UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment

No.1) *

XPeng Inc.

(Name of Issuer)

Class A Ordinary Shares, par value US$0.00001

per share

(Title of Class of Securities)

98422D105**

(CUSIP Number)

Jinwei Zhang

Alibaba Group Holding Limited

26/F, Tower One, Times Square

1 Matheson Street, Causeway Bay

Hong Kong

Telephone: +852 2215-5100

with copies to:

Peng Yu, Esq.

Kirkland & Ellis

26th Floor, Gloucester Tower

The Landmark

15 Queen’s Road Central, Hong Kong

(852)

3761 3300

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

December 6, 2023

(Date of Event which Requires Filing of this

Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§240.13d-7 for other parties to whom copies are to be sent.

| * | The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities,

and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page. |

| ** | This CUSIP number applies to the Issuer’s American Depositary

Shares, evidenced by American Depositary Receipts, each representing two Class A Ordinary

Shares of the Issuer. |

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of

Section 18 of the Securities Exchange Act of 1934 (the “Act”) or otherwise subject to the liabilities of that

section of the Act but shall be subject to all other provisions of the Act (however, see the Notes)

| CUSIP No. 98422D105 |

|

Page 2 of 7 |

| 1. |

Names

of Reporting Persons.

Alibaba Group Holding Limited |

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions)

(a) ¨

(b) x

|

| 3. |

SEC

Use Only

|

| 4. |

Source

of Funds (See Instructions)

WC |

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨ |

| 6. |

Citizenship

or Place of Organization

Cayman Islands |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

7. |

Sole

Voting Power

191,918,464 Class A Ordinary Shares1 |

| 8. |

Shared Voting Power

|

| 9. |

Sole

Dispositive Power

191,918,464 Class A Ordinary Shares |

| 10. |

Shared Dispositive Power

|

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

191,918,464 Class A Ordinary Shares |

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

¨ |

| 13. |

Percent

of Class Represented by Amount in Row (11)

12.5% of Class A Ordinary Shares2 (representing

10.2% of the total issued and outstanding ordinary shares of the Issuer)3 |

| 14. |

Type

of Reporting Person (See Instructions)

CO |

| |

|

|

|

1 The

Reporting Persons are deemed to beneficially own 191,918,464 Class A ordinary shares (“Class A Ordinary Shares”)

based on beneficial ownership of: (i) 6,650,000 American Depositary Shares (“ADSs”) representing a total of

13,300,000 Class A Ordinary Shares and (ii) 178,618,464 Class A Ordinary Shares, which were previously reported in respect of Class

C ordinary shares (“Class C Ordinary Shares”) that converted into Class A Ordinary Shares in connection with the

Issuer’s global offering on the Hong Kong Stock Exchange.

2 This

percentage is calculated based upon 1,536,647,573 total issued and outstanding Class A Ordinary Shares as reported in the

Issuer’s current report on Form 6-K furnished on December 6, 2023, excluding 9,052 Class A Ordinary Shares issued to the

Issuer’s depository bank for bulk issuance of ADSs and reserved for future issuance upon the exercise or vesting of awards

granted under the Issuer’s 2019 Equity Incentive Plan as of December 6, 2023.

3 This

percentage is calculated based upon 1,885,355,830 total issued and outstanding ordinary shares of the Issuer as reported in the

Issuer’s current report on Form 6-K furnished on December 6, 2023, comprised of (i) 1,536,647,573 Class A Ordinary Shares and

(ii) 348,708,257 Class B Ordinary Shares, par value US$0.00001 per share, of the Issuer (“Class B Ordinary

Shares”).

| CUSIP No. 98422D105 |

|

Page 3 of 7 |

| 1. |

Names

of Reporting Persons.

