Star Equity Holdings, Inc. (Nasdaq: STRR; STRRP) (“Star” or the

“Company”), a diversified holding company, announced today that

effective August 9, 2024, it completed an investment in Enservco

Corporation (NYSE American: ENSV) (“Enservco” or “ENSV”), a

Colorado-based Energy Services company that is expanding into the

Transportation & Logistics sector via the acquisition of

Buckshot Trucking, LLC (“Buckshot”).

Transaction Highlights

- Star issued

250,000 shares of its 10% Series A Cumulative Perpetual Preferred

Stock (“STRRP”) to Enservco in exchange for 12.5 million ENSV

common shares and share equivalents, representing $2.5 million in

value using STRRP’s $10.00 per share liquidation preference.

- Star also made a

$1 million short-term loan to Enservco in the form of a promissory

note to facilitate the acquisition of Buckshot.

- Star will

receive one seat on Enservco’s Board of Directors, which has been

designated for Star’s CEO, Rick Coleman.

Enservco provides specialized well-site services

to the domestic onshore oil and gas industry. Its current operating

segments, Hot Oiling & Acidizing and Frac Water Heating,

support drilling, completion, production, and maintenance

activities spanning the life of oil and gas wells. Of note, as

recently announced, Enservco is implementing a strategic

repositioning of its operations via the partial sale of its Frac

Water Heating business, and by entering the Transportation &

Logistics sector via the acquisition of Buckshot.

Jeff Eberwein, Executive Chairman of Star,

commented, “We are excited to partner with Enservco on this

investment, which advances Star’s expansion strategy by further

diversifying its portfolio beyond Building Solutions, marking our

initial entry into the Energy Services and Transportation &

Logistics sectors. We believe the strength of Enservco’s management

team and its ongoing reorganization position it well for long-term

growth. We look forward to participating in Enservco’s future

success and believe this investment will be highly accretive to our

shareholders.”

Additional Transaction

Details

- Star’s

short-term loan to Enservco has a 20% annualized interest rate and

is collateralized by the STRRP shares issued to ENSV.

- At close, Star

acquired approximately 20% of ENSV common shares and additional

preferred shares convertible into ENSV common stock.

- All ENSV

securities acquired in this transaction will be held in Star’s

Investments division.

About Enservco Corporation

Based in Longmont, CO, with field locations in

major oil and gas basins throughout the U.S., Enservco serves more

than 300 E&P customers, including majors, mid-tier, and small

independent operators. With one of the industry’s largest, most

modern equipment fleets, the Company provides an array of

complementary oilfield services that help customers increase

efficiencies and maximize production. Through the recent

acquisition of Buckshot Trucking, LLC, Enservco has pivoted into

Logistics, a less-seasonal, higher-margin business with multiple

opportunities for organic and inorganic growth.

For more information, visit

http://enservco.com/.

About Star Equity Holdings,

Inc.

Star Equity Holdings, Inc. is a diversified

holding company currently composed of two divisions: Building

Solutions and Investments.

Building Solutions

Our Building Solutions division operates in

three businesses: (i) modular building manufacturing; (ii)

structural wall panel and wood foundation manufacturing, including

building supply distribution operations; and (iii) glue-laminated

timber (glulam) column, beam, and truss manufacturing.

Investments

Our Investments division manages and finances

the Company’s real estate assets as well as its investment

positions in private and public companies.

Forward-Looking Statements

“Safe Harbor” Statement under the Private

Securities Litigation Reform Act of 1995: This release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. All statements in this

release that are not statements of historical fact are hereby

identified as “forward-looking statements” for the purpose of the

safe harbor provided by Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. Forward-looking Statements include, without limitation,

statements regarding (i) the plans and objectives of management for

future operations, including plans or objectives relating to

acquisitions and related integration, development of commercially

viable products, novel technologies, and modern applicable

services, (ii) projections of income (including income/loss),

EBITDA, earnings (including earnings/loss) per share, free cash

flow (FCF), capital expenditures, cost reductions, capital

structure or other financial items, (iii) the future financial

performance of the Company or acquisition targets and (iv) the

assumptions underlying or relating to any statement described

above. Moreover, forward-looking statements necessarily involve

assumptions on the Company’s part. These forward-looking statements

generally are identified by the words “believe”, “expect”,

“anticipate”, “estimate”, “project”, “intend”, “plan”, “should”,

“may”, “will”, “would”, “will be”, “will continue” or similar

expressions. Such forward-looking statements are not meant to

predict or guarantee actual results, performance, events, or

circumstances and may not be realized because they are based upon

the Company's current projections, plans, objectives, beliefs,

expectations, estimates and assumptions and are subject to a number

of risks and uncertainties and other influences, many of which the

Company has no control over. Actual results and the timing of

certain events and circumstances may differ materially from those

described above as a result of these risks and uncertainties.

