The Fund is very different from most

mutual funds in that it seeks to provide investment results that match the opposite of the performance of a specific benchmark on a daily basis, a result opposite of most other mutual funds. The pursuit of such investment goal has the following

implications:

Because the Fund seeks daily inverse investment results, the return of the Fund for a period longer than a single trading

day will be the result of each day’s compounded returns over the period, which will very likely differ from the inverse return of the Fund’s benchmark for that period. As a consequence, especially in periods of market volatility, the path

or trend of the benchmark during the longer period may be at least as important to the Fund’s cumulative return for the longer period as the cumulative return of the benchmark for the relevant longer period. Further, the return for investors

who invest for a period longer than a single trading day will not be the product of the return of the Fund’s stated investment goal (

e.g.

, -1x) and the cumulative performance of the Fund’s benchmark.

The risk of the Fund not achieving its daily investment objective will be more acute when the underlying index has an extreme one-day movement

approaching 50%. In addition, as a result of compounding, because the Fund has a single day investment objective, the Fund’s performance for periods greater than one day is likely to be either greater than or less than the inverse of the

performance of the underlying index (

e.g.,

-1x), before accounting for fees and fund expenses.

The Fund is not suitable for all

investors and is designed to be utilized only by sophisticated investors who (a) understand the consequences of seeking daily inverse investment results, (b) understand the risk of shorting, and (c) intend to actively monitor and manage their

investments. Investors who do not understand the Fund or do not intend to actively manage and monitor their investments should not buy shares of the Fund.

There is no assurance that the Fund will achieve its objective and an investment in the Fund could lose money. The Fund is not a complete investment program.

Before you invest, you may wish to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You may obtain the Prospectus and other information about the

Fund, including the Statement of Additional Information (SAI) and most recent reports to shareholders, at no cost by visiting http://guggenheiminvestments.com/services/prospectuses-and-reports, calling 800.820.0888 or

e-mailing

services@guggenheiminvestements.com. The Fund’s Prospectus and SAI, both dated August 1, 2013, as revised from time to time, and the Fund’s most recent shareholder reports, are incorporated

by reference into this Summary Prospectus.

SUMISP500AC-0813x0814

Inverse S&P 500

®

Strategy Fund

IMPORTANT INFORMATION ABOUT THE FUND

The Inverse S&P 500

®

Strategy Fund (the

“Fund”) is very different from most other mutual funds in that it seeks to provide investment results that match the opposite of the performance of a specific benchmark on a

daily basis,

a result opposite of most mutual funds. As a

result, the Fund may be riskier than alternatives that do not rely on the use of derivatives to achieve their investment objectives.

Because the Fund seeks daily inverse investment results, the return of the Fund for a period of longer than a single trading day will be the result

of each day’s compounded returns over the period, which will very likely differ from the inverse return of the Fund’s underlying index (as defined below) for that period. As a consequence, especially in periods of market volatility, the

path or trend of the benchmark during the longer period may be at least as important to the Fund’s return for the longer period as the cumulative return of the benchmark for the relevant longer period. Further, the return for investors who

invest for a period longer than a single trading day will not be the product of the return of the Fund’s stated investment goal (

e.g.

, -1x) and the cumulative performance of the underlying index.

The Fund is not suitable for all investors.

The Fund should be utilized only by investors who (a) understand the consequences of seeking

daily inverse investment results, (b) understand the risk of shorting and (c) intend to actively monitor and manage their investments. Investors who do not meet these criteria should not buy shares of the Fund. An investment in the Fund is

not a complete investment program.

INVESTMENT OBJECTIVE

The Fund seeks to provide investment results that match, before fees and expenses, the performance of a specific benchmark on a daily basis. The Fund’s current benchmark is the inverse

(opposite) of the performance of the S&P 500

®

Index (the “underlying index”). The Fund does

not seek to achieve its investment objective over a period of time greater than one day.