Taobao China Holding Limited |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions)

(a) ¨ (b) x

|

| 3. |

SEC Use Only

|

| 4. |

Source

of Funds (See Instructions)

WC |

| 5. |

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨ |

| 6. |

Citizenship

or Place of Organization

Hong Kong |

Number

of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

7. |

Sole

Voting Power

191,918,464 Class A Ordinary Shares4 |

| 8. |

Shared

Voting Power

|

| 9. |

Sole

Dispositive Power

191,918,464 Class A Ordinary Shares |

| 10. |

Shared Dispositive Power

|

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

191,918,464 Class A Ordinary Shares |

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions)

¨ |

| 13. |

Percent

of Class Represented by Amount in Row (11)

12.5% of Class A Ordinary Shares5 (representing

10.2% of the total issued and outstanding ordinary shares of the Issuer)6 |

| 14. |

Type

of Reporting Person (See Instructions)

CO |

| |

|

|

|

4 The

Reporting Persons are deemed to beneficially own 191,918,464 Class A Ordinary Shares based on beneficial ownership of: (i) 6,650,000

ADSs representing a total of 13,300,000 Class A Ordinary Shares and (ii) 178,618,464 Class A Ordinary Shares, which were previously

reported in respect of Class C Ordinary Shares that converted into Class A Ordinary Shares in connection with the Issuer’s

global offering on the Hong Kong Stock Exchange.

5 This

percentage is calculated based upon 1,536,647,573 total issued and outstanding Class A Ordinary Shares as reported in the

Issuer’s current report on Form 6-K furnished on December 6, 2023, excluding 9,052 Class A Ordinary Shares issued to the

Issuer’s depository bank for bulk issuance of ADSs and reserved for future issuance upon the exercise or vesting of awards

granted under the Issuer’s 2019 Equity Incentive Plan as of December 6, 2023.

6 This

percentage is calculated based upon 1,885,355,830 total issued and outstanding ordinary shares of the Issuer as reported in the

Issuer’s current report on Form 6-K furnished on December 6, 2023, comprised of (i) 1,536,647,573 Class A Ordinary Shares and

(ii) 348,708,257 Class B Ordinary Shares.

| CUSIP No. 98422D105 |

|

Page 4 of 7 |

The information set forth in response to each separate Item below

shall be deemed to be a response to all Items where such information is relevant.

This Amendment No. 1 to Schedule 13D (this “Amendment

No. 1”) is filed to amend and supplement the Schedule 13D filed by the Reporting Persons named therein with the Securities

and Exchange Commission on September 7, 2020 (the “Original Schedule 13D”), with respect to XPeng Inc. (the “Issuer”).

Except as specifically amended and supplemented by this Amendment No. 1, the Original Schedule 13D remains in full force and effect.

All capitalized terms contained herein but not otherwise defined shall have the meaning ascribed to such terms in the Original Schedule

13D.

| Item 5. | Interest

in Securities of the Issuer. |

The information set forth in Item 5 of the Original

Schedule 13D is amended as follows:

(a)-(b) The responses of each Reporting

Person to Rows (7) through (13) of the cover pages of this Amendment No.1 are hereby incorporated by reference into this Item

5 and are as of the date hereof.

Except as disclosed in this Amendment No.1, none

of the Reporting Persons nor, to the best of their knowledge, any of the persons listed in Schedules A-1 or A-2 hereto, beneficially

owns any Class A Ordinary Shares or has the right to acquire any Class A Ordinary Shares.

Except as disclosed in this Amendment No.1, none

of the Reporting Persons presently has the power to vote or to direct the vote or to dispose or direct the disposition of any of the

Class A Ordinary Shares which it may be deemed to beneficially own.

(c) This Amendment No. 1 is being filed

to reflect a change in the percentage previously reported solely as a result of the change in the outstanding Class A Ordinary

Shares reported by the Issuer as of December 6, 2023. The Reporting Person has no other material changes to the information

previously reported or transactions within the prior 60 days to disclose. Neither the filing of this Amendment No. 1 nor any of

its contents shall be deemed to constitute an admission by any of the Reporting Persons that such person is the beneficial owner of

any of the shares of the Issuer’s Class A Ordinary Shares referred to herein for purposes of the Act, or for any other

purpose.

(d) To the best knowledge of the Reporting

Persons, no person other than the Reporting Persons has the right to receive or the power to direct the receipt of dividends from, or

the proceeds from the sale of, the securities beneficially owned by the Reporting Persons identified in this Item 5.

(e) Not applicable.

