| PROSPECTUS SUPPLEMENT |

Filed pursuant to Rule 424(b)(5) |

| (To Prospectus dated April 28, 2022) |

Registration Number 333-263711 |

Asensus Surgical, Inc.

Up to $100 Million

Common Stock

We are offering, through this prospectus supplement and the accompanying prospectus, up to $100 million of shares of our common stock, $0.001 par value per share in this offering pursuant to the Controlled Equity OfferingSM Sales Agreement, or the Sales Agreement, among us and Cantor Fitzgerald & Co., or Cantor, and Oppenheimer & Co. Inc., or Oppenheimer. We refer to each of Cantor and Oppenheimer individually as an “Agent” and collectively as the “Agents”.

In accordance with the terms of the Sales Agreement, we may offer and sell shares of our common stock at any time and from time to time through or to Cantor or Oppenheimer as sales agent or principal. Sales of the common stock, if any, will be made at market prices by any method that is deemed to be an “at the market offering” as defined in Rule 415 under the Securities Act of 1933, as amended, or the Securities Act.

The aggregate compensation payable to the Agents shall be up to 3.0% of the gross sales price of the shares sold pursuant to the Sales Agreement. In connection with the sale of the common stock on our behalf, each Agent will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of each Agent will be deemed to be underwriting commissions or discounts.

Subject to the terms and conditions of the Sales Agreement, each Agent will use its commercially reasonable efforts consistent with its normal trading and sales practices to sell on our behalf any shares to be offered by us under the Sales Agreement. There is no arrangement for funds to be received in any escrow, trust or similar arrangement.

Our common stock is listed on the NYSE American under the symbol “ASXC.” On May 9, 2022, the last reported sale price of our common stock on the NYSE American was $0.37 per share.

Investing in our common stock involves risks. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page S-7 of this prospectus supplement and under similar headings in the other documents that are incorporated by reference in this prospectus supplement and the accompanying prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is May 10, 2022.

TABLE OF CONTENTS

Page

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus, dated March 18, 2022, are part of a “shelf” registration statement on Form S-3. This prospectus supplement the terms of this offering of shares of our common stock and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The accompanying prospectus, including the documents incorporated by reference, provides more general information, some of which may not apply to this offering. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or in any document incorporated by reference that was filed with the Securities and Exchange Commission, or SEC, before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date the statement in the document having the later date modifies or supersedes the earlier statement.

You should rely only on the information contained in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus. We have not, and no Agent has, authorized anyone to provide you with different or additional information. You should assume that the information in this prospectus supplement and the accompanying prospectus is accurate only as of the date on the front of the respective document and that any information that we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement or the accompanying prospectus or the time of any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

As used in this prospectus supplement, the terms “we,” “our,” “us,” or the “Company” refer to Asensus Surgical, Inc., including its subsidiaries: Asensus Surgical US, Inc., Asensus International, Inc., Asensus Surgical Italia S.r.l., Asensus Surgical Europe S.à.r.l., Asensus Surgical Taiwan Ltd., Asensus Surgical Japan K.K., Asensus Surgical Israel Ltd., Asensus Surgical Netherlands B.V., and Asensus Surgical Canada, Inc.

This prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus supplement or the accompanying prospectus are the property of their respective owners.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this prospectus supplement, or incorporated by reference into this prospectus supplement, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements, other than statements of historical fact, included or incorporated in this prospectus supplement regarding our strategy, future operations, collaborations, intellectual property, cash resources, financial position, future revenues, projected costs, prospects, plans, and objectives of management are forward-looking statements. The words “believes,” “anticipates,” “estimates,” “plans,” “expects,” “intends,” “may,” “could,” “should,” “potential,” “likely,” “projects,” “continue,” “will,” and “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We cannot guarantee that we actually will achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. There are a number of important factors that could cause our actual results to differ materially from those indicated or implied by forward-looking statements, including, but not limited to:

|

● our history of operating losses:

|

|

● our ability to successfully transition from a research and development company to a company focused on market development activities and sales and distribution of our products;

|

|

● our ability to successfully implement our Performance-Guided Surgery™ strategy and grow our business as a result;

|

|

● our ability to successfully develop, clinically test and commercialize our products;

|

|

● our ability to identify and pursue development of additional products;

|

|

● the timing and outcome of the regulatory review process for our products;

|

|

● competition from existing and new market entrants;

|

|

● our ability to successfully acquire new technologies and successfully use such acquisitions to advance our business and product offerings;

|

|

● our ability to fund our operations until break even;

|

|

● the impact of foreign currency fluctuations on our financial results;

|

|

● our ability to attract and retain key management, marketing and scientific personnel;

|

|

● our ability to successfully prepare, file, prosecute, maintain, defend and enforce patent claims and other intellectual property rights;

|

|

● changes in the health care and regulatory environments of the United States, Europe, Japan, Russia and other jurisdictions in which the Company operates; and

|

|

● the impact of the COVID-19 pandemic, or future pandemics, on our operations.

|

These factors and the other cautionary statements made or incorporated by reference in this prospectus should be read as being applicable to all related forward-looking statements whenever they appear in this prospectus. In addition, any forward-looking statements represent our estimates only as of the date that this prospectus is filed with the SEC, and should not be relied upon as representing our estimates as of any subsequent date. We do not assume any obligation to update any forward-looking statements. We disclaim any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

You should rely only on the information contained in this prospectus supplement (including in any documents incorporated by reference herein). We have not authorized anyone to provide you with any different information. We are offering to sell our securities, and seeking offers to buy, only in jurisdictions where offers and sales are permitted.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about us, this offering and information appearing elsewhere in this prospectus supplement and in the accompanying prospectus and in the documents we incorporate by reference. This summary is not complete and does not contain all of the information that you should consider before investing in shares of our common stock. The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein. Before you decide to invest in shares of our common stock, to fully understand this offering and its consequences to you, you should read the entire prospectus supplement and the accompanying prospectus carefully, including the risk factors beginning on page S-7 of this prospectus supplement and in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and in Item 1.A of our Quarterly Report on Form 10-Q for the three months ended March 31, 2022, filed with the SEC on May 4, 2022, as such risk factors may be amended, updated or modified periodically in our quarterly reports filed on Form 10-Q with the SEC, and any amendment or update thereto reflected in subsequent filings with the SEC incorporated by reference in this prospectus, and the documents incorporated by reference herein and therein.

Company Overview

Asensus Surgical, Inc. is a medical device company that is digitizing the interface between the surgeon and the patient to pioneer a new era of Performance-Guided Surgery™ by unlocking clinical intelligence for surgeons to enable consistently superior outcomes and a new standard of laparoscopic surgery. This builds upon the foundation of Digital Laparoscopy with our Senhance® Surgical System powered by the Intelligent Surgical Unit™ (ISU™) to increase surgeon control and reduce surgical variability. With the addition of machine vision, augmented intelligence, and deep learning capabilities throughout the surgical experience, we intend to holistically address the current clinical, cognitive and economic shortcomings that drive surgical outcomes and value-based healthcare.

