false

0001471727

Better Choice Co Inc.

0001471727

2024-10-18

2024-10-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): October 18, 2024

Better

Choice Company, Inc.

(Exact

name of Registrant as Specified in its Charter)

| Delaware |

|

001-40477 |

|

83-4284557 |

(State or other Jurisdiction

of Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

12400

Race Track Road

Tampa,

Florida 33626

(Address

of Principal Executive Offices) (Zip Code)

(Registrant’s

Telephone Number, Including Area Code): (212) 896-1254

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☒ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $0.001 par value share |

|

BTTR |

|

NYSE American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01. Regulation FD Disclosure

On

October 18, 2024, the Company issued a press release updating its stockholders regarding the progress on its previously announced acquisition

of SRx Health Solutions Inc. A copy of the press release is attached as Exhibit 99.1 to this current report on Form 8-K and is incorporated

herein by reference.

The

information in Item 7.01 of this Current Report shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall

such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act,

except as shall be expressly set forth by specific reference in such a filing.

Forward-Looking

Statements

This

current report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the “safe harbor” created by

those sections. All statements in this current report that are not based on historical fact are “forward looking statements.”

These statements may be identified by words such as “estimates,” “anticipates,” “projects,” “plans,”

“strategy,” “goal,” or “planned,” “seeks,” “may,” “might”, “will,”

“expects,” “intends,” “believes,” “should,” and similar expressions, or the negative

versions thereof, and which also may be identified by their context. All statements that address operating performance or events or developments

the Company expects or anticipates will occur in the future, such as stated objectives or goals, refinement of strategy, attempts to

secure additional financing, exploring possible business alternatives, or that are not otherwise historical facts, are forward-looking

statements. While management has based any forward-looking statements included in this current report on its current expectations, the

information on which such expectations were based may change. Forward-looking statements involve inherent risks and uncertainties which

could cause actual results to differ materially from those in the forward-looking statements as a result of various factors, including

risks associated with the Company’s ability to obtain additional capital in the future, the proposed transaction with SRx, general

economic factors, competition in the industry and other factors that could cause actual results to be materially different from those

described herein as anticipated, believed, estimated or expected. Additional risks and uncertainties are described in or implied by the

Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations sections of the Company’s

2023 Annual Report on Form 10-K, filed on April 12, 2024 and other reports filed from time to time with the Securities and Exchange Commission

(“SEC”). The Company urges you to consider those risks and uncertainties in evaluating its forward-looking statements. Readers

are cautioned to not place undue reliance upon any such forward-looking statements, which speak only as of the date made. Except as otherwise

required by the federal securities laws, the Company disclaims any obligation or undertaking to publicly release any updates or revisions

to any forward-looking statement contained herein (or elsewhere) to reflect any change in its expectations with regard thereto, or any

change in events, conditions, or circumstances on which any such statement is based.

Additional

Information and Where to Find It

The

Company will prepare a proxy statement for the Company’s stockholders to be filed with the SEC. The proxy statement will be mailed

to the Company’s stockholders. The Company urges investors, stockholders and other interested persons to read, when available,

the proxy statement, as well as other documents filed with the SEC, because these documents will contain important information about

the proposed transaction. Such persons can also read the Company’s Annual Report on Form 10-K for the fiscal year ended December

31, 2023, for a description of the security holdings of its officers and directors and their respective interests as security holders

in the consummation of the transactions described herein. The Company’s definitive proxy statement will be mailed to stockholders

of the Company as of a record date to be established for voting on the transactions described in this report. The Company’s stockholders

will also be able to obtain a copy of such documents, without charge, by directing a request to: Carolina Martinez, Chief Financial Officer

of Better Choice Company, Inc., 12400 Race Track Road, Tampa, FL 33626; e-mail: nmartinez@bttrco.com. These documents, once available,

can also be obtained, without charge, at the SEC’s web site (www.sec.gov).

Participants

in Solicitation

The

Company and its respective directors, executive officers and other members of their management and employees, under SEC rules, may be

deemed to be participants in the solicitation of proxies of the Company’s stockholders in connection with the proposed transaction.

Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of the Company’s

directors in its Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the SEC on April 12, 2024.

Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to the Company’s

stockholders in connection with the proposed transaction will be set forth in the proxy statement for the proposed business combination

when available. Information concerning the interests of the Company’s participants in the solicitation, which may, in some cases,

be different than those of the Company’s equity holders generally, will be set forth in the proxy statement relating to the proposed

business combination when it becomes available.

