Switzerland to Ease Crypto Regulation

20 Juillet 2018 - 6:53PM

ADVFN Crypto NewsWire

In an attempt to regain its cryptocurrency crown, Switzerland is

planning to ease crypto regulation, as regulators step up efforts

to prevent the migration of cryptocurrency projects from the

country.

The exodus of digital currency projects is resulting in

Switzerland losing business to the likes of Gibraltar, the Cayman

Islands, and Liechtenstein.

The ‘Crypto Nation’ wants its title back

Switzerland was once known as the ‘Crypto Nation’, a title that

has been slowly waning after a tighter regulatory framework was

introduced in February 2018. Data released by PwC showed the

Swiss had dropped from second place to sixth in the amount of

Initial Coin Offering (ICO) funds countries raise, prompting the

Swiss to make a regulatory U-turn by encouraging banks to accept

the accounts of cryptocurrency organizations.

Supporters of virtual currency in Switzerland consider the

market to be central to the future of global finance.

Banks need greater access to crypto entities

The wealthy canton of Zug in central Switzerland is hailed as

‘Crypto Valley’, with around 300 cryptocurrency ventures opening in

the town in recent years. Though without access to the banking

system, many of the crypto entities are struggling to function in

Zug and threaten to leave if the government fails to provide them

with the access they need.

As Heinz Taennler, Zug’s finance director says:

“All their banking relationships are going to Liechtenstein.

These are hundreds of jobs that have been created, and every job is

important.”

Switzerland’s financial market supervisor, FINMA, is in talks

with the Swiss National Bank (SNB) about the steps needed to be

taken to ease crypto regulation and ensure banks are more

accessible to cryptocurrency ventures.

As Thomas Moser, of the SNB, told Reuters:

“We would not want to close the door on the opportunities

that such innovation (cryptocurrencies) might bring.”

Despite moves to regulate the market by introducing more

stringent regulatory frameworks this year, crypto startups have

still been attracted to Switzerland, cementing themselves in

‘Crypto Valley’.

For example, in May this year, the blockchain venture ConsenSys

announced a partnership with the

Crypto Valley Association (CVA), the government-supported

association, which has been a leading force in Switzerland’s

growing blockchain market.

At the same time, Bitfinex, the fifth largest cryptocurrency

exchange, said it was planning on moving

offices from Hong Kong to Switzerland.

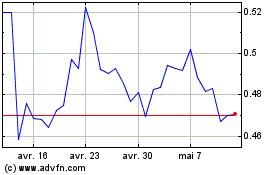

Ripple (COIN:XRPEUR)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

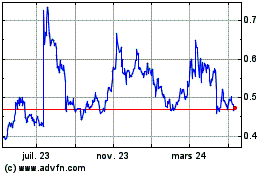

Ripple (COIN:XRPEUR)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024