Our mission is focused on leveraging robotic technologies, augmented intelligence, and machine learning capabilities to: reduce variability in surgery, drive more predictable outcomes, optimize resources and costs, and work with hospital systems that strive to employ innovative healthcare strategies. By leveraging advanced digital technologies, we aim to enable surgeons to take the best surgical practices and techniques from everywhere and utilize them to help improve outcomes, reduce variability, control the unexpected, reduce costs, reduce cognitive and physical fatigue of surgeons, and provide patients with the best care possible. We believe that by digitizing the interface between the surgeon and patient, we can unlock clinical intelligence to pioneer a new era of surgery, which we are calling Performance-Guided Surgery.

Historical advances in surgery have largely focused on bringing tools and techniques into the operating room to reduce the invasiveness of procedures. When we introduced Digital Laparoscopy, our intention was to help surgeons minimize surgical variability in a cost-effective manner. The next logical step in the progression is looking for ways to deliver clinical intelligence and analytics, which we believe can be enabled by what we refer to as Performance-Guided Surgery.

Performance-Guided Surgery builds upon our foundation of Digital Laparoscopy by adding machine vision, augmented intelligence, and deep learning capabilities through all surgical phases to help guide improved decision making, enriched collaboration, and enhanced predictability for all surgeons (independent of skill level and experience). Our Performance-Guided Surgery strategy is composed of the following framework:

| |

●

|

Intra-operative - in what we call “intelligent preparation,” our machine learning models will take data from all procedures done utilizing our current Senhance System with the ISU, such as tracking surgical motion and team interaction, to create a large and constantly improving database of surgeries and their outcomes to enable surgeons to best inform their approach and surgical setup. We are collecting such surgical data through our TRUST clinical registry. We believe TRUST is the largest robotic-assisted laparoscopic registry in the industry. To date our investigators have enrolled more than 1,700 patients as of the end of the first quarter of 2022. The registry includes a variety of procedural specialties, including abdominal, thoracic, urologic, and gynecological procedures performed at select sites across Europe. The Company expects to continue to grow this body of clinical data to support its commercial strategy as well as help to facilitate an increasing number of high-quality clinical publications demonstrating the value of Senhance and Performance-Guided Surgery.

|

| |

●

|

We also believe the Senhance System provides “perceptive real-time guidance” for intra-operative tasks, allowing any surgeon performing a procedure with the Senhance System to perform multiple tasks and benefit from the collective knowledge and rules-based performance of thousands of other successful Senhance-based procedures. Not only will this provide the surgeon with a pathway to better outcomes, but we also believe it will ultimately help reduce the cognitive load of the surgeons.

|

| |

●

|

Post-operative – finally, by tapping into the vast amount of data captured during procedures, surgeons and operating room staff will be able to get “performance analytics” with actionable assessments of their performance giving them the information needed to improve performance over time. We intend to establish a new standard of analytics to improve not only the skills of all surgeons but move towards best-practice-sharing that bridges the global surgeon community.

|

We continue the market development for and commercialization of the Senhance® Surgical System, which digitizes laparoscopic minimally invasive surgery, or MIS. The Senhance System is the first and only multi-port, digital laparoscopy platform designed to maintain laparoscopic MIS standards while providing digital benefits such as haptic feedback, robotic precision, comfortable ergonomics, advanced instrumentation including 3mm microlaparoscopic instruments, 5mm articulating instruments, eye-sensing camera control and fully-reusable standard instruments to help maintain per-procedure costs similar to traditional laparoscopy.

We believe that future outcomes of minimally invasive surgery will be enhanced through our combination of more advanced tools and robotic functionality which are designed to:

| |

●

|

empower surgeons with improved precision, ergonomics, dexterity and visualization;

|

| |

●

|

offer high patient satisfaction and enable a desirable post-operative recovery; and

|

| |

●

|

provide a cost-effective robotic system, compared to existing alternatives today, for a wide range of clinical applications and operative sites within the healthcare system.

|

Our strategy is to focus on the market development, commercialization, and further development of the Senhance System. We further believe that:

| |

●

|

laparoscopic robotic surgery will need to continue to evolve given the pressures of value-based healthcare and existing operating room inefficiencies, surgical variability, and workforce challenges;

|

| |

●

|

with the Senhance System, surgeons can benefit from the haptic feedback, enhanced three-dimensional, high definition, or 3DHD, vision, and open architecture consistent with current laparoscopic surgery procedures; and

|

| |

●

|

patients will continue to seek a minimally invasive option, offering minimal scarring and fewer incisions, for many common general abdominal and gynecologic surgeries, which desires are addressed by the Senhance System.

|

The Senhance System addresses these key challenges for laparoscopic surgeons and hospitals by delivering the benefits of robotics with improved control of the surgical field, enhanced visualization and camera control and improved ergonomics, coupled with the familiarity of laparoscopic motion and consistent per-procedure costs.

The Senhance System is available for sale in Europe, the United States, Japan, Taiwan, Russia (to the extent lawful) and select other countries.

| |

●

|

The Senhance System has a CE Mark in Europe for adult and pediatric laparoscopic abdominal and pelvic surgery, as well as limited thoracic surgeries excluding cardiac and vascular surgery.

|

| |

●

|

In the United States, we have 510(k) clearance from the FDA for use of the Senhance System in general laparoscopic surgical procedures and laparoscopic gynecologic surgery in a total of 31 indicated procedures, including benign and oncologic procedures, laparoscopic inguinal, hiatal and paraesophageal hernia, sleeve gastrectomy and laparoscopic cholecystectomy (gallbladder removal) surgery.

|

| |

●

|

In Japan, we have received regulatory approval and reimbursement for 98 laparoscopic procedures.

|

| |

●

|

The Senhance System received its registration certificate by the Russian medical device regulatory agency, Roszdravnadzor, allowing for its sale and utilization throughout the Russian Federation.

|

We also enter into lease arrangements with certain qualified customers. For some lease arrangements, the customers are provided with the right to purchase the leased Senhance System during or at the end of the lease term (which we refer to as a “Lease Buyout”).