Signatures

After reasonable inquiry and to the best of their knowledge and belief,

the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: December 12, 2023

| |

Alibaba Group Holding Limited |

| |

|

| |

By: |

/s/ Jinwei Zhang |

| |

|

Name: Jinwei Zhang |

| |

|

Title: Authorized Signatory |

| |

|

| |

Taobao China Holding Limited |

| |

|

| |

By: |

/s/ Lei Jin |

| |

|

Name: Lei Jin |

| |

|

Title: Authorized Signatory |

SCHEDULE A-1

Directors and Executive Officers of Alibaba

Group Holding Limited

The following table sets forth the name, citizenship, business address

and present principal occupation of each director and executive officer of Alibaba Group Holding Limited, an exempted company incorporated

under the laws of the Cayman Islands (“AGHL”).

| Name

and Citizenship |

Present

Principal Occupation |

| Directors7 |

| Joseph

C. TSAI, Canada |

Chairman

of AGHL |

Eddie

Yongming WU, Singapore

c/o 969 West Wen Yi Road

Yu Hang District, Hangzhou 311121

People’s Republic of China |

Director

and Chief Executive Officer of AGHL |

| J.

Michael EVANS, Canada |

Director

and President of AGHL |

| Maggie

Wei WU, People’s Republic of China |

Director

of AGHL |

| Jerry

YANG, United States of America |

Independent

Director of AGHL; Founding Partner of AME Cloud Ventures |

| Wan

Ling MARTELLO, United States of America |

Independent

Director of AGHL; Co-founder and Partner of BayPine |

| Weijian

SHAN, People’s Republic of China |

Independent

Director of AGHL; Executive Chairman and Founder of PAG |

| Irene

Yun-Lien LEE, People’s Republic of China |

Independent

Director of AGHL; Executive Chairman of Hysan Development Limited |

| Albert

Kong Ping NG, People’s Republic of China |

Independent

Director of AGHL |

| Kabir

MISRA, United States of America |

Independent

Director of AGHL; Managing Partner at RPS Ventures |

| Executive

Officers8 |

| Toby

Hong XU, People’s Republic of China |

Chief

Financial Officer of AGHL |

| Jane

Fang JIANG, People’s Republic of China |

Chief

People Officer of AGHL |

| Zeming

WU, People’s Republic of China |

Chief

Technology Officer of AGHL |

| Sara

Siying YU, People’s Republic of China |

General

Counsel of AGHL |

| Trudy

Shan DAI, Singapore |

Chief

Executive Officer of Taobao and Tmall Group of AGHL |

| Yongfu

YU, Cyprus |

Chief

Executive Officer of Local Services Group of AGHL |

| Fan

JIANG, People’s Republic of China |

Chief

Executive Officer of Alibaba International Digital Commerce Group of AGHL |

| Lin

WAN, People’s Republic of China |

Chief

Executive Officer of Cainiao Smart Logistics Network Limited |

| Luyuan

FAN, People’s Republic of China |

Chief

Executive Officer of Digital Media and Entertainment Group of AGHL |

7

Unless otherwise noted, the business address for each director listed is 26/F, Tower One, Times Square, 1 Matheson Street,

Causeway Bay, Hong Kong.

8

Unless otherwise noted, the business address for each executive officer listed is c/o 969 West Wen Yi Road, Yu Hang District,

Hangzhou 311121, People’s Republic of China.

SCHEDULE A-2

Directors and Executive Officers of Taobao

China Holding Limited

The following table sets

forth the names and present principal occupation of each director of Taobao China Holding Limited, a company organized under the laws

of Hong Kong (“TCHL”). The business address for each person listed below is 26/F, Tower One, Times Square, 1 Matheson

Street, Causeway Bay, Hong Kong. TCHL does not have any executive officers. As used below, the term “AGHL” refers

to Alibaba Group Holding Limited, an exempted company incorporated under the laws of the Cayman Islands.

| Name/Citizenship |

Present

Principal Occupation |

| Jinwei

ZHANG, People’s Republic of China |

Company Secretary of AGHL |

| Yik

Lam LEE, People’s Republic of China |

Director of Finance of AGHL |

| Yuehong

QIN, People’s Republic of China |

Vice President, Corporate Finance

of AGHL |

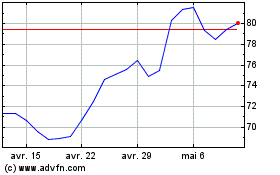

Alibaba (NYSE:BABA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

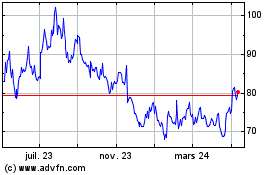

Alibaba (NYSE:BABA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024