Revenue Increased 37.2% to $103 Million Year

Over Year

NuCera Business Integration Progressing,

Elevating Company-Wide Results While Expanding Geographic Footprint

and Specialized Product Offerings

Chase Corporation (NYSE American: CCF), a global specialty

chemicals company that is a leading manufacturer of protective

materials for high-reliability applications across diverse market

sectors, today announced financial results for the first fiscal

quarter ended November 30, 2022.

Fiscal First Quarter Financial and Recent Operational

Highlights

- Total Revenue grew 37.2% to $103 million, primarily attributed

to inorganic growth from the NuCera business which was acquired in

the first month of Q1 FY23

- Gross Margin of 34.9%, compared to 37.0% in Q1 FY22 — reduction

primarily due to a $2.2M purchase accounting adjustment (inventory

step-up) related to our NuCera business (37.1% margin adjusted for

the purchase accounting effect)

- Net Income was $6.7 million, or $0.71 per diluted share,

compared to $9.7 million, or $1.02 per diluted share, for Q1 FY22 –

reduction primarily due to additional $5.9M amortization expense

related to purchase accounting for our NuCera business ($2.8M out

of the $5.9M was incremental expense for fully amortized intangible

in the first fiscal quarter), in addition to the inventory step-up

adjustment

- Free Cash Flow was $4.7 million, compared to Free Cash Flow of

$5.4 million in Q1 FY22 — reduction primarily due to continued

strategic inventory build (an increase of $6.6 million in Q1 FY23)

to meet customer demand and address increased backlog

- EBITDA was $21.5 million, compared to $17.2 million in Q1

FY22

- Adjusted EBITDA grew 42% to $25.2 million, compared to $17.7

million in Q1 FY22

Adam P. Chase, President and Chief Executive Officer of Chase

Corporation, said, “The first fiscal quarter marked an important

milestone for Chase as we closed NuCera Solutions (“NuCera”), our

largest acquisition ever, in the first week of the fiscal quarter.

With the business integration progressing well, we are already

benefiting from the addition of NuCera’s end markets. Chase

continued to meet customer demand across all segments, while also

remaining focused on sustaining our operational excellence and

maintaining financial flexibility despite broader

macro-environmental challenges in the quarter.”

Mr. Chase continued, “Our Adhesives, Sealants and Additives and

Industrial Tapes segments again drove year-over-year revenue growth

in the period largely due to the contributions from the NuCera

acquisition. Our revenue growth was also supported by fully

realized price increase benefits and rising demand within our

Industrial Tapes business. Corrosion Protection and Waterproofing

reported a slight revenue decline in the quarter due to a modest

decrease in sales volumes within our building envelope, coating and

lining systems and pipeline coatings product lines. The softening

demand in our Corrosion, Protection and Waterproofing segment was

further challenged by project delays in the Middle East market and

continued COVID-19 overhang delays in China affecting revenue

within other Asian-end markets. Despite the macro-driven

constraints, we are encouraged by the raw material and input

availability improvements across all three segments.”

Mr. Chase added, “As a result of the completed acquisition of

NuCera and associated purchase accounting expenses, Chase underwent

a stepdown in gross margin to 34.9% versus 37.0% in the year ago

period. Excluding the $2.2 million inventory step up, our gross

margin maintained 37.1% in the period on an adjusted basis. While

we are impacted by ongoing inflationary, logistical and labor

pressures, we continue to work to counteract margin compression and

evaluate strategic pricing actions as necessary. Furthermore,

within our business optimization efforts, we plan to launch an

inventory de-stocking process in the second half of fiscal 2023 to

normalize our inventory to pre-supply chain crisis levels. Chase’s

projected inventory levels, coupled with the softening of supply

chain challenges, strategically positions us to deliver for our

customers while properly managing the shelf life of our

materials.”

Mr. Chase concluded, “The dedicated employees of Chase worked

tirelessly to ensure we delivered for our customers while we

ensured our financial flexibility to opportunistically grow into

adjacent markets. We are prepared to capture key macro-level

trends, including strength in electronic chip availability and

energy infrastructure maintenance, and believe we have the right

team in place to execute on our strategic objectives. To further

enhance our business operations, the Company began the process of

upgrading our current Oracle Legacy ERP System to the Oracle Fusion

Cloud Platform. This upgrade will position us with a more advanced

system to support business expansion, access to upgrades in

functionality and a more modern system for operations”

Michael J. Bourque, Chase Corporation’s Treasurer and Chief

Financial Officer stated, “We are excited by Chase’s recent

acquisition of NuCera which expanded our end markets, customer base

reach, and overall product portfolio. As a result of this

transformational acquisition, several purchase accounting

adjustments were made including inventory step up, intangible

assets, goodwill, and other working capital adjustments.

Additionally, we experienced some incremental depreciation and

amortization impacts to our bottom line. We are pleased with the

performance of NuCera and will continue to prioritize completing

the integration of the business while capitalizing on its growth

momentum.”