Our focus over the last few years has been on seeking regulatory approvals and clearances for the Senhance System and related product offerings and instruments and pursuing commercialization of our products. The following chart describes our success in achieving regulatory clearances and approvals to date.

|

Product/Indications

|

FDA Clearance

|

CE Mark

|

Other Approvals

|

|

Senhance System

|

October 2017

|

January 2012

|

Taiwan – April 2018

Japan – May 2019

Russian Federation – December 2020

|

|

Indications for Use of Senhance System

|

|

● Initial general surgery indications for laparoscopic colorectal and gynecologic surgery procedures

|

October 2017

|

N/A

|

N/A

|

|

● Extended to cholecystectomy and inguinal hernia repair

|

May 2018

|

N/A

|

N/A

|

|

● Extended to hiatal and paraesophageal hernia, sleeve gastrectomy, and sacrocolpopexy

|

March 2021

|

N/A

|

N/A

|

|

● General surgery indications

|

General laparoscopic surgical procedures and laparoscopic gynecologic surgery in a total of 31 indicated procedures, including benign and oncologic procedures, laparoscopic inguinal, hiatal and paraesophageal hernia, sleeve gastrectomy and laparoscopic cholecystectomy

|

For adult and pediatric laparoscopic abdominal and pelvic surgery, as well as limited thoracic surgeries excluding cardiac and vascular surgery

|

Japan – regulatory approval and reimbursement for 98 laparoscopic procedures – July 2019

|

|

● Pediatric indications

|

N/A

|

February 2020

|

N/A

|

|

Instruments and Other Products

|

|

● Intelligent Surgical Unit, or ISU

|

Initial - March 2020

Expansion of augmented intelligence in August 2021

|

January 2021

|

Japan - December 2020

|

|

● 5mm articulating instruments

|

July 2021

|

September 2018

|

N/A

|

|

● 3mm diameter instruments

|

October 2018

|

April 2019

|

Taiwan - November 2018

Japan - October 2019

|

|

● Senhance ultrasonic system

|

January 2019

|

September 2018

|

Japan - October 2020

|

|

● 3 and 5mm hooks

|

5mm July 2019

3mm November 2019

|

December 2019

|

Japan - December 2020

|

On January 19, 2021, we announced that we received CE Mark for the ISU, allowing us to expand our augmented intelligence capabilities to all global areas accepting CE Marks. In addition, in August 2021, we received FDA clearance for expanded augmented intelligence features on the ISU. The ISU enables machine vision-driven control of the camera for a surgeon by responding to commands and recognizing certain objects and locations in the surgical fields and allows a surgeon to change the visualized field of view using the movement of their instruments. The newest ISU features expand upon these capabilities and introduce more advanced features including 3D measurement, digital tagging, image enhancement, and enhanced camera control based on real-time data from anatomical structures while performing surgery. We acquired the assets used in the development of the ISU as part of our October 2018 acquisition of the assets, intellectual property and highly experienced multidisciplinary personnel of Medical Surgical Technologies, Inc., or MST, an Israeli-based medical technology company.

On July 28, 2021, we announced that we received FDA clearance for 5mm diameter articulating instruments, offering better access to difficult-to-reach areas of the anatomy by providing two additional degrees of freedom. These instruments previously received CE Mark for use in the EU.

We also focused on expanding the indications for use of the Senhance System. As of March 2021, the Senhance System is FDA cleared for use in general laparoscopic surgical procedures and laparoscopic gynecologic surgery in a total of 31 indicated procedures, including benign and oncologic procedures, laparoscopic inguinal, hiatal and paraesophageal hernia, sleeve gastrectomy and laparoscopic cholecystectomy. We continue to make additional submissions for clearance or approval for enhancements to the Senhance System and related instruments and accessories, including additional filings and approvals sought in Japan.

From our inception, we devoted a substantial percentage of our resources to research and development and start-up activities, consisting primarily of product design and development, clinical studies, manufacturing, recruiting qualified personnel and raising capital. We expect to continue to invest in research and development and market development as we implement our strategy. As a result, we will need to generate significant revenue in order to achieve profitability.

As used herein, the terms “Company,” ”we,” “our,” or “us” each includes Asensus Surgical, Inc. and its subsidiaries, Asensus Surgical US, Inc., Asensus International, Inc., Asensus Surgical Italia S.r.l., Asensus Surgical Europe S.à.r.l., Asensus Surgical Taiwan Ltd., Asensus Surgical Japan K.K., Asensus Surgical Israel Ltd., Asensus Surgical Netherlands B.V., and Asensus Surgical Canada, Inc.

We operate in one business segment.

Risks and Uncertainties

We are subject to risks similar to other similarly sized companies in the medical device industry. These risks include, without limitation: potential negative impacts on our operations caused by the COVID-19 pandemic; our ability to continue as a going concern; the historical lack of profitability; our ability to raise additional capital; the liquidity and capital resources of our customers; our ability to successfully implement our strategy and increase utilization of the Senhance System; the timing and outcome of the regulatory review process for our products; changes in the health care and regulatory environments of the United States, the United Kingdom, the European Union, Japan, Taiwan and other countries in which we operate or intend to operate; our ability to attract and retain key management, marketing and scientific personnel; our ability to successfully prepare, file, prosecute, maintain, defend and enforce patent claims and other intellectual property rights; competition in the market for robotic surgical devices; and our ability to identify and pursue development of additional products.

Material Changes

There have been no material changes in our affairs since the end of the latest fiscal year for which audited financial statements were included in the latest Annual Report on Form 10-K and that have not been described in a Quarterly Report on Form 10-Q or Current Report on Form 8-K filed under the Securities Exchange Act of 1934, as amended.

Company Information

We were organized as a Delaware corporation on August 19, 1988. Our principal executive offices are located at 1 TW Alexander Drive, Suite 160, Durham, NC 27703. Our phone number is (919) 765-8400 and our Internet address is www.asensus.com. The information on our website or any other website is not incorporated by reference in this prospectus supplement and does not constitute a part of this prospectus supplement.

THE OFFERING

|

Securities Offered:

|

Up to an aggregate of $100,000,000 of shares of our common stock pursuant to the Sales Agreement with Cantor and Oppenheimer, as sales agents. See “Plan of Distribution” beginning on page S-11 of this prospectus supplement.

|

| |

|

|

Common Stock Outstanding:

|

As of March 31, 2022, we had 236,415,239 shares of common stock outstanding.

|

| |

|

|

Manner of Offering:

|

“At the market offering” made from time to time through or to the Agents as sales agents or principals. See “Plan of Distribution” beginning on page S-11 of this prospectus supplement.

|

| |

|

|

Use of Proceeds:

|

We currently intend to use the net proceeds of this offering, if any, for general corporate purposes, including working capital, marketing, product development and capital expenditures. See “Use of Proceeds” on page S-8 of this prospectus supplement.

|

| |

|

|

Risk Factors:

|

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-7 of this prospectus supplement and the other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus.

|

| |

|

|

NYSE American symbol:

|

Our common stock is listed on the NYSE American under the symbol “ASXC.”

|

The number of shares of common stock outstanding as of March 31, 2022, excludes, as of such date:

|

● 47,735 shares of common stock we have issued between April 1, 2022 and May 4, 2022;

|

|

● 6,766,520 shares of common stock issuable upon the exercise of outstanding options granted under our equity incentive plans at a weighted average exercise price of $4.74 per share;

|

|

● 1,120,300 shares of common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $1.94 per share;

|

|

● 7,299,111 shares of common stock issuable upon vesting of outstanding restricted stock units; and

|

|

● 12,923,639 shares of common stock available for future issuance under our equity incentive plans.

|

Unless otherwise stated in this prospectus supplement, all information in this prospectus supplement, including share and per share amounts assumes that there were no exercises of outstanding options or warrants after March 31, 2022.

