false

0001171486

0001171486

2024-10-15

2024-10-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 15, 2024

|

NATURAL RESOURCE PARTNERS LP

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Delaware

|

001-31465

|

35-2164875

|

|

(State or other jurisdiction

of incorporation or organization)

|

(Commission File

Number)

|

(I.R.S. Employer

Identification No.)

|

| |

|

1415 Louisiana St., Suite 3325

Houston, Texas 77002

|

|

(Address of principal executive office) (Zip Code)

|

| |

|

(713) 751-7507

|

|

Registrant’s telephone number, including area code

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Units representing limited partner interests

|

|

NRP

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 1.01. Entry Into a Material Definitive Agreement

The information under Item 2.03 below is incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

On October 15, 2023, NRP (Operating) LLC (“Opco”) entered into that certain Seventh Amendment to the Third Amended and Restated Credit Agreement (the “Seventh Amendment”) by and among Opco, the lenders party thereto and Zions Bancorporation, N.A. dba Amegy Bank, as administrative agent (in such capacity, the “Administrative Agent”) and collateral agent.

The Seventh Amendment amends and modifies that certain Third Amended and Restated Credit Agreement, dated as of June 16, 2015 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Credit Facility”) among Opco, the lenders party thereto and the Administrative Agent which provides for lender commitments of $200.0 million. The Seventh Amendment provides for changes and modifications to the Credit Facility as set forth therein, which include, among other things, (i) the extension of the maturity date from August 2027 to October 2029 and (ii) modifications to Opco’s ability to declare and make certain restricted payments.

The Seventh Amendment is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits

|

(d)

|

|

Exhibits.

|

| |

|

|

|

Exhibit

|

|

|

| Number |

|

Description |

| 10.1 |

|

Seventh Amendment to the Third Amended and Restated Credit Agreement, dated as of October 15, 2024, by and among NRP (Operating) LLC, the lenders party thereto and Zions Bancorporation, N.A. dba Amegy Bank, as administrative agent and collateral agent. |

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NATURAL RESOURCE PARTNERS L.P.

(Registrant)

|

|

|

|

|

|

|

|

|

By:

|

NRP (GP) LP

|

|

|

|

|

its General Partner

|

|

|

|

|

|

|

| |

By: |

GP Natural Resource Partners LLC |

|

| |

|

its General Partner |

|

| |

|

|

|

| Date: October 17, 2024 |

|

/s/ Philip T. Warman |

|

| |

|

Philip T. Warman |

|

| |

|

General Counsel |

|

2

Exhibit 10.1

SEVENTH AMENDMENT TO

THIRD AMENDED AND RESTATED CREDIT AGREEMENT

THIS SEVENTH AMENDMENT TO THIRD AMENDED AND RESTATED CREDIT AGREEMENT (this “Amendment”) is entered into as of October 15, 2024, by and among NRP (OPERATING) LLC, a Delaware limited liability company (the “Borrower”), the Lenders party hereto (as defined below), and ZIONS BANCORPORATION, N.A. dba AMEGY BANK, a national banking association (“Amegy”), as administrative agent (in such capacity, the “Administrative Agent”) for the Lenders, as Swingline Lender, and as an Issuing Bank.

Preliminary Statement

WHEREAS, the Borrower is party to that certain Third Amended and Restated Credit Agreement dated as of June 16, 2015 (as amended by the First Amendment to Third Amended and Restated Credit Agreement dated as of June 3, 2016, the Second Amendment to Third Amended and Restated Credit Agreement dated as of March 2, 2017, the Third Amendment to Third Amended and Restated Credit Agreement dated as of January 18, 2019, the Fourth Amendment to Third Amended and Restated Credit Agreement dated as of April 3, 2019, the Master Assignment Agreement and Fifth Amendment to Third Amended and Restated Credit Agreement dated as of August 9, 2022 (the “Fifth Amendment”), the Sixth Amendment to Third Amended and Restated Credit Agreement dated as of May 11, 2023, and as further amended, restated, supplemented, or otherwise modified from time to time, the “Credit Agreement”), among the Borrower, the lenders party thereto (collectively, the “Lenders” and each individually, a “Lender”), and the Administrative Agent;

WHEREAS, the Borrower has requested that the Administrative Agent and the Lenders party hereto amend the Credit Agreement, and the Administrative Agent and the Lenders have agreed to do so, in each case on the terms and subject to the conditions set forth in this Amendment.