Mr. Bourque added, “Chase has a multi-decade track record of

managing its balance sheet to ensure strength and flexibility to

capture inorganic growth opportunities, while continuing to pursue

attractive targets and organic growth. Our balance sheet remains

healthy, with $35 million available in our debt facility and a

total cash position of $56.2 million as of November 30. We are well

positioned to pay back our debt created as a result of the

acquisition utilizing cash on hand and our ability to generate free

cash flow. Chase has begun its repayments, allocating $15 million

toward our credit revolver balance in the first quarter, and we

intend to continue debt payments on a regular basis. In the quarter

we also had an income tax rate of 21.8% versus 25.8% in the year

ago period. Finally, as we continue to prioritize creating

shareholder value to complement our growth, we have completed the

distribution of our previously announced annual dividend of $1.00

per share subsequent to the quarter end.”

Segment Results

Adhesives, Sealants and Additives

For the Three Months Ended

November 30,

2022

2021

Revenue

$

55,553

$

31,049

Cost of products and services sold

36,232

18,905

Gross Margin

$

19,321

$

12,144

Gross Margin %

35%

39%

Revenue in the Adhesives, Sealants and Additives segment

increased $24.5 million, or 78.9% in the first quarter ended

November 30, 2022. The increase in segment revenue is predominately

due to year-to-date inorganic growth from our NuCera business

acquired in the first week of fiscal 2023. The remaining revenue

gain was due to price increases realized over the comparable prior

year period and increased demand for both our world-wide focused

electronic and industrial coatings product line and our North

American-focused functional additives product line.

Industrial Tapes

For the Three Months Ended

November 30,

2022

2021

Revenue

$

39,077

$

32,761

Cost of products and services sold

25,719

22,231

Gross Margin

$

13,358

$

10,530

Gross Margin %

34%

32%

Revenue from the Industrial Tapes segment increased $6.3

million, or 19.3% in the first quarter ended November 30, 2022. The

rise in revenue is primarily due to price increases realized over

the comparable prior year period and improved demand for our North

American-focused cable materials, specialty products and pulling

and detection product lines. Tempering this overall increase in

revenue were quarter-to-quarter reduction in sales volume from our

Asia-based electronic materials product line.

Corrosion Protection and Waterproofing

For the Three Months Ended

November 30,

2022

2021

Revenue

$

8,263

$

11,200

Cost of products and services sold

5,049

6,145

Gross Margin

$

3,214

$

5,055

Gross Margin %

39%

45%

Revenue from the Corrosion Protection and Waterproofing segment

decreased by $2.9 million, or 26.2% in the first quarter ended

November 30, 2022. The decrease in the quarter was due to a

reduction in sales volume for our building envelope, coating and

lining systems and pipeline coatings product lines over the

comparable prior period. The decrease in revenue for our building

envelope and coating and lining systems product lines are

predominately due to quarter-to-quarter decrease in customer sales

volume due to customer inventory reduction initiatives compared to

the prior comparable period. Additionally, the decrease in revenue

for our pipeline coatings product line is due to project delays in

the Middle East market and continued COVID-19 overhang delays in

China which affect other revenue within Asian-end markets and

outpaces North American sales gains in the oil and gas markets.

Partially offsetting the decrease in revenue was quarter-to-quarter

increase in revenue for our bridge and highway product line due to

increased demand of bridge and highway projects in North

America.

About Chase Corporation

Chase Corporation, a global specialty chemicals company that was

founded in 1946, is a leading manufacturer of protective materials

for high-reliability applications throughout the world. More

information can be found on our website https://chasecorp.com/

Use of Non-GAAP Financial Measures

The Company has used non-GAAP financial measures in this press

release. Adjusted net income, Adjusted diluted EPS, EBITDA,

Adjusted EBITDA and Free cash flow are non-GAAP financial measures.

The Company believes that Adjusted net income, Adjusted diluted

EPS, EBITDA, Adjusted EBITDA and Free cash flow are useful

performance measures as they are used by its executive management

team to measure operating performance, to allocate resources to

enhance the financial performance of its business, to evaluate the

effectiveness of its business strategies and to communicate with

its board of directors and investors concerning its financial

performance. The Company believes Adjusted net income, Adjusted

diluted EPS, EBITDA, Adjusted EBITDA and Free cash flow are

commonly used by financial analysts and others in the industries in

which the Company operates, and thus provide useful information to

investors. However, Chase’s calculation of Adjusted net income,

Adjusted diluted EPS, EBITDA, Adjusted EBITDA and Free cash flow

may not be comparable to similarly-titled measures published by

others. Non-GAAP financial measures should be considered in

addition to, and not as an alternative to, the Company’s reported

results prepared in accordance with GAAP. This press release

provides reconciliations from the most directly comparable

financial measure presented in accordance with U.S. GAAP to each

non-GAAP financial measure.

Cautionary Note Concerning Forward-Looking Statements

Certain statements in this press release are forward-looking.