RISK FACTORS

Investing in our common stock involves a high degree of risk. For a discussion of the factors you should carefully consider before deciding to purchase any of our securities, please review “Part I, Item 1.A - Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on February 28, 2022, and in Item 1.A of our Quarterly Report on Form 10-Q for the three months ended March 31, 2022, filed with the SEC on May 4, 2022, which are incorporated by reference in this prospectus supplement and the accompanying prospectus in their entirety, together with the other information contained in this prospectus supplement, the accompanying prospectus and the documents we have filed or will subsequently file that are incorporated by reference. The risks and uncertainties described in the documents incorporated by reference are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of those risks actually occurs, our business, financial condition and results of operations would suffer. In that event, the market price of our common stock could decline, and you may lose all or part of your investment in our common stock.

Risks Relating to this Offering

Our stockholders have experienced dilution of their percentage ownership of our stock and may experience additional dilution in the future.

We have raised significant capital through the issuance of our common stock and warrants, particularly in the common stock offerings that occurred in the first quarter of 2021, and anticipate that we will need to raise additional capital in the future in order to continue our operations and achieve our business objectives. We cannot assure you that we will be able to sell shares or other securities in any offering at a price per share that is equal to or greater than the price per share paid by investors in previous offerings, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock or other securities convertible into or exchangeable for our common stock in future transactions may be higher or lower than the price per share in previous offerings. The future issuance of the Company’s equity securities will further dilute the ownership of our outstanding common stock. The market price of our common stock has been, and may continue to be, highly volatile, and such volatility could cause the market price of our common stock to decrease and could cause you to lose some or all of your investment in our common stock.

Management will have broad discretion as to the use of the net proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion as to the application of the net proceeds and could use them for purposes other than those contemplated at the time of this offering. Our stockholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase our results of operations or the market value of our common stock. Our failure to apply these funds effectively could have a material adverse effect on our business, delay the development and approval of our products and cause the price of our common stock to decline.

If you purchase shares of our common stock in this offering, you will experience immediate dilution as a result of this offering.

Because the price per share being offered may be higher than net tangible book value per share of our common stock, you will experience dilution to the extent of the difference between the offering price per share of common stock you pay in this offering and the net tangible book value per share of our common stock immediately after this offering. Our net tangible book value as of March 31, 2022 was approximately $143.8 million, or $0.61 per share of common stock. Net tangible book value per share is equal to our total tangible assets minus total liabilities, all divided by the number of shares of common stock outstanding. See “Dilution” on page S-10 of this prospectus supplement for a more detailed illustration of the dilution you may incur if you participate in this offering. Because the sales of the shares offered hereby will be made directly into the market or in negotiated transactions, the prices at which we sell these shares will vary and these variations may be significant. Purchasers of the shares we sell, as well as our existing stockholders, will experience significant dilution if we sell shares at prices significantly below the price at which they invested.

If you purchase shares of our common stock in this offering, you may experience future dilution as a result of future equity offerings or other equity issuances.

In order to raise additional capital, we may in the future offer and issue additional shares of our common stock or other securities convertible into or exchangeable for our common stock. We cannot assure you that we will be able to sell shares or other securities in any offering at a price per share that is equal to or greater than the price per share paid by investors in previous offerings, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock or other securities convertible into or exchangeable for our common stock in future transactions may be higher or lower than the price per share in previous offerings. Further, we may choose to raise additional capital due to market conditions or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans. In addition, the exercise of outstanding stock options and warrants or the settlement of outstanding restricted stock units would result in further dilution of your investment.

It is not possible to predict the actual number of shares we will sell under the Sales Agreement, or the gross proceeds resulting from those sales.

Subject to certain limitations in the Sales Agreement and compliance with applicable law, we have the discretion to deliver a placement notice to the Agents at any time throughout the term of the Sales Agreement. The number of shares that are sold through the Agents after delivering a placement notice will fluctuate based on a number of factors, including the market price of the common stock during the sales period, the limits we set with the Agents in any applicable placement notice, and the demand for our common stock during the sales period. Because the price per share of each share sold will fluctuate during the sales period, it is not currently possible to predict the number of shares that will be sold or the gross proceeds to be raised in connection with those sales, if any.

The common stock offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares in this offering at different times will likely pay different prices, and so they may experience different levels of dilution and different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold in this offering. In addition, there is no minimum or maximum sales price for shares to be sold in this offering. Investors may experience a decline in the value of the shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

We do not currently intend to pay dividends on our common stock, and any return to investors is expected to come, if at all, only from potential increases in the price of our common stock.

At the present time, we intend to use available funds to finance our operations. Accordingly, while payments of dividends is within the discretion of our board of directors, no cash dividends on our common stock have been declared or paid by us, and we have no intention of paying any such dividends in the foreseeable future. Any return to investors is expected to come, if at all, only from potential increases in the price of our common stock.

USE OF PROCEEDS

The amount of proceeds from this offering will depend on the number of shares sold, if any, and the market price at which they are sold. We currently intend to use the net proceeds of this offering for general corporate purposes, including working capital, product development and capital expenditures. As a result, our management will have broad discretion to allocate the net proceeds from this offering for any purpose, and investors will be relying on the judgment of our management with regard to the use of these net proceeds. Pending use of the net proceeds as described above, we intend to invest the net proceeds in money-market funds or U.S. treasuries until we use them for their stated purpose.

These expected uses of proceeds represent our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve. The amounts and timing of our actual expenditures may vary significantly depending on numerous factors, including those described in “Special Note Regarding Forward-Looking Statements” on page S-ii of this prospectus supplement. As a result, our management will have broad discretion in the application of the net proceeds from this offering, and investors will be relying on the judgment of our management regarding the application of the net proceeds from this offering. The timing and amount of our actual expenditures will be based on many factors, including cash flows from operations and the anticipated growth of our business.

DESCRIPTION OF SECURITIES WE ARE OFFERING

The material terms and provisions of our common stock are described under the caption “Description of Capital Stock” beginning on page 5 of the accompanying base prospectus. Our common stock is listed on the NYSE American under the symbol “ASXC.” Our transfer agent is Continental Stock Transfer and Trust Company.