NOW, THEREFORE, in consideration of the mutual covenants herein contained and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto hereby agree as follows (all capitalized terms used herein and not otherwise defined shall have the meanings as defined in the Credit Agreement):

Section 1. Amendments to Credit Agreement. Effective as of the Effective Date (as defined below), the Credit Agreement is hereby amended as follows:

(a) Section 1.1 (Definitions) of the Credit Agreement is hereby amended to (i) delete the definitions of “Parent Notes”, “Preferred Stock” and “Springing Maturity Date” in their entirety, and (ii) amend and restate the definitions of “Available Free Cash Flow”, “Free Cash Flow”, “Maturity Date” and “Permitted Parent Payment” in their entirety as follows:

““Available Free Cash Flow” means, when determined as of any date on which the Borrower makes any cash Restricted Payment pursuant to Section 6.06(e) (such date, a “date of determination”), an amount equal to (a) the sum of (i) all cash of the Loan Parties that is not restricted cash (as determined in accordance with GAAP) and all Permitted Investments held by the Loan Parties, in each case as of the date immediately prior to the first day of the applicable Available Free Cash Flow Period (defined below) plus (ii) Free Cash Flow for the most recently ended period of four consecutive fiscal quarters for which the Financial Statement Delivery Date has occurred and with respect to which the Borrower has delivered to the Administrative Agent a Compliance Certificate in accordance with Section 5.01(c) (each an “Available Free Cash Flow Period”), minus (b) the aggregate amount of all Restricted Payments made by the Borrower (except to the extent made using Qualified Cash Proceeds) during and since the end of such Available Free Cash Flow Period, and as of such date of determination, pursuant to Sections 6.06(c), (d), and (e), minus (c) the aggregate amount of all investments, loans, and advances made in cash by the Borrower and its Subsidiaries (except (i) any such investments in, and loans and advances to or among, the Loan Parties or (ii) to the extent made using Qualified Cash Proceeds) during and since the end of such Available Free Cash Flow Period, and as of such date of determination, pursuant to Sections 6.04(b), (c), (k), and (l).”

““Free Cash Flow” means, for any Available Free Cash Flow Period, for the Borrower and its Subsidiaries on a consolidated basis, the total of (a) Consolidated EBITDDA for such Available Free Cash Flow Period, minus (b) the increase (or plus the decrease) in non-cash working capital since the last day of the period of four consecutive fiscal quarters ending immediately prior to such Available Free Cash Flow Period, minus (c) the sum of the following amounts, in each case without duplication and to the extent added back in the calculation of Consolidated EBITDDA for such Available Free Cash Flow Period: (i) cash interest expense; (ii) cash income tax expense (including any Permitted Tax Distributions); and (iii) any other cash charge that reduces the income of the Borrower and its Subsidiaries for such Available Free Cash Flow Period; minus (d) the aggregate amount of all prepayments and repayments of Indebtedness (other than Indebtedness of the type described in clause (c) of the definition thereof) made in cash (other than any such prepayments and repayments to the extent made using Qualified Cash Proceeds) during such Available Free Cash Flow Period, in each case, which cannot be reborrowed pursuant to the terms of such Indebtedness (and for the avoidance doubt, in the case of a voluntary prepayment of Loans, only to the extent accompanied by a simultaneous and equivalent reduction in the Commitments); minus (e) the aggregate amount of capital expenditures (determined in accordance with GAAP) made by the Borrower and its Subsidiaries in cash (other than any such capital expenditures to the extent (i) permitted under Section 6.04 or (ii) made using Qualified Cash Proceeds) during such Available Free Cash Flow Period; plus (f) any cash income deducted from or not taken into account in determining Consolidated EBITDDA for such Available Free Cash Flow Period; provided that, notwithstanding the foregoing, Free Cash Flow for any Available Free Cash Flow Period shall not be less than zero.”

