Enservco Announces Exit of Colorado Frac Water Heating Business Through Sale of Assets

09 Août 2024 - 12:45PM

Enservco Corporation (NYSE American: ENSV) (“Enservco” or the

“Company”) today announced it has sold to HP Oilfield Services, LLC

(“HP”) certain Colorado based assets of Heat Waves Hot Oil Service,

LLC, a wholly owned subsidiary of Enservco (the “Transaction”).

Transaction consideration from HP was

$1,695,000, including $1,221,625, in cash and a short-term note of

$473,375 (the “Note”). The Note will be paid ratably over five

months from October 1, 2024 to February 1, 2025. The Transaction’s

net proceeds are targeted for retirement of debt, specifically

borrowings under the Company’s Utica Facility.

The Company also announced that it is nearing

completion of the previously announced acquisition of Buckshot

Tucking, LLC with closing expected within days.

TRANSACTION RATIONALE/HIGHLIGHTS &

OTHER UPDATES

- Sale of Colorado

frac water heating assets is consistent with strategy of being less

reliant on seasonal-focused business;

- Net proceeds to

be used to pay down certain of the Company’s debt obligations,

specifically its Utica Facility. Following the pay down, the

Company expects to restructure the remaining Utica Facility;

- Divesting the

heating business allows Enservco to redirect its resources, both

financial and managerial, towards the transportation and logistics

market servicing the broad energy sector;

- Includes the

previously announced and pending Buckshot Acquisition, which is

expected to be immediately accretive and strategically transform

the Company by entering the logistics market via a business with

substantial operational and financial visibility; and

- The Company will

continue to provide both frac water heating and hot oil services

across the Marcellus/Utica basins, where last year’s Rapid Hot

acquisition contributed to significantly improved operating results

in the region.

MANAGEMENT COMMENTARY

Rich Murphy, Chairman and CEO of Enservco,

commented, “For more than a year, we have undergone a significant

review of our business portfolio to identify, evaluate and execute

on initiatives to drive increased efficiencies and other

improvements throughout our operations. Concurrent with these

activities, we spent considerable time and effort improving our

financial position while we also evaluated various opportunities to

enhance our value proposition both in the marketplace and with

investors. I am pleased that our team – with the full support of

our Board – continues to make significant progress on multiple

fronts. This includes the previously announced Buckshot Acquisition

and the Company’s Equity Line of Credit facility (“ELOC”), which

has now been approved by a majority of the shareholders and is

being implemented. The Buckshot transaction, the ELOC, and

additional steps the Company is engaged in support our ongoing

efforts to regain compliance with NYSE American Listing

Standards.”

Mr. Murphy, continued, “With the sale of our

Colorado frac water heating assets, we plan to use the net proceeds

from the Transaction to pay down our higher-interest borrowings,

specifically those under our Utica Facility. Following the pay

down, we expect to work with Utica, or other lenders if needed, to

renegotiate the remaining balance under the Utica Facility to terms

that will further improve Enservco’s financial position.”

Mr. Murphy, concluded, “Today’s announcement

represents another significant step in our process of transitioning

our business portfolio away from one with a significant focus on

seasonal industry activities to a much larger addressable market

providing year-round cash flows and margin generation. Combined

with today’s announcement and our successes over the past year, we

believe we have placed the Company in a stronger position to drive

near and long-term value for shareholders. We appreciate the

continued support of all our stakeholders – especially our employee

team – and look forward to keeping everyone apprised of our

progress.”

ABOUT ENSERVCO

Enservco provides a range of oilfield services

through its various operating subsidiaries, including hot oiling,

acidizing, frac water heating, and related services in major

domestic oil and gas basins across the United States. Additional

information is available at www.enservco.com. On March 20, 2024,

the Company announced an agreement to purchase Buckshot Trucking

LLC, an energy logistics provider in multiple key oil and gas

basins (the “Buckshot Acquisition”). The Buckshot Acquisition is

scheduled to close in the third quarter of 2024. When closed, the

Buckshot Acquisition would provide Enservco with a growing business

that is not weather dependent, allow the Company to enter steady

year-round logistics, provide an expanded operating footprint, and

improve cash flow visibility.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This news release contains information that is

"forward-looking" in that it describes events and conditions

Enservco reasonably expects to occur in the future. Expectations

for the future performance of Enservco are dependent upon a number

of factors, and there can be no assurance that Enservco will

achieve the results as contemplated herein. Certain statements

denoting future possibilities, are forward-looking statements. The

accuracy of these statements cannot be guaranteed as they are

subject to a variety of risks, which are beyond Enservco's ability

to predict, or control and which may cause actual results to differ

materially from the projections or estimates contained herein.

Among these risks are those set forth in Enservco’s annual report

on Form 10-K for the year ended December 31, 2023, and subsequently

filed documents with the Securities and Exchange Commission

(“SEC”). Forward looking statements in this news release that are

subject to risks also include (a) closing of the Buckshot

Acquisition on anticipated terms and timing, and the ability of

Enservco to successfully integrate Buckshot’s market opportunities,

personnel and operations and to achieve expected benefit; and (b)

our ability to further transform into a logistics business; (c) the

ability to restructure our debt; and (d) the ability to maintain

compliance with the NYSE/American Stock Market. Enservco disclaims

any obligation to update any forward-looking statement made

herein.

CONTACT

Mark PattersonChief Financial OfficerEnservco

Corporationmpatterson@enservco.com

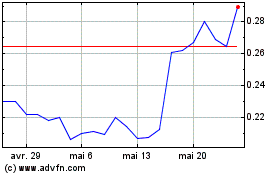

ENSERVCO (AMEX:ENSV)

Graphique Historique de l'Action

De Mar 2025 à Avr 2025

ENSERVCO (AMEX:ENSV)

Graphique Historique de l'Action

De Avr 2024 à Avr 2025