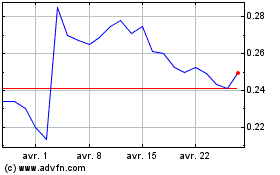

PRICE RANGE OF OUR COMMON STOCK

Our common stock began trading on the NYSE American on April 2, 2014 under the symbol “TRXC.” Our symbol changed to “ASXC” on March 5, 2021 following the change of our corporate name to Asensus Surgical, Inc.

The closing price of our common stock as reported on the NYSE American on May 9, 2022 was $0.37 per share. As of May 9, 2022, there were approximately 58 record holders of our common stock (counting all shares held in single nominee registration as one stockholder). This does not include the number of persons whose stock is in nominee or “street name” accounts through brokers.

DILUTION

If you purchase common stock in this offering, your interest may be diluted to the extent of the difference between the offering price of the common stock offered hereby and the as-adjusted net tangible book value per share of common stock after this offering.

The net tangible book value of our common stock as of March 31, 2022 was approximately $143.8 million, or approximately $0.61 per share. Net tangible book value per share represents the amount of our total tangible assets less total liabilities divided by the total number of shares of our common stock outstanding.

Dilution per share to new investors represents the difference between the amount per share paid by purchasers for our common stock in this offering from time to time and the net tangible book value per share of our common stock immediately following the completion of this offering.

After giving effect to the sale of shares of common stock offered by this prospectus supplement at an assumed offering price of $0.44 per share based on the closing price of our common stock as of May 4, 2022, and after deducting commissions and estimated aggregate offering expenses payable by us, our as adjusted net tangible book value as of March 31, 2022 would have been approximately $240.9 million, or approximately $0.52 per share. This represents an immediate decrease in net tangible book value of approximately $0.09 per share to our existing stockholders and an immediate dilution in as adjusted net tangible book value of approximately $0.08 per share to purchasers of our common stock in this offering, as illustrated by the following table:

|

Assumed offering price per share

|

|

|

|

|

|

$ |

0.44 |

|

|

Net tangible book value per share at March 31, 2022

|

|

$ |

0.61 |

|

|

|

|

|

|

Decrease in net tangible book value per share attributable to existing shareholders

|

|

$ |

0.09 |

|

|

|

|

|

|

As adjusted net tangible book value per share as of March 31, 2022 after giving effect to this offering

|

|

|

|

|

|

$ |

0.52 |

|

|

Dilution per share to investors purchasing our common stock in this offering

|

|

|

|

|

|

$ |

0.08 |

|

The number of shares of common stock outstanding as of March 31, 2022, excludes, as of such date:

|

● 47,735 shares of common stock we have issued between April 1, 2022 and May 4, 2022;

|

|

● 6,766,520 shares of common stock issuable upon the exercise of outstanding options granted under our equity incentive plans at a weighted average exercise price of $4.74 per share;

|

|

● 1,120,300 shares of common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $1.94 per share;

|

|

● 7,299,111 shares of common stock issuable upon vesting of outstanding restricted stock units; and

|

|

● 12,923,639 shares of common stock available for future issuance under our equity incentive plans.

|

Unless otherwise stated in this prospectus supplement, all information in this prospectus supplement, including share and per share amounts assumes that there were no exercises of outstanding options or warrants after March 31, 2022.

To the extent that outstanding options or warrants are exercised, you will experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

PLAN OF DISTRIBUTION

We have entered into the Sales Agreement with Cantor Fitzgerald & Co. and Oppenheimer & Co. Inc., pursuant to which we may issue and sell shares of our common stock having an aggregate gross sales price of up to $100,000,000 from time to time through or to the applicable Agent, acting as sales agent or principal. The Sales Agreement has been filed as an exhibit to a report filed under the Exchange Act and incorporated by reference into this prospectus supplement.

Following delivery of a placement notice and subject to the terms and conditions of the Sales Agreement, the Agents may offer and sell our common stock by any method permitted by law deemed to be an “at the market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act. We may instruct the Agents not to sell our common stock if the sales cannot be effected at or above the price designated by us from time to time. We or the Agents may suspend the offering of our common stock upon notice and subject to other conditions.

We will pay the Agents commissions, in cash, for their respective services in acting as agents in the sale of our common stock. The Agents will be entitled to compensation under the terms of the Sales Agreement at a fixed commission rate of up to 3.0% of the gross proceeds from each sale of our common stock. Because there is no minimum offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds to us, if any, are not determinable at this time. We have also agreed to reimburse the Agents for certain specified expenses, including the fees and disbursements of its legal counsel, in an amount not to exceed $75,000. We estimate that the total expenses for this offering, excluding compensation and reimbursements payable to the Agents under the terms of the Sales Agreement, will be approximately $85,000.

Settlement for sales of our common stock will occur on the second trading day following the date on which any sales are made, or on some other date that is agreed upon by us and the applicable Agent in connection with a particular transaction, in return for payment of the net proceeds to us. Sales of our common stock as contemplated in this prospectus supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and the applicable Agent may agree upon. There is no arrangement for funds to be received in an escrow, trust or similar arrangement. The Agents will use commercially reasonable efforts consistent with their respective normal trading and sales practices to solicit offers to purchase the shares of our common stock under the terms and subject to the conditions set forth in the Sales Agreement. In connection with the sales of our common stock on our behalf, each of the Agents will be deemed to be an “underwriter” within the meaning of the Securities Act and the compensation of the Agents will be deemed to be underwriting commissions or discounts. We have also agreed to provide indemnification and contributions to the Agents against certain liabilities, including liabilities under the Securities Act and the Exchange Act.

This offering of our common stock pursuant to the Sales Agreement will terminate as permitted therein. We, on the one hand, and each of the Agents with respect to itself only, on the other hand, may terminate the Sales Agreement at any time upon ten days’ prior notice.

Each of the Agents and their respective affiliates may in the future provide various investment banking, commercial banking and other financial services for us and our affiliates, for which services they may in the future receive customary fees and compensation. To the extent required by Regulation M, neither of the Agents will engage in any market making activities involving our common stock while the offering is ongoing under this prospectus supplement.

This prospectus supplement in electronic format may be made available on websites maintained by the Agents, and the Agents may distribute this prospectus supplement electronically.

Transfer Agent and Registrar

The transfer agent of our common stock is Continental Stock Transfer & Trust Company. The transfer agent and registrar’s address is 1 State St 30th Floor, New York, NY 10004, and the telephone number is (212) 509-4000.

LEGAL MATTERS

Certain legal matters with respect to the securities offered hereby have been passed upon by Ballard Spahr LLP, Philadelphia, Pennsylvania. The Agents are being represented in connection with this offering by Duane Morris LLP, New York, New York.