““Maturity Date” means October 15, 2029.”

““Permitted Parent Payment” means cash dividends to Parent not to exceed an amount necessary to permit Parent to pay (a) franchise and excise taxes and other fees, taxes and expenses required to maintain their corporate existence and (b) reasonable and customary corporate expenses and operating expenses relating to maintaining their ownership interest in the Borrower (including reasonable out-of-pocket expenses for legal, administrative and accounting services provided by third parties, insurance, and compensation, benefits and other amounts payable to officers and employees in connection with their employment in the ordinary course of business and to directors and board of director observers).”

(b) Section 5.01(d) (Financial Statements; Ratings Change and Other Information) of the Credit Agreement is hereby amended and restated in its entirety as follows:

“(d) within 20 days (or such later date as the Administrative Agent may approve in its sole discretion) after the end of each month in which Parent redeems or repurchases any Equity Interests of Parent, a report summarizing all such redemptions and repurchases consummated during such month and the amount of any Restricted Payments made pursuant to Section 6.06(d) to consummate such transactions, which report shall be certified by a Financial Officer of the Borrower as being true and correct;”

(c) Section 6.06(d) (Restricted Payments) of the Credit Agreement is hereby amended and restated in its entirety as follows:

“(d) Restricted Payments used to redeem or repurchase any Equity Interests of Parent, provided that, (i) the Borrower has delivered to the Administrative Agent a certificate in accordance with Section 5.01(f)(i) with respect to the intended use of the proceeds of such Restricted Payment, and (ii) at the time of and immediately after giving pro forma effect to any such Restricted Payment described in this clause (d) (and any Borrowings incurred in connection therewith), (A) no Default or Event of Default has occurred and is continuing or would result therefrom, (B) Liquidity is not less than an amount equal to 20% of the Commitments then in effect and (C) the Leverage Ratio for the most recently ended period of four consecutive fiscal quarters for which the Financial Statement Delivery Date has occurred and with respect to which the Borrower has delivered to the Administrative Agent a Compliance Certificate in accordance with Section 5.01(c), is less than 2.00 to 1.00, and”

Section 2. Representations True; No Default. On the Effective Date, the Borrower represents and warrants that:

(a) this Amendment has been duly authorized, executed and delivered on its behalf; the Credit Agreement, as amended by this Amendment, together with the other Loan Documents to which Borrower is a party, constitute valid and legally binding agreements of Borrower enforceable in accordance with their terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law;

(b) the representations and warranties of Borrower contained in Article III of the Credit Agreement, as amended by this Amendment, are true and correct in all material respects (or, if qualified by “material,” “material adverse effect” or similar language, in all respects) on and as of the Effective Date as though made on and as of the Effective Date, except to the extent that any such representation or warranty is expressly stated to relate to an earlier date in which case such representation and warranty will be true and correct in all material respects (or if qualified by “material,” “material adverse effect” or similar language, in all respects) on and as of such earlier date; and

(c) after giving effect to this Amendment, no Default or Event of Default under the Credit Agreement has occurred and is continuing.

Section 3. Expenses. To the extent invoiced reasonably in advance of the Effective Date, the Borrower shall pay to the Administrative Agent all reasonable out-of-pocket expenses incurred in connection with the execution of this Amendment and any amounts outstanding pursuant to Section 9.03 of the Credit Agreement, including the reasonable fees, charges and disbursements of Porter Hedges LLP, counsel for the Administrative Agent.