Item

9.01 Financial Statements and Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Better Choice Company Inc. |

| |

|

|

| |

By: |

/s/ Carolina Martinez |

| |

Name: |

Carolina Martinez |

| |

Title: |

Chief Financial Officer |

| |

|

|

| October 18, 2024 |

|

|

Exhibit 99.1

Better

Choice Company Chairman Issues Letter to Shareholders as Company Continues to Make Progress Towards the Closing of its SRx Health Acquisition

Combined

company will emerge as a leading global health and wellness company by providing better products and solutions for pets, people, and

families

Combined

2025 revenue and EBITDA expected to be approximately +$270 million, and +$10 million, respectively1

Better

Choice net tangible book value is $4.07 per share2 and net current asset value per share is $3.943

Transaction

is expected to close in late Q4 2024 or early Q1 2025

TAMPA,

FL, October 18, 2024 (GLOBE NEWSWIRE) -- Better Choice Company (NYSE: BTTR) (“Better Choice” or “the Company”),

a pet health and wellness company, Chairman, Michael Young, today is issuing a letter to shareholders as the Company continues to make

progress towards the closing of its acquisition of SRx Health Solutions Inc. (‘SRx Health’), a leading provider of innovative

healthcare solutions, in an all-stock transaction for approximately $125 million.

Shareholders

are encouraged to listen to the fireside chat hosted on October 15, 2024 at 4:30 p.m. ET by the management teams of Better Choice and

SRx Health, which can be accessed by visiting https://ir.betterchoicecompany.com/.

Better

Choice Shareholders,

We

believe that our transformational acquisition of SRx Health will position Better Choice as a leading global health and wellness company,

providing better products and solutions for pets, people, and families. The combination of the two companies is expected to generate

significant cash flow, yield operational efficiencies, and cost savings, while providing large growth opportunities that will drive sustainable

organic growth for each respective business. We expect the transaction to close in late Q4 of this year or early Q1 of 2025.

To

date, each business has generated steady sales growth and cash flow.

Better

Choice has established its premium pet food brand Halo through our omni-channel distribution model. Gross sales of the brand totaled

approximately USD$49 million in 2023, approximately half of which was e-commerce and 28% was international, driven by growth in China.

For the second quarter of 2024, Better Choice generated close to break-even adjusted EBITDA of less than $(0.03) million4,

which reflects our success in stabilizing the business and resetting it to profitable growth.

SRx

Health generated approximately CAD$180 million in revenue and generated positive adjusted EBITDA in 20235. Today, SRx operates

one of the largest specialty pharmacy networks in Canada with 36 specialty pharmacy locations, 40 specialty health/infusion clinics,

4 clinical trial sites, and 2 wholesale distribution facilities. As one of only a few specialty pharma operators with a network that

extends across Canada, SRx Health is one of the most comprehensive providers of specialty healthcare in the country.

| (1) | The

pro forma financial information presented in this press release is based on management’s

assumptions and is not audited. Key assumptions include organic growth of 30%+, new pharma

collaborations and patient support program wins, and operating leverage unlock. These pro

forma figures are based on the company’s historical financial statements as of December 31,

2023, and should be read in conjunction with the company’s audited financial statements. |

| (2) | Net

tangible book value per share as of 6/30/24 is determined by dividing our total tangible

assets, less total liabilities, by 2.7 million shares outstanding immediately after the Offering

assuming exercise of all 1,028,000 pre-funded warrants sold (the “Pre-Funded Warrants”),

on a pro-forma and as adjusted basis giving effect to the above referenced items. |

| (3) | Net

current asset value per share as of 6/30/24 is determined by dividing total current assets,

less total current liabilities, by 2.7 million shares outstanding immediately after the Offering

assuming exercise of all the Pre-Funded Warrants, on a pro-forma and as adjusted basis giving

effect to the above referenced items. |

| (4) | Adjusted

EBITDA is a non-GAAP measure. Reconciliation of Adjusted EBITDA to net income (loss), the

most directly comparable GAAP financial measure, is set forth in a reconciliation table accompanying

the Company’s second quarter 2024 earnings release published August 12, 2024. |

| (5) | Results

of SRx Health consolidated financial statements for the year ended September 30, 2023, prepared

in accordance with IFRS. Pro Forma Adjusted EBITDA is a non-GAAP measure. Reconciliation

of Pro Forma Adjusted EBITDA to net loss, the most directly comparable GAAP financial measure,

is set forth in a reconciliation table accompanying the Company’s press release published

September 3, 2024. Management is still analyzing the financial statement impact upon conversion

from IFRS to GAAP. |

The

combined companies for the trailing twelve months have generated USD$235 million in revenue, increasing approximately 25% quarter-over-quarter.