EXPERTS

The consolidated financial statements as of December 31, 2021 and 2020 and for each of the three years in the period ended December 31, 2021 and management's assessment of the effectiveness of internal control over financial reporting as of December 31, 2021 incorporated by reference in this Prospectus Supplement have been so incorporated in reliance on the reports of BDO USA, LLP, an independent registered public accounting firm, incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 that we filed with the SEC under the Securities Act. This prospectus supplement and the accompanying prospectus do not contain all of the information included in the registration statement. We have omitted certain parts of the registration statement in accordance with the rules and regulations of the SEC. For further information, we refer you to the registration statement, including its exhibits and schedules. Statements contained in this prospectus supplement and the accompanying prospectus about the provisions or contents of any contract, agreement or any other document referred to are not necessarily complete. Please refer to the actual exhibit for a more complete description of the matters involved.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings, including the registration statement and exhibits, are available to the public at the SEC’s website at http://www.sec.gov. You may also read, without charge, and copy the documents we file, at the SEC’s public reference rooms at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You can request copies of these documents by writing to the SEC and paying a fee for the copying cost. Please call the SEC at 1-800-SEC-0330 for further information on the public reference rooms.

We maintain an Internet site at www.asensus.com. We have not incorporated by reference into this prospectus supplement or the accompanying prospectus the information on our website, and you should not consider any of the information posted on or hyper-linked to our website to be a part of this prospectus supplement or the accompanying prospectus.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with the SEC, which means we can disclose important information to you by referring you to those documents. The information we incorporate by reference is an important part of this prospectus supplement, and certain information that we will later file with the SEC will automatically update and supersede this information. We incorporate by reference the documents listed below as well as any future filings made with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement until we sell all of the securities under this prospectus supplement, except that we do not incorporate any document or portion of a document that is “furnished” to the SEC, but not deemed “filed.” The following documents filed with the SEC are incorporated by reference in this prospectus supplement and the accompanying prospectus:

| |

•

|

|

our Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC on February 28, 2022;

|

| |

•

|

|

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, filed with the SEC on May 4, 2022;

|

| |

•

|

|

our Current Reports on Form 8-K filed with the SEC on March 15, 2022 and on March 18, 2022;

|

| |

•

|

|

our definitive proxy statements on Schedule 14A, filed with the SEC on April 25, 2022; and

|

| |

•

|

|

the description of the Company’s common stock contained in the Registration Statement on Form 8-A filed on April 7, 2014, and any amendments to each such Registration Statement filed subsequently thereto, including all amendments or reports filed for the purpose of updating such description.

|

We will furnish to you, on written or oral request, a copy of any or all of the documents that have been incorporated by reference, including exhibits to these documents. You may request a copy of these filings at no cost by writing or telephoning our Secretary at the following address and telephone number:

Asensus Surgical, Inc.

Attention: Joshua Weingard, Chief Legal Officer and Secretary

1 TW Alexander Drive, Suite 160

Durham, NC 27703

Telephone No.: (919) 765-8400

PROSPECTUS

$150,000,000

Common Stock

Preferred Stock

Warrants

Units

We may offer and sell from time to time, in one or more offerings, up to $150,000,000 of any combination of common stock, preferred stock and warrants, either individually or in units consisting of any two or more of such securities. We may also offer securities upon the exercise of warrants.

Each time we sell securities pursuant to this prospectus, we will provide the specific terms of the securities offered in a supplement to this prospectus. The prospectus supplements will also describe the specific manner in which we will offer these securities and may also supplement, update or amend information contained in this prospectus. You should read this prospectus and any related prospectus supplement carefully before you invest in our securities.

The securities may be sold on a delayed or continuous basis directly by us, through dealers, agents or underwriters designated from time to time, or through any combination of these methods. If any dealers, agents or underwriters are involved in the sale of the securities in respect of which this prospectus is being delivered, we will disclose their names and the nature of our arrangements with them in any prospectus supplement. The net proceeds we expect to receive from any such sale will also be included in the applicable prospectus supplement.

Our common stock is traded on the NYSE American under the symbol “ASXC.” On March 14, 2022 the closing price of our common stock was $0.53 per share.

Investing in our securities involves a high degree of risk. See “RISK FACTORS” on page 5.

This prospectus may not be used to offer or sell securities unless accompanied by a prospectus supplement for the securities being sold.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus is April 28, 2022

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical fact, included or incorporated in this prospectus regarding our strategy, future operations, collaborations, intellectual property, cash resources, financial position, future revenues, projected costs, prospects, plans, and objectives of management are forward-looking statements. The words “believes,” “anticipates,” “estimates,” “plans,” “expects,” “intends,” “may,” “could,” “should,” “potential,” “likely,” “projects,” “continue,” “will,” and “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We cannot guarantee that we actually will achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. There are a number of important factors that could cause our actual results to differ materially from those indicated or implied by forward-looking statements. These important factors include those referenced under the heading “Risk Factors.” These factors and the other cautionary statements made in this prospectus should be read as being applicable to all related forward-looking statements whenever they appear in this prospectus. In addition, any forward-looking statements represent our estimates only as of the date that this prospectus is filed with the SEC, and should not be relied upon as representing our estimates as of any subsequent date. We do not assume any obligation to update any forward-looking statements. We disclaim any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

You should rely only on the information contained in this prospectus and in any prospectus supplement (including in any documents incorporated by reference herein or therein). We have not authorized anyone to provide you with any different information. We are offering to sell our securities, and seeking offers to buy, only in jurisdictions where offers and sales are permitted.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in, or incorporated by reference into, this prospectus. This summary does not contain all of the information you should consider before investing in our securities. You should read this entire prospectus carefully, especially the “Risk Factors” section beginning on page 5 and our consolidated financial statements and the related notes and risk factors incorporated by reference into this prospectus, before making an investment decision.

Company Overview

Asensus Surgical, Inc. is a medical device company that is digitizing the interface between the surgeon and the patient to pioneer a new era of Performance-Guided Surgery™ by unlocking clinical intelligence for surgeons to enable consistently superior outcomes and a new standard of laparoscopic surgery. This builds upon the foundation of Digital Laparoscopy with our Senhance® Surgical System powered by the Intelligent Surgical Unit™ (ISU™) to increase surgeon control and reduce surgical variability. With the addition of machine vision, augmented intelligence, and deep learning capabilities throughout the surgical experience, we intend to holistically address the current clinical, cognitive and economic shortcomings that drive surgical outcomes and value-based healthcare.