These may be identified by the use of forward-looking words or

phrases including, but not limited to, “believe,” “expect,”

“anticipate,” “should,” “planned,” “estimated” and “potential.”

These forward-looking statements are based on Chase Corporation’s

current expectations. The Private Securities Litigation Reform Act

of 1995 provides a “safe harbor” for such forward-looking

statements. To comply with the terms of the safe harbor, the

Company cautions investors that any forward-looking statements made

by the Company are not guarantees of future performance and that a

variety of factors could cause the Company's actual results and

experience to differ materially from the anticipated results or

other expectations expressed in the Company's forward-looking

statements. The risks and uncertainties which may affect the

operations, performance, development and results of the Company's

business include, but are not limited to, the following:

uncertainties relating to economic conditions; uncertainties

relating to customer plans and commitments; the pricing and

availability of equipment, materials and inventories; technological

developments; performance issues with suppliers and subcontractors;

economic growth; delays in testing of new products; the Company’s

ability to successfully integrate acquired operations; the

effectiveness of cost-reduction plans; rapid technology changes;

the highly competitive environment in which the Company operates;

as well as expected impact of the coronavirus disease (COVID-19)

pandemic on the Company's businesses. Investors are cautioned not

to place undue reliance on these forward-looking statements, which

speak only as of the date the statement was made. The Company does

not assume any obligation to update or revise any forward-looking

statement made in this release or that may from time to time be

made by or on behalf of the Company. Additional information

regarding the factors that may cause actual results to differ

materially from these forward-looking statements is available in

the Company’s filings with the Securities and Exchange Commission,

including the risks and uncertainties identified in Part I, Item 1A

- Risk Factors of the Company’s Annual Report on Form 10-K for the

year ended August 31, 2022.

The following table summarizes the Company’s unaudited financial

results for the three months ended November 30, 2022 and 2021.

For the Three Months Ended

November 30,

All figures in thousands, except per

share figures

2022

2021

Revenue

$

102,893

$

75,010

Costs and Expenses

Cost of products and services sold

67,000

47,281

Selling, general and administrative

expenses

21,607

13,375

Research and product development costs

1,491

993

Operations optimization costs

653

59

Acquisition-related costs

29

—

Loss on impairment of right-of-use lease

asset

548

—

Loss on contingent consideration

306

475

Operating income

11,259

12,827

Interest expense

(2,138)

(87)

Other income (expense)

(521)

377

Income before income taxes

8,600

13,117

Income taxes

1,876

3,390

Net income

$

6,724

$

9,727

Net income per diluted share

$

0.71

$

1.02

Weighted average diluted shares

outstanding

9,444

9,438

Reconciliation of net income to EBITDA and

adjusted EBITDA

Net income

$

6,724

$

9,727

Interest expense

2,138

87

Income taxes

1,876

3,390

Depreciation expense

2,330

877

Amortization expense

8,400

3,125

EBITDA

$

21,468

$

17,206

Loss on contingent consideration

306

475

Operations optimization costs

653

59

Acquisition-related costs

29

—

Purchase accounting adjustments

2,200

—

Loss on impairment of right-of-use lease

asset

548

—

Adjusted EBITDA

$

25,204

$

17,740

For the Three Months Ended

November 30,

2022

2021

Reconciliation of net income to adjusted

net income

Net income

$

6,724

$

9,727

Stock based compensation excess tax loss

(gain)

(141)

—

Loss on contingent consideration

306

475

Operations optimization costs

653

59

Acquisition-related costs

29

—

Purchase accounting adjustments

2,200

—

Loss on impairment of right-of-use lease

asset

548

—

Income taxes *

(785)

(112)

Adjusted net income

$

9,534

$

10,149

Adjusted net income per diluted share

(Adjusted diluted EPS)

$

1.00

$

1.07

* For the three month ended November 30, 2022 and 2021,

represents the aggregate tax effect assuming a 21% tax rate for the

items impacting pre-tax income, which is our effective U.S.

statutory Federal tax rate for fiscal 2023 and 2022.

For the Three Months Ended

November 30,

2022

2021

Reconciliation of cash provided by

operating activities to free cash flow

Net cash provided by operating

activities

$

6,758

$

5,903

Purchases of property, plant and

equipment

(2,052)

(496)

Free cash flow

$

4,706

$

5,407

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230105005998/en/

Investor & Media Contact: Jackie Marcus or Ashley

Gruenberg Alpha IR Group Phone: (617) 982-0475 E-mail:

CCF@alpha-ir.com or Shareholder & Investor Relations Department

Phone: (781) 332-0700 E-mail: investorrelations@chasecorp.com

Website: www.chasecorp.com

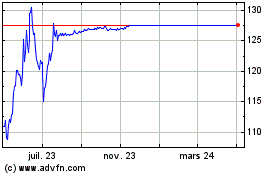

Chase (AMEX:CCF)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Chase (AMEX:CCF)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025