Section 4. Effectiveness. This Amendment shall become effective on the first date (the “Effective Date”) on which each of the following conditions is satisfied:

(a) The Administrative Agent shall have received:

(i) this Amendment executed by the Borrower, the Guarantors, the Administrative Agent, each Issuing Bank, the Swingline Lender, and the Lenders;

(ii) the Fee Letter dated as of the date hereof (the “Seventh Amendment Fee Letter”), executed by the Borrower and Administrative Agent;

(iii) an officer’s certificate of each Loan Party, certifying as to incumbency of officers, specimen signatures, true and correct copies of its organizational documents (or that there have been no changes thereto since the date of the officer’s certificate delivered to the Administrative Agent in connection with the Fifth Amendment), and resolutions adopted by such Loan Party’s board of directors or other applicable governing body authorizing and approving such Loan Party’s execution of this Amendment and the other documents and instruments executed and delivered in connection herewith, and the consummation of the transactions contemplated hereby;

(iv) certificates of good standing, existence, or their equivalent with respect to each Loan Party, certified as of a recent date by the appropriate Governmental Authority of the state of its organization and, to the extent requested by Agent, each other state in which it is qualified to do business; and

(v) appropriate lien searches, including UCC searches, in each Loan Party’s jurisdiction of organization and any other jurisdiction reasonably requested by the Administrative Agent, reflecting no Liens encumbering the assets of the Loan Parties other than Permitted Liens.

(b) Each of the representations and warranties made by the Borrower and each Guarantor in or pursuant to the Loan Documents, as amended by this Amendment, shall be true and correct in all material respects (or if qualified by “material,” “material adverse effect” or similar language, in all respects) on and as of the Effective Date, except to the extent that any such representation or warranty is expressly stated to relate to an earlier date in which case such representation and warranty will be true and correct in all material respects (or if qualified by “material,” “material adverse effect” or similar language, in all respects) on and as of such earlier date.

(c) After giving effect to this Amendment, no Default or Event of Default under the Credit Agreement has occurred and is continuing.

(d) The Borrower shall have paid, and the Administrative Agent shall have received (for itself and for the account of the Lenders, as applicable), the fees required to be paid on the Effective Date pursuant to the Seventh Amendment Fee Letter.

(e) All fees and expenses due to the Administrative Agent and the Lenders (including pursuant to Section 3 of this Amendment) shall have been received.

The Administrative Agent shall notify the Borrower and the Lenders of the Effective Date upon the satisfaction or waiver of all of the foregoing conditions, and such notice will be conclusive and binding.

Section 5. Waivers Generally. Except as expressly waived herein, all covenants, obligations and agreements of each Loan Party contained in the Credit Agreement and the other Loan Documents shall remain in full force and effect in accordance with their terms. Without limitation of the foregoing, the Waivers are hereby granted to the extent and only to the extent specifically stated herein and for no other purpose and shall not be deemed to (a) be a consent or agreement to, or waiver or modification of, or amendment to, any other term or condition of the Credit Agreement, any other Loan Document or any of the documents referred to therein, (b) except as expressly set forth herein, prejudice any right or rights which the Administrative Agent or the Lenders may now have or may have in the future under or in connection with the Credit Agreement, any other Loan Document or any of the documents referred to therein, or (c) constitute any course of dealing or other basis for altering any obligation of the Borrower or any other Loan Party or any right, privilege or remedy of the Administrative Agent or the Lenders under the Credit Agreement, the other Loan Documents, or any other contract or instrument. Granting the Waivers set forth herein does not and should not be construed to be an assurance or promise that consents or waivers will be granted in the future, whether for the matters herein stated or on other unrelated matters.

Section 6. Reaffirmation. The Borrower hereby confirms and agrees that, notwithstanding the effectiveness of this Amendment, each Loan Document to which the Borrower is a party to, and the obligations of the Borrower contained in the Credit Agreement, this Amendment or in any other Loan Document to which it is a party are, and shall continue to be, in full force and effect and are hereby ratified and confirmed in all respects, in each case as amended by this Amendment. For greater certainty and without limiting the foregoing, the Borrower hereby confirms the existing security interests granted by the Borrower in favor of the Collateral Agent for the benefit of the Secured Parties pursuant to the Loan Documents in the Collateral described therein shall continue to secure the Obligations of the Loan Parties under the Credit Agreement and the other Loan Documents as and to the extent provided in the Loan Documents.