FEES AND EXPENSES OF THE FUND

This table describes the fees and expenses that you may pay if you buy and hold A-Class Shares or C-Class Shares of the Fund. You may qualify for

sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in certain funds in the Guggenheim Investments family of funds. More information about these and other discounts is available from your

financial professional and under the “Sales Charges” section on page 269 of the Prospectus and in the “Sales Charges, Reductions, and Waivers” section beginning on page 94 of the Fund’s Statement of Additional Information

(the “SAI”).

|

|

|

|

|

|

|

|

|

|

|

|

|

A-Class

Shares

|

|

|

C-Class

Shares

|

|

|

SHAREHOLDER FEES

(fees paid directly from your investment)

|

|

|

|

|

|

|

|

|

|

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering

price)

|

|

|

4.75%

|

|

|

|

None

|

|

|

Maximum Deferred Sales Charge (Load) (as a percentage of initial purchase price or

current market value, whichever is less)

|

|

|

None

|

|

|

|

1.00%

|

|

|

ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your

investment)

|

|

|

|

|

|

|

|

|

|

Management Fees

|

|

|

0.90%

|

|

|

|

0.90%

|

|

|

Distribution and/or Shareholder Service (12b-1) Fees

|

|

|

0.25%

|

|

|

|

1.00%

|

|

|

Other Expenses

|

|

|

0.50%

|

|

|

|

0.50%

|

|

|

Total Annual Fund Operating Expenses

|

|

|

1.65%

|

|

|

|

2.40%

|

|

EXAMPLE

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Fund for the time periods indicated, and then

redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on

these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

A-Class Shares

|

|

$

|

635

|

|

|

$

|

971

|

|

|

$

|

1,329

|

|

|

$

|

2,337

|

|

|

C-Class Shares

|

|

$

|

343

|

|

|

$

|

748

|

|

|

$

|

1,280

|

|

|

$

|

2,736

|

|

You would pay the following expenses if you did not redeem your shares:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

C-Class Shares

|

|

$

|

243

|

|

|

$

|

748

|

|

|

$

|

1,280

|

|

|

$

|

2,736

|

|

PORTFOLIO TURNOVER

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction

costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the Example, affect the Fund’s performance. During the most recent fiscal

year, the Fund’s portfolio turnover rate was 0% of the average value of its portfolio. The Fund’s portfolio turnover rate is calculated without regard to cash instruments or derivatives. If such instruments were included, the Fund’s

portfolio turnover rate might be significantly higher.

PRINCIPAL INVESTMENT STRATEGIES

Unlike a traditional index fund, the Fund’s investment objective is to perform exactly opposite the underlying index, and

the Fund generally will not own the securities included in the underlying index. Instead, the Fund employs as its investment strategy a program of engaging in short sales of securities included in the underlying index and investing to a significant

extent in derivative instruments, which primarily consist of equity index swaps, futures contracts, and options on securities, futures contracts, and stock indices. The Fund’s investment in derivatives serves as a substitute for directly

selling short each of the securities included in the underlying index and produces inverse exposure to the underlying index. Certain of the Fund’s derivative investments may be traded in the over-the-counter (“OTC”) market, which

generally provides for less transparency than exchange-traded derivative instruments. Under normal circumstances, the Fund will invest at least 80% of its net assets, plus any borrowings for investment purposes, in financial instruments with

economic characteristics that should perform opposite to the securities of companies included in the underlying index. The S&P 500

®

Index is a capitalization-weighted index composed of 500 common stocks, which are chosen by the Standard & Poor’s Corporation (“S&P”) on a

statistical basis, and which generally represent large-capitalization companies with capitalizations ranging from $2 billion to $401.7 billion as of June 30, 2013. To the extent the Fund’s underlying index is concentrated in a particular

industry the Fund will necessarily be concentrated in that industry. On a day-to-day basis, the Fund may hold U.S. government securities or cash equivalents to collateralize its short sales and derivative positions. The Fund also may enter into

repurchase agreements with counterparties that are deemed to present acceptable credit risks. In an effort to ensure that the Fund is fully invested on a day-to-day basis, the Fund may conduct any necessary trading activity at or just prior to the

close of the U.S. financial markets. The Fund is non-diversified and, therefore, may invest a greater percentage of its assets in a particular issuer in comparison to a diversified fund.