Factors that may influence or contribute to the inaccuracy of

forward-looking statements or cause actual results to differ

materially from expected or desired results may include, without

limitation, the substantial amount of debt of the Company and the

Company’s ability to repay or refinance it or incur additional debt

in the future; the Company’s need for a significant amount of cash

to service and repay the debt and to pay dividends on the Company’s

preferred stock; the restrictions contained in the debt agreements

that limit the discretion of management in operating the business;

legal, regulatory, political and economic risks in markets and

public health crises that reduce economic activity and cause

restrictions on operations (including the recent coronavirus

COVID-19 outbreak); the length of time associated with servicing

customers; losses of significant contracts or failure to get

potential contracts being discussed; disruptions in the

relationship with third party vendors; accounts receivable

turnover; insufficient cash flows and resulting lack of liquidity;

the Company's inability to expand the Company's business;

unfavorable changes in the extensive governmental legislation and

regulations governing healthcare providers and the provision of

healthcare services and the competitive impact of such changes

(including unfavorable changes to reimbursement policies); high

costs of regulatory compliance; the liability and compliance costs

regarding environmental regulations; the underlying condition of

the technology support industry; the lack of product

diversification; development and introduction of new technologies

and intense competition in the healthcare industry; existing or

increased competition; risks to the price and volatility of the

Company’s common stock and preferred stock; stock volatility and in

liquidity; risks to preferred stockholders of not receiving

dividends and risks to the Company’s ability to pursue growth

opportunities if the Company continues to pay dividends according

to the terms of the Company’s preferred stock; the Company’s

ability to execute on its business strategy (including any cost

reduction plans); the Company’s failure to realize expected

benefits of restructuring and cost-cutting actions; the Company’s

ability to preserve and monetize its net operating losses; risks

associated with the Company’s possible pursuit of acquisitions; the

Company’s ability to consummate successful acquisitions and execute

related integration, as well as factors related to the Company’s

business including economic and financial market conditions

generally and economic conditions in the Company’s markets; failure

to keep pace with evolving technologies and difficulties

integrating technologies; system failures; losses of key management

personnel and the inability to attract and retain highly qualified

management and personnel in the future; and the continued demand

for and market acceptance of the Company’s services. For a detailed

discussion of cautionary statements and risks that may affect the

Company’s future results of operations and financial results,

please refer to the Company’s filings with the Securities and

Exchange Commission, including, but not limited to, the risk

factors in the Company’s most recent Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q. This release reflects management’s

views as of the date presented.

All forward-looking statements are necessarily

only estimates of future results, and there can be no assurance

that actual results will not differ materially from expectations,

and, therefore, you are cautioned not to place undue reliance on

such statements. Further, any forward-looking statement speaks only

as of the date on which it is made, and we undertake no obligation

to update any forward-looking statement to reflect events or

circumstances after the date on which the statement is made or to

reflect the occurrence of unanticipated events.

| For more

information contact: |

|

|

| Star Equity

Holdings, Inc. |

The Equity Group |

|

| Rick Coleman |

Lena Cati |

|

| CEO |

Senior Vice President |

|

| 203-489-9508 |

212-836-9611 |

|

|

admin@starequity.com |

lcati@equityny.com |

|

| |

|

|

|

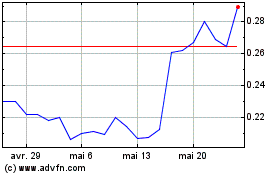

ENSERVCO (AMEX:ENSV)

Graphique Historique de l'Action

De Mar 2025 à Avr 2025

ENSERVCO (AMEX:ENSV)

Graphique Historique de l'Action

De Avr 2024 à Avr 2025