Section 7. Miscellaneous Provisions.

(a) From and after the Effective Date, the Credit Agreement will be deemed to be amended and modified as herein provided, and except as so amended and modified the Credit Agreement will continue in full force and effect. This Amendment shall constitute a Loan Document for all purposes under the Credit Agreement and each of the other Loan Documents.

(b) The Credit Agreement and this Amendment will be read and construed as one and the same instrument.

(c) Any reference in any of the Loan Documents to the Credit Agreement will be a reference to the Credit Agreement as amended by this Amendment.

(d) This Amendment will be construed in accordance with and governed by the laws of the State of New York and of the United States of America.

(e) This Amendment may be signed in any number of counterparts and by different parties in separate counterparts and may transmitted and executed by facsimile, portable document format (PDF), and other electronic means, each of which will be deemed an original but all of which together will constitute one and the same instrument.

(f) The headings herein will be accorded no significance in interpreting this Amendment.

Section 8. Binding Effect. This Amendment is binding upon and will inure to the benefit of the parties hereto and their respective successors and assigns, except that neither the Borrower nor any Lender will not have the right to assign its rights hereunder or any interest herein except in accordance with the terms of the Credit Agreement.

Section 9. Final Agreement of the Parties. This Amendment may not be contradicted by evidence of prior, contemporaneous, or subsequent oral agreements with respect to the matters covered by this Amendment. There are no unwritten oral agreements between the parties hereto with respect to the matters covered by this Amendment.

[Signatures appear on the following pages.]

IN WITNESS WHEREOF, the following parties have caused this Amendment to be executed by their respective duly authorized officers as of the date first written above.

BORROWER:

NRP (OPERATING) LLC,

a Delaware limited liability company

By: /s/ Christopher J. Zolas

Christopher J. Zolas

Chief Financial Officer

Signature Page to

Seventh Amendment to Third Amended and Restated Credit Agreement

ADMINISTRATIVE AGENT:

ZIONS BANCORPORATION, N.A. dba AMEGY BANK,

as Administrative Agent

By: /s/ John N. Moffitt

John N. Moffitt

Senior Vice President

LENDERS:

ZIONS BANCORPORATION, N.A. dba AMEGY BANK,

as an Issuing Bank, as Swingline Lender, and as a Lender

By: /s/ John N. Moffitt

John N. Moffitt

Senior Vice President

Signature Page to

Seventh Amendment to Third Amended and Restated Credit Agreement

CADENCE BANK,

as a Lender

By: /s/ Molly Zlotnik

Name: Molly Zlotnik

Title: Vice President

Signature Page to

Seventh Amendment to Third Amended and Restated Credit Agreement

FROST BANK,

as a Lender

By: /s/ Carly Bylund

Name: Carly Bylund

Title: Vice President

Signature Page to

Seventh Amendment to Third Amended and Restated Credit Agreement

SUMMIT COMMUNITY BANK,

as a Lender

By: /s/ Lisa Dennison

Name: Lisa Dennison

Title: Market President

Signature Page to

Seventh Amendment to Third Amended and Restated Credit Agreement

PROSPERITY BANK,

as a Lender

By: /s/ Chase Zalman

Name: Chase Zalman

Title: Regional President

Signature Page to

Seventh Amendment to Third Amended and Restated Credit Agreement

THE FIRST BANK AND TRUST COMPANY,

as a Lender

By: /s/ Hugh Ferguson

Name: Hugh Ferguson

Title: Senior Vice President

Signature Page to

Seventh Amendment to Third Amended and Restated Credit Agreement

GULF CAPITAL BANK,

as a Lender

By: /s/ Kristen Mclean

Name: Kristen Mclean

Title: SVP, Relationship Manager

Signature Page to

Seventh Amendment to Third Amended and Restated Credit Agreement

ACKNOWLEDGMENT OF GUARANTORS

TO

SEVENTH AMENDMENT TO THIRD AMENDED AND RESTATED CREDIT AGREEMENT

Each of the undersigned Guarantors hereby confirms that each Loan Document (as the same may be amended or amended and restated, as the case may be, pursuant to and in connection with this Amendment) to which it is a party or otherwise bound remains in full force and effect and will continue to secure, to the fullest extent possible, the payment and performance of all Obligations, including without limitation the payment and performance of all Loans now or hereafter existing under or in respect of the Credit Agreement and the other Loan Documents. The Guarantors specifically reaffirm and extend their obligations under each of their applicable Guaranty Agreements to cover all Obligations evidenced by the Credit Agreement as same has been created, amended and/or restated by or in connection with this Amendment) and its grant of security interests pursuant to the Security Agreement and the other Collateral Documents are reaffirmed and remain in full force and effect after giving effect to this Amendment. The Guaranty Agreements and all the terms thereof shall remain in full force and effect and the Guarantors hereby acknowledge and agree that same are valid and existing and that each of the Guarantors’ obligations thereunder shall not be impaired or limited by the execution or effectiveness of this Amendment. Each Guarantor hereby represents and warrants that all representations and warranties contained in this Amendment and the other Loan Documents to which it is a party or otherwise bound, as amended hereby, are true, correct and complete in all material respects on and as of the Effective Date, except to the extent such representations and warranties specifically relate to an earlier date, in which case they were true, correct and complete in all material respects (or if qualified by “material,” “material adverse effect” or similar language, in all respects) on and as of such earlier date. Administrative Agent and the Lenders hereby preserve all of their rights against each Guarantor under its applicable Guaranty Agreement and the other Loan Documents to which each applicable Guarantor is a party.

Each Guarantor acknowledges and agrees that (i) notwithstanding the conditions to the effectiveness set forth in this Amendment, such Guarantor is not required by the terms of the Credit Agreement, this Amendment or any other Loan Document to consent to the amendments of the Credit Agreement effected pursuant to this Amendment; and (ii) nothing in the Credit Agreement, this Amendment or any other Loan Document shall be deemed to require the consent of such Guarantor to any future amendments to the Credit Agreement.

[Signatures appear on the following page.]

ACIN LLC

GATLING MINERAL, LLC

HOD LLC

INDEPENDENCE LAND COMPANY, LLC

RIVERVISTA MINING, LLC

SHEPARD BOONE COAL COMPANY LLC

WBRD LLC

WILLIAMSON TRANSPORT LLC

WPP LLC

NRP TRONA LLC,

as Guarantors

By: NRP (Operating) LLC, as sole member of each of the above named Guarantors

By: /s/ Christopher J. Zolas

Christopher J. Zolas

Chief Financial Officer and Treasurer

Signature Page to Acknowledgement of Guarantors

(Seventh Amendment to Third Amended and Restated Credit Agreement)

v3.24.3

Document And Entity Information

|

Oct. 15, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

NATURAL RESOURCE PARTNERS LP

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 15, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-31465

|

| Entity, Tax Identification Number |

35-2164875

|

| Entity, Address, Address Line One |

1415 Louisiana St., Suite 3325

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

77002

|

| City Area Code |

713

|

| Local Phone Number |

751-7507

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Units representing limited partner interests

|

| Trading Symbol |

NRP

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001171486

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

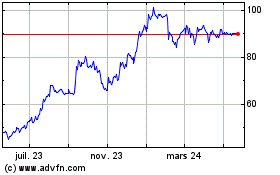

Natural Resource Partners (NYSE:NRP)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

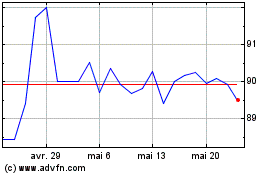

Natural Resource Partners (NYSE:NRP)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024