PRINCIPAL RISKS

As with all mutual funds, a shareholder is subject to the risk that his or her

investment could lose money. In addition to this risk, the Fund is subject to a number of additional risks that may affect the value of its shares, including:

Active Trading Risk

—Active trading, also called “high portfolio turnover,” may result in higher brokerage costs or mark-up charges, which may negatively affect Fund

performance. High portfolio turnover may also result in high levels of short-term capital gains, which are generally taxable as ordinary income when distributed to shareholders. Large movements of assets into and out of the Fund due to active

trading also may adversely affect the Fund’s ability to achieve its investment objective.

CFTC Regulatory Risk

—The

Commodity Futures Trading Commission (“CFTC”) has recently adopted amendments to certain CFTC rules, and is in the process of promulgating new rules, that will subject the Fund and the Advisor to certain CFTC disclosure, reporting, and

recordkeeping requirements if the Fund does not operate within certain derivatives trading and marketing limitations. Compliance with these additional requirements will likely increase Fund expenses and may adversely affect the Fund’s ability

to obtain exposure to certain investments and the commodities market generally. Certain of the regulatory requirements that

would apply to the Fund have not yet been adopted, and it is unclear what the effect of those requirements would be on the Fund if they are adopted. Consistent with the Fund’s investment

strategies and investment policies, the Advisor intends to maintain the flexibility to utilize certain derivatives beyond the CFTC’s new trading limitations and to comply with CFTC rules to the extent required to maintain such investment

flexibility.

Correlation and Compounding Risk

—A number of factors may affect the Fund’s ability to achieve a high

degree of correlation with its benchmark, and there can be no guarantee that the Fund will achieve a high degree of correlation. Failure to achieve a high degree of correlation may prevent the Fund from achieving its investment objective. The risk

of the Fund not achieving its daily investment objective will be more acute when the underlying index has an extreme one-day movement approaching 50%.

In addition, as a result of compounding, because the Fund has a single day investment

objective, the Fund’s performance for periods greater than one day is likely to be either greater than or less than the inverse of the performance of the underlying index, before accounting for fees and Fund expenses.

Compounding affects all investments, but has a more significant impact on a leveraged fund. In general, particularly during periods of higher index

volatility, compounding will cause longer term results to be more or less than the inverse of the return of the underlying index. This effect becomes more pronounced as volatility increases.

Fund performance for periods greater than one day can be estimated given any set of assumptions for the following factors: (a) underlying index performance; (b) underlying index

volatility; (c) financing rates associated with leverage; (d) other Fund expenses; (e) dividends paid by companies in the underlying index; and (f) period of time. The chart below illustrates the impact of two principal

factors—volatility and index performance—on Fund performance. The chart shows estimated Fund returns for a number of combinations of performance and volatility over a one-year period. Performance shown in the chart assumes: (a) no

dividends paid by the companies included in the underlying index; (b) no Fund expenses; and (c) a cost of leverage of zero percent. If Fund expenses were included, the Fund’s performance would be lower than shown.

Areas shaded lighter represent those scenarios where the Fund can be expected to return more than the inverse performance of the underlying index;

conversely, areas shaded darker represent those scenarios where the Fund can be expected to return the same or less than the inverse performance of the underlying index.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Index Performance