Our mission is focused on leveraging robotic technologies, augmented intelligence, and machine learning capabilities to: reduce variability in surgery, drive more predictable outcomes, optimize resources and costs, and work with hospital systems that strive to employ innovative healthcare strategies. By leveraging advanced digital technologies, we aim to enable surgeons to take the best surgical practices and techniques from everywhere and utilize them to help improve outcomes, reduce variability, control the unexpected, reduce costs, reduce cognitive and physical fatigue of surgeons, and provide patients with the best care possible. We believe that by digitizing the interface between the surgeon and patient, we can unlock clinical intelligence to pioneer a new era of surgery, which we are calling Performance-Guided Surgery.

Historical advances in surgery have largely focused on bringing tools and techniques into the operating room to reduce the invasiveness of procedures. When we introduced Digital Laparoscopy, our intention was to help surgeons minimize surgical variability in a cost-effective manner. The next logical step in the progression is looking for ways to deliver clinical intelligence and analytics, which we believe can be enabled by what we refer to as Performance-Guided Surgery.

Performance-Guided Surgery builds upon our foundation of Digital Laparoscopy by adding machine vision, augmented intelligence, and deep learning capabilities through all surgical phases to help guide improved decision making, enriched collaboration, and enhanced predictability for all surgeons (independent of skill level and experience). Our Performance-Guided Surgery strategy is composed of the following framework:

| |

●

|

Pre-operative - in what we call “intelligent preparation,” our machine learning models will take data from all procedures done utilizing our current Senhance System with the ISU, such as tracking surgical motion and team interaction, to create a large and constantly improving database of surgeries and their outcomes to enable surgeons to best inform their approach and surgical setup.

|

| |

●

|

Intra-operative – we believe the Senhance System provides “perceptive real-time guidance” for intra-operative tasks, allowing any surgeon performing a procedure with the Senhance System to perform multiple tasks and benefit from the collective knowledge and rules-based performance of thousands of other successful Senhance-based procedures. Not only will this provide the surgeon with a pathway to better outcomes, but we also believe it will ultimately help reduce the cognitive load of the surgeons.

|

| |

●

|

Post-operative – finally, by tapping into the vast amount of data captured during procedures, surgeons and operating room staff will be able to get “performance analytics” with actionable assessments of their performance giving them the information needed to improve performance over time. We intend to establish a new standard of analytics to improve not only the skills of all surgeons but move towards best-practice-sharing that bridges the global surgeon community.

|

We continue the market development for and commercialization of the Senhance® Surgical System, which digitizes laparoscopic minimally invasive surgery, or MIS. The Senhance System is the first and only multi-port, digital laparoscopy platform designed to maintain laparoscopic MIS standards while providing digital benefits such as haptic feedback, robotic precision, comfortable ergonomics, advanced instrumentation including 3mm microlaparoscopic instruments, 5mm articulating instruments, eye-sensing camera control and fully-reusable standard instruments to help maintain per-procedure costs similar to traditional laparoscopy.

We believe that future outcomes of minimally invasive surgery will be enhanced through our combination of more advanced tools and robotic functionality which are designed to:

| |

●

|

empower surgeons with improved precision, ergonomics, dexterity and visualization;

|

| |

●

|

offer high patient satisfaction and enable a desirable post-operative recovery; and

|

| |

●

|

provide a cost-effective robotic system, compared to existing alternatives today, for a wide range of clinical applications and operative sites within the healthcare system.

|

Our strategy is to focus on the market development, commercialization, and further development of the Senhance System. We further believe that:

| |

●

|

laparoscopic robotic surgery will need to continue to evolve given the pressures of value-based healthcare and existing operating room inefficiencies, surgical variability, and workforce challenges;

|

| |

●

|

with the Senhance System, surgeons can benefit from the haptic feedback, enhanced three-dimensional, high definition, or 3DHD, vision, and open architecture consistent with current laparoscopic surgery procedures; and

|

| |

●

|

patients will continue to seek a minimally invasive option, offering minimal scarring and fewer incisions, for many common general abdominal and gynecologic surgeries, which desires are addressed by the Senhance System.

|

The Senhance System addresses these key challenges for laparoscopic surgeons and hospitals by delivering the benefits of robotics with improved control of the surgical field, enhanced visualization and camera control and improved ergonomics, coupled with the familiarity of laparoscopic motion and consistent per-procedure costs.

The Senhance System is available for sale in Europe, the United States, Japan, Taiwan, Russia and select other countries.

| |

●

|

The Senhance System has a CE Mark in Europe for adult and pediatric laparoscopic abdominal and pelvic surgery, as well as limited thoracic surgeries excluding cardiac and vascular surgery.

|

| |

●

|

In the United States, we have 510(k) clearance from the FDA for use of the Senhance System in general laparoscopic surgical procedures and laparoscopic gynecologic surgery in a total of 31 indicated procedures, including benign and oncologic procedures, laparoscopic inguinal, hiatal and paraesophageal hernia, sleeve gastrectomy and laparoscopic cholecystectomy (gallbladder removal) surgery.

|

| |

●

|

In Japan, we have received regulatory approval and reimbursement for 98 laparoscopic procedures.

|

| |

●

|

The Senhance System received its registration certificate by the Russian medical device regulatory agency, Roszdravnadzor, allowing for its sale and utilization throughout the Russian Federation.

|

We also enter into lease arrangements with certain qualified customers. For some lease arrangements, the customers are provided with the right to purchase the leased Senhance System during or at the end of the lease term (which we refer to as a Lease Buyout). In the first quarter of 2021, we completed one Lease Buyout of a Senhance System.

Our focus over the last few years has been on seeking regulatory approvals and clearances for the Senhance System and related product offerings and instruments and pursuing commercialization of our products. The following chart describes our success in achieving regulatory clearances and approvals to date.

|

Product/Indications

|

FDA Clearance

|

CE Mark

|

Other Approvals

|

|

Senhance System

|

October 2017

|

January 2012

|

Taiwan – April 2018

Japan – May 2019

Russian Federation – December 2020

|

|

Indications for Use of Senhance System

|

|

● Initial general surgery indications for laparoscopic colorectal and gynecologic surgery procedures

|

October 2017

|

N/A

|

N/A

|

|

● Extended to cholecystectomy and inguinal hernia repair

|

May 2018

|

N/A

|

N/A

|

|

● Extended to hiatal and paraesophageal hernia, sleeve gastrectomy, and sacrocolpopexy

|

March 2021

|

N/A

|

N/A

|

|

● General surgery indications

|

General laparoscopic surgical procedures and laparoscopic gynecologic surgery in a total of 31 indicated procedures, including benign and oncologic procedures, laparoscopic inguinal, hiatal and paraesophageal hernia, sleeve gastrectomy and laparoscopic cholecystectomy

|

For adult and pediatric laparoscopic abdominal and pelvic surgery, as well as limited thoracic surgeries excluding cardiac and vascular surgery

|

Japan – regulatory approval and reimbursement for 98 laparoscopic procedures – July 2019