From

an operational perspective, we expect to achieve immediate cost savings estimated to be approximately USD$1.7 million annually, with

potential for further upside as we continue to integrate the two companies. There are also new verticals and geographic expansion opportunities

as a combined entity versus stand alone. As an example, our plan is to expand into veterinary medicine in 2025 with our new

initiative Better Pet Rx. By leveraging the expertise of SRx Health’s management team,

with their pre-existing relationships in pharma, and their robust infrastructure, Better Choice can complement the Halo portfolio of

premium and super-premium pet food products by expanding into this new, large and growing market to support Halo’s momentum forward.

Additionally, there are new markets that each respective business has not yet explored, including the United States in the case of SRx

Health, and European Union and Asia-Pacific regions in the case of both Better Choice and SRx Health, which regions represent new and

untapped large total addressable markets.

On

a pro forma basis, we project 2025 combined revenue and EBITDA to be over USD$270 million and over USD$10 million, respectively1.

Pro

forma fully diluted shares outstanding including shares to be issued to SRx Health is 22,911,334 shares, with insiders owning approximately

75% of the outstanding shares. From a valuation perspective, net tangible book value is $4.072 per share and net current asset

value per share is $3.943, both well below the current price of our equity.

As

we near the closing of the transaction in the coming months we will ask the Better Choice and SRx Health shareholders to vote.

We

sincerely appreciate your unwavering support and trust as we strive to build a global health and wellness brand by 2025, paving the way

for a promising future together.

Thank

you,

Michael

Young

Chairman

of Better Choice Company

About

Better Choice Company Inc.

Better

Choice Company Inc. is a rapidly growing pet health and wellness company committed to leading the industry shift toward pet products

and services that help dogs and cats live healthier, happier, and longer lives. We take an alternative, nutrition-based approach to pet

health relative to conventional dog and cat food offerings and position our portfolio of brands to benefit from the mainstream trends

of growing pet humanization and consumer focus on health and wellness. We have a demonstrated, multi-decade track record of success selling

trusted pet health and wellness products and leverage our established digital footprint to provide pet parents with the knowledge to

make informed decisions about their pet’s health. We sell the majority of our dog food, cat food and treats under the Halo brand,

which is focused, respectively, on providing sustainably sourced kibble and canned food derived from real whole meat, and minimally processed

raw-diet dog food and treats. For more information, please visit https://www.betterchoicecompany.com.

About SRX Health

SRx operates as a Canadian

healthcare service provider specializing in the Specialty Pharmacy segment of the pharmaceutical industry. Distinguishing itself as a

National Specialty Pharmacy provider, SRx concentrates on overseeing a patient’s healthcare journey, spanning from acute pharmaceutical

needs to chronic and rare disease management. This unique focus positions SRx to deliver a more holistic and integrated solution, catering

to the requirements of both patients and key healthcare stakeholders. Our all-encompassing end-to-end offerings include wholesale/distribution

facilities, patient support programs, infusion clinics, retail pharmacies, co-designed clinical programs, clinical trials, and diagnostic

services.

Our

strategic growth plan is forward-thinking and revolves around fostering increased collaboration with pharmaceutical manufacturers and

prescribers. With a specific emphasis on the expanding market of chronic and rare diseases, we target specialty drugs associated with

closed and limited distribution networks. The objective is to broaden their distribution and improve accessibility. Our overarching goal

is to elevate our current presence from 34 to 100 specialty pharmacy locations across mid-sized population centers throughout Canada,

thereby enhancing the scope of healthcare services and establishing new industry benchmarks. In the subsequent phase of SRx’s evolution,

we aim to extend our reach beyond the borders of Canada. Leveraging our comprehensive approach, we aspire to simplify healthcare on a

global scale. For more information on SRx, please visit https://www.srxhealth.ca.

Forward

Looking Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words

“believe,” “may,” “estimate,” “continue,” “anticipate,” “intend,”

“should,” “plan,” “could,” “target,” “potential,” “is likely,”

“will,” “expect” and similar expressions, as they relate to us, are intended to identify forward-looking statements.

The Company has based these forward-looking statements largely on our current expectations and projections about future events and financial

trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Some or all

of the results anticipated by these forward-looking statements may not be achieved. Further information on the Company’s risk factors

is contained in our filings with the SEC. Any forward-looking statement made by us herein speaks only as of the date on which it is made.

Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict

all of them. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information,

future developments or otherwise, except as may be required by law.

Company

Contact:

Better

Choice Company, Inc.

Kent Cunningham, CEO

Investor

Contact:

KCSA

Strategic Communications

Valter Pinto, Managing Director

T: 212-896-1254

Valter@KCSA.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

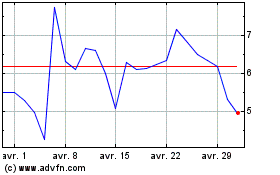

Better Choice (AMEX:BTTR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Better Choice (AMEX:BTTR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025