, Chavant or the

combined company will achieve their expected results. Neither the

Company nor Chavant undertakes any duty to update these

forward-looking statements, except as otherwise required by

law.

Participants in the

SolicitationThe Company and Chavant and their respective

directors and officers and other members of management may, under

SEC rules, be deemed to be participants in the solicitation of

proxies from Chavant’s stockholders with the Business Combination

and the other matters set forth in the Registration Statement.

Information about Chavant’s directors and executive officers is set

forth in Chavant’s filings with the SEC, including Chavant’s Form

10-K for the year ended December 31, 2022, Chavant’s Form 10-Q for

subsequent quarterly periods and the Registration Statement.

Additional information regarding the direct and indirect interests,

by security holdings or otherwise, of those persons and other

persons who may be deemed participants in the Business Combination

may be obtained by reading the definitive proxy

statement/prospectus. You may obtain free copies of these documents

as described above under “Important Information and Where to Find

It.”

No Offer or SolicitationThis press

release is not a proxy statement or solicitation of a proxy,

consent or authorization with respect to any securities or in

respect of the Business Combination and is not intended to and does

not constitute an offer to sell or the solicitation of an offer to

buy, sell or solicit any securities or any proxy, vote or approval,

nor shall there be any sale of securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offer of securities shall be deemed to be made

except by means of a prospectus meeting the requirements of Section

10 of the Securities Act.

Media and Investor Contacts:

George Medici/Laurie BermanPondelWilkinson

Inc.310.279.5980gmedici@pondel.comlberman@pondel.com

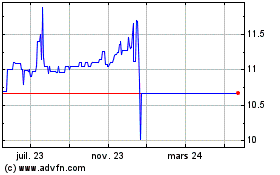

Chavant Capital Acquisit... (NASDAQ:CLAY)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Chavant Capital Acquisit... (NASDAQ:CLAY)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024