|

|

● Pediatric indications

|

N/A

|

February 2020

|

N/A

|

|

Instruments and Other Products

|

|

● Intelligent Surgical Unit, or ISU

|

Initial - March 2020

Expansion of augmented intelligence in August 2021

|

January 2021

|

Japan - December 2020

|

|

● 5mm articulating instruments

|

July 2021

|

September 2018

|

N/A

|

|

● 3mm diameter instruments

|

October 2018

|

April 2019

|

Taiwan - November 2018

Japan - October 2019

|

|

● Senhance ultrasonic system

|

January 2019

|

September 2018

|

Japan - October 2020

|

|

● 3 and 5mm hooks

|

5mm July 2019

3mm November 2019

|

December 2019

|

Japan - December 2020

|

On January 19, 2021, we announced that we received CE Mark for the ISU, allowing us to expand our augmented intelligence capabilities to all global areas accepting CE Marks. In addition, in August 2021, we received FDA clearance for expanded augmented intelligence features on the ISU. The ISU enables machine vision-driven control of the camera for a surgeon by responding to commands and recognizing certain objects and locations in the surgical fields and allows a surgeon to change the visualized field of view using the movement of their instruments. The newest ISU features expand upon these capabilities and introduce more advanced features including 3D measurement, digital tagging, image enhancement, and enhanced camera control based on real-time data from anatomical structures while performing surgery. We acquired the assets used in the development of the ISU as part of our October 2018 acquisition of the assets, intellectual property and highly experienced multidisciplinary personnel of Medical Surgical Technologies, Inc., or MST, an Israeli-based medical technology company.

On July 28, 2021, we announced that we received FDA clearance for 5mm diameter articulating instruments, offering better access to difficult-to-reach areas of the anatomy by providing two additional degrees of freedom. These instruments previously received CE Mark for use in the EU.

We also focused on expanding the indications for use of the Senhance System. As of March 2021, the Senhance System is FDA cleared for use in general laparoscopic surgical procedures and laparoscopic gynecologic surgery in a total of 31 indicated procedures, including benign and oncologic procedures, laparoscopic inguinal, hiatal and paraesophageal hernia, sleeve gastrectomy and laparoscopic cholecystectomy. We continue to make additional submissions for clearance or approval for enhancements to the Senhance System and related instruments and accessories, including additional filings and approvals sought in Japan.

From our inception, we devoted a substantial percentage of our resources to research and development and start-up activities, consisting primarily of product design and development, clinical studies, manufacturing, recruiting qualified personnel and raising capital. We expect to continue to invest in research and development and market development as we implement our strategy. As a result, we will need to generate significant revenue in order to achieve profitability.

As used herein, the terms “Company,” ”we,” “our,” or “us” each includes Asensus Surgical, Inc. and its subsidiaries, Asensus Surgical US, Inc., Asensus International, Inc., Asensus Surgical Italia S.r.l., Asensus Surgical Europe S.à.r.l., Asensus Surgical Taiwan Ltd., Asensus Surgical Japan K.K., Asensus Surgical Israel Ltd., Asensus Surgical Netherlands B.V., and Asensus Surgical Canada, Inc.

We operate in one business segment.

Company Information

We were organized as a Delaware corporation on August 19, 1988. Our principal executive offices are located at 1 TW Alexander Drive, Suite 160, Durham, NC 27703. Our phone number is (919) 765-8400 and our Internet address is www.asensus.com. The information on our website or any other website is not incorporated by reference in this prospectus and does not constitute a part of this prospectus.

ABOUT THIS PROSPECTUS

This prospectus is part of a “shelf” registration statement that we filed with the U.S. Securities and Exchange Commission, or the SEC. By using a shelf registration statement, we may, from time to time, issue any combination of the securities described in this prospectus in one or more offerings up to an aggregate maximum offering price of $150,000,000 in one or more offerings. Each time we sell any of our securities, we will provide a prospectus supplement that will contain more specific information about the offering and the terms of the securities being sold. We may also add, update or change in the prospectus supplement any of the information contained in this prospectus or the documents incorporated by reference.

This prospectus provides you with a general description of our company and our securities. For further information about our business and our securities, you should refer to the registration statement and the reports incorporated by reference in this prospectus, as described in “Where You Can Find More Information.”

You should rely only on the information contained in this prospectus and in any prospectus supplement (including in any documents incorporated by reference herein or therein). We have not authorized anyone to provide you with any different information. We are offering to sell our securities, and seeking offers to buy, only in jurisdictions where offers and sales are permitted.

RISK FACTORS

Investing in our securities involves substantial risks. In addition to other information contained in this prospectus and any accompanying prospectus supplement, before investing in our securities, you should carefully consider the risks described under the heading “Risk Factors” in our most recent Annual Report on Form 10-K, as it may be amended, and subsequent Quarterly Reports on Form 10-Q, and in any other documents incorporated by reference into this prospectus, as updated by our future filings. These risks are not the only ones faced by us. Additional risks not known or that are deemed immaterial could also materially and adversely affect our financial condition, results of operations, our products, business and prospects. Any of these risks might cause you to lose all or a part of your investment.

USE OF PROCEEDS

Unless otherwise indicated in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the securities under this prospectus, if any, together with our existing cash resources, for working capital and other general corporate purposes, including research and development, commercialization and regulatory clearance activities for our products. We may also use a portion of the net proceeds that we receive to acquire or invest in complementary businesses, products, services, technologies, or other assets. At this time, we have not determined the specific uses of any offering proceeds, or the amounts we plan to spend on any particular use or the timing of such expenditures, which may vary significantly depending on various factors such as our research and development activities, regulatory approvals, competition, marketing and sales, and the market acceptance of any products introduced by us or our partners. Pending application of the net proceeds from any particular offering, we intend to invest such proceeds in short-term, interest-bearing, investment-grade securities.

Each time we issue securities, we will provide a prospectus supplement that will contain information about how we intend to use the proceeds from each such offering.

We cannot guarantee that we will receive any proceeds in connection with any offering hereunder because we may choose not to issue any of the securities covered by this prospectus.

DESCRIPTION OF CAPITAL STOCK

Our authorized capital stock consists of 750,000,000 shares of common stock, par value $0.001 per share, and 25,000,000 shares of preferred stock, par value $0.01 per share, none of which are outstanding.

Common Stock

Of the authorized common stock, as of December 31, 2021, there were 235,218,552 shares outstanding, and as of December 31, 2021, there were 9,599,990 shares of our common stock reserved for the exercise of outstanding stock options, warrants and restricted stock units. As of March 14, 2022, there were approximately 60 record holders (counting all shares held in single nominee registration as one stockholder). This does not include the number of persons whose stock is in nominee or “street name” accounts through brokers. The par value of our common stock is $0.001 per share.