|

|

|

Annualized Volatility

|

|

|

1x

|

|

|

-1x

|

|

|

10%

|

|

|

25%

|

|

|

50%

|

|

|

75%

|

|

|

100%

|

|

|

|

-60%

|

|

|

|

60%

|

|

|

|

148%

|

|

|

|

132%

|

|

|

|

96%

|

|

|

|

42%

|

|

|

|

-6%

|

|

|

|

-50%

|

|

|

|

50%

|

|

|

|

98%

|

|

|

|

87%

|

|

|

|

57%

|

|

|

|

14%

|

|

|

|

-28%

|

|

|

|

-40%

|

|

|

|

40%

|

|

|

|

65%

|

|

|

|

56%

|

|

|

|

30%

|

|

|

|

-5%

|

|

|

|

-38%

|

|

|

|

-30%

|

|

|

|

30%

|

|

|

|

42%

|

|

|

|

34%

|

|

|

|

13%

|

|

|

|

-18%

|

|

|

|

-47%

|

|

|

|

-20%

|

|

|

|

20%

|

|

|

|

24%

|

|

|

|

18%

|

|

|

|

-3%

|

|

|

|

-28%

|

|

|

|

-54%

|

|

|

|

-10%

|

|

|

|

10%

|

|

|

|

10%

|

|

|

|

4%

|

|

|

|

-13%

|

|

|

|

-36%

|

|

|

|

-59%

|

|

|

|

0%

|

|

|

|

0%

|

|

|

|

-1%

|

|

|

|

-6%

|

|

|

|

-22%

|

|

|

|

-43%

|

|

|

|

-64%

|

|

|

|

10%

|

|

|

|

-10%

|

|

|

|

-10%

|

|

|

|

-15%

|

|

|

|

-29%

|

|

|

|

-48%

|

|

|

|

-67%

|

|

|

|

20%

|

|

|

|

-20%

|

|

|

|

-17%

|

|

|

|

-22%

|

|

|

|

-35%

|

|

|

|

-53%

|

|

|

|

-69%

|

|

|

|

30%

|

|

|

|

-30%

|

|

|

|

-24%

|

|

|

|

-28%

|

|

|

|

-40%

|

|

|

|

-56%

|

|

|

|

-71%

|

|

|

|

40%

|

|

|

|

-40%

|

|

|

|

-29%

|

|

|

|

-33%

|

|

|

|

-44%

|

|

|

|

-60%

|

|

|

|

-73%

|

|

|

|

50%

|

|

|

|

-50%

|

|

|

|

-34%

|

|

|

|

-37%

|

|

|

|

-48%

|

|

|

|

-62%

|

|

|

|

-76%

|

|

|

|

60%

|

|

|

|

-60%

|

|

|

|

-38%

|

|

|

|

-41%

|

|

|

|

-51%

|

|

|

|

-65%

|

|

|

|

-78%

|

|

The underlying index’s annualized historical volatility rate for the five year period ended June 30, 2013

is 18.42%. The underlying index’s highest one-year volatility rate during the five year period is 8.22%. The underlying index’s annualized performance for the five year period ended June 30, 2013 is 7.01%.

Historical underlying index volatility and performance are not indications of what the underlying index volatility and performance will be in the

future.

Counterparty Credit Risk

—The Fund may invest in financial instruments involving counterparties that attempt to gain

exposure to a particular group of securities, index or asset class without actually purchasing those securities or investments, or to hedge a position. The Fund’s use of such financial instruments, including swap agreements, involves risks that

are different from those

associated with ordinary portfolio securities transactions. For example, if a swap agreement counterparty defaults on its payment obligations to the Fund, this default will cause the value of

your investment in the Fund to decrease. Swap agreements also may be considered to be illiquid. Similarly, if the credit quality of an issuer or guarantor of a debt instrument improves, this change may adversely affect the value of the Fund’s

investment.

Derivatives Risk

—The Fund’s investments in derivatives may pose risks in addition to those associated with

investing directly in securities or other investments, including illiquidity of the derivatives, imperfect correlations with underlying investments or the Fund’s other portfolio holdings, lack of availability and counterparty risk. The Fund

could lose more than the principal amount invested.

Early Closing Risk

—The Fund is subject to the risk that unanticipated

early closings of securities exchanges and other financial markets may result in the Fund’s inability to buy or sell securities or other financial instruments on that day and may cause the Fund to incur substantial trading losses.

Equity Risk

—The Fund is subject to the risk that the value of the equity securities or equity-based derivatives in the Fund’s

portfolio will decline due to volatility in the equity market caused by general market and economic conditions, perceptions regarding particular industries represented in the equity market, or factors relating to specific companies to which the Fund

has investment exposure.

Large-Capitalization Securities Risk

—The Fund is subject to the risk that large-capitalization

stocks may outperform other segments of the equity market or the equity market as a whole.

Liquidity Risk

—In certain

circumstances, it may be difficult for the Fund to purchase and sell particular investments within a reasonable time at a fair price. While the Fund intends to invest in liquid futures, options, forwards and swap contracts, under certain market

conditions, such as when the market makes a “limit move,” it may be difficult or impossible for the Fund to liquidate such investments. In addition, the ability of the Fund to assign an accurate daily value to certain investments may be

difficult, and the Advisor may be required to fair value the investments.

Market Risk

—The Fund’s investments in

securities and derivatives, in general, are subject to market risks that may cause their prices, and therefore the Fund’s value, to fluctuate over time. An investment in the Fund may lose money.

Non-Diversification Risk

—The Fund is considered non-diversified and can invest a greater portion of its assets in securities of

individual issuers than a diversified fund. As a result, changes in the market value of a single security could cause greater fluctuations in the value of Fund shares than would occur in a diversified fund.

OTC Trading Risk

—Certain of the derivatives in which the Fund may invest may be traded (and privately negotiated) in the OTC market.

While the OTC derivatives market is the primary trading venue for many derivatives, it is largely unregulated. As a result and similar to other privately negotiated contracts, the Fund is subject to counterparty credit risk with respect to such

derivative contracts.

Passive Investment Risk

—The Fund is not actively managed and the Advisor does not attempt to take

defensive positions in rising markets. Therefore, the Fund may be subject to greater losses in a rising market than a fund that is actively managed.

Repurchase Agreement Risk

—The Fund’s investment in repurchase agreements may be subject to market and credit risk with respect to the collateral securing the repurchase agreements.

Investments in repurchase agreements also may be subject to the risk that the market value of the underlying obligations may decline prior to the expiration of the repurchase agreement term.

Short Sales Risk

—Short selling a security involves selling a borrowed security with the expectation that the value of the security will decline, so that the security may be purchased at

a lower price when returning the borrowed security. The risk for loss on short selling is greater than the original value of the securities sold short because the price of the borrowed security may rise, thereby increasing the price at which the

security must be purchased. Government actions also may affect the Fund’s ability to engage in short selling.

Tracking Error

Risk

—The Advisor may not be able to cause the Fund’s performance to match that of the Fund’s benchmark, either on a daily or aggregate basis. Factors such as Fund expenses, imperfect correlation between the Fund’s investments

and those of the underlying index, rounding of share prices, changes to the composition of the underlying index, regulatory policies, and high portfolio turnover rate all contribute to tracking error. Tracking error may cause the Fund’s

performance to be less than you expect.

Trading Halt Risk

—If a trading halt occurs, the Fund may temporarily be unable to

purchase or sell securities, options or futures contracts. Such a trading halt near the time the Fund prices its shares may limit the Fund’s ability to use leverage and may prevent the Fund from achieving its investment objective.

PERFORMANCE INFORMATION

The following bar chart shows the performance of the C-Class Shares of the Fund from year to year. The variability of performance over time provides an indication of the risks of investing in the

Fund. The following tables show the performance of the A-Class Shares and C-Class Shares of the Fund as an average over different periods of time in comparison to the performance of a broad-based market index. The figures in the bar chart and tables

assume the reinvestment of dividends and capital gains distributions but do not reflect sales charges. If they did, returns would be lower. Of course, this past performance (before and after taxes) does not necessarily indicate how the Fund will

perform in the future.

Updated performance information is available on the Fund’s website at www.guggenheiminvestments.com or by

calling Guggenheim Investments Client Services at 800.820.0888.

The performance information shown below for C-Class Shares is based on a

calendar year. The year-to-date return for the period from January 1, 2013 through June 30, 2013 is -13.71%.

|

|

|

|

|

Highest Quarter Return

(quarter ended 12/31/2008) 16.04%

|

|

Lowest Quarter Return

(quarter ended 6/30/2009) -15.73%

|

AVERAGE ANNUAL TOTAL RETURN

(for periods ended December 31, 2012)

The after-tax returns presented in the table below are calculated using highest historical individual federal marginal income tax rates and do not

reflect the impact of state and local taxes. Your actual after-tax returns will depend on your specific tax situation and may differ from those shown below. After-tax returns are not relevant to investors who hold shares of the Fund through

tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A-Class Shares

|

|

Past

1 Year

|

|

|

Past

5 Years

|

|

|

Since Inception

(3/31/2004)

|

|

|

Return Before Taxes

|

|

|

-20.28%

|

|

|

|

-9.23%

|

|

|

|

-7.11%

|

|

|

Return After Taxes on Distributions

|

|

|

-20.28%

|

|

|

|

-9.34%

|

|

|

|

-7.51%

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares

|

|

|

-13.18%

|

|

|

|

-7.61%

|

|

|

|

-5.88%

|

|

|

S&P 500

®

Index

(reflects no deduction for fees, expenses or taxes)

|

|

|

16.00%

|

|

|

|

1.66%

|

|

|

|

4.88%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C-Class Shares

|

|

Past

1 Year

|

|

|

Past

5 Years

|

|

|

Past

10 Years

|

|

|

Return Before Taxes

|

|

|

-17.79%

|

|

|

|

-9.03%

|

|

|

|

-9.20%

|

|

|

Return After Taxes on Distributions

|

|

|

-17.79%

|

|

|

|

-9.14%

|

|

|

|

-9.66%

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares

|

|

|

-11.56%

|

|

|

|

-7.45%

|

|

|

|

-7.32%

|

|

|

S&P 500

®

Index

(reflects no deduction for fees, expenses or taxes)

|

|

|

16.00%

|

|

|

|

1.66%

|

|

|

|

7.10%

|

|

MANAGEMENT

INVESTMENT

ADVISOR

Security Investors, LLC, which operates under the name Guggenheim Investments, serves as the investment adviser of the Fund.

PORTFOLIO MANAGERS

|

|

•

|

|

Michael P. Byrum,

CFA, Senior Vice President. Mr. Byrum has been associated with the Advisor since 1993.

|

|

|

•

|

|

Michael J. Dellapa,

CFA, CAIA, Portfolio Manager. Mr. Dellapa has been associated with the Advisor since 2000.

|

|

|

•

|

|

Ryan A. Harder,

CFA, Portfolio Manager. Mr. Harder has been associated with the Advisor since 2004.

|

PURCHASE AND SALE OF FUND SHARES

The

minimum initial investment amounts and account balance requirements for A-Class Shares or C-Class Shares are typically:

|

|

•

|

|

$1,000 for retirement accounts

|

|

|

•

|

|

$2,500 for all other accounts

|

Accounts opened through a financial intermediary will be subject to your financial intermediary’s minimum initial investment amount and minimum account balance requirements, which may be

different than the amounts above.

There are no minimum amount requirements for subsequent investments in the Fund except for subsequent

investments made via Automated Clearing House (“ACH”).

The Fund reserves the right to waive the minimum initial investment

amount, account balance, and certain other investor eligibility requirements at any time, with or without prior notice to you.

The Fund

redeems its shares continuously and investors may sell their shares back to the Fund on any day that the New York Stock Exchange (the “NYSE”) is open for business (a “Business Day”). You will ordinarily submit your transaction

order through your financial intermediary or other securities dealers through which you opened your shareholder account or through Guggenheim Investments directly. The Fund also offers you the option to send redemption orders to Guggenheim

Investments by mail, fax or telephone.

TAX INFORMATION

Fund distributions are generally taxable as ordinary income or capital gains (or a combination of both), unless your investment is in an IRA or other tax-advantaged retirement account.

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related

services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your sales person to recommend the Fund over another investment. Ask your sales person or visit your financial intermediary’s

website for more information.

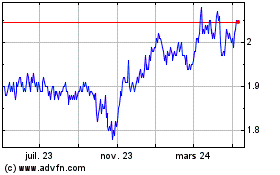

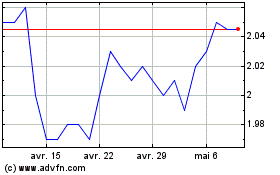

Credit Suisse High Yield (AMEX:DHY)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Credit Suisse High Yield (AMEX